Description: Hillsborough Florida Waivers of Subrogation refers to a legal document commonly used in insurance agreements and contracts in Hillsborough County, Florida. This waiver is an essential provision that prevents an insurance company from seeking reimbursement from a negligent third party. It essentially bars the insurer from pursuing subrogation rights to recover its costs or losses from parties other than the policyholder. These waivers play a crucial role in various scenarios, especially in construction contracts, property leases, and other agreements that expose parties to potential liability risks. By incorporating a Hillsborough Florida Waiver of Subrogation clause, the insurer relinquishes its right to recoup financial losses from those who might be responsible for the damages. There are different types of Hillsborough Florida Waivers of Subrogation, depending on the specific requirements of a contract or insurance policy. Here are some common types: 1. General Hillsborough Florida Waiver of Subrogation: The general waiver of subrogation applies to all parties involved in a contract. It is a blanket waiver that encompasses both the policyholder and any other party named in the agreement, ensuring that no party can be held responsible for any losses incurred by the insurer. 2. Limited Hillsborough Florida Waiver of Subrogation: A limited waiver of subrogation is more specific and restricts the scope of the waiver to certain parties or situations defined within the contract. This type of waiver may protect subcontractors, employees, or specific vendors from subrogation claims. 3. Mutual Hillsborough Florida Waiver of Subrogation: A mutual waiver of subrogation is an agreement between two or more parties involved in a contract. Each party agrees to waive their subrogation rights against the other, creating a reciprocal arrangement that protects all parties involved. In Hillsborough County, Florida, incorporating a Hillsborough Florida Waiver of Subrogation into contracts and insurance policies is highly recommended to manage liability risks effectively. These waivers provide a level of financial protection for policyholders and parties involved in agreements, ensuring that insurance companies cannot seek reimbursement from negligent third parties. Whether it's a general, limited, or mutual waiver of subrogation, these provisions help create a more secure and reliable business environment in Hillsborough, Florida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Renuncias a la subrogación - Waivers of Subrogation

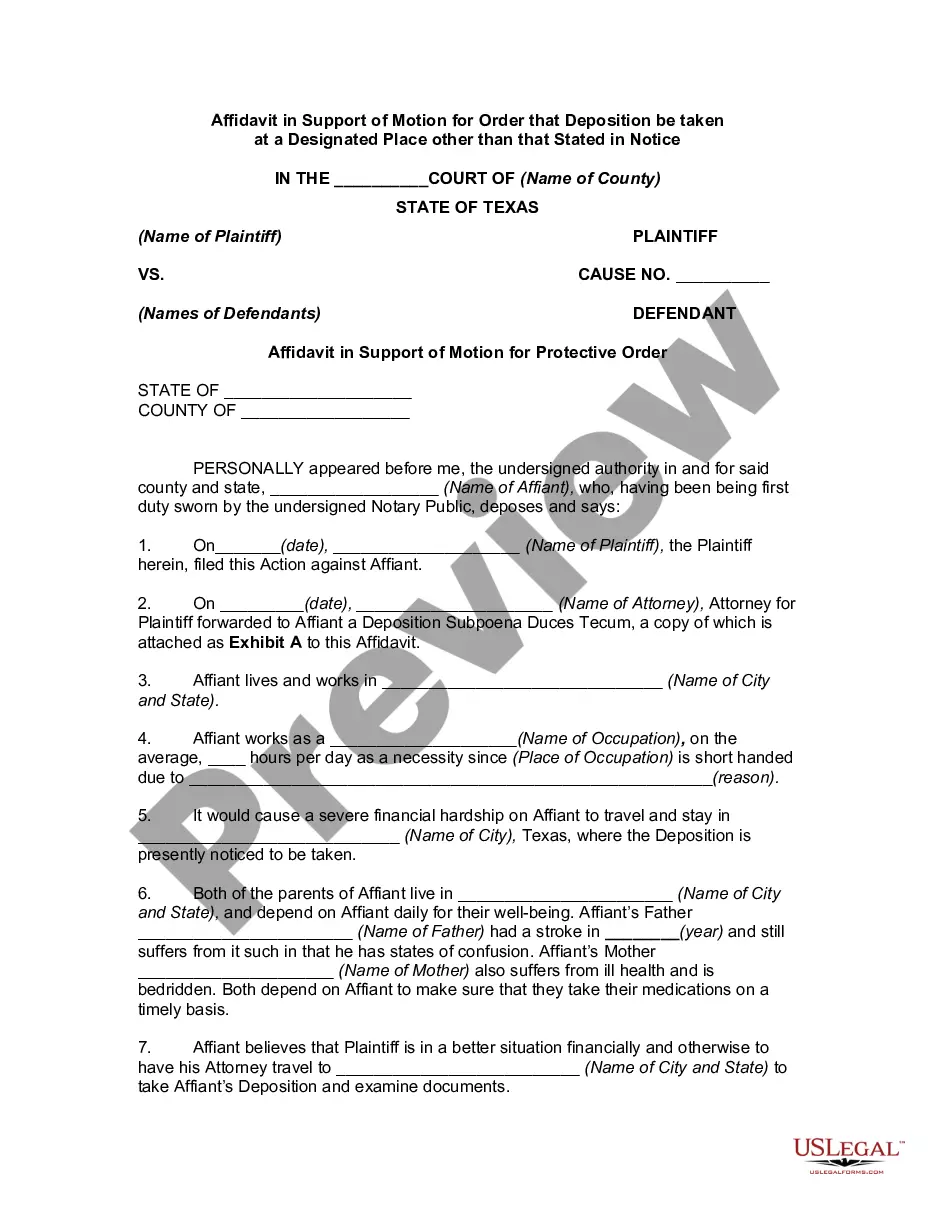

Description

How to fill out Hillsborough Florida Renuncias A La Subrogación?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from scratch, including Hillsborough Waivers of Subrogation, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any activities related to document completion simple.

Here's how to locate and download Hillsborough Waivers of Subrogation.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the validity of some documents.

- Check the related forms or start the search over to locate the correct file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Hillsborough Waivers of Subrogation.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Hillsborough Waivers of Subrogation, log in to your account, and download it. Of course, our website can’t take the place of an attorney entirely. If you need to deal with an exceptionally difficult case, we advise getting an attorney to check your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Become one of them today and get your state-compliant paperwork with ease!