Wayne Michigan Gross Up Clause for Expense Stop Stipulated Base or Office Net Lease In a commercial lease agreement, the Wayne Michigan Gross Up Clause refers to a provision that addresses the treatment of operational expenses and the potential for their increase or decrease over time. It is particularly important in Expense Stop Stipulated Base or Office Net Lease arrangements. This clause ensures fair allocation of expenses between the landlord and tenant while accounting for fluctuations in the property's overall operating costs. The Wayne Michigan Gross Up Clause recognizes that certain expenses, such as maintenance, taxes, insurance, and utilities, may change due to variations in occupancy levels or market conditions. The clause stipulates that when these expenses reach a predetermined or "stop" amount, the tenant will be responsible for any additional costs exceeding this baseline. By using keywords like "Wayne Michigan Gross Up Clause," landlords and tenants can ensure their lease agreement includes an appropriate provision to address increasing expenses beyond the stipulated base amount. Incorporating relevant terms increases legal clarity and aligns the lease with the specific regulations and practices within Wayne, Michigan. It is important to understand that different types of Wayne Michigan Gross Up Clauses can be used in an Expense Stop Stipulated Base or Office Net Lease. These variations include: 1. Fixed Percentage Gross Up Clause: This clause establishes a fixed percentage by which the landlord can increase the tenant's share of expenses beyond the stipulated base. For example, if the base amount is $10,000 and the fixed percentage is set at 3%, the tenant would be responsible for any costs exceeding $10,300. 2. Market Rent Gross Up Clause: In this scenario, the gross up is based on the difference between the actual rentable area occupied by the tenant and the total rentable area in the property. This clause ensures that the expenses are distributed proportionally based on the square footage occupied by each tenant, allowing for a fair allocation. 3. Expense Stop Gross Up Clause: This type of clause sets a limit or "expense stop" on the amount the tenant is responsible for paying in expenses. Once the expenses exceed this predetermined threshold, the landlord can gross up the costs above the stop amount to allocate the excess expenses between the tenant and other occupants of the property. The inclusion of a Wayne Michigan Gross Up Clause is vital for landlords and tenants in Expense Stop Stipulated Base or Office Net Lease agreements. It promotes transparency and fairness in expense allocation, safeguarding both parties' interests while adhering to the specific legal guidelines and practices within Wayne, Michigan.

Wayne Michigan Gross Up Clause for Expense Stop Stipulated Base or Office Net Lease In a commercial lease agreement, the Wayne Michigan Gross Up Clause refers to a provision that addresses the treatment of operational expenses and the potential for their increase or decrease over time. It is particularly important in Expense Stop Stipulated Base or Office Net Lease arrangements. This clause ensures fair allocation of expenses between the landlord and tenant while accounting for fluctuations in the property's overall operating costs. The Wayne Michigan Gross Up Clause recognizes that certain expenses, such as maintenance, taxes, insurance, and utilities, may change due to variations in occupancy levels or market conditions. The clause stipulates that when these expenses reach a predetermined or "stop" amount, the tenant will be responsible for any additional costs exceeding this baseline. By using keywords like "Wayne Michigan Gross Up Clause," landlords and tenants can ensure their lease agreement includes an appropriate provision to address increasing expenses beyond the stipulated base amount. Incorporating relevant terms increases legal clarity and aligns the lease with the specific regulations and practices within Wayne, Michigan. It is important to understand that different types of Wayne Michigan Gross Up Clauses can be used in an Expense Stop Stipulated Base or Office Net Lease. These variations include: 1. Fixed Percentage Gross Up Clause: This clause establishes a fixed percentage by which the landlord can increase the tenant's share of expenses beyond the stipulated base. For example, if the base amount is $10,000 and the fixed percentage is set at 3%, the tenant would be responsible for any costs exceeding $10,300. 2. Market Rent Gross Up Clause: In this scenario, the gross up is based on the difference between the actual rentable area occupied by the tenant and the total rentable area in the property. This clause ensures that the expenses are distributed proportionally based on the square footage occupied by each tenant, allowing for a fair allocation. 3. Expense Stop Gross Up Clause: This type of clause sets a limit or "expense stop" on the amount the tenant is responsible for paying in expenses. Once the expenses exceed this predetermined threshold, the landlord can gross up the costs above the stop amount to allocate the excess expenses between the tenant and other occupants of the property. The inclusion of a Wayne Michigan Gross Up Clause is vital for landlords and tenants in Expense Stop Stipulated Base or Office Net Lease agreements. It promotes transparency and fairness in expense allocation, safeguarding both parties' interests while adhering to the specific legal guidelines and practices within Wayne, Michigan.

