Miami-Dade Florida Landlord Bankruptcy Clause is a provision included in lease agreements to address the rights and responsibilities of both landlords and tenants in the event of the landlord's bankruptcy. This clause outlines the specific terms and conditions that govern the lease agreement in such circumstances, protecting the interests of both parties involved. In the case of bankruptcy, landlords may face financial difficulties that can impact their ability to manage rental properties and honor the terms of existing leases. The Miami-Dade Florida Landlord Bankruptcy Clause ensures that tenants are informed of their rights and provides guidelines to follow in these challenging situations. The specific language and terms of the Miami-Dade Florida Landlord Bankruptcy Clause may vary depending on the agreement between the landlord and tenant. It is essential for both parties to understand these terms thoroughly before signing the lease agreement. Some common types of landlord bankruptcy clauses in Miami-Dade, Florida, include: 1. Lease Termination Clause: This clause allows either party, the landlord or tenant, to terminate the lease if the landlord files for bankruptcy. It typically outlines the required notice period and procedures for termination. 2. Continuation of Lease Clause: This clause allows the lease agreement to remain in effect despite the landlord's bankruptcy. The tenant is still obligated to pay rent, and the landlord must fulfill their responsibilities outlined in the lease. 3. Assignment of Lease Clause: This clause permits the landlord to assign the lease to a third party, such as a trustee or another property management entity, during bankruptcy proceedings. The tenant's rights and obligations remain the same under the new landlord. 4. Security Deposit Clause: This clause addresses the handling of the tenant's security deposit in the event of the landlord's bankruptcy. It specifies whether the deposit will be returned or transferred to a new landlord or trustee, as well as the timeline for such actions. It is crucial for tenants to consult with legal professionals familiar with Miami-Dade Florida landlord-tenant laws to ensure they fully comprehend the landlord bankruptcy clause, its implications, and their rights under such circumstances. Additionally, landlords are advised to seek legal advice when drafting lease agreements to include comprehensive and fair bankruptcy clauses that abide by Florida state laws. Understanding the Miami-Dade Florida Landlord Bankruptcy Clause is vital for both tenants and landlords, as it establishes clear guidelines for protection and enforcement of the lease agreement in challenging financial situations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Cláusula de Quiebra del Propietario - Landlord Bankruptcy Clause

State:

Multi-State

County:

Miami-Dade

Control #:

US-OL28042

Format:

