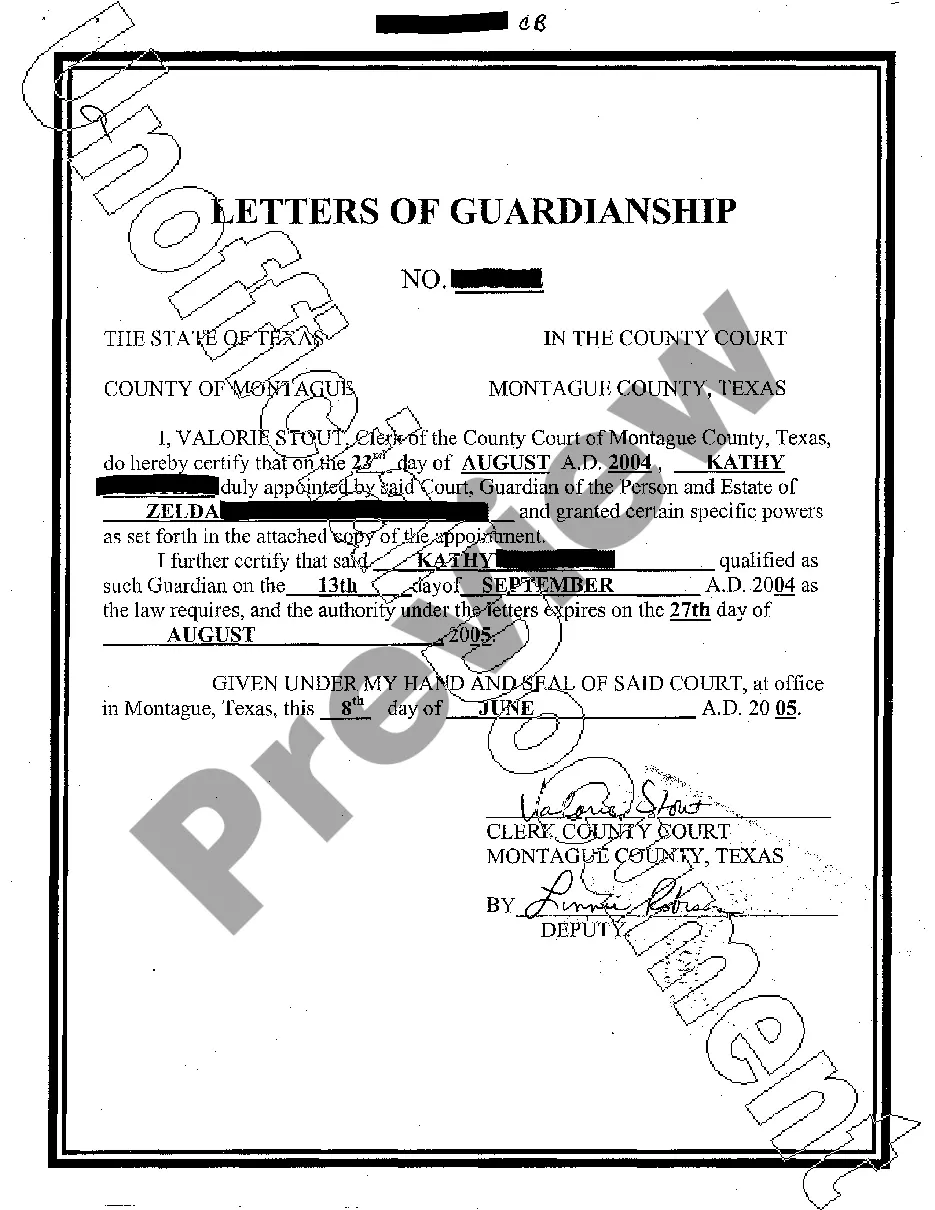

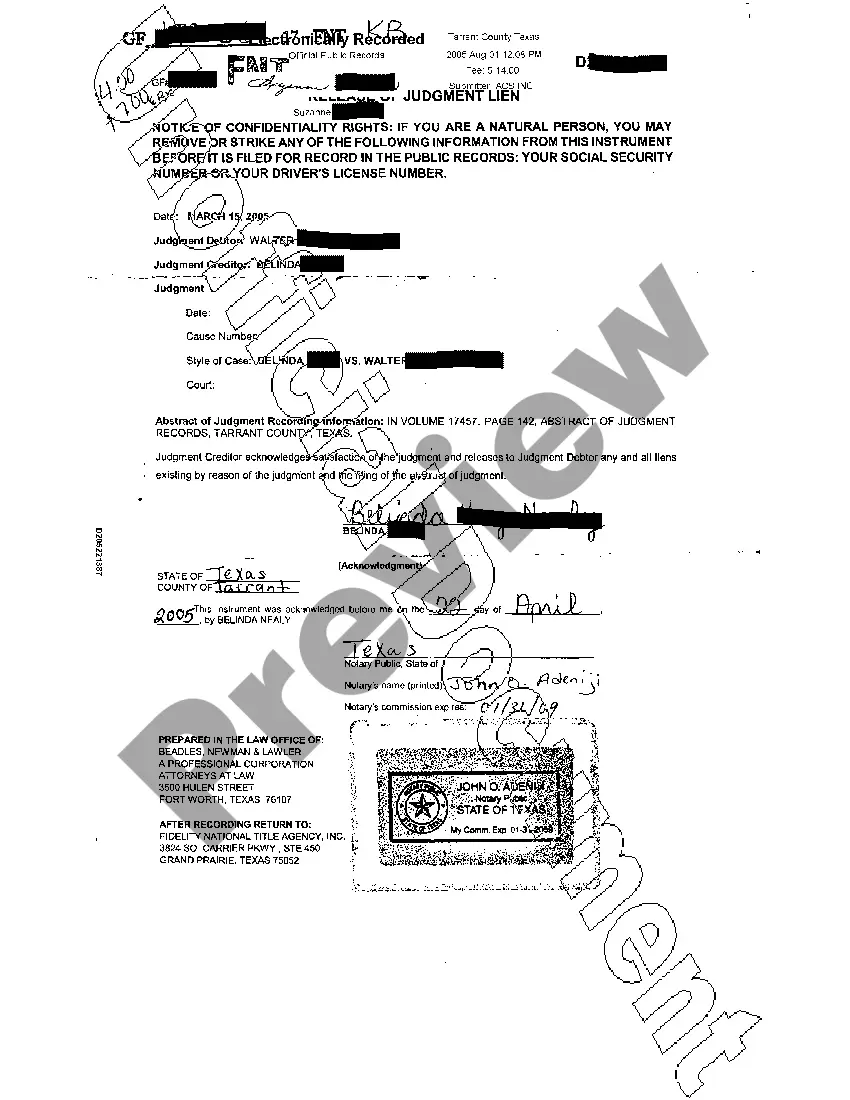

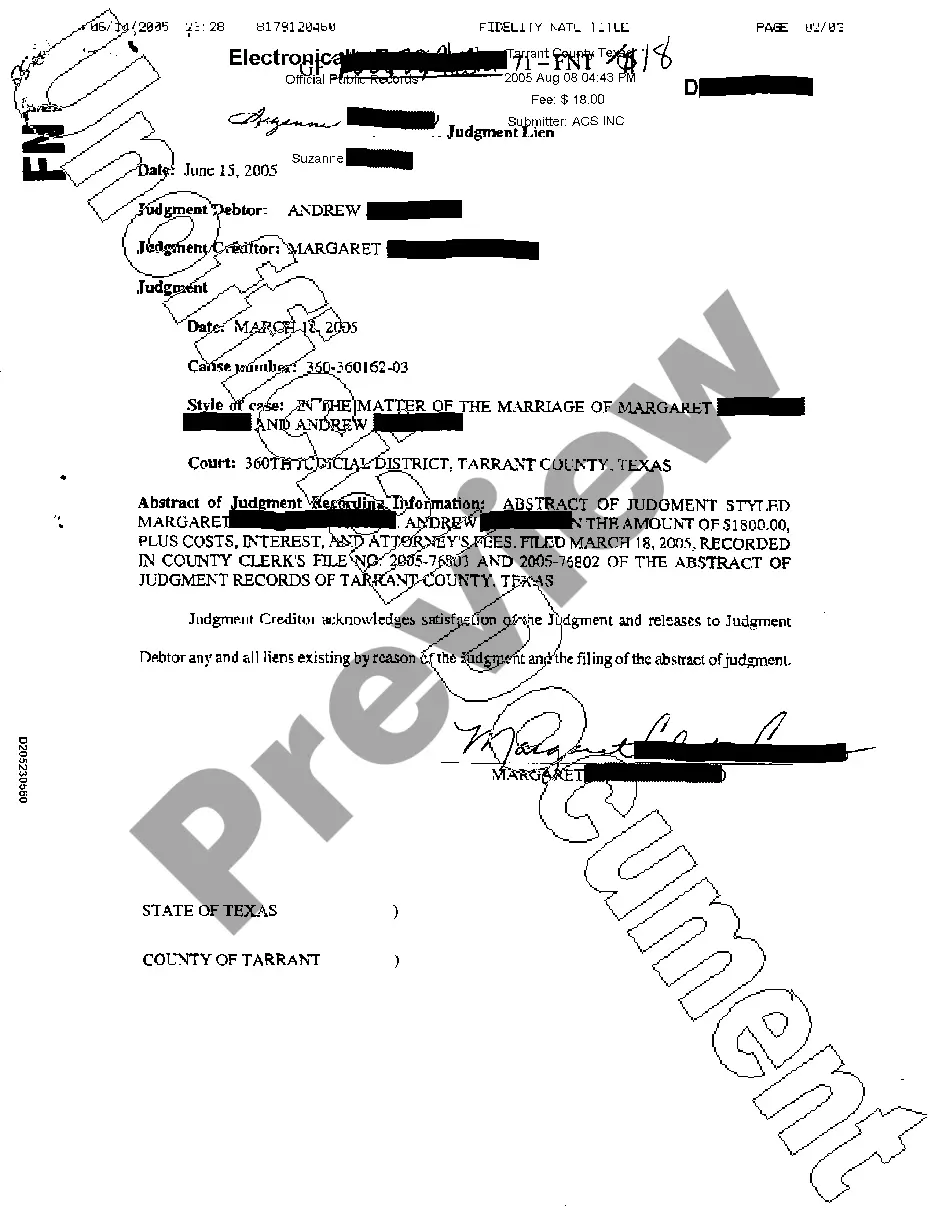

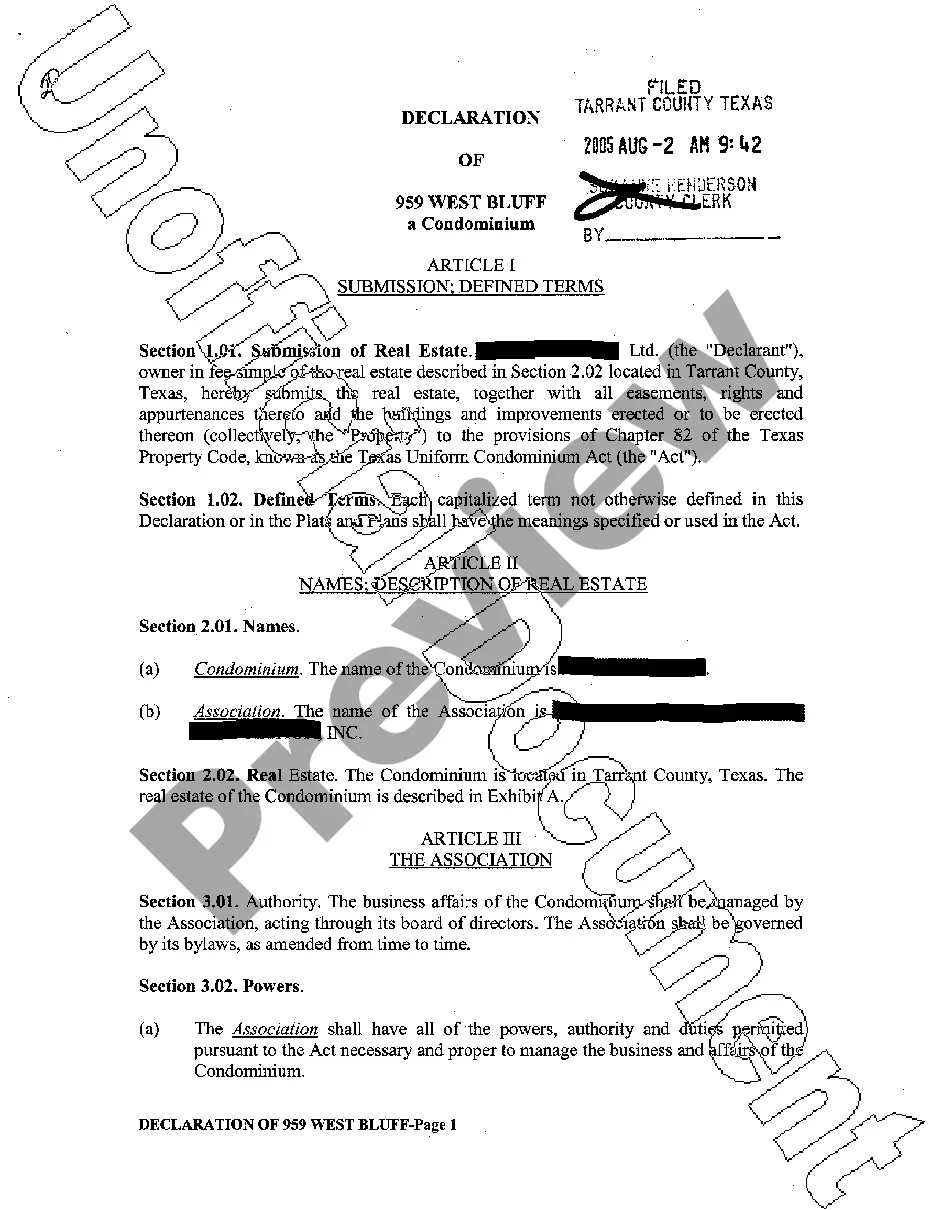

The Harris Texas Detailed Subordination Provision is a legal clause that outlines the specific terms and conditions governing subordination agreements in Harris County, Texas. This provision is crucial in real estate transactions involving multiple lenders or creditors, ensuring the proper ranking of liens and rights in case of default. When it comes to Harris Texas Detailed Subordination Provisions, there are two common types: 1. Intercreditor Subordination Provision: This type of provision governs the relationship between a senior lender and a junior lender. It establishes the priority of their respective liens and interest in the property in the event of foreclosure or default. The Intercreditor Subordination Provision helps clarify the rights and obligations of each party, providing a clear framework for their involvement and potential losses in the transaction. 2. Agreement between Existing and Future Lenders: This type of provision is often seen in situations where a borrower seeks to secure additional loans, potentially jeopardizing the interests of existing lenders. The Agreement between Existing and Future Lenders allows them to agree on the terms of a subsequent loan and ensures that the existing lenders' interests are adequately protected. By defining the subordination terms for future loans, this provision reduces uncertainties and disputes among lenders. When implementing a Harris Texas Detailed Subordination Provision, there are several keywords that are crucial to understand: 1. Lien priority: Determining the order in which liens are given precedence in case of default. 2. Collateral: Refers to the property or asset that secures the loan or debt. 3. Default: Occurs when a borrower fails to meet their obligations, such as making timely payments or violating specific loan terms. 4. Subordination agreement: A legal contract that establishes the priority, ranking, and relative rights of multiple creditors or lenders. 5. Foreclosure: The legal process by which a lender can take possession of a property and sell it to recover the unpaid debt. 6. Creditor: A person or entity that lends money to a borrower, typically in exchange for interest or other financial benefits. 7. Borrower: An individual or organization that receives funds from a lender and is obligated to repay the debt according to agreed-upon terms. The Harris Texas Detailed Subordination Provision plays a vital role in ensuring clarity, consistency, and fairness in real estate transactions involving multiple creditors and lenders. By defining the rights and responsibilities of each party, these provisions minimize disputes and provide a solid legal foundation for all individuals or entities involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Disposición detallada de subordinación - Detailed Subordination Provision

Description

How to fill out Harris Texas Disposición Detallada De Subordinación?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Harris Detailed Subordination Provision, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Harris Detailed Subordination Provision from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Harris Detailed Subordination Provision:

- Analyze the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!