The San Jose California Provision defines the taxable components falling into the escalation definition of taxes. It is crucial to understand the specific elements subject to taxation in order to comply with local tax laws and regulations effectively. By outlining and categorizing these components, the San Jose California Provision ensures fair taxation practices and allows businesses and individuals to accurately calculate their tax liabilities. This provision encompasses various taxable components, which can be broadly categorized as income, property, sales, and use taxes. Each type of tax carries specific provisions and regulations that determine what is taxable within San Jose, California. Let's examine each category in detail: 1. Income Taxes: The San Jose California Provision defines taxable income generated within the city limits. This includes wages, salaries, tips, commissions, bonuses, and any other compensation received for services rendered. Additionally, income from rental properties, investments, and self-employment are subject to taxation as well. 2. Property Taxes: Under this provision, property taxes are levied on real estate, such as residential homes, commercial buildings, and vacant land within San Jose. The taxable components include the assessed value of the property, improvements made to the property, and any changes in ownership. 3. Sales Taxes: San Jose imposes a sales tax on the purchase of goods and services within the city. The provision outlines the taxable components on a wide range of items, such as retail products, electronics, clothing, furniture, vehicles, and more. It also defines the applicable tax rates and provides guidelines on exemptions and special circumstances. 4. Use Taxes: When taxable goods are purchased from outside San Jose for use within the city, individuals and businesses are liable for use taxes. The provision determines the taxable components and rates for these out-of-state purchases, ensuring that they are subject to the same taxation as locally bought goods. To ensure compliance with San Jose California tax laws, it is essential to consult the specific provisions relevant to each tax type. Additionally, businesses should stay informed about any updates or amendments to the San Jose California Provision to accurately calculate their tax liabilities. By understanding these components and adhering to the guidelines, individuals and businesses can fulfill their tax obligations and contribute to the city's development and maintenance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Disposición que define los componentes imponibles que caen en la definición de escalamiento de los impuestos - Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes

Description

How to fill out San Jose California Disposición Que Define Los Componentes Imponibles Que Caen En La Definición De Escalamiento De Los Impuestos?

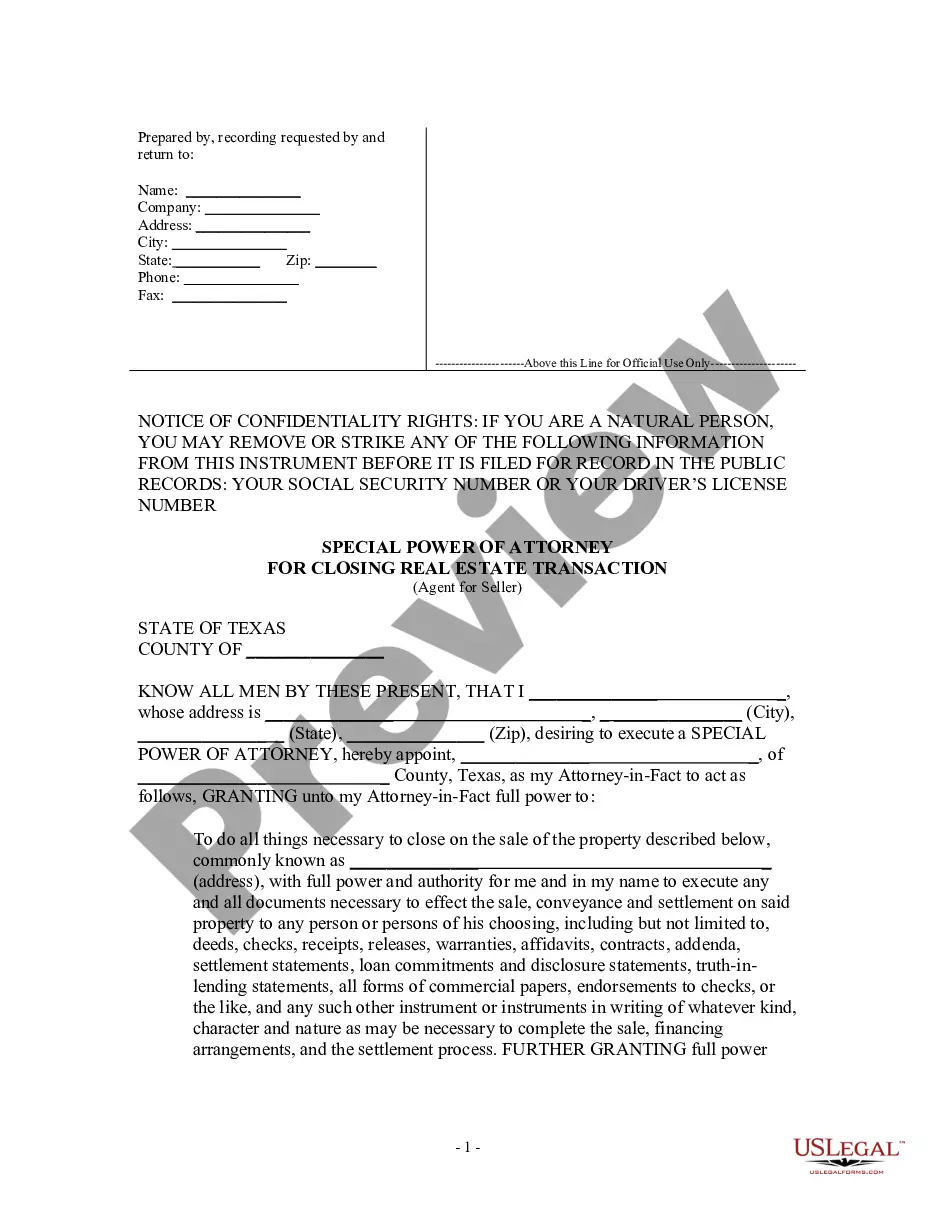

Creating paperwork, like San Jose Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes, to manage your legal matters is a challenging and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for different cases and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the San Jose Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before downloading San Jose Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes:

- Make sure that your document is compliant with your state/county since the rules for creating legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the San Jose Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start utilizing our website and get the document.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can try and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!