Tarrant Texas Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share refers to the process and calculations involved in determining the proportional responsibility of tenants for property taxes in Tarrant County, Texas. This concept is crucial for landlords, property owners, and tenants alike, as it ensures a fair distribution of tax burdens. In Tarrant County, property taxes are levied based on the assessed value of the property. The share of tax to be paid by each tenant is determined by their proportionate share, which is calculated using the Tarrant Texas Measurement Representations and Proportionate Share Adjustment method. There are different types of Tarrant Texas Measurement Representations and Proportionate Share Adjustment methods, including: 1. Actual Square Footage Method: This method calculates the tenant's proportionate share based on the actual square footage they occupy in relation to the total square footage of the property. The larger the tenant's space, the higher their proportionate tax share will be. 2. Rentable Square Footage Method: In this method, the tenant's proportionate share is determined based on the rentable square footage they occupy. This includes not only the actual space they use but also their share of common areas and other shared facilities. 3. Partial Occupancy Method: When a tenant only occupies a portion of a property, this method is used to calculate their proportionate tax share. It considers the ratio of occupied space to the total space available. Additionally, within Tarrant County, there may be specific regulations and rules that govern the calculation of proportionate tax shares. These regulations are designed to ensure accuracy and fairness in tax allocation among tenants. It is important for landlords and tenants to be aware of these Tarrant Texas Measurement Representations and Proportionate Share Adjustment methods to understand their tax obligations accurately. By knowing the method used and the formula applied, both parties can make informed decisions and plan accordingly. In conclusion, Tarrant Texas Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share is a vital aspect of property taxation in Tarrant County. It ensures that each tenant pays their fair share of property taxes, considering factors such as square footage, rentable space, and occupancy rate.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Representaciones de Medición y Ajuste de la Parte Proporcional de los Inquilinos Participación Proporcional del Impuesto - Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share

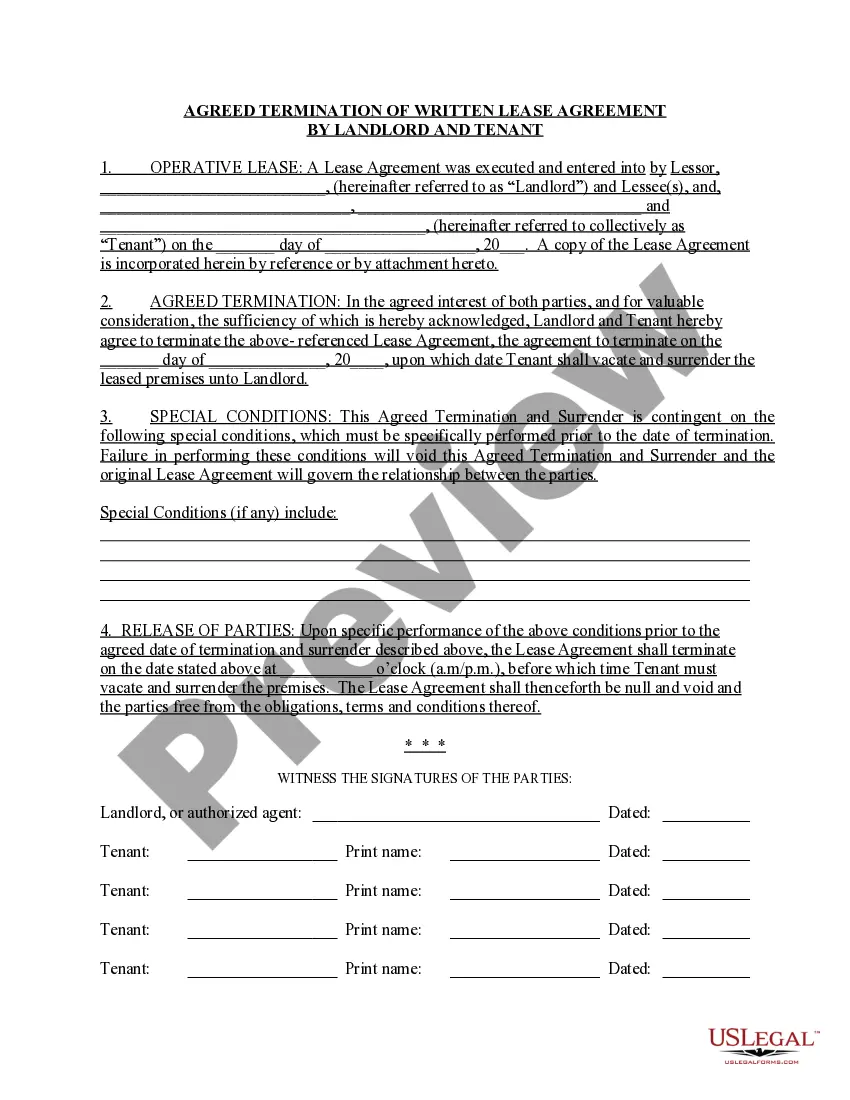

Description

How to fill out Tarrant Texas Representaciones De Medición Y Ajuste De La Parte Proporcional De Los Inquilinos Participación Proporcional Del Impuesto?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Tarrant Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Tarrant Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Tarrant Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share:

- Examine the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!