Wayne, Michigan is a vibrant and growing city located in Wayne County, within the Detroit metropolitan area. Known for its rich history, diverse community, and strong economy, Wayne offers a great place for businesses and individuals alike to thrive. When it comes to commercial leases in Wayne, there are specific options to renew that can greatly impact the tenant's operating expenses and tax basis. Let's take a closer look at these options: 1. Standard Option to Renew: This is the most common type of option to renew found in commercial leases in Wayne, Michigan. It provides the tenant with the right to extend the lease term beyond its initial expiration date, typically for a set period of time, such as one to five years. 2. Option to Renew with Updated Tenant Operating Expense: In some cases, the option to renew may include an update to the tenant's operating expenses, which could result in an increase or decrease in the overall costs associated with the lease. This can be influenced by factors such as inflation, changes in property taxes, or alterations in the building's maintenance costs. 3. Option to Renew with Updated Tax Basis: Another variation of the option to renew in Wayne, Michigan involves updating the tax basis for the tenant. This means that any changes in property tax rates, assessments, or applicable tax laws during the lease term can impact the tenant's tax liabilities upon renewal. By including an Option to Renew that updates the tenant operating expense and tax basis, both landlords and tenants in Wayne, Michigan can ensure that the lease agreement remains fair and reflective of market conditions. This also provides an opportunity for tenants to negotiate better terms or consider alternate locations if costs are substantially impacted. It is important for both parties to carefully review the terms and conditions of the renewal option, seeking legal advice if necessary, to fully understand the potential financial implications. This will help in making informed decisions and ensuring a mutually beneficial outcome. In conclusion, Wayne, Michigan offers various options to renew a commercial lease, including the option to update tenant operating expenses and tax basis. These options should be carefully evaluated by both landlords and tenants to determine their financial impact and make informed decisions regarding the future of the lease agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Opción de Renovación que Actualiza los Gastos Operativos del Inquilino y la Base Impositiva - Option to Renew that Updates the Tenant Operating Expense and Tax Basis

Description

How to fill out Wayne Michigan Opción De Renovación Que Actualiza Los Gastos Operativos Del Inquilino Y La Base Impositiva?

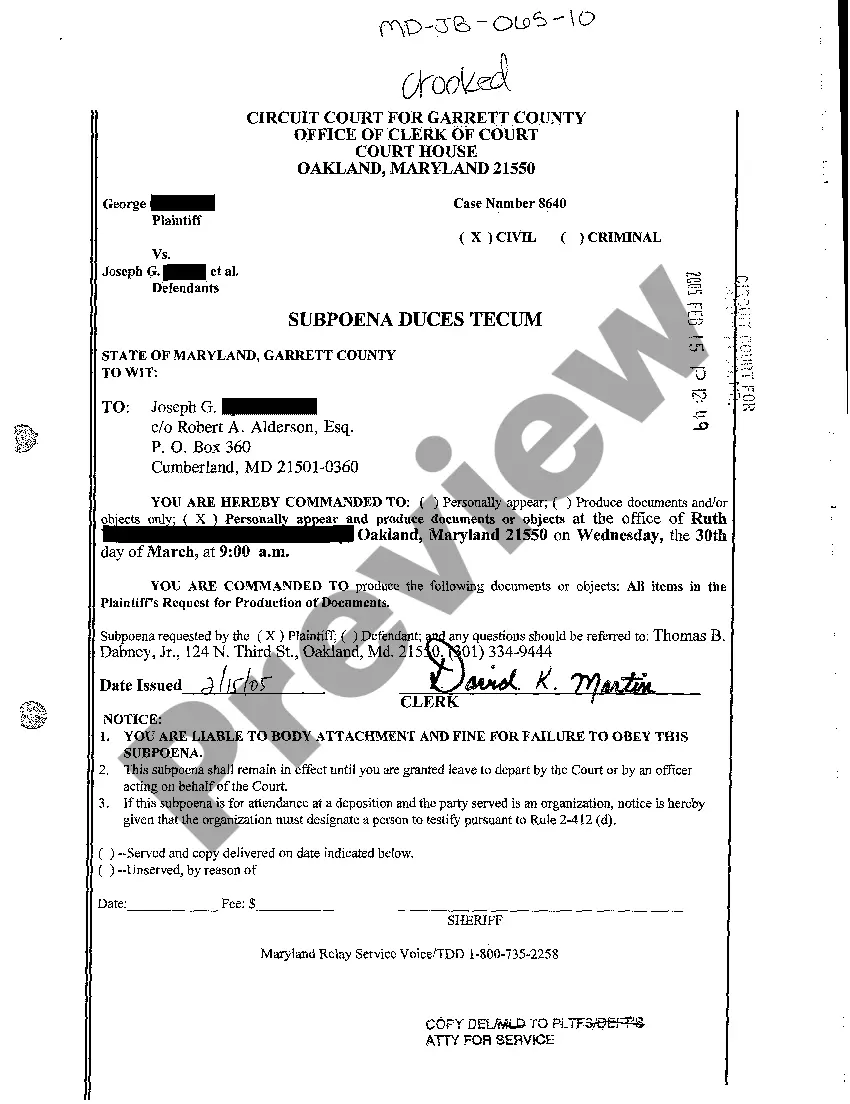

How much time does it typically take you to draft a legal document? Since every state has its laws and regulations for every life scenario, locating a Wayne Option to Renew that Updates the Tenant Operating Expense and Tax Basis suiting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. Apart from the Wayne Option to Renew that Updates the Tenant Operating Expense and Tax Basis, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Professionals check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Wayne Option to Renew that Updates the Tenant Operating Expense and Tax Basis:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Wayne Option to Renew that Updates the Tenant Operating Expense and Tax Basis.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

En sintesis, el metodo es dividir el valor total del alquiler por el indice correspondiente a la ultima actualizacion de los 12 meses posteriores y multiplicarlo por el indice del 2022 de la misma fecha. El numero que arroje esta cuenta sera el valor que los inquilinos tendran que pagar por todo el ano.

Consiste simplemente en aplicar a la renta mensual el IPC interanual publicado a la fecha de actualizacion. Si el IPC es positivo, la renta sube; y si el ipc es negativo, la renta baja. Un error frecuente es esperar a que salga el ipc del mes en que el contrato cumple una anualidad para actualizarlo.

Para actualizar una renta tendremos que consultar en la pagina web del INE el valor del IPC y aplicar la subida o la bajada en funcion del valor del IPC con dos meses de antelacion al que el contrato cumple la anualidad, ya que el dato oficial suele publicarse el dia 15 de cada mes.

El incremento que se aplica sobre los alquileres se basan en los aumentos inflacionarios (Indice de Precios al Consumidor IPC) y salariales (RIPTE). Por ende, la suba de este mes sera del 60%, un porcentaje muy similar al que se termino dando en agosto.

A partir de la nueva ley, los alquileres se ajustan una vez por ano con una formula compuesta en un 50% por la evolucion de los salarios (indice Ripte) y 50% por la evolucion de la inflacion que mide el Indec (IPC).

La Real Academia Espanola, define la prorroga como la continuacion de algo por un tiempo determinado, mientras que la renovacion como la accion y efecto de renovar, sustituir, modificar, reanudar.

Los gastos que puede repercutir el dueno del inmueble al inquilino pueden ser el Impuesto de Bienes Inmuebles (IBI), la tasa de basura, la comunidad, e incluso algunas obras realizadas en el inmueble. En el contrato de alquiler debe contemplarse quien es el responsable de dichos gastos.

La renovacion contrato alquiler se hace de forma automatica una vez han pasado los 5 anos y si ninguna de las dos partes expresa la voluntad de rescindir del contrato. Una vez se renueva el contrato, se extendera por un periodo de 3 anos.

Para finalizar, la formula que se debe aplicar es el total del alquiler dividido por el indice con fecha de cuando se firmo el contrato, multiplicado por el indice del dia en que se aplica el aumento sobre el mismo. Ese valor que arroje sera el importe del alquiler que el inquilino debera abonar durante todo el ano.

La renovacion contrato alquiler se hace de forma automatica una vez han pasado los 5 anos y si ninguna de las dos partes expresa la voluntad de rescindir del contrato. Una vez se renueva el contrato, se extendera por un periodo de 3 anos.