Nassau County, located in New York, has specific provisions in place to regulate changes in share ownership of corporations and partnerships. These provisions aim to ensure transparency, fairness, and legal compliance during such transitions. Here is a detailed description of some key aspects and types of Nassau New York Provision Dealing with Changes in Share Ownership: 1. Transfer of Shares: Nassau County's provisions outline the process of transferring ownership of shares within a corporation or partnership. This includes the formalities involved, documentation required, and any registration or approval processes. 2. Shareholder Agreements: Corporations often have shareholder agreements that address the rights and responsibilities of shareholders and outline procedures for transferring ownership. The Nassau New York Provision emphasizes the importance of these agreements and may require their enforcement or modification during share ownership changes. 3. Due Diligence: Before any share transfer takes place, both parties involved, whether in a corporation or partnership, must conduct thorough due diligence. This entails assessing the financial, legal, and operational aspects of the entity to ensure that the proposed transfer is suitable and compliant with applicable laws and regulations. 4. Valuation of Shares: Determining the value of shares is crucial during ownership changes. The Nassau New York Provision might require the use of specific valuation methodologies or the involvement of independent appraisers to determine a fair price. This ensures that the transfer is equitable for both parties involved. 5. Reporting and Disclosures: Nassau County provisions may mandate the reporting of all share ownership changes, whether partial or complete, in both corporations and partnerships. This information helps maintain transparency within the business community and assists in monitoring compliance with regulatory requirements. 6. Shareholder Approval: Depending on the nature and scale of the ownership change, shareholder approval may be necessary. Nassau County may specify the thresholds or procedures for obtaining such approval, ensuring that major decisions are made collectively, and protecting the rights and interests of all shareholders. 7. Tax Implications: The Nassau New York Provision acknowledges and addresses the potential tax implications associated with share ownership changes. This includes considerations such as capital gains or losses, transfer taxes, and any other tax obligations that may arise during the transaction. By having these provisions in place, Nassau County seeks to foster an environment conducive to business transactions while safeguarding the interests of all stakeholders involved. It is important for corporations and partnerships operating in Nassau County to familiarize themselves with these provisions and comply with them to avoid any legal complications or disputes during share ownership changes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Disposición que Trata de Cambios en la Propiedad de Acciones de Corporaciones y Cambios en la Propiedad de Acciones de Sociedades - Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership

Description

How to fill out Nassau New York Disposición Que Trata De Cambios En La Propiedad De Acciones De Corporaciones Y Cambios En La Propiedad De Acciones De Sociedades?

Draftwing forms, like Nassau Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership, to take care of your legal matters is a difficult and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents intended for various cases and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Nassau Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before getting Nassau Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership:

- Ensure that your document is specific to your state/county since the rules for creating legal documents may differ from one state another.

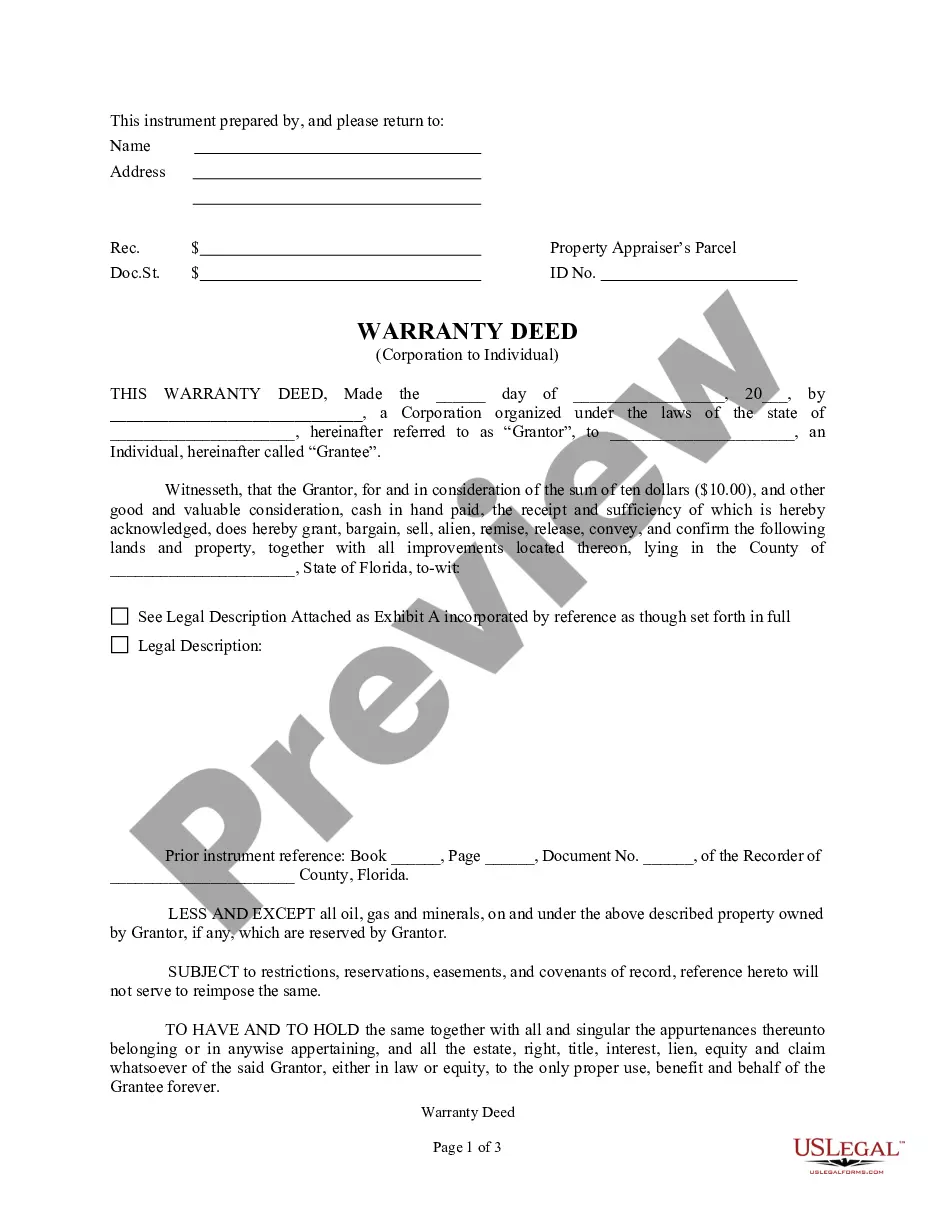

- Learn more about the form by previewing it or going through a brief description. If the Nassau Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our website and download the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!