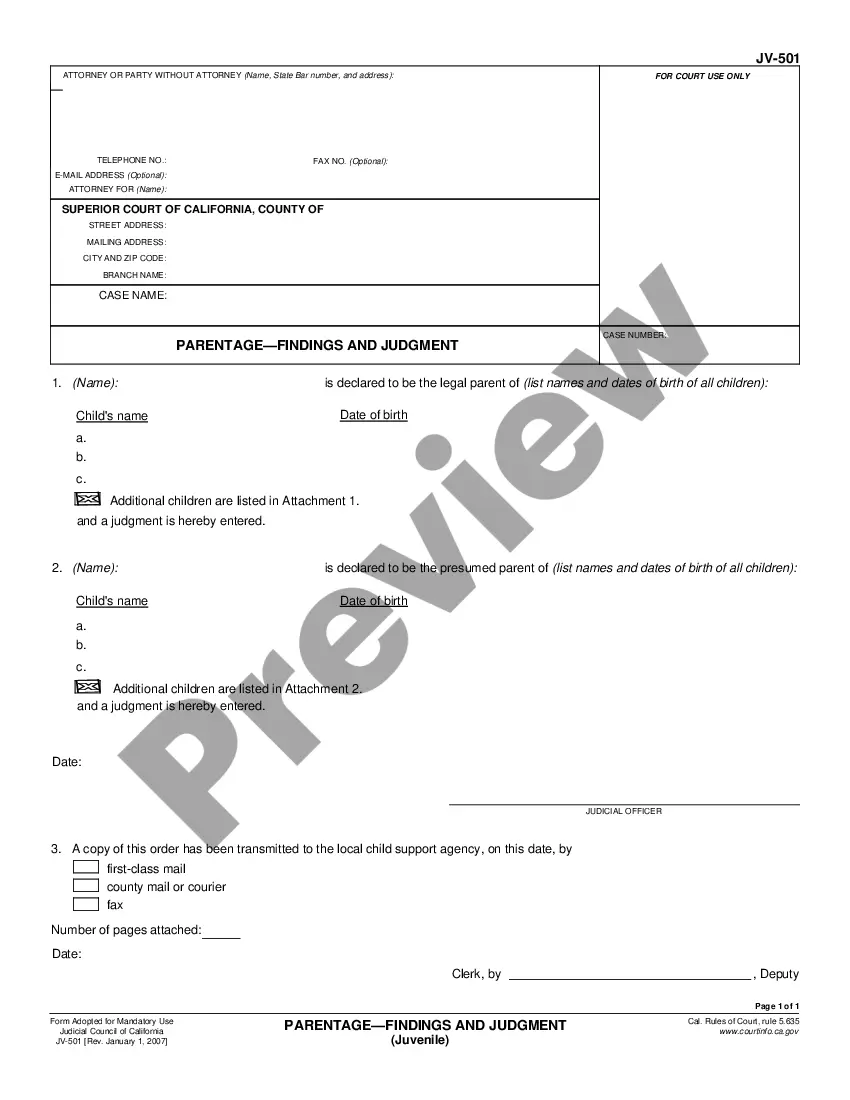

Bexar Texas Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share: The Bexar Texas Measurement Representations refer to guidelines and definitions used in determining the size or square footage of a property within the Bexar County, Texas area. These measurements are crucial in various real estate transactions such as leases, sales, and property assessments. The Proportionate Share Adjustment of Tenants Proportionate Tax Share involves the allocation of property tax responsibilities among different tenants occupying a property. This adjustment ensures that each tenant contributes proportionally to the overall tax burden based on the amount of space they occupy within the property. Different Types: 1. Gross Leasable Area (GLA): GLA represents the total floor space within a building that is available for lease to tenants. It includes both the actual occupied space and common areas such as hallways, lobbies, restrooms, and shared facilities. GLA is commonly used in determining rental rates and tenant contributions. 2. Net Leasable Area (LA): LA refers to the usable area within a property that can be leased to tenants, excluding common areas. It represents the actual space available for tenants' exclusive use and is used for calculating rent and tax obligations. 3. Rentable Area: Rentable area combines the occupied space of a tenant along with their proportionate share of common areas. It includes the tenant's usable area, plus a proportionate share of common spaces, such as corridors and restrooms. Rentable area is often used to determine rent and property tax contributions. 4. Tenant Proportionate Share: Tenant Proportionate Share refers to the percentage or fraction assigned to each tenant that represents their portion of the total property tax liability. It is usually determined by dividing the tenant's occupied area (either GLA or LA) by the total leasable area of the property. 5. Proportionate Share Adjustment: The Proportionate Share Adjustment ensures that each tenant's contribution to property taxes accurately reflects their occupied area and the overall tax burden. It may involve adjustments based on changes in tenants' proportionate shares during a lease term or when there are modifications in the property's leasable areas. 6. Common Area Maintenance (CAM) Charges: CAM charges are additional fees paid by tenants to cover the costs of maintaining and operating shared spaces within a commercial property. These charges are allocated proportionally based on the tenant's occupied area and typically include expenses related to cleaning, landscaping, security, and utilities for common areas. Understanding Bexar Texas Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share is essential for landlords, tenants, and real estate professionals when negotiating leases, allocating costs, and ensuring fair tax responsibilities within the Bexar County area.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Representaciones de Medición y Ajuste de la Parte Proporcional de los Inquilinos Participación Proporcional del Impuesto - Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share

