The Harris Texas State of Delaware Limited Partnership Tax Notice is an important document that provides crucial information regarding the tax obligations and requirements for limited partnerships formed in the state of Delaware. This detailed notice serves as a guide for limited partners and investors to understand their tax liabilities and obligations under the jurisdiction of Harris County, Texas and the state of Delaware. Limited partnerships are a popular choice for business entities due to their tax benefits and flexibility. However, it is essential to comply with Harris Texas State and Delaware tax laws to avoid any penalties or legal issues. The Harris Texas State of Delaware Limited Partnership Tax Notice compiles all the necessary guidelines and instructions, ensuring that limited partners remain in good standing with the tax authorities. The notice covers various aspects of taxation for limited partnerships, ranging from filing requirements to calculating and paying taxes. It outlines the specific tax forms and schedules that must be completed, along with the deadlines for submission. By providing detailed explanations, the notice ensures that limited partners understand their obligations and can accurately fulfill their tax responsibilities. As for the different types of Harris Texas State of Delaware Limited Partnership Tax Notices, they may vary based on the specific nature of the limited partnership. Some common variations include: 1. General Partnership Tax Notice: This notice is applicable to general partnerships operating in both Harris County, Texas and the state of Delaware. It outlines the tax requirements and obligations for general partners, providing them with clear instructions on how to file their taxes. 2. Limited Liability Partnership Tax Notice: Limited liability partnerships (Laps) have unique tax considerations, and this notice focuses on their specific requirements in Harris County, Texas, and the state of Delaware. It addresses the taxation rules applicable to Laps, ensuring that partners understand their individual tax liabilities. 3. Master Limited Partnership Tax Notice: This notice is relevant to partnerships structured as master limited partnerships (Maps). Maps often operate in the energy sector and carry specific tax regulations. The notice provides comprehensive guidance on filing taxes, ensuring compliance with both Harris County, Texas, and Delaware tax laws. In conclusion, the Harris Texas State of Delaware Limited Partnership Tax Notice is a comprehensive document that conveys indispensable information regarding tax obligations for limited partnerships. It covers an array of topics and provides clarity to limited partners, regarding various types of limited partnerships, including general partnerships, limited liability partnerships, and master limited partnerships. Understanding and adhering to the guidelines outlined in this notice is essential for limited partners to comply with tax regulations and maintain legal and financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Aviso de impuestos de sociedad limitada del estado de Delaware - State of Delaware Limited Partnership Tax Notice

Description

How to fill out Harris Texas Aviso De Impuestos De Sociedad Limitada Del Estado De Delaware?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Harris State of Delaware Limited Partnership Tax Notice, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Harris State of Delaware Limited Partnership Tax Notice from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Harris State of Delaware Limited Partnership Tax Notice:

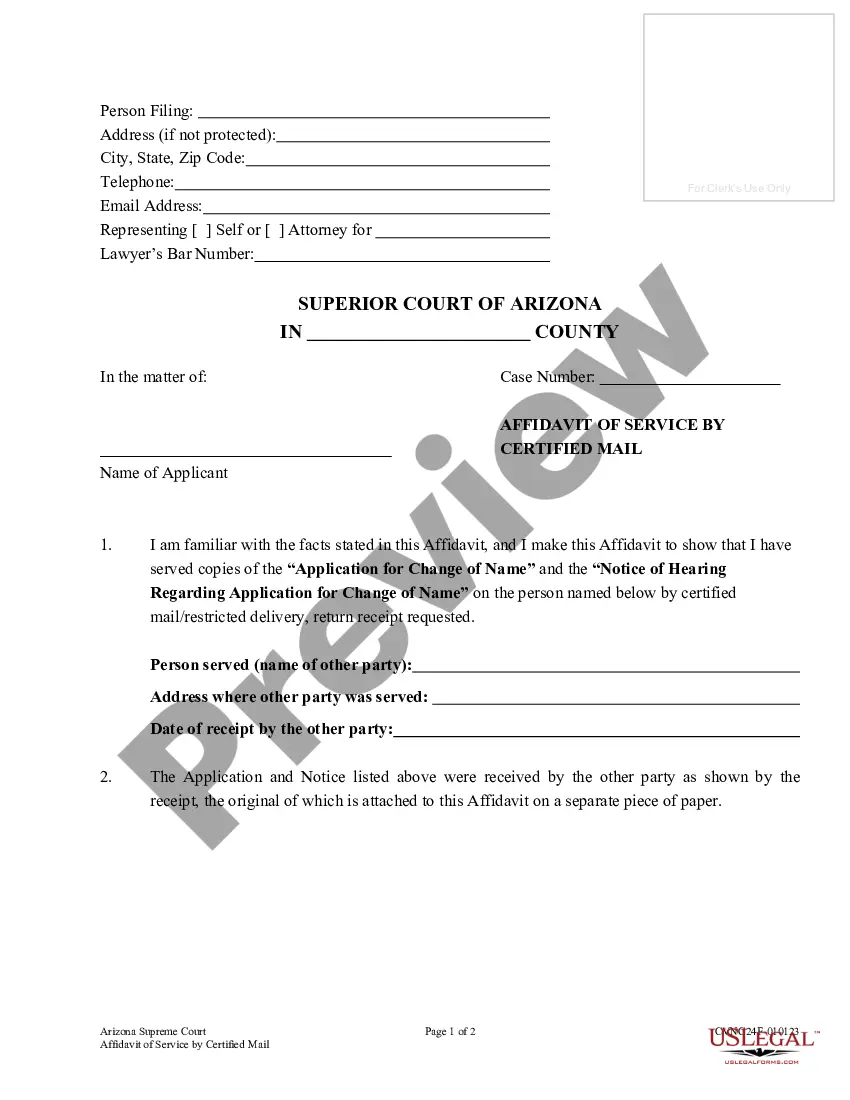

- Analyze the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!