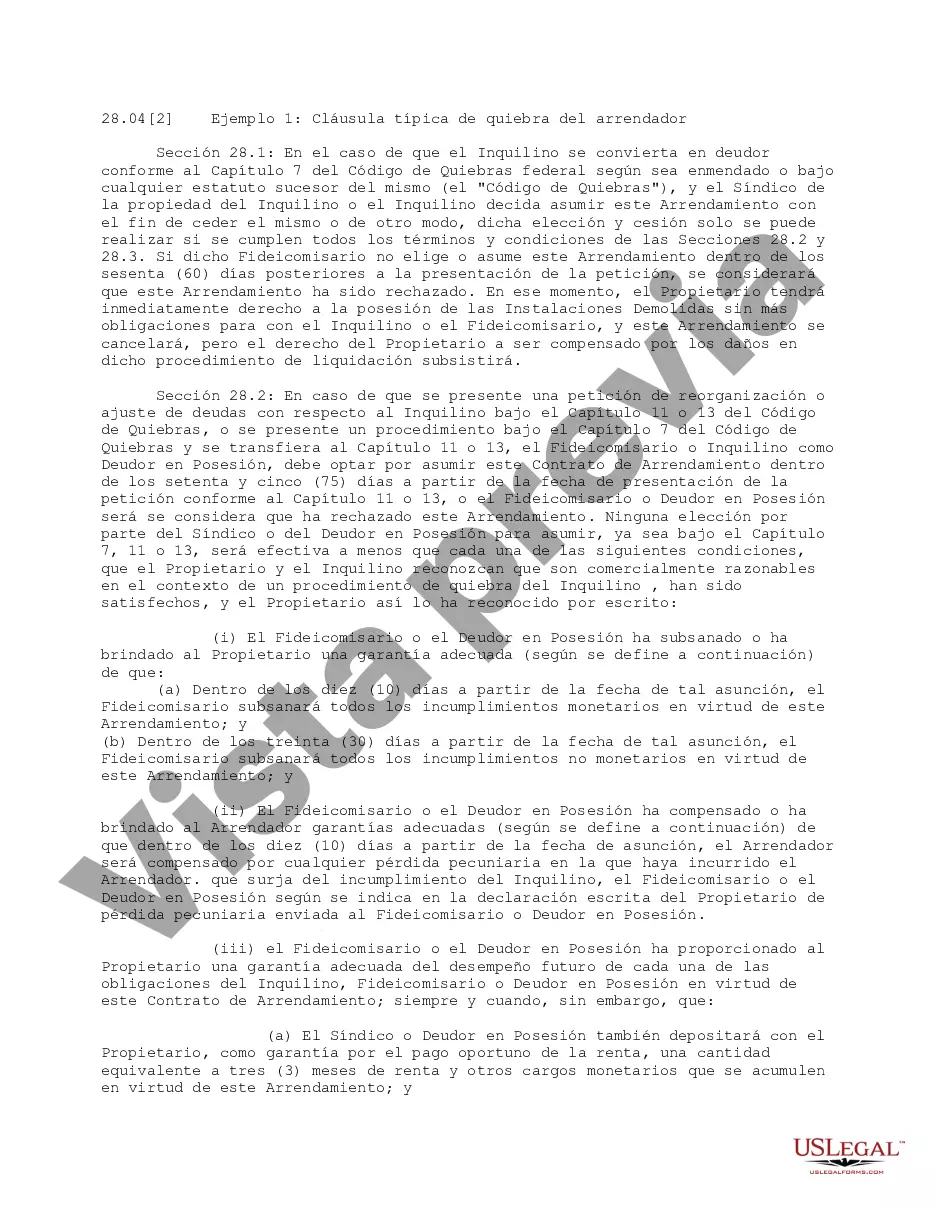

The Suffolk New York landlord bankruptcy clause is a legal provision that specifically applies to the relationship between landlords and tenants in the Suffolk County region of New York. This clause addresses the issue of what happens to a tenant's rights and obligations in the event that their landlord files for bankruptcy. In general, a landlord bankruptcy clause protects the rights of both the tenant and the landlord during bankruptcy proceedings. It sets forth the guidelines and procedures to be followed in order to ensure a fair and equitable resolution for all parties involved. One type of Suffolk New York landlord bankruptcy clause is the automatic stay provision. This provision states that if a landlord declares bankruptcy, a tenant cannot be evicted or have their lease terminated solely due to the bankruptcy filing. The automatic stay provision provides a temporary relief to tenants, allowing them to remain in their rental unit while the bankruptcy process unfolds. Another type of Suffolk New York landlord bankruptcy clause is the assumption or rejection of the lease. When a landlord files for bankruptcy, they have the option to assume or reject the existing leases with their tenants. If the lease is assumed, the landlord is essentially agreeing to continue the lease under the terms agreed upon prior to bankruptcy. However, if the lease is rejected, the landlord can terminate the lease, and the tenant may need to vacate the premises. Furthermore, the Suffolk New York landlord bankruptcy clause also addresses the issue of security deposits. It specifies how security deposits will be handled during bankruptcy proceedings. Generally, the landlord is required to keep the security deposit in a separate account and use it only for its intended purpose, which is to cover any unpaid rent or damages to the property. The clause may also outline the process for tenants to recover their security deposit if the landlord fails to fulfill their obligations. It's important to note that the specifics of the Suffolk New York landlord bankruptcy clause may vary depending on the specific lease agreement and applicable state and federal laws. Therefore, tenants and landlords should carefully review their lease agreements and seek legal advice to fully understand their rights and obligations in the event of bankruptcy. In summary, the Suffolk New York landlord bankruptcy clause is a crucial provision that safeguards the interests of tenants and landlords when faced with bankruptcy. By addressing issues such as lease assumption or rejection, automatic stay, and security deposit handling, this clause helps provide clarity and protection for both parties during challenging times.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Cláusula de Quiebra del Propietario - Landlord Bankruptcy Clause

Description

How to fill out Suffolk New York Cláusula De Quiebra Del Propietario?

Creating forms, like Suffolk Landlord Bankruptcy Clause, to take care of your legal matters is a challenging and time-consumming process. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms crafted for different scenarios and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Suffolk Landlord Bankruptcy Clause template. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before getting Suffolk Landlord Bankruptcy Clause:

- Make sure that your template is specific to your state/county since the regulations for creating legal paperwork may vary from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Suffolk Landlord Bankruptcy Clause isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin using our website and download the document.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is ready to go. You can try and download it.

It’s an easy task to find and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!