Nassau New York Detailed Subordination Provision refers to a legal clause often included in various financial agreements and contracts executed in Nassau County, New York. This provision lays out the specific terms and conditions under which one creditor's claim takes priority or precedence over another creditor's claim in the event of default or bankruptcy. Such provisions are prevalent in real estate mortgages, loan agreements, and debt securities, and they serve to protect the interests of lenders and ensure orderly distribution of funds in case of insolvency or foreclosure. In Nassau County, there are several types of detailed subordination provisions in use, including: 1. Intercreditor Subordination Provision: This type of provision is commonly found in syndicated loan agreements where multiple lenders are involved. It outlines the hierarchy of creditors and determines the priority of repayment in case of default. It ensures that senior lenders (e.g., banks) are paid first before junior lenders. 2. Mortgage Subordination Provision: This provision is often seen in real estate transactions involving multiple mortgages. It establishes the order in which various mortgages are repaid upon the sale or foreclosure of the property. Typically, the first mortgage has priority over subsequent mortgages, securing the repayment for the first lien holder. 3. Subordinated Debt Subordination Provision: This provision is relevant in the context of bond issues or corporate debt offerings. It defines the order in which different tiers or classes of debt holders would be repaid during bankruptcy proceedings. Senior debt holders are given priority over subordinated or junior debt holders. 4. Lender Subordination Provision: This provision can occur when a creditor willingly agrees to subordinate their claim to another creditor's claim. It is often used when a borrower needs to secure additional financing and the new lender requires a higher position in the priority of claim. The Nassau New York Detailed Subordination Provision is a crucial element in financial agreements, as it helps manage risk, protect lenders' interests, and establish a fair distribution of funds in situations where default or insolvency may occur. It is essential to consult with legal professionals familiar with Nassau County regulations to ensure the provision is properly structured and enforceable under the local laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Disposición detallada de subordinación - Detailed Subordination Provision

Description

How to fill out Nassau New York Disposición Detallada De Subordinación?

Whether you plan to start your company, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Nassau Detailed Subordination Provision is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Nassau Detailed Subordination Provision. Follow the instructions below:

- Make sure the sample meets your individual needs and state law requirements.