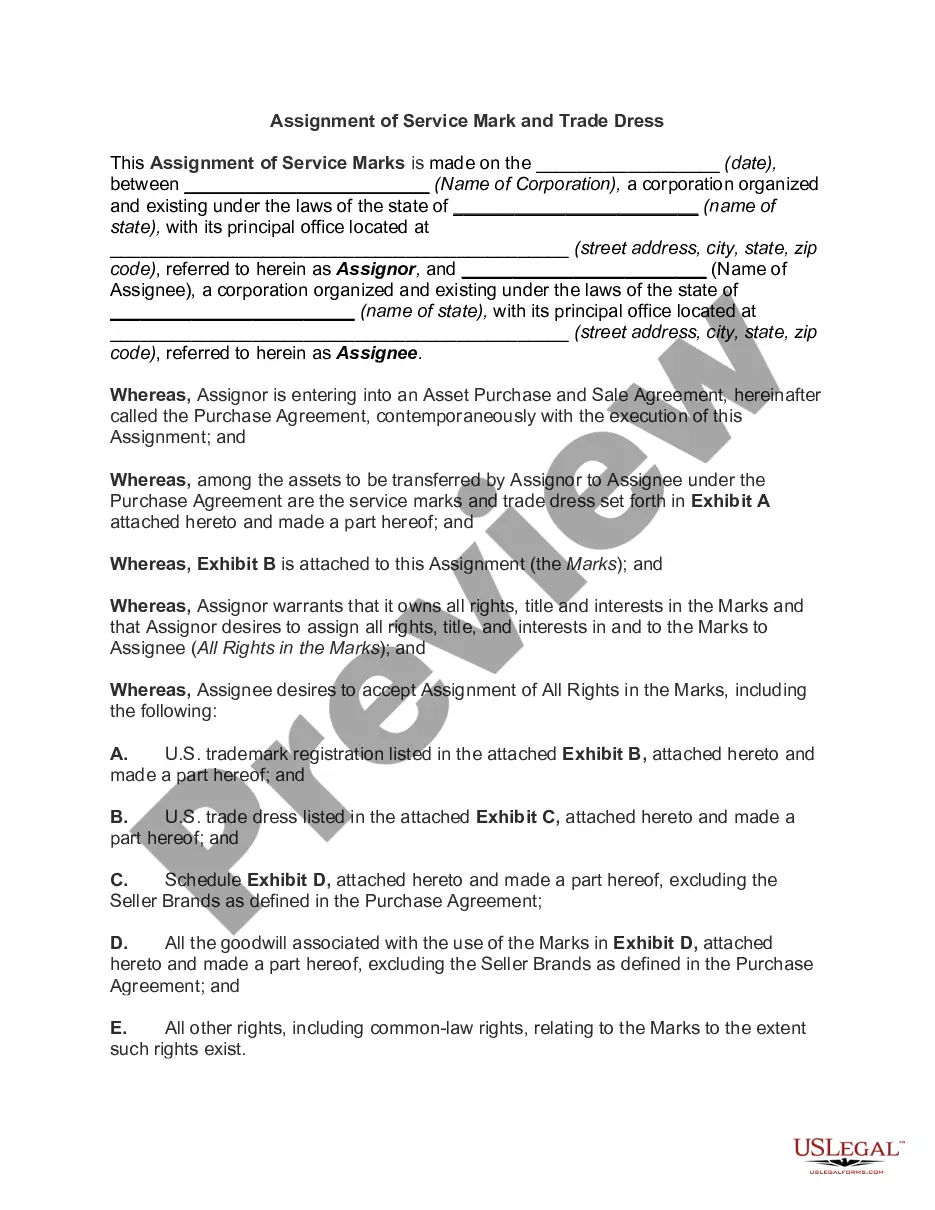

Description

How to fill out Bexar Texas Representaciones De Medición Y Ajuste De La Parte Proporcional De Los Inquilinos Participación Proporcional Del Impuesto?

