Bronx, New York is a borough located in New York City. It is known for its vibrant culture, diverse population, and rich history. The borough is home to numerous notable landmarks, such as the iconic Yankee Stadium, the Bronx Zoo, and the New York Botanical Garden. The Bronx has a thriving business community, attracting investors from various industries. One important financial document relevant to strategic investments made during the Initial Public Offering (IPO) is the Stock Purchase Agreement. This agreement sets out the terms and conditions between the purchaser and the seller for the purchase of stock shares in a company. There are different types of Bronx New York Form — Stock Purchase Agreement for Strategic Investment made in the context of an IPO. These can include: 1. Common Stock Purchase Agreement: This type of agreement involves the purchase of common stock, which represents ownership in a company and provides voting rights to the shareholders. 2. Preferred Stock Purchase Agreement: Preferred stock offers certain advantages over common stock, such as priority in dividend payments and higher liquidation preference. This agreement pertains to the purchase of preferred stocks during the IPO. 3. Convertible Stock Purchase Agreement: Convertible stock allows shareholders to convert their holdings into a different class of stock, usually common stock. This agreement outlines the terms and conditions for purchasing convertible stock during the IPO. 4. Restricted Stock Purchase Agreement: Restricted stock refers to stock that has certain limitations on its transferability or vesting. In this agreement, the purchaser agrees to the restrictions and conditions surrounding the purchase of restricted stock during the IPO. The Bronx New York Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering serves as a legal contract that protects the rights and interests of both the purchaser and seller during the IPO process. It provides details on the number of shares being purchased, the purchase price, any conditions or restrictions, and the rights and obligations of both parties. It is important for both parties involved in the IPO to carefully review and understand the terms of the Stock Purchase Agreement to ensure a smooth and mutually beneficial transaction. Consultation with legal professionals experienced in IPOs and securities law is highly recommended navigating the complexities of this agreement effectively.

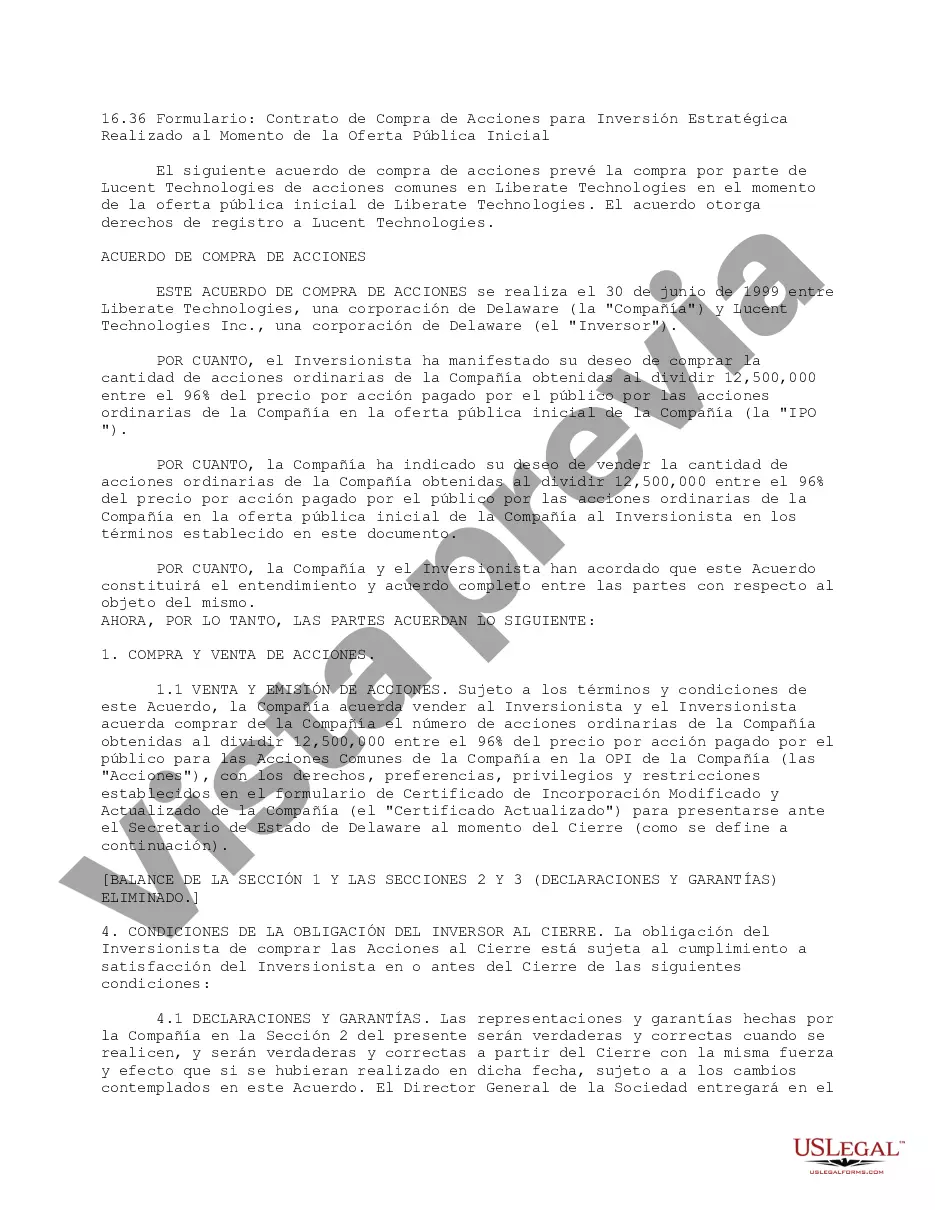

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Formulario - Acuerdo de Compra de Acciones para Inversión Estratégica Realizado en el Momento de la Oferta Pública Inicial - Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering

Description

How to fill out Bronx New York Formulario - Acuerