Tarrant Texas Clauses Relating to Venture IPO refer to specific contractual provisions included in agreements between venture capitalists and startup companies based in Tarrant County, Texas, with the aim of regulating initial public offerings (IPOs). These clauses are crucial in defining the rights, responsibilities, and protections for both parties involved in the process of taking a startup public. There are several types of Tarrant Texas Clauses Relating to Venture IPO, each serving different purposes and addressing various aspects of the IPO journey. Some commonly encountered clauses are: 1. Voting Rights Clause: This clause outlines the voting rights of the venture capitalists and the startup company's founders or shareholders in the decision-making process regarding the IPO. It can include provisions on majority vote requirements, super majority provisions, and the power to appoint board members. 2. Lock-Up Period Clause: This clause sets restrictions on the sale or transfer of shares held by the startup's founders, shareholders, or venture capitalists for a specified period following the IPO. The lock-up period is typically intended to demonstrate stability and prevent volatile fluctuations in the stock price immediately after the public offering. 3. Registration Rights Clause: This clause outlines the rights of the venture capitalists or other major shareholders to request the registration of their shares with the Securities and Exchange Commission (SEC) following the IPO. It defines the procedures and obligations related to the registration process, allowing the shareholders to sell their shares in public markets. 4. Drag-Along Rights Clause: In the event of a potential acquisition or merger, this clause allows venture capitalists holding a significant portion of shares to compel the startup's founders or minority shareholders to join the transaction. It ensures that all shareholders are aligned in the decision-making process and have the opportunity to monetize their investments. 5. Anti-Dilution Clause: This clause protects venture capitalists from the dilution of their ownership percentage if the startup issues additional shares at a lower price in subsequent funding rounds. It typically grants the investors the right to receive additional shares or compensation, thereby maintaining their proportionate ownership. 6. Board Composition Clause: This clause defines the composition of the startup's board of directors post-IPO. It may establish the number of board seats allocated to venture capitalists and the qualification criteria for board members. Additionally, it may include provisions regarding board appointment rights and the rights of shareholders to remove directors. 7. Preemptive Rights Clause: This clause grants venture capitalists the right to maintain their ownership percentage by purchasing additional shares in subsequent funding rounds before they are offered to other shareholders. It helps ensure that the investors have an opportunity to participate in the company's growth and avoid dilution. It is worth mentioning that the specific clauses mentioned above are not exhaustive, and the terms and conditions may vary based on the negotiations between the venture capital firm and the startup company. The inclusion of these clauses in contractual agreements fosters transparency, protects the interests of both parties, and facilitates a smooth transition from private to public ownership through an IPO.

Tarrant Texas Clauses Relating to Venture IPO

Description

How to fill out Tarrant Texas Clauses Relating To Venture IPO?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business objective utilized in your county, including the Tarrant Clauses Relating to Venture IPO.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Tarrant Clauses Relating to Venture IPO will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the Tarrant Clauses Relating to Venture IPO:

- Make sure you have opened the correct page with your localised form.

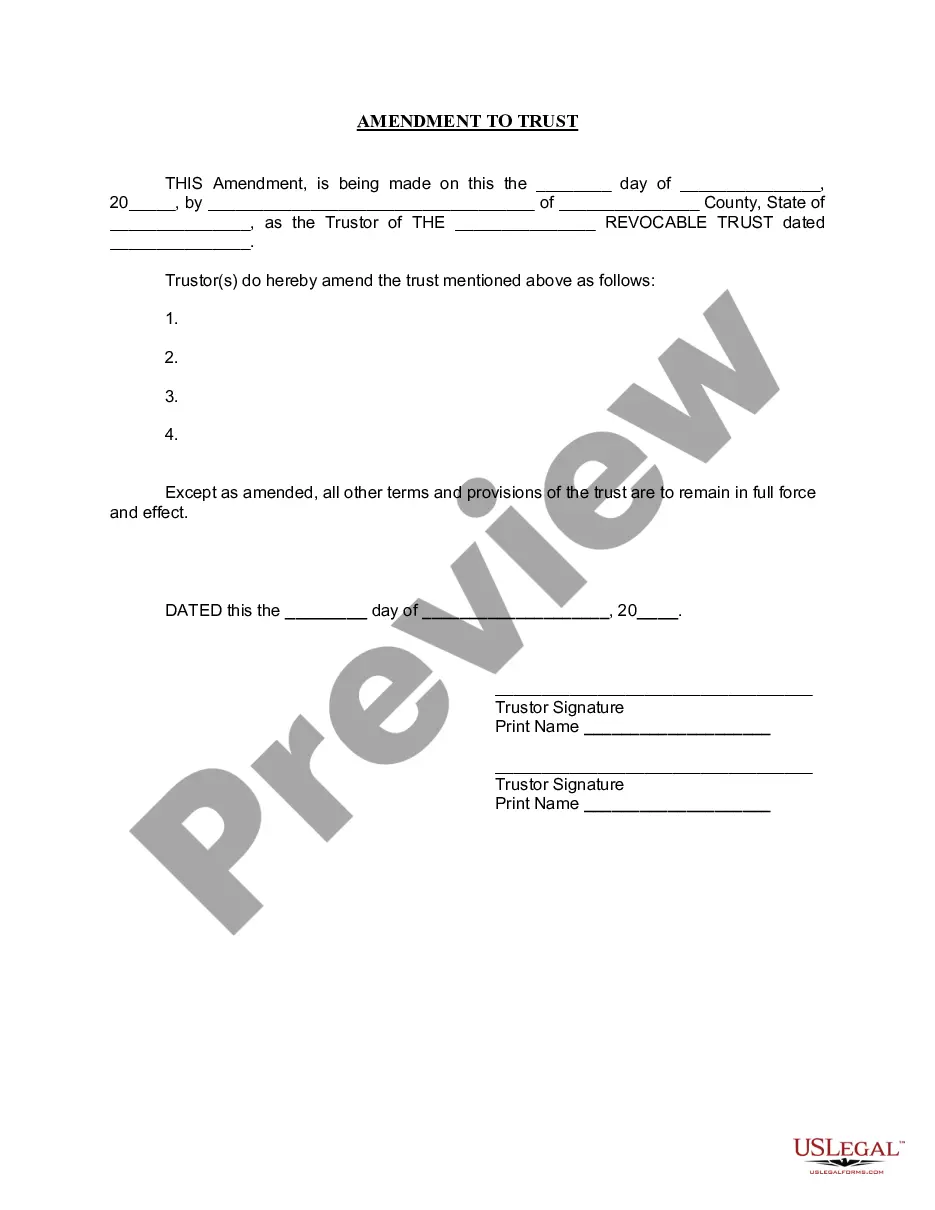

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Tarrant Clauses Relating to Venture IPO on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!