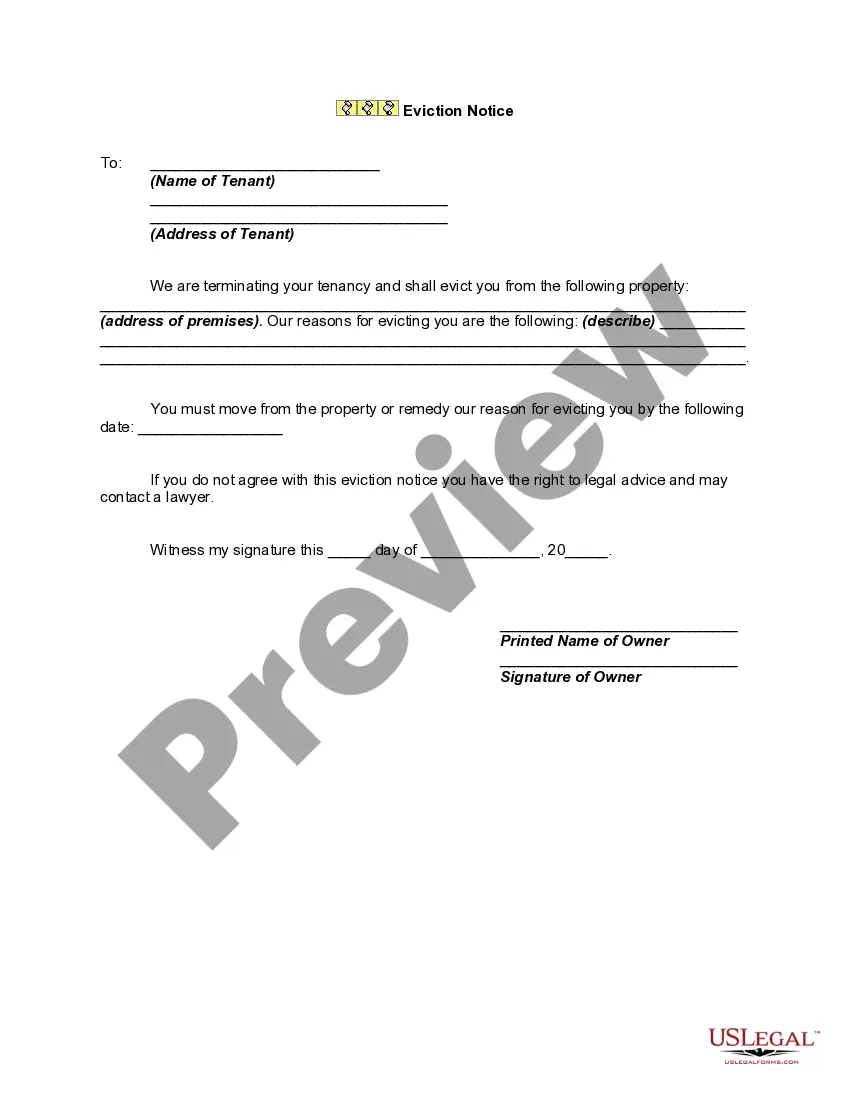

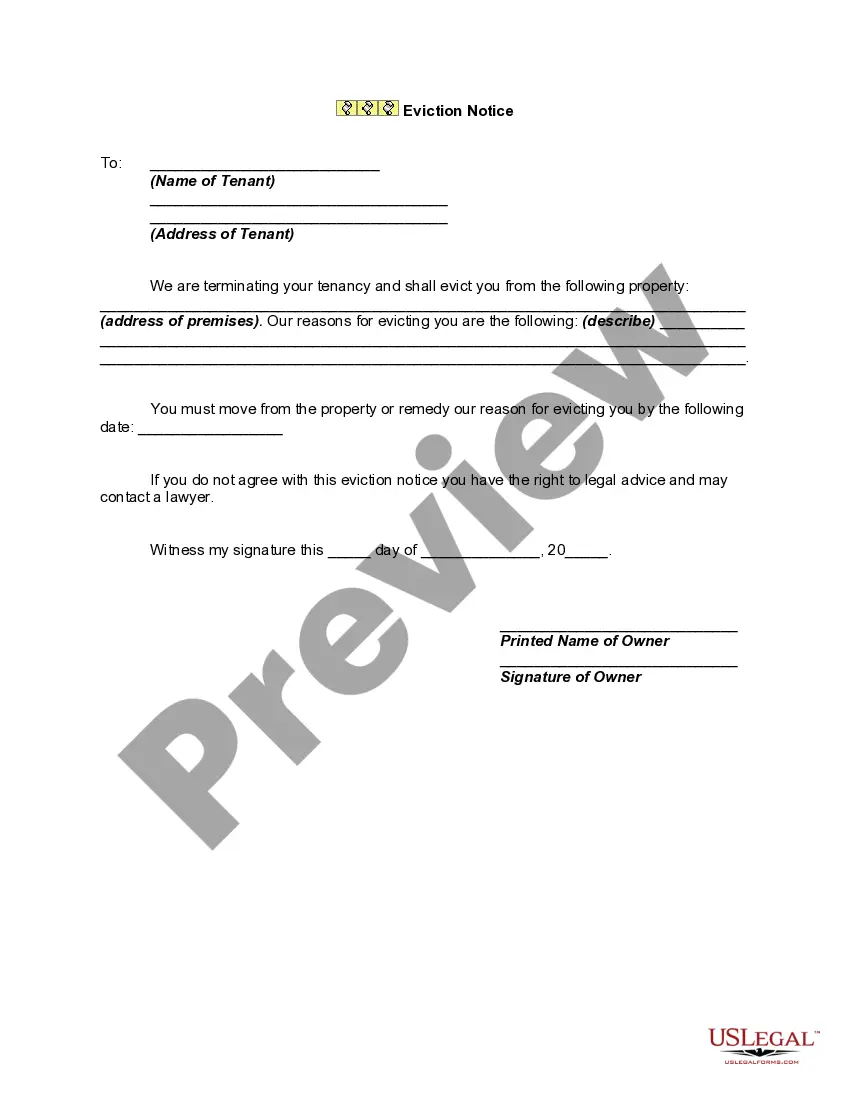

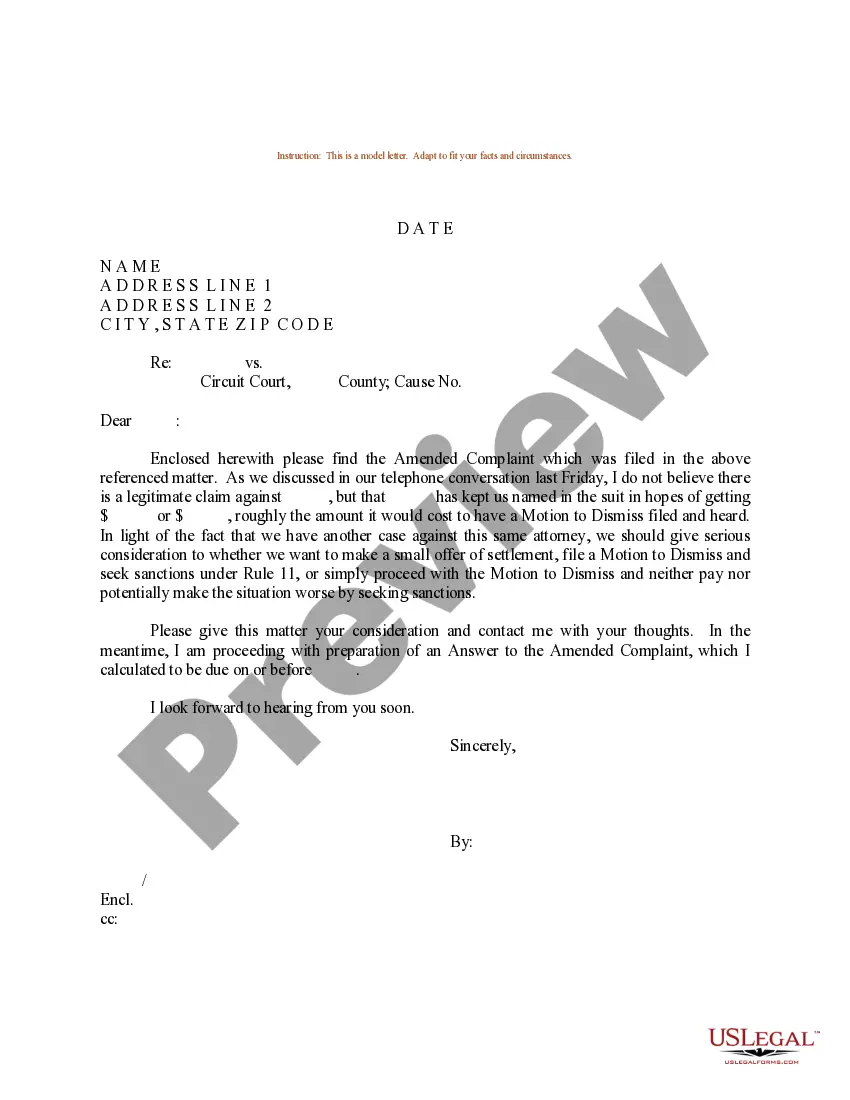

Creating documents, like Bexar Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share, to manage your legal matters is a challenging and time-consumming task. Many situations require an attorney’s participation, which also makes this task expensive. However, you can take your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms crafted for a variety of cases and life circumstances. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Bexar Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before getting Bexar Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share:

- Make sure that your template is compliant with your state/county since the rules for writing legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Bexar Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin using our service and download the form.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment details.

- Your form is ready to go. You can try and download it.

It’s easy to find and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

En conclusion, se puede decir que el plazo que tiene el inquilino para desocupar es de 3 meses contados desde la fecha en que le fue notificado el aviso de terminacion o no renovacion. Terminacion del contrato de arrendamiento de vivienda urbana.

En el mes de agosto, el aumento fue del 7,0% y en el 2022 acumulan una suba del 59%, por encima de la inflacion.

¿Que documentacion te van a pedir para alquilar un piso siendo autonomo? Declaracion de la renta. Modelo 130. Pagos de las cuotas a la Seguridad Social. Aval bancario. Seguro de proteccion del alquiler. Queda con el propietario. Ofrece alternativas economicas.

La renta no puede aumentar mas de dos veces por ano. El total del aumento en un plazo de 12 meses no puede ser mas del limite de aumento de renta (inicialmente 8.3 %).

Independientemente de si el arrendatario es asalariado, autonomo, pensionista o funcionario, el ratio sueldo/precio del alquiler que suele tomarse como referencia para valorar la solvencia del inquilino es que, tras el pago de la renta, el sueldo restante (lo que le queda para vivir) del arrendatario sea superior al 60

Lo que resta para saber como calcular aumento de alquiler 2022 es tomar el valor de variacion y multiplicarlo por el monto en pesos que se venia abonando de alquiler cada mes. El resultado sera el importe actualizado.

¿Donde se declara el alquiler de vivienda? La declaracion del arrendamiento se realiza en el apartado de rendimientos de capital inmobiliario (casillas 562, parte estatal, casilla 563, parte autonomica). Si cumples los requisitos, podras desgravar parte del importe.

¿Como demuestro una solvencia economica? Dinero en efectivo: esta es la manera mas comun de probar una solvencia economica. Estados de cuentas bancarios: Imprime tus estados de cuenta. Estados de Cuenta de Tarjetas de Credito.

El aumento puede llegar a ser hasta de un 10%, dependiendo de la ciudad y las regulaciones que existan para el control de renta.

En un estudio de solvencia se miran los ingresos y los gastos del inquilino y se valora el total que le queda para hacer frente a las mensualidades. Las aseguradoras examinaran que el importe de las rentas no superen el 30% o 40% de los ingresos del candidato.

More info

Ensure that landowners are not able to game the system and avoid paying taxes they owe or making a fraudulent claim for exemptions. For more information on appraisals and the District's portion of the net pension contribution for municipal employees, refer to the Tax Assistance and Assessment Program (TRAP) section of the Tax Code. Appraisals and ensure that landowners pay their fair share of taxes. Ensure that landowners are not able to game the system and avoid paying taxes they owe or making a fraudulent claim for exemptions. For more information on appraisals and the District's portion of the net pension contribution for municipal employees, refer to the Tax Assistance and Assessment Program (TRAP) section of the Tax Code. Prohibiting Tax Exemptions for Municipal Employees. The District of Columbia's Tax Code prohibits the District from offering tax exclusions for municipal retirees for whom a District tax bill was assessed within the immediately preceding 12 months.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.