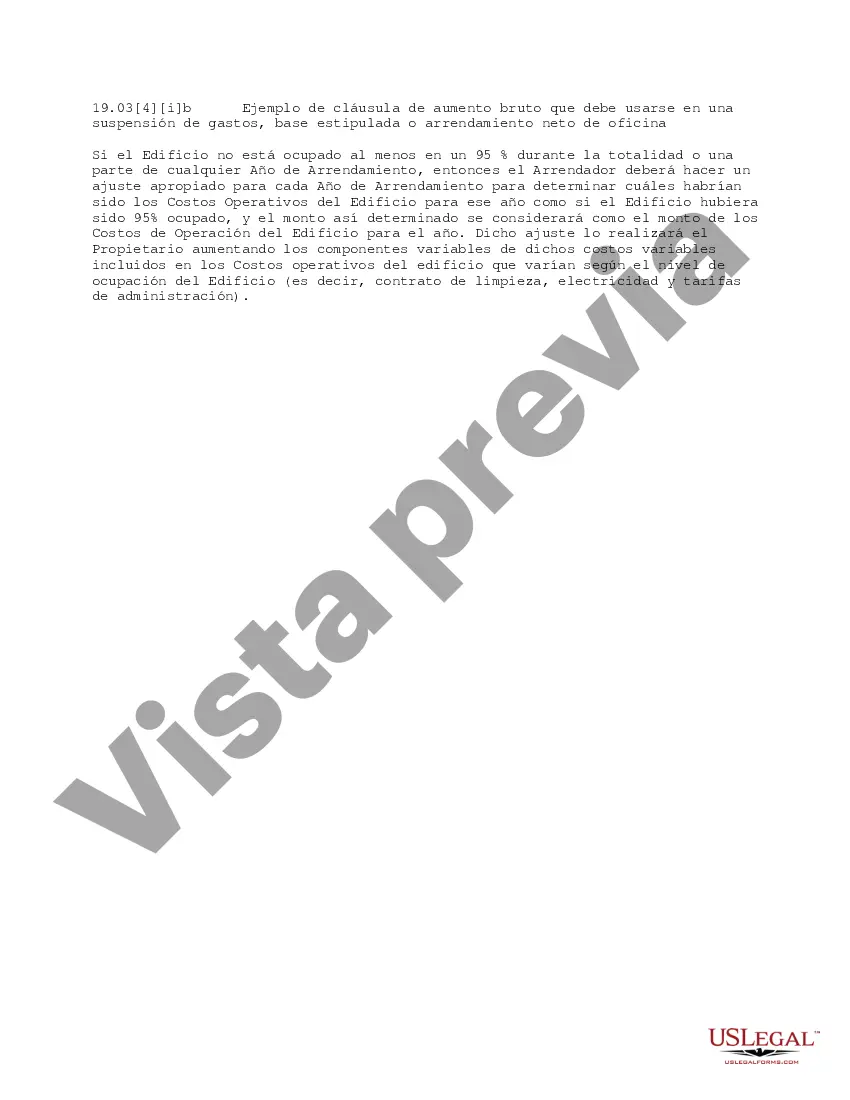

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.