Salt Lake Utah Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share refers to a specific method for determining the tax obligations of tenants in Salt Lake City, Utah, based on their proportionate share of the total property measurement. In commercial real estate leasing, tenants are typically responsible for paying their share of property taxes in addition to their rent. The calculation of this share is commonly done through the Salt Lake Utah Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share method. This method involves two key elements: measurements representations and proportionate share adjustment. First, the measurement representations are used to determine the area or square footage of the tenant's leased space relative to the total area of the property. This ensures accuracy in calculating the proportionate share. The second element, proportionate share adjustment, is based on the tenant's proportionate occupancy period during the tax year. If a tenant occupies the space for only a portion of the year, their tax share will be adjusted accordingly. Different types of Salt Lake Utah Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share may include: 1. Gross Lease Proportionate Tax Share: Under this type, the tenant's tax share is calculated based on their share of the total property measurement without any adjustment for occupancy periods. The tenant pays a fixed percentage of the total property tax throughout their lease term. 2. Prorate Lease Proportionate Tax Share: In this approach, the tax share is adjusted based on the tenant's occupancy period. The tenant pays a proportionate share of the property tax in relation to the duration of their occupancy within the tax year. 3. Net Lease Proportionate Tax Share: This type of tax share calculation is most commonly used in commercial leases. The tenant is responsible for both their direct expenses (rent and utilities) and their share of property taxes based on their measurement representation and occupancy period adjustment. In conclusion, the Salt Lake Utah Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share method is a fair and practical way to allocate property tax responsibilities among tenants in the Salt Lake City area. It ensures accuracy by considering the tenant's occupied measurement representation and adjusts their proportionate share based on their occupancy period.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Representaciones de Medición y Ajuste de la Parte Proporcional de los Inquilinos Participación Proporcional del Impuesto - Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share

Description

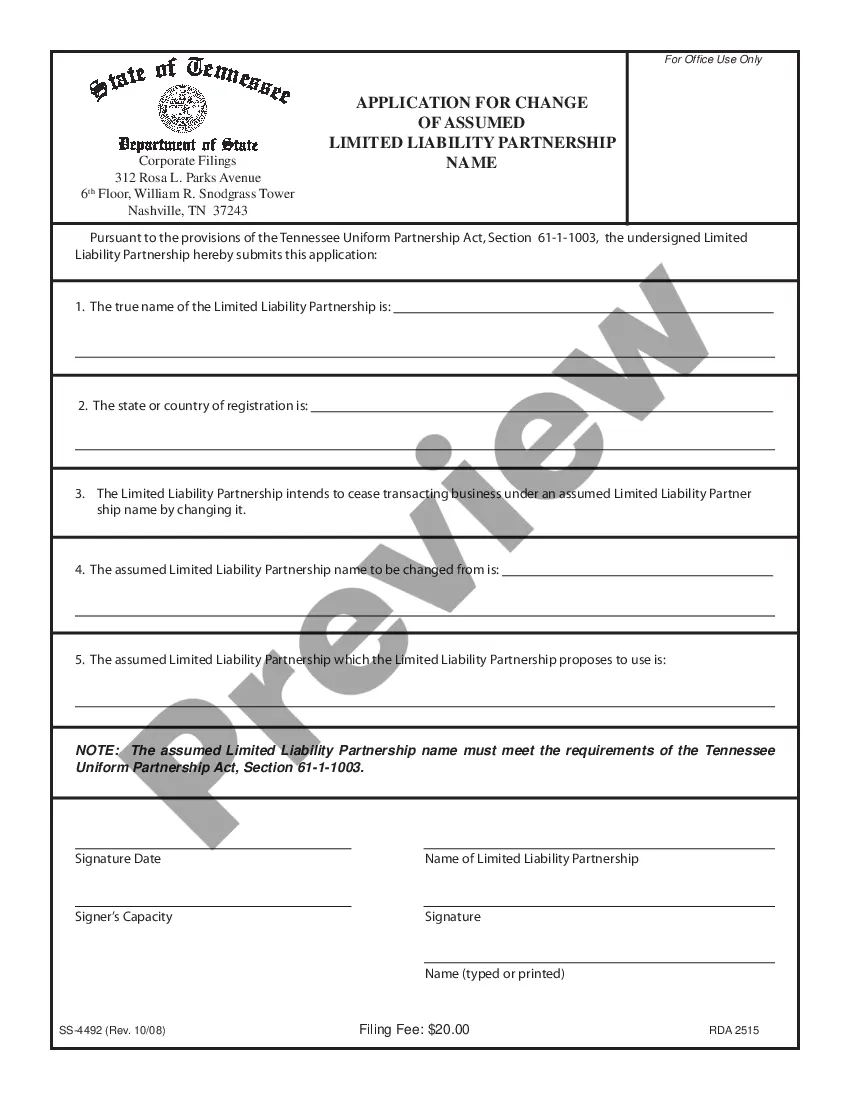

How to fill out Salt Lake Utah Representaciones De Medición Y Ajuste De La Parte Proporcional De Los Inquilinos Participación Proporcional Del Impuesto?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Salt Lake Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the recent version of the Salt Lake Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Salt Lake Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Salt Lake Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!