Word

Instant download

Description

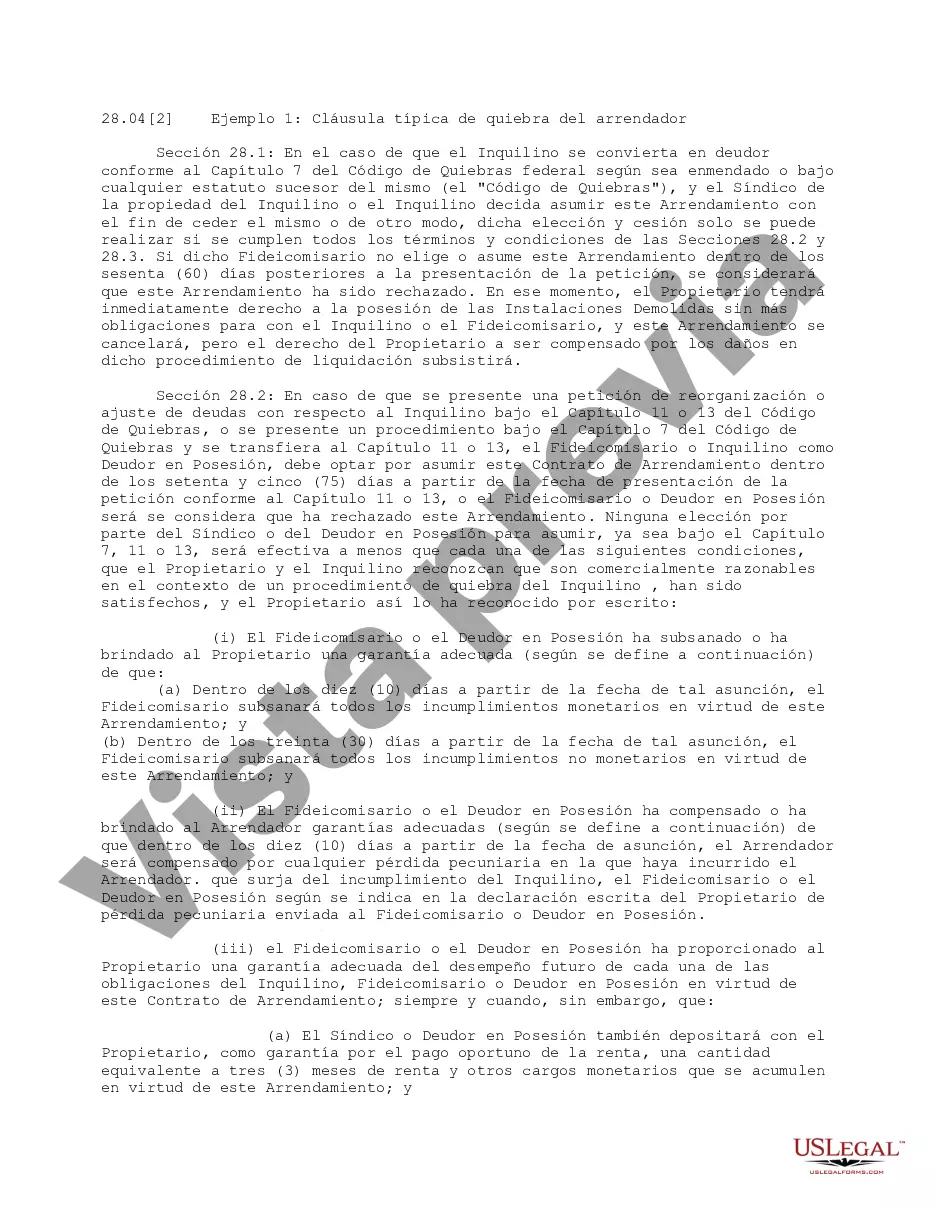

Negociación y Redacción de Arrendamientos de Oficinas

Miami-Dade Florida Landlord Bankruptcy Clause is a provision included in lease agreements to address the rights and responsibilities of both landlords and tenants in the event of the landlord's bankruptcy. This clause outlines the specific terms and conditions that govern the lease agreement in such circumstances, protecting the interests of both parties involved. In the case of bankruptcy, landlords may face financial difficulties that can impact their ability to manage rental properties and honor the terms of existing leases. The Miami-Dade Florida Landlord Bankruptcy Clause ensures that tenants are informed of their rights and provides guidelines to follow in these challenging situations. The specific language and terms of the Miami-Dade Florida Landlord Bankruptcy Clause may vary depending on the agreement between the landlord and tenant. It is essential for both parties to understand these terms thoroughly before signing the lease agreement. Some common types of landlord bankruptcy clauses in Miami-Dade, Florida, include: 1. Lease Termination Clause: This clause allows either party, the landlord or tenant, to terminate the lease if the landlord files for bankruptcy. It typically outlines the required notice period and procedures for termination. 2. Continuation of Lease Clause: This clause allows the lease agreement to remain in effect despite the landlord's bankruptcy. The tenant is still obligated to pay rent, and the landlord must fulfill their responsibilities outlined in the lease. 3. Assignment of Lease Clause: This clause permits the landlord to assign the lease to a third party, such as a trustee or another property management entity, during bankruptcy proceedings. The tenant's rights and obligations remain the same under the new landlord. 4. Security Deposit Clause: This clause addresses the handling of the tenant's security deposit in the event of the landlord's bankruptcy. It specifies whether the deposit will be returned or transferred to a new landlord or trustee, as well as the timeline for such actions. It is crucial for tenants to consult with legal professionals familiar with Miami-Dade Florida landlord-tenant laws to ensure they fully comprehend the landlord bankruptcy clause, its implications, and their rights under such circumstances. Additionally, landlords are advised to seek legal advice when drafting lease agreements to include comprehensive and fair bankruptcy clauses that abide by Florida state laws. Understanding the Miami-Dade Florida Landlord Bankruptcy Clause is vital for both tenants and landlords, as it establishes clear guidelines for protection and enforcement of the lease agreement in challenging financial situations.

Free preview