A Santa Clara California Tenant Letter of Credit in Lieu of a Security Deposit is a financial instrument that serves as an alternative to a traditional security deposit for rental properties in Santa Clara, California. This letter of credit provides assurance to the landlord that the tenant will fulfill their rental obligations and cover any potential damages to the property. In a standard rental agreement, landlords often require a security deposit from tenants as a form of protection against unpaid rent, property damage, or other lease violations. However, in lieu of a cash deposit, tenants can choose to provide a letter of credit issued by a bank or financial institution. This letter guarantees the payment of a certain sum agreed upon between the landlord and tenant, should the tenant fail to fulfill their obligations. The Santa Clara California Tenant Letter of Credit in Lieu of a Security Deposit offers several advantages to both landlords and tenants. Landlords benefit from the assurance of having funds readily available in case of any breach of the rental agreement, while tenants do not have to tie up a significant amount of money in a traditional security deposit. Different types of Santa Clara California Tenant Letter of Credit in Lieu of a Security Deposit may include: 1. Standby Letter of Credit (SBLC): This type of letter of credit guarantees payment to the landlord in case the tenant defaults on their rental obligations. It acts as a surety for the tenant's financial commitments. 2. Irrevocable Letter of Credit (IOC): An IOC is a legally binding agreement that ensures the tenant's bank will immediately pay the landlord if the tenant defaults. This letter cannot be canceled or modified without the consent of all parties involved. 3. Revocable Letter of Credit: Unlike the IOC, a revocable letter of credit can be canceled or modified by the issuing bank without the consent of the tenant or landlord. This type of letter might be less common for rental agreements as it offers less security to the landlord. 4. Documentary Letter of Credit: This type of letter of credit requires the tenant to provide specific documents, such as proof of payment or other supporting evidence, to release payment to the landlord. It adds a layer of verification to the transaction. The Santa Clara California Tenant Letter of Credit in Lieu of a Security Deposit offers flexibility and security for both landlords and tenants in rental agreements. It provides an alternative to traditional, upfront cash deposits while ensuring financial protection for the property owner.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Carta de crédito del inquilino en lugar de un depósito de seguridad - Tenant Letter of Credit in Lieu of a Security Deposit

Description

How to fill out Santa Clara California Carta De Crédito Del Inquilino En Lugar De Un Depósito De Seguridad?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Santa Clara Tenant Letter of Credit in Lieu of a Security Deposit, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Santa Clara Tenant Letter of Credit in Lieu of a Security Deposit from the My Forms tab.

For new users, it's necessary to make several more steps to get the Santa Clara Tenant Letter of Credit in Lieu of a Security Deposit:

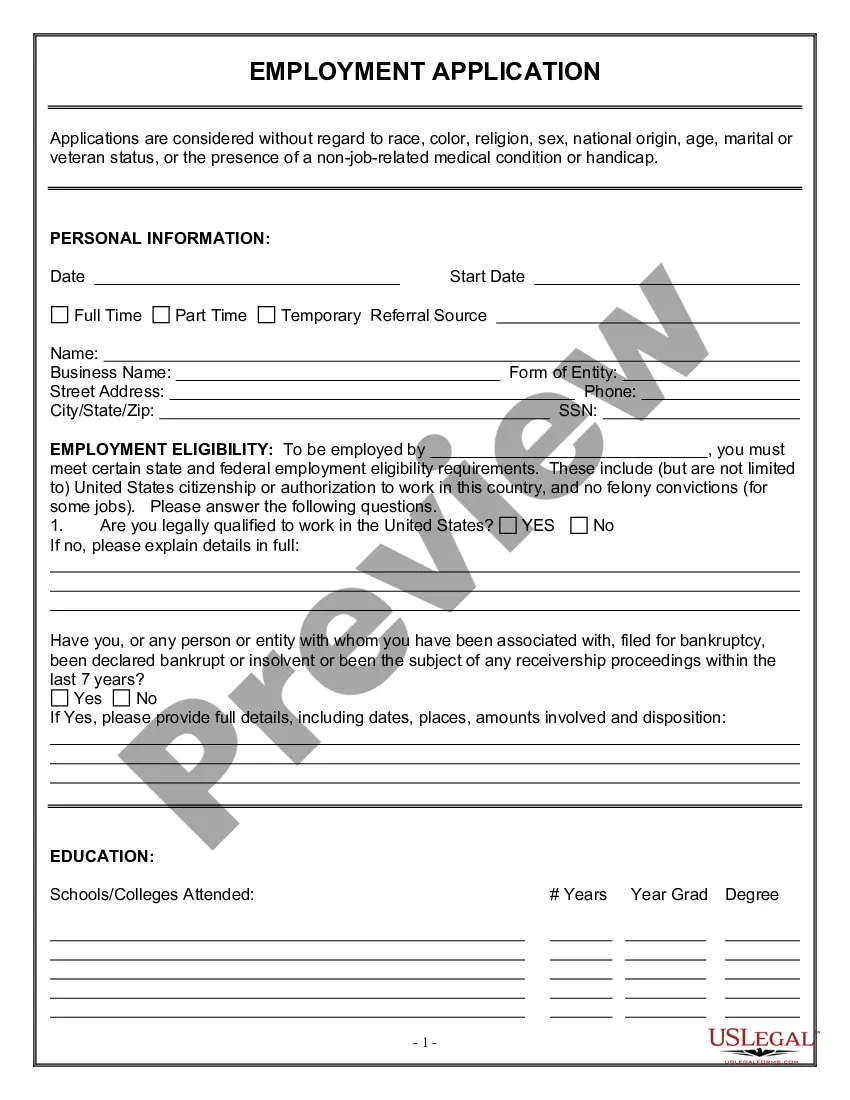

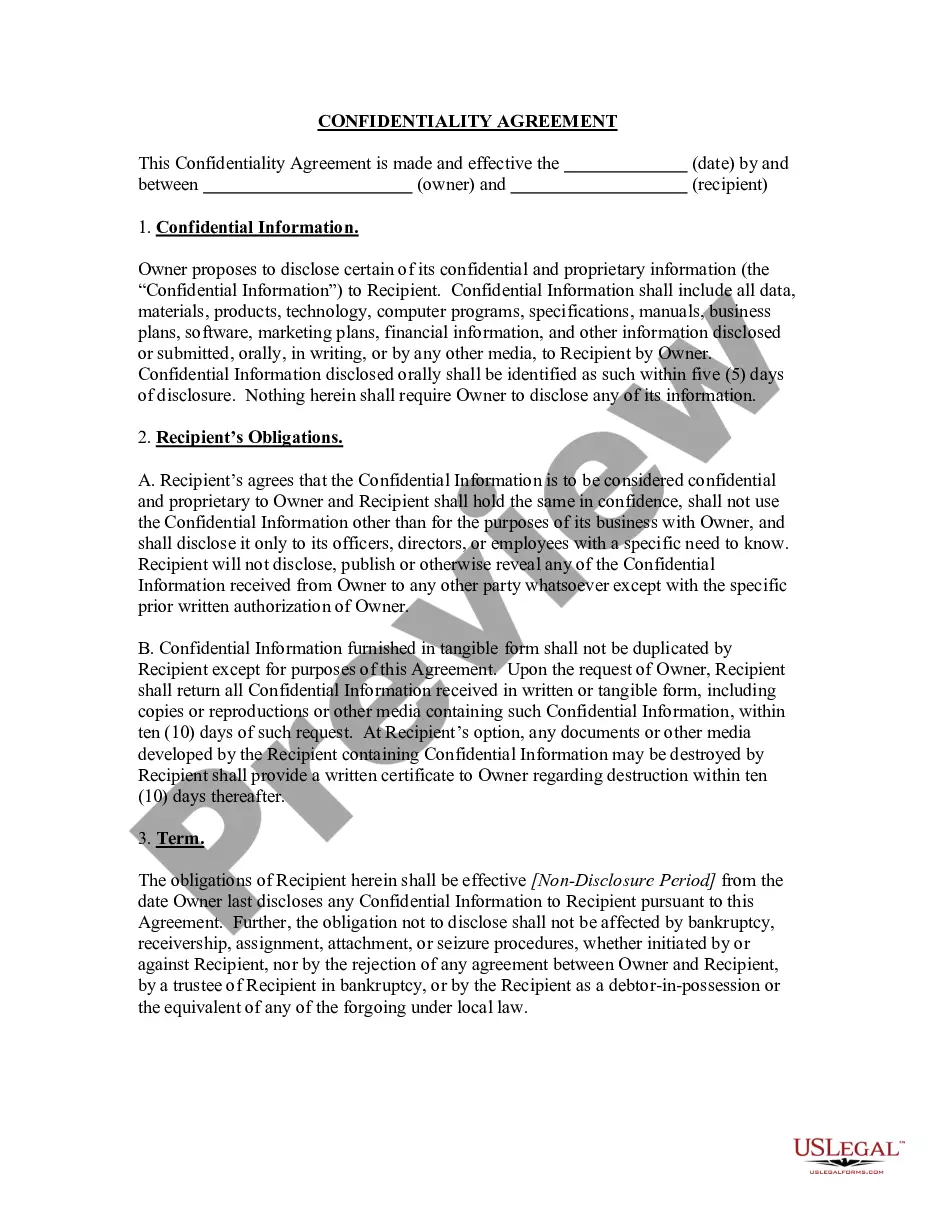

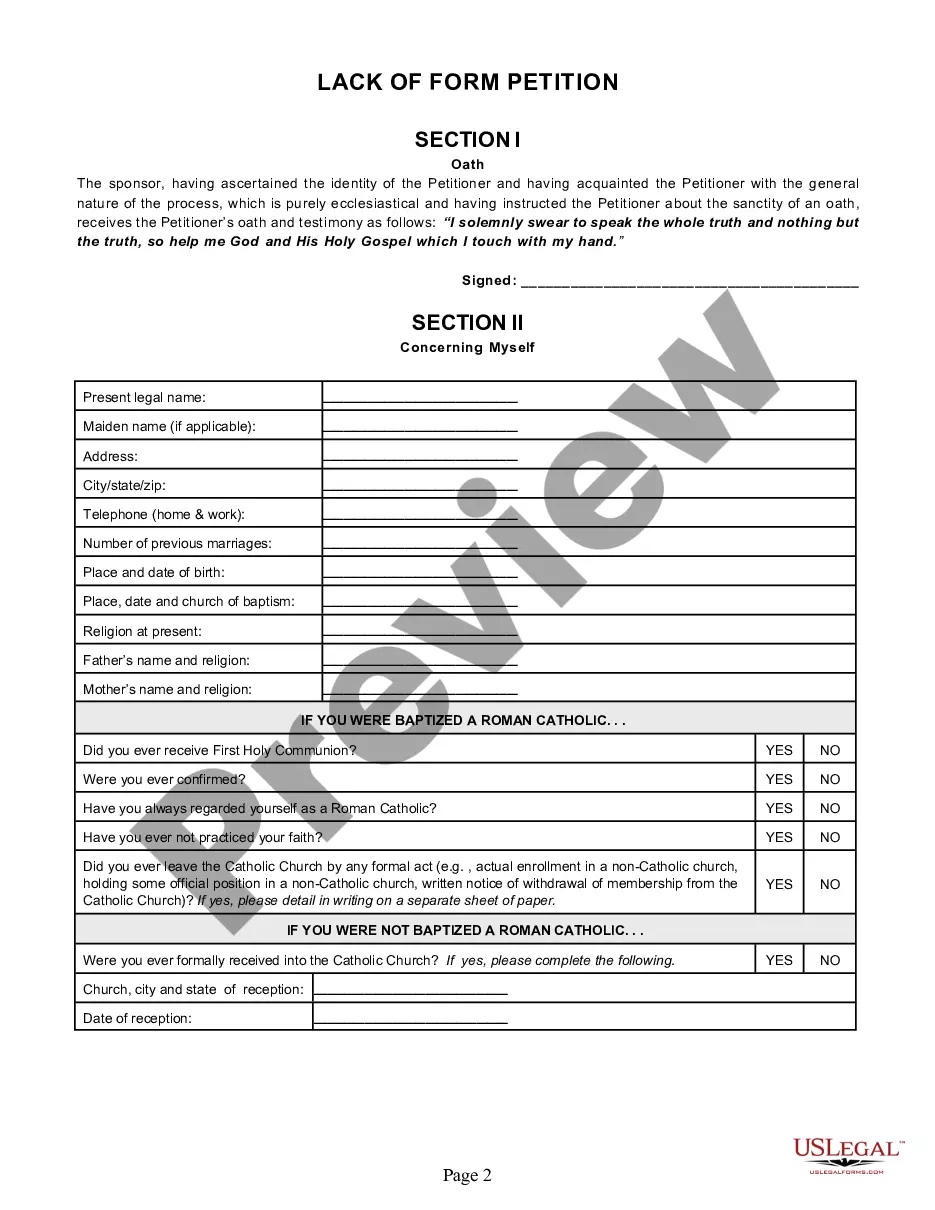

- Take a look at the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!