Title: Understanding Cuyahoga Ohio State of Delaware Limited Partnership Tax Notices Keywords: Cuyahoga Ohio, State of Delaware, limited partnership, tax notice Introduction: Cuyahoga Ohio State of Delaware Limited Partnership Tax Notices serve as official communications regarding various tax-related matters concerning limited partnerships registered in the state of Delaware. These notices are crucial for maintaining compliance with tax regulations and ensuring that partnerships fulfill their tax obligations. This article aims to provide a detailed description of the Cuyahoga Ohio State of Delaware Limited Partnership Tax Notice, discussing different types and their significance. Types of Cuyahoga Ohio State of Delaware Limited Partnership Tax Notice: 1. Annual Tax Return Notice: The Annual Tax Return Notice is an essential document that outlines the partnership's obligation to file an annual tax return to Delaware. This notice provides guidance on the necessary forms, deadlines, and instructions for reporting partnership income, deductions, credits, and other financial details. 2. Estimated Tax Payment Notice: Partnerships may receive an Estimated Tax Payment Notice, which informs them about their obligation to make quarterly estimated tax payments throughout the year. This notice specifies the deadlines and payment instructions to ensure compliance with Delaware's tax requirements. 3. Tax Assessment Notice: A Tax Assessment Notice is issued if the Delaware Division of Revenue determines that the partnership's tax liability has been underreported or inaccurately reported. This notice provides details about the discrepancy, calculations, and potential penalties or interest charges, requiring prompt resolution to rectify the issue. 4. Tax Compliance Audit Notice: Partnerships may receive a Tax Compliance Audit Notice, triggering an examination of their tax records and compliance with Delaware tax regulations. This notice outlines the audit process, including document requests, deadlines for submission, and potential consequences of non-compliance. Importance and Compliance: Complying with Cuyahoga Ohio State of Delaware Limited Partnership Tax Notices is vital for partnerships to avoid penalties, interest charges, and potential legal issues. It is crucial for partnerships to carefully review these notices, seek professional advice if needed, and promptly respond to any requirements stated within the notice to ensure continued compliance. Conclusion: Cuyahoga Ohio State of Delaware Limited Partnership Tax Notices play a significant role in maintaining tax compliance for limited partnerships operating in Delaware. By understanding the various types of notices and their significance, partnerships can effectively manage their tax obligations, fulfill reporting requirements, and avoid unnecessary penalties. Regularly monitoring and promptly addressing any notices received is essential for partnerships to smoothly navigate Delaware's tax regulations and maintain their legal, financial standing.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Aviso de impuestos de sociedad limitada del estado de Delaware - State of Delaware Limited Partnership Tax Notice

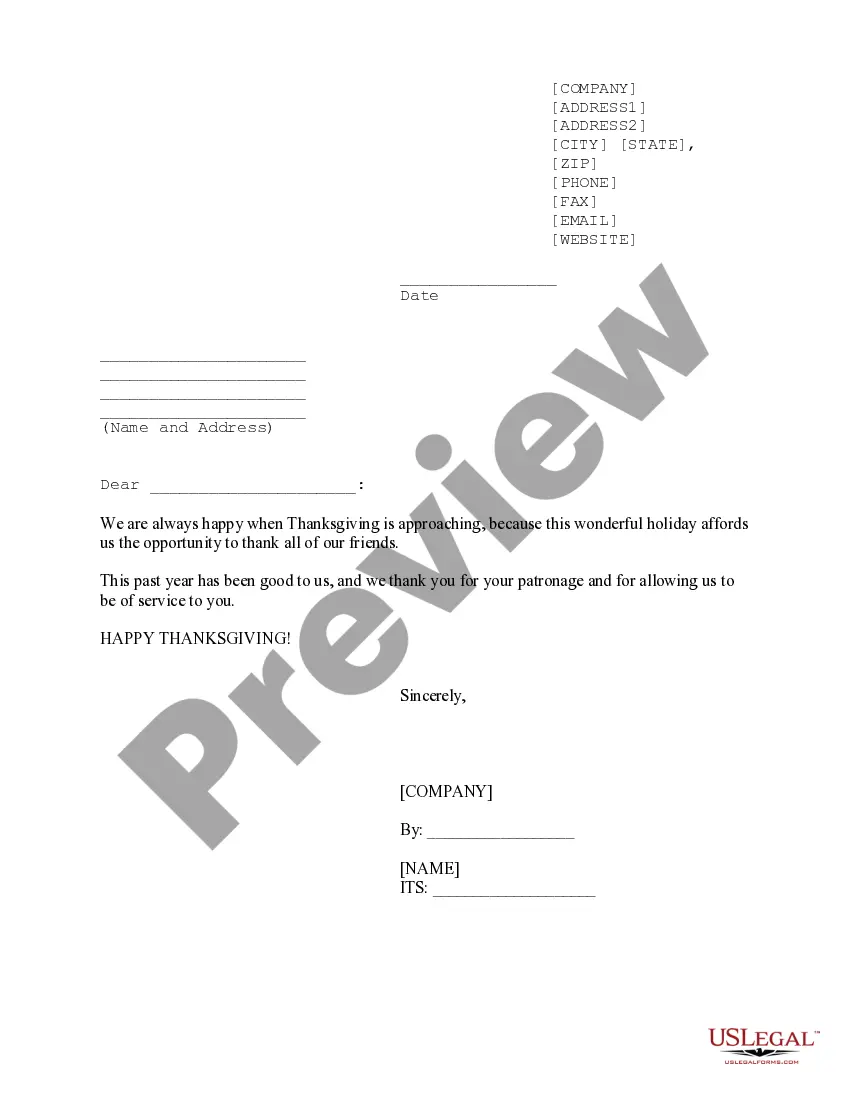

Description

How to fill out Cuyahoga Ohio Aviso De Impuestos De Sociedad Limitada Del Estado De Delaware?

Draftwing documents, like Cuyahoga State of Delaware Limited Partnership Tax Notice, to manage your legal affairs is a difficult and time-consumming process. Many cases require an attorney’s involvement, which also makes this task expensive. However, you can get your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for various scenarios and life situations. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Cuyahoga State of Delaware Limited Partnership Tax Notice form. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before getting Cuyahoga State of Delaware Limited Partnership Tax Notice:

- Ensure that your template is specific to your state/county since the rules for creating legal papers may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Cuyahoga State of Delaware Limited Partnership Tax Notice isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start using our website and download the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is ready to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!