Hennepin County in Minnesota is known for its comprehensive clauses and regulations related to accounting matters. These clauses are designed to ensure transparency, accuracy, and accountability in financial reporting for various entities operating within the county. One of the prominent types of Hennepin Minnesota Clauses Relating to Accounting Matters is the "Hennepin County Financial Reporting Clause." This clause mandates businesses operating within the county to comply with specific financial reporting standards, such as Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS). This clause aims to standardize the accounting practices across the county, ensuring consistent and reliable financial information. Another significant type of clause is the "Hennepin County Audit Requirement Clause." As per this clause, businesses are obligated to undergo an annual financial audit conducted by an independent certified public accountant (CPA) or a licensed firm. This requirement ensures that the financial statements provided by entities are accurate, audited, and free from material misstatements or fraudulent activities. Additionally, Hennepin Minnesota Clauses Relating to Accounting Matters also encompass the "Hennepin County Compliance Clause." This clause focuses on enforcing adherence to relevant laws, regulations, and policies in accounting practices. It outlines the obligation of businesses to comply with federal, state, and local financial regulations and submit all required financial documentation to Hennepin County authorities. Moreover, the "Hennepin County Internal Control Clause" is another essential aspect where businesses are required to establish and maintain adequate internal controls to safeguard their assets, prevent fraud, and ensure accurate financial reporting. This clause emphasizes the importance of internal control systems within organizations to enhance the integrity and reliability of financial information. Overall, Hennepin Minnesota Clauses Relating to Accounting Matters encompass a range of comprehensive obligations and standards that businesses must adhere to in order to maintain financial transparency and accountability within the county. These clauses aim to protect the interests of stakeholders, enhance confidence in financial reporting, and promote a fair and ethical business environment in Hennepin County, Minnesota.

Hennepin Minnesota Clauses Relating to Accounting Matters

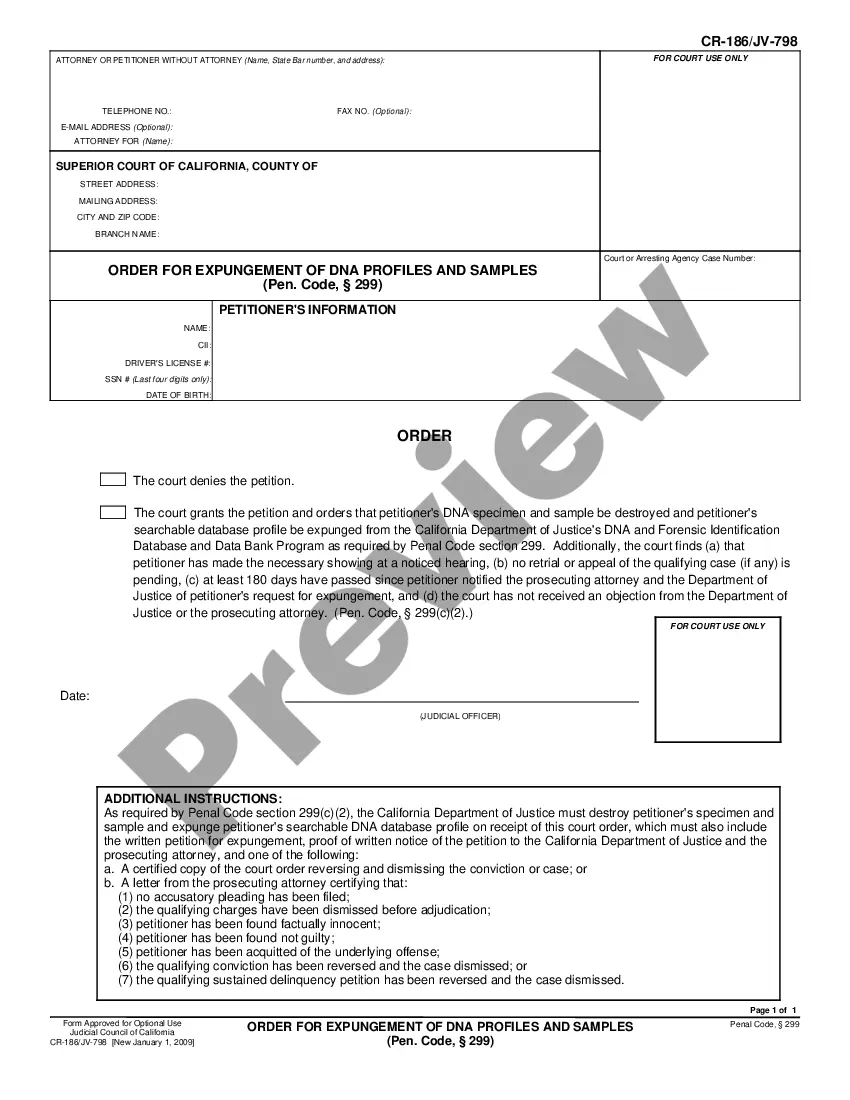

Description

How to fill out Hennepin Minnesota Clauses Relating To Accounting Matters?

Preparing paperwork for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Hennepin Clauses Relating to Accounting Matters without professional help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Hennepin Clauses Relating to Accounting Matters by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guide below to get the Hennepin Clauses Relating to Accounting Matters:

- Examine the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any situation with just a few clicks!