Phoenix, Arizona is a vibrant city located in the southwestern United States. Known for its beautiful desert landscapes and sunny climate, it is a popular destination for tourists and a thriving hub for businesses. One of the important aspects of leasing commercial property in Phoenix, Arizona, is the option to renew a lease agreement. This option allows tenants to extend their lease period beyond the initial term, typically for a predetermined number of years. It provides stability for businesses, allowing them to continue operating in the same location and maintain their customer base. When reviewing an option to renew the lease agreement, tenants should pay attention to the updates related to operating expenses and tax basis. This is crucial as it can have significant financial implications for businesses. Operating expenses refer to the costs incurred to operate and maintain the property. These can include utilities, property management fees, insurance, repairs, and maintenance. The option to renew may include a provision that updates the tenant's responsibility for paying operating expenses. This could involve negotiations between the tenant and landlord to determine how these expenses will be calculated, allocated, and adjusted over time. Similarly, the tax basis of a property is the value assigned for tax assessment purposes. This can affect the amount of property taxes that the tenant is responsible for paying. The option to renew may include updates to the tax basis, reflecting any changes in the property's assessed value or changes in taxation policies. It is important for tenants to carefully review the option to renew and consult with legal counsel or a real estate professional specializing in commercial leases to fully understand the implications. Different types of Phoenix, Arizona options to renew that update the tenant operating expense and tax basis may include: 1. Fixed Percentage Increase: The option to renew may stipulate a fixed percentage increase in operating expenses and tax basis annually or at predetermined intervals. This allows for predictable and consistent adjustments in these expenses. 2. CPI Adjustments: The option to renew may include adjustments tied to the Consumer Price Index (CPI). The CPI measures changes in the cost of living and can be used to determine adjustments in operating expenses and tax basis. This ensures that expenses align with inflationary changes. 3. Negotiable Expenses: The option to renew may allow for negotiations between the tenant and landlord regarding specific operating expenses. This gives tenants more flexibility in determining which expenses they will be responsible for and how they will be allocated. In conclusion, Phoenix, Arizona offers various types of options to renew lease agreements that can update the tenant operating expense and tax basis. It is essential for tenants to carefully review and understand the terms of these options to make informed decisions that align with their business needs and financial circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Opción de Renovación que Actualiza los Gastos Operativos del Inquilino y la Base Impositiva - Option to Renew that Updates the Tenant Operating Expense and Tax Basis

Description

How to fill out Phoenix Arizona Opción De Renovación Que Actualiza Los Gastos Operativos Del Inquilino Y La Base Impositiva?

Whether you intend to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Phoenix Option to Renew that Updates the Tenant Operating Expense and Tax Basis is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to get the Phoenix Option to Renew that Updates the Tenant Operating Expense and Tax Basis. Follow the guide below:

