Harris Texas Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership is an important aspect of business law that regulates the transfer of ownership in corporations and partnerships in Harris County, Texas. This provision ensures a smooth transition of ownership, protects the rights of existing shareholders or partners, and maintains the stability and continuity of businesses. In Harris County, Texas, the provision dealing with changes in share ownership of corporations encompasses various types, each serving a specific purpose: 1. Transfer of Shares: This type of provision outlines the procedures and requirements for transferring shares in a corporation. It may specify the need for board approval, share transfer restrictions, and the documentation necessary to complete the transfer. 2. Preemptive Rights: Preemptive rights give existing shareholders the opportunity to purchase additional shares before they are offered to external parties. This provision safeguards the proportional ownership interests of existing shareholders in case of new issuance. 3. Shareholder Agreements: Shareholder agreements supplement the corporation's bylaws and cover provisions related to changes in share ownership. These agreements may include buy-sell provisions, drag-along and tag-along rights, and rights of first refusal, among others. 4. Dilution Protection: Dilution protection clauses aim to safeguard shareholders from any loss of ownership percentage due to subsequent stock issuance or convertible securities. These provisions set limits on the dilution level or provide anti-dilution mechanisms to protect shareholders' interests. Similar to changes in share ownership of corporations, Harris Texas Provision also deals with changes in share ownership of partnerships. This provision addresses the transfer of partnership interests and ensures a seamless transition without disrupting the partnership's operations. Key aspects related to changes in share ownership of partnerships include: 1. Consent and Approval: The provision may require the consent and approval of all partners or a majority vote to authorize a transfer of partnership interests. This ensures mutual agreement and protects the interests of all partners. 2. Partnership Agreements: Partnership agreements serve as the primary source of guidance for changes in share ownership. These agreements may include provisions related to the admission of new partners, withdrawal or retirement of existing partners, and dissociation procedures. 3. Valuation and Consideration: The provision may outline the valuation methods used to determine the fair value of partnership interests during transfers. It may also address the consideration involved, such as monetary compensation or the exchange of assets. 4. Continuity and Governance: The provision ensures that the transfer of ownership does not disrupt the continuity and governance of the partnership. It may address issues such as the continuity of existing contracts, distribution of profits, and decision-making authority post-transfer. It is crucial for businesses operating in Harris County, Texas, to understand and comply with these provisions to facilitate smooth ownership transitions and protect the interests of all stakeholders involved. Seeking legal counsel and following the guidelines set forth by the Harris Texas Provision is highly recommended ensuring compliance and mitigate any legal risks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Disposición que Trata de Cambios en la Propiedad de Acciones de Corporaciones y Cambios en la Propiedad de Acciones de Sociedades - Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership

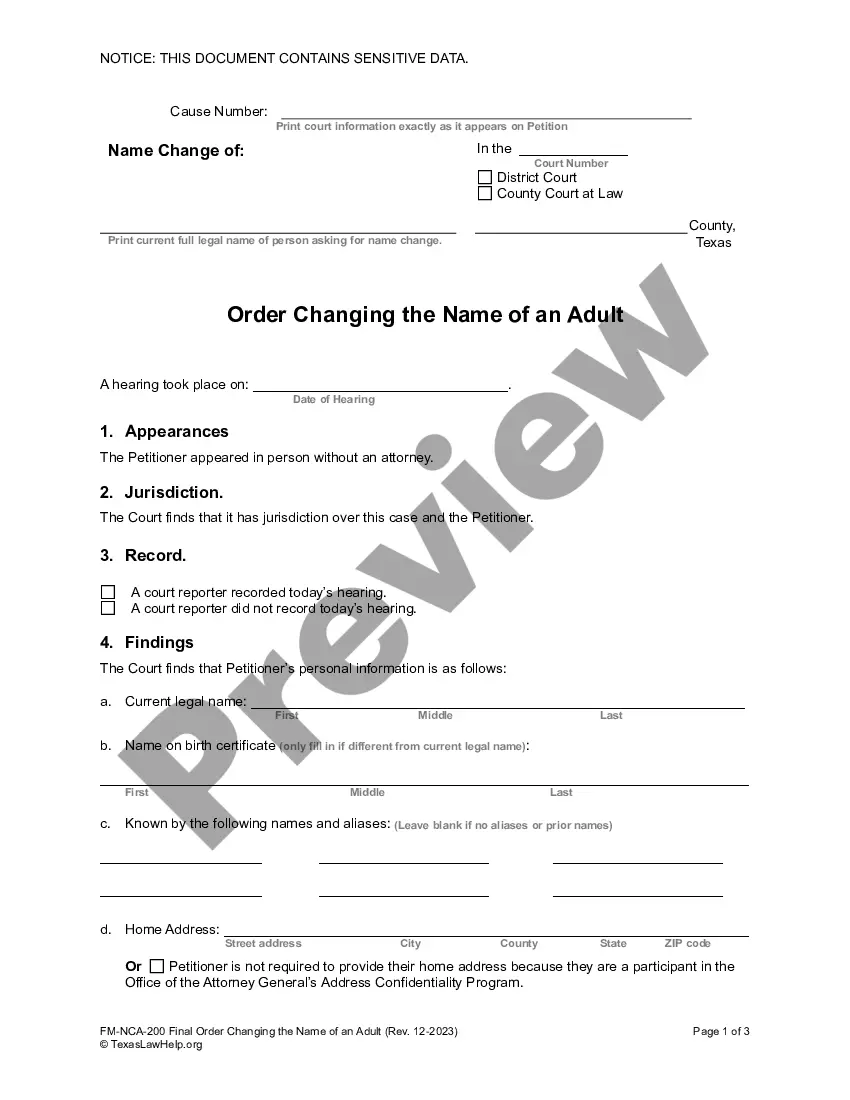

Description

How to fill out Harris Texas Disposición Que Trata De Cambios En La Propiedad De Acciones De Corporaciones Y Cambios En La Propiedad De Acciones De Sociedades?

Preparing paperwork for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Harris Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Harris Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership by yourself, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step guide below to get the Harris Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership:

- Examine the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any use case with just a couple of clicks!