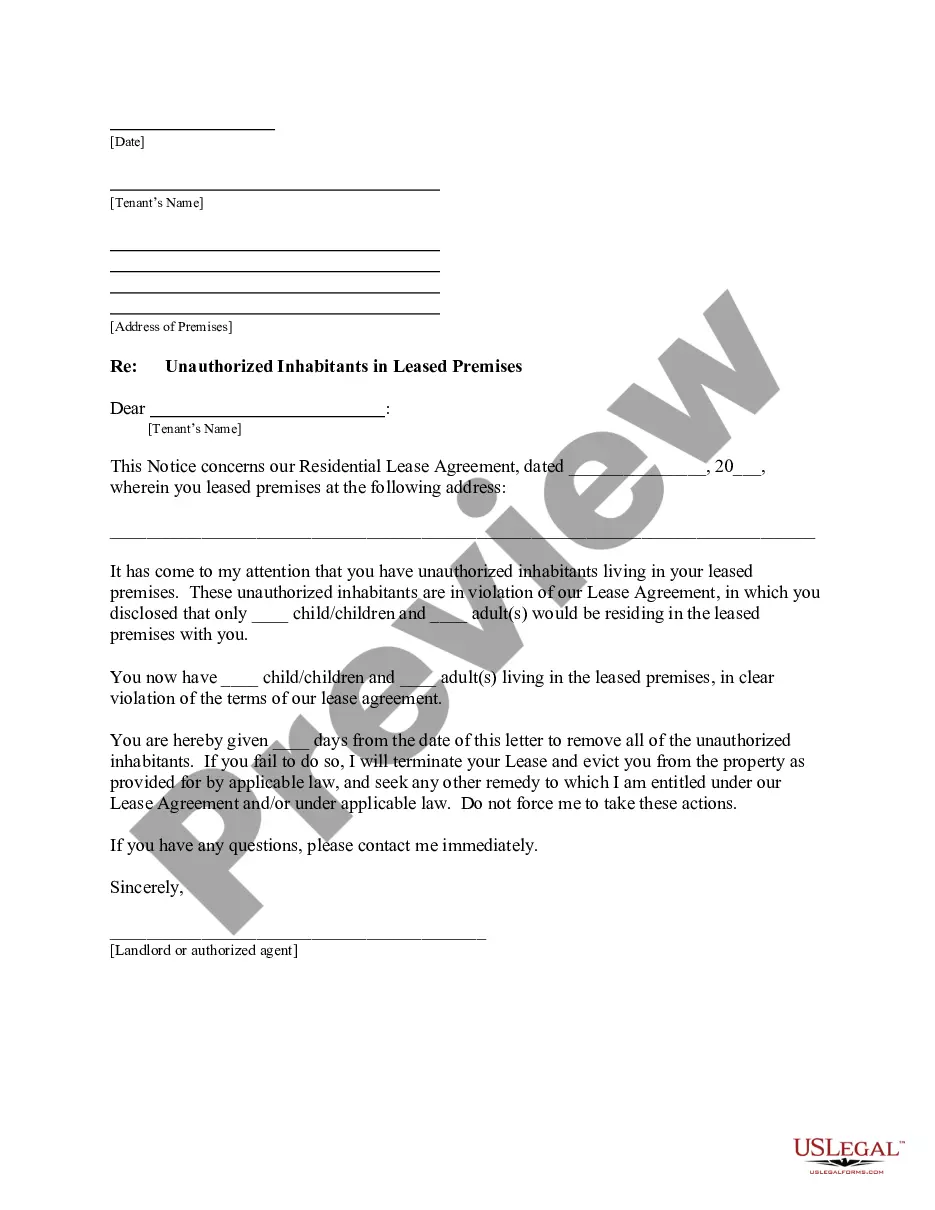

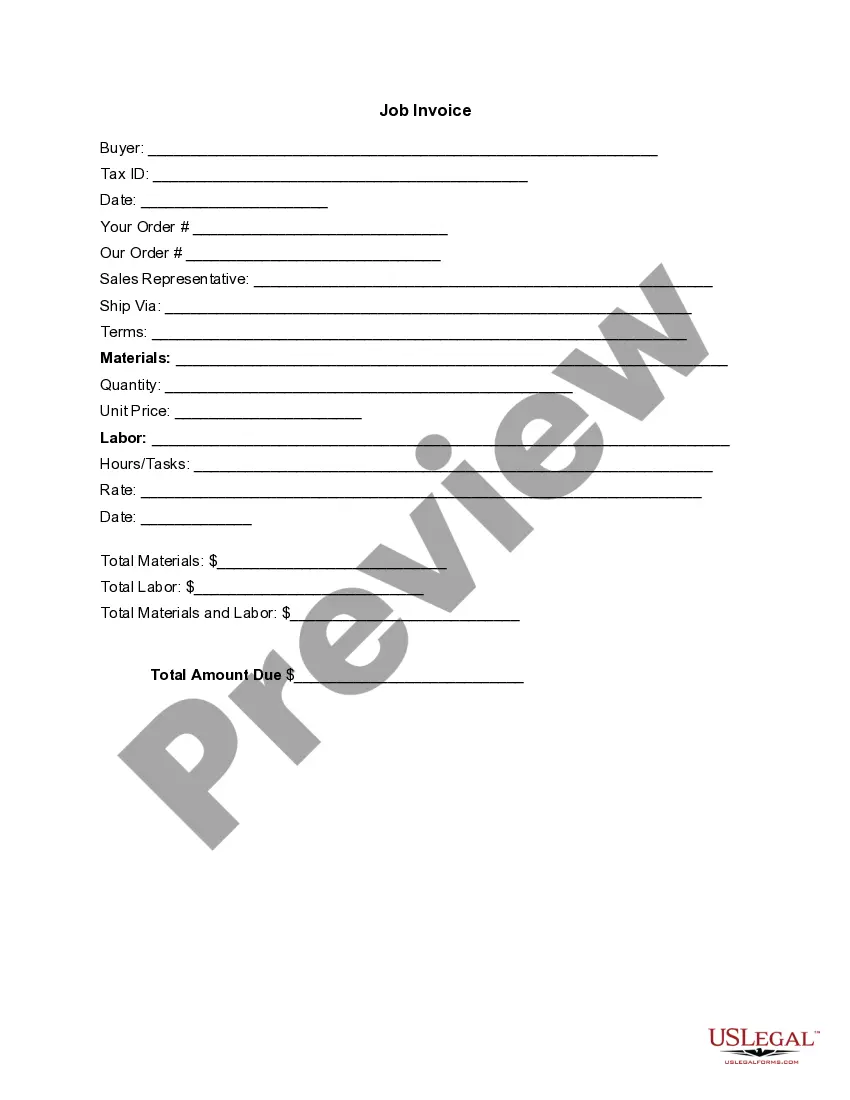

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Detailed Subordination Provision in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!