Hennepin County, Minnesota is located in the central part of the state and is home to the city of Minneapolis. Within the county, there are various clauses setting forth the standard measuring method to be used for remeasurement. These clauses have been put in place to ensure accurate and consistent measurement practices in a variety of settings, such as construction, real estate, and property assessment. Real Estate Remeasurement Clause: One type of Hennepin Minnesota clause setting forth the standard measuring method to be used for remeasurement is specifically related to real estate. This clause aims to define the precise measuring standards to be used by real estate agents, appraisers, and property owners when determining the dimensions and square footage of a property. It outlines the requirements for measuring the interior and exterior spaces, the methodology for calculating square footage, and any specific guidelines applicable to different property types (e.g., single-family homes, condominiums, commercial buildings). Construction Remeasurement Clause: In the construction industry, a separate Hennepin Minnesota clause exists to guide remeasurement practices. This clause ensures that construction projects comply with standard measurement techniques when determining material quantities, estimating costs, and assessing project progress. It may include guidelines on measuring different elements of the construction site, such as foundations, walls, roofs, and overall floor space. The clause aims to regulate consistency in measuring methods across various construction projects within Hennepin County. Property Assessment Remeasurement Clause: When it comes to property assessment, Hennepin Minnesota has established specific clauses to govern remeasurement procedures. These clauses provide guidelines for assessing the value of properties for tax purposes based on accurate measurements. They outline measurement standards and methodologies used by property assessors to determine the taxable area of land and buildings. The clause may address issues such as including or excluding certain features in the measurement, calculation methods for irregularly shaped properties, and the use of technological tools (like laser measurement) to ensure accuracy. Importance of Standard Measuring Method for Remeasurement: The establishment of these Hennepin Minnesota clauses setting forth the standard measuring method to be used for remeasurement is essential for several reasons. First, it promotes fairness and consistency when dealing with property transactions, constructions, or tax assessments. By having a standard measurement method, it ensures that all parties involved are working with the same guidelines, reducing the possibility of measurement-related disputes. Second, accurate measurements play a crucial role in determining property values, construction costs, and appropriate tax assessments. Consistent measuring practices help establish uniformity in property assessments, preventing disparities and ensuring equitable taxation. Furthermore, standard measuring techniques foster transparency and trust among the various stakeholders involved in real estate transactions, construction projects, and local taxation processes. It allows for effective communication and understanding of property dimensions, reducing confusion and promoting smoother negotiations. In conclusion, Hennepin County in Minnesota has different clauses establishing the standard measuring method to be used for remeasurement in various contexts, including real estate, construction, and property assessment. These clauses ensure accuracy, consistency, fairness, and trust within these industries and play a vital role in property valuation, construction estimation, and tax assessment processes.

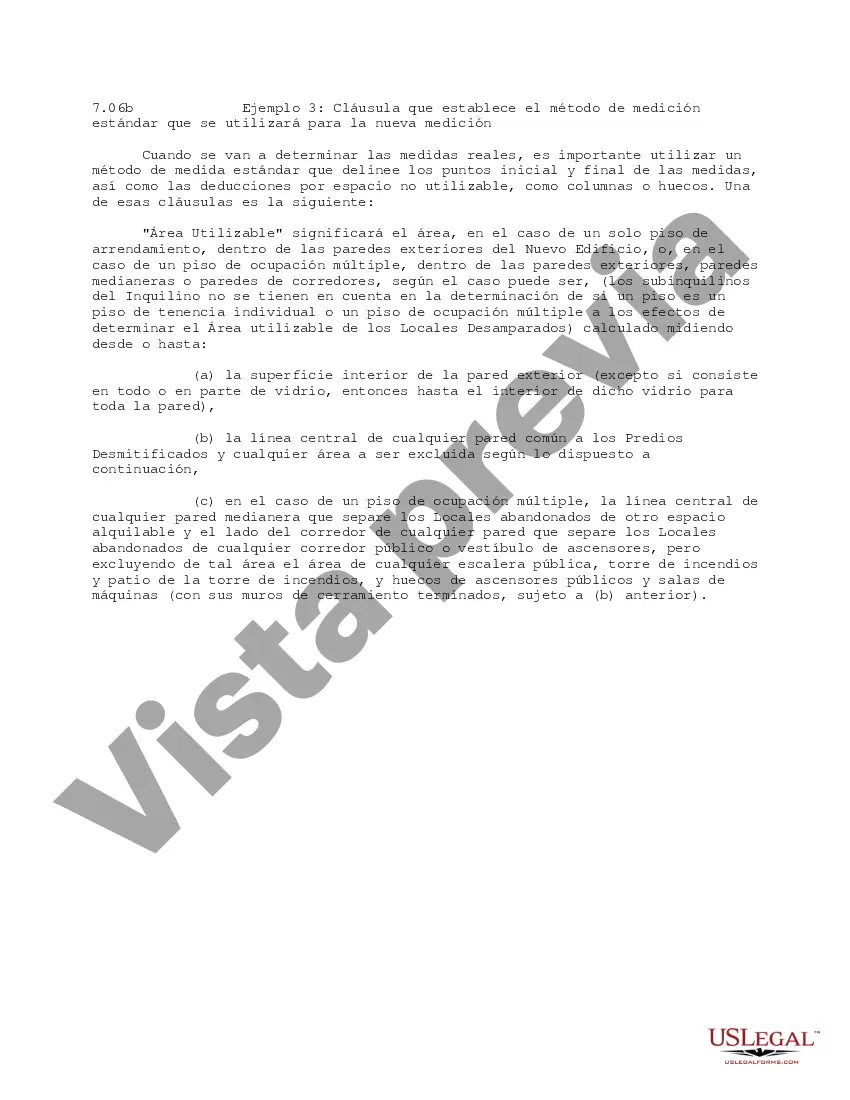

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Cláusula que establece el método de medición estándar que se utilizará para la nueva medición - Clause Setting Forth the Standard Measuring Method to Be Used for Remeasurement

Description

How to fill out Hennepin Minnesota Cláusula Que Establece El Método De Medición Estándar Que Se Utilizará Para La Nueva Medición?

Preparing legal documentation can be difficult. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Hennepin Clause Setting Forth the Standard Measuring Method to Be Used for Remeasurement, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Consequently, if you need the current version of the Hennepin Clause Setting Forth the Standard Measuring Method to Be Used for Remeasurement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Hennepin Clause Setting Forth the Standard Measuring Method to Be Used for Remeasurement:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Hennepin Clause Setting Forth the Standard Measuring Method to Be Used for Remeasurement and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!