Dallas Texas is a bustling metropolis renowned for its vibrant culture, economic significance, and diverse community. When it comes to commercial leases, understanding the concept of Dallas Texas Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share is crucial. Measurement Representations refer to the accurate calculation and representation of the measurements of a leased space. Landlords and tenants rely on these measurements to determine the rent and other lease obligations accurately. Precise measurement representations ensure fairness and transparency in lease agreements, minimizing potential disputes. Proportionate Share Adjustment of Tenants Proportionate Tax Share is an important aspect of commercial leases in Dallas, Texas. It involves allocating the expenses associated with the property's real estate taxes among the tenants based on their respective proportions of the total leasable area. The proportionate tax share ensures that each tenant bears their fair share of the tax burden, aligning with the principle of proportionality. Different types of Dallas Texas Measurement Representations and Proportionate Share Adjustments of Tenants Proportionate Tax Share may include: 1. Gross Leasable Area (GLA) Measurement: This calculates the total leasable area within a commercial property, including both usable and common areas. GLA measurement is essential for determining the proportionate share and rent for each tenant. 2. Net Leasable Area (LA) Measurement: LA measures the usable area exclusively assigned to a tenant, excluding any common areas or shared spaces. LA is particularly relevant when determining the proportionate share of expenses like real estate taxes, as it considers only the area directly utilized by the tenant. 3. Common Area Allocation: In some cases, tenants may also be responsible for a proportionate share of expenses related to common areas within the property, such as lobbies, hallways, restrooms, or parking lots. This allocation ensures fair distribution of costs associated with shared spaces. 4. Base Year Comparison: Proportionate tax shares can be adjusted periodically by comparing the current year's real estate tax expenses with a predefined base year. Any increase above the base year serves as the adjustment factor for each tenant's tax share. This adjustment prevents disproportionate increases in tax burdens. Dallas Texas Measurement Representations and Proportionate Share Adjustments of Tenants Proportionate Tax Share play a vital role in maintaining transparency, fairness, and accuracy in commercial leases. Understanding these concepts is crucial for both landlords and tenants to ensure a harmonious and mutually beneficial leasing experience in the vibrant city of Dallas, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Representaciones de Medición y Ajuste de la Parte Proporcional de los Inquilinos Participación Proporcional del Impuesto - Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share

Description

How to fill out Dallas Texas Representaciones De Medición Y Ajuste De La Parte Proporcional De Los Inquilinos Participación Proporcional Del Impuesto?