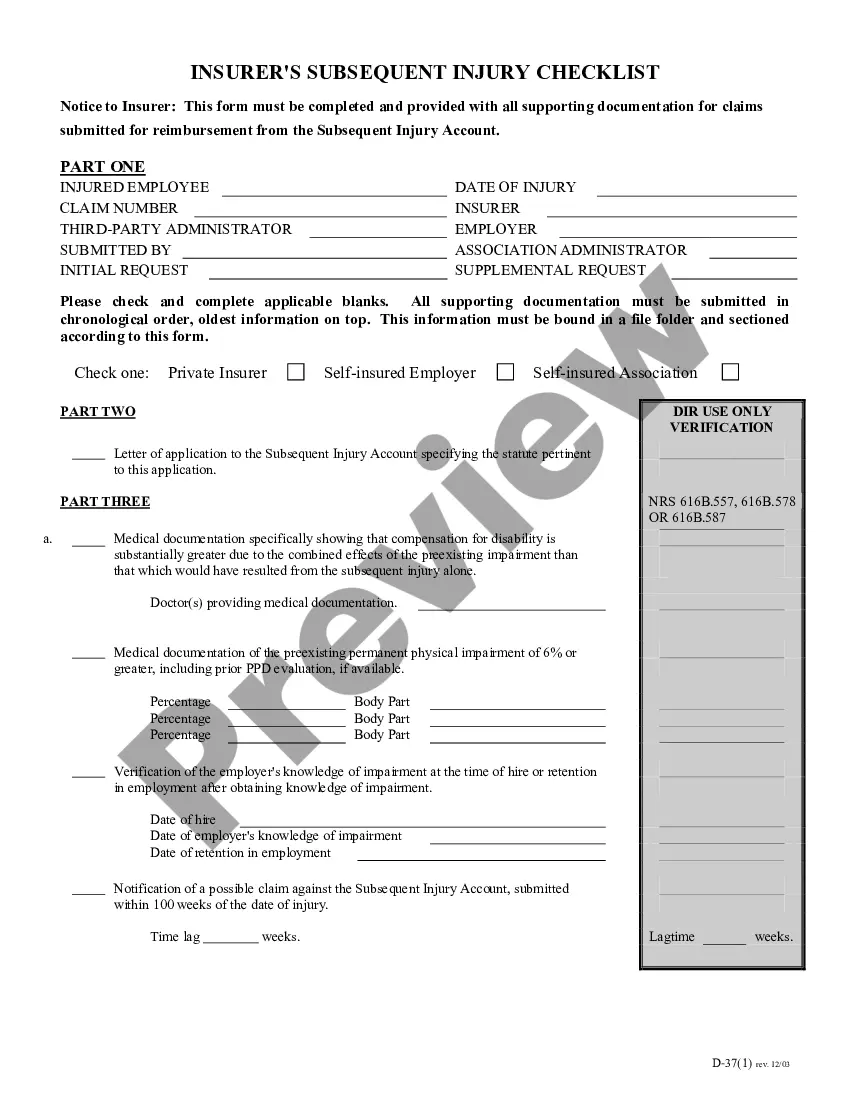

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Phoenix Option to Renew that Updates the Tenant Operating Expense and Tax Basis in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

Ajustes. Para los contratos de alquiler de inmuebles para vivienda el precio del alquiler se debe fijar como valor unico, por periodos mensuales y solo se pueden realizar ajustes anuales. En ningun caso se pueden establecer bonificaciones ni otras metodologias que puedan producir error.

Una de las medidas mas impactantes es el limite que ha puesto el Gobierno a la actualizacion de los precios del alquiler. Este limite sera de un maximo del 2%, una gran diferencia con respecto a si se actualizase con respecto al IPC, el cual ha subido un 8,3% en junio de 2022.

¿Por que se ha fijado en el 2% el limite al incremento del alquiler? Como explicaremos mas adelante, el Real Decreto-ley 6/2022, de 29 de marzo establece que el arrendador y el arrendatario negocien la actualizacion de la renta.

A partir de la nueva ley, los alquileres se ajustan una vez por ano con una formula compuesta en un 50% por la evolucion de los salarios (indice Ripte) y 50% por la evolucion de la inflacion que mide el Indec (IPC).

Lo que resta para saber como calcular aumento de alquiler 2022 es tomar el valor de variacion y multiplicarlo por el monto en pesos que se venia abonando de alquiler cada mes. El resultado sera el importe actualizado.

En sintesis, el metodo es dividir el valor total del alquiler por el indice correspondiente a la ultima actualizacion de los 12 meses posteriores y multiplicarlo por el indice del 2022 de la misma fecha. El numero que arroje esta cuenta sera el valor que los inquilinos tendran que pagar por todo el ano.

El incremento se calcula multiplicando la renta base inicial del inquilino por el porcentaje de incremento permisible anual.

Inicio el 2022 y los arriendos podran aumentar hasta en un 5,6%, cifra que corresponde a la variacion anual del Indice de Precios al Consumidor (IPC) del 2021, de acuerdo con el Departamento Administrativo Nacional de Estadistica (Dane) y segun estimaciones del Banco de la Republica.

Consiste simplemente en aplicar a la renta mensual el IPC interanual publicado a la fecha de actualizacion. Si el IPC es positivo, la renta sube; y si el ipc es negativo, la renta baja. Un error frecuente es esperar a que salga el ipc del mes en que el contrato cumple una anualidad para actualizarlo.

Incremento anual de renta 2022 establecido por la ley Los contratos de arrendamiento generalmente se realizan por periodos anuales, y al concluir ese tiempo se pueden renovar. No obstante, el casero puede realizar un incremento de hasta 10% sobre el monto vigente.