The Harris Texas Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes is a regulation implemented by the Harris County, Texas government that outlines the specific taxable components that contribute to the escalation definition of taxes in the region. This provision serves to provide transparency and clarity to taxpayers and property owners on how their taxes are calculated and what elements are included in the overall taxation process. Key components falling into the escalation definition of taxes under the Harris Texas Provision may include: 1. Property Valuation: This refers to the assessed value of a property, which is determined by the county appraisal district. The provision defines the specific methods and criteria used to calculate property valuations for taxation purposes. 2. Real Estate Improvements: Any improvements made to real estate, such as buildings, structures, or additions, may be considered taxable components falling under the escalation definition of taxes. The provision outlines how these improvements are assessed and included in the overall tax calculation. 3. Taxable Personal Property: Certain types of personal property may also be subject to taxation under this provision. It defines which assets or items fall under the taxable category and how their value is assessed for tax purposes. 4. Applicable Tax Rates: The provision may specify the tax rates applied to different taxable components. It outlines the percentages or formulas used to calculate taxes based on the assessed values. 5. Exemptions and Deductions: The provision may outline any exemptions or deductions allowed for certain taxable components falling under the escalation definition of taxes. This could include exemptions for homestead properties, senior citizens, disabled individuals, or other qualifying circumstances. Different types of Harris Texas Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes may include residential, commercial, agricultural, and industrial properties. Each of these property types may have specific guidelines and criteria for determining the taxable components and rates. In summary, the Harris Texas Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes is a regulatory framework that establishes the taxable components contributing to the escalation definition of taxes in Harris County, Texas. Through this provision, the county government ensures a fair and transparent taxation process by clearly defining how property valuations, real estate improvements, taxable personal property, tax rates, and exemptions/deductions are incorporated into the overall tax calculation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Disposición que define los componentes imponibles que caen en la definición de escalamiento de los impuestos - Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes

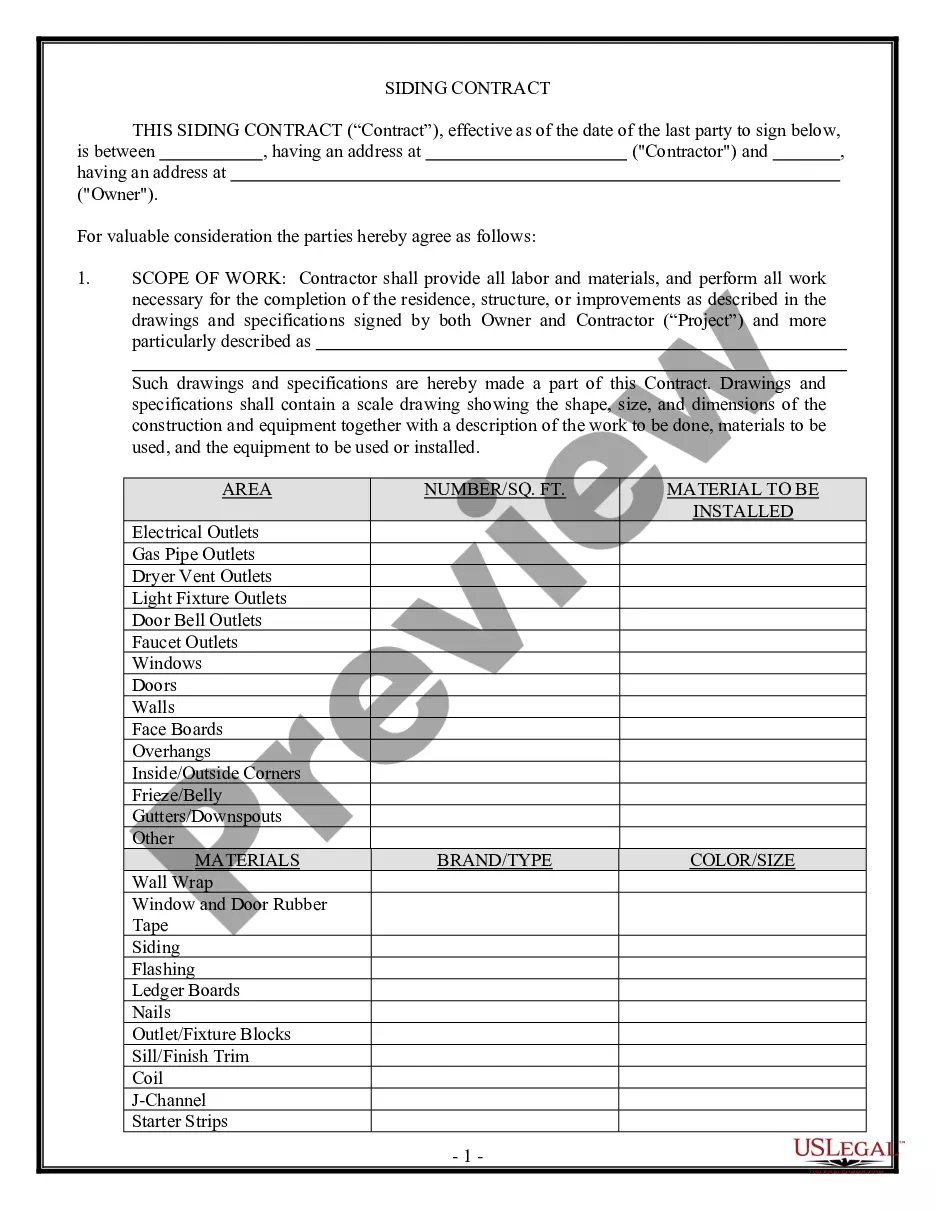

Description

How to fill out Harris Texas Disposición Que Define Los Componentes Imponibles Que Caen En La Definición De Escalamiento De Los Impuestos?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Harris Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Harris Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Harris Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes:

- Examine the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!