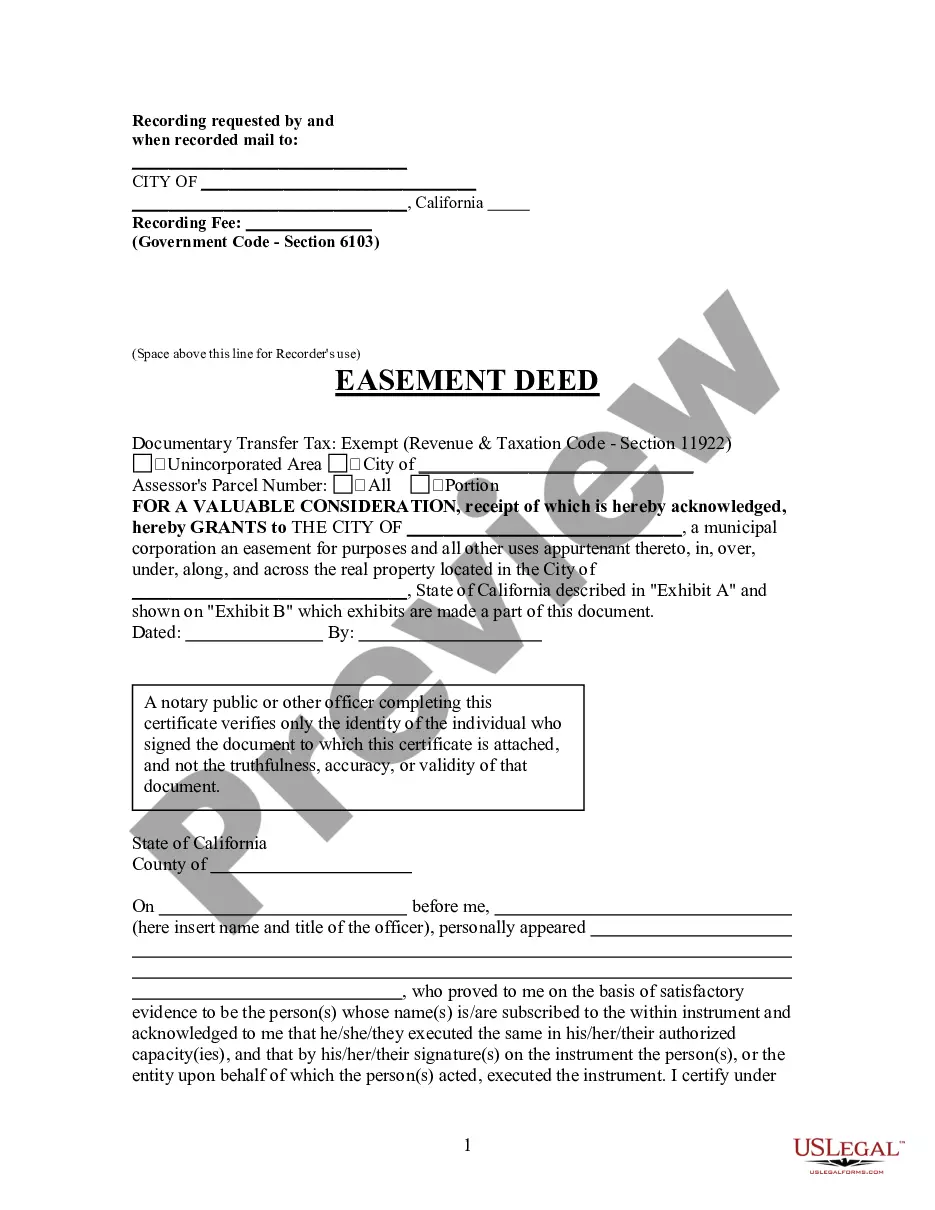

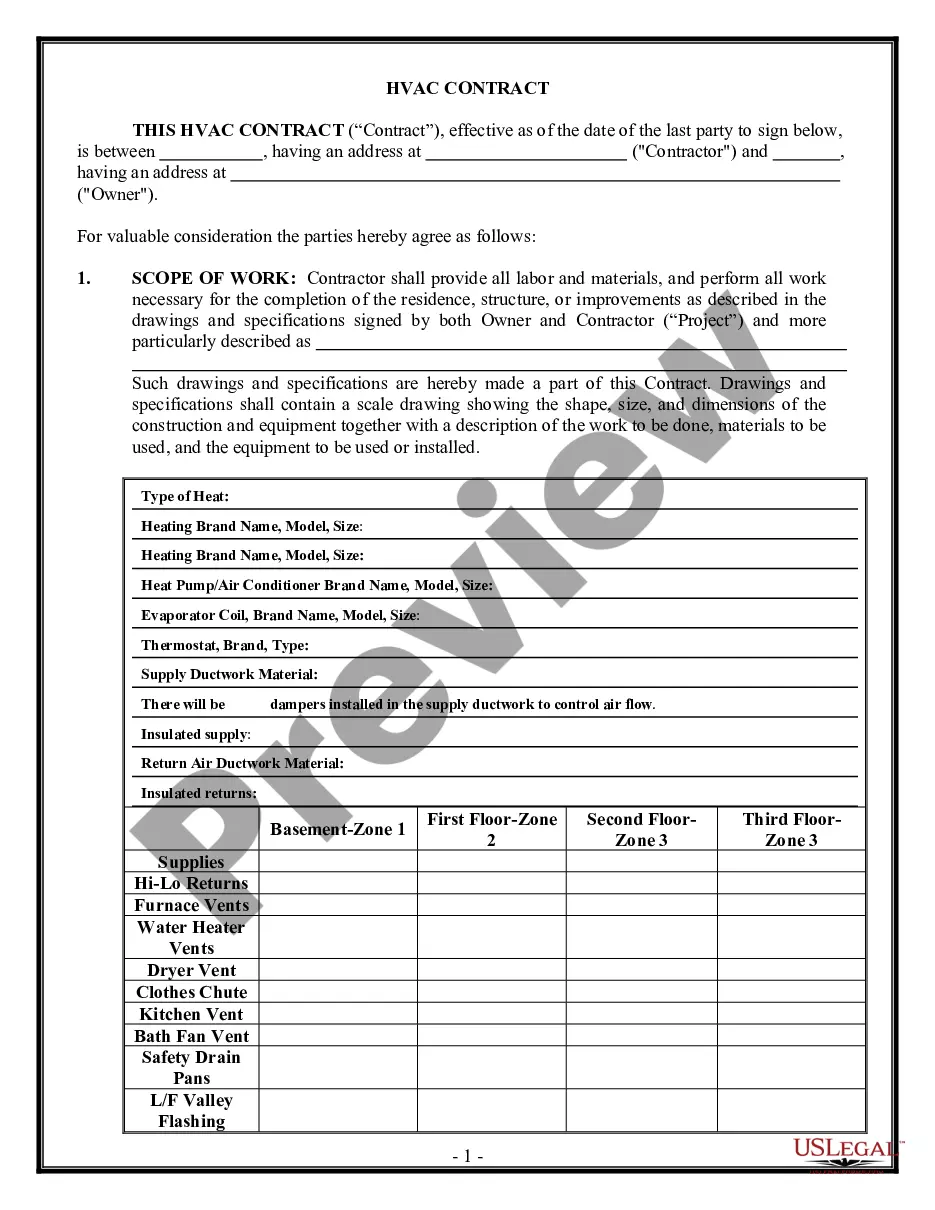

Draftwing forms, like Dallas Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share, to manage your legal matters is a difficult and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents created for a variety of cases and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Dallas Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before downloading Dallas Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share:

- Ensure that your document is specific to your state/county since the rules for writing legal documents may differ from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the Dallas Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to begin utilizing our service and get the document.

- Everything looks great on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your form is ready to go. You can try and download it.

It’s easy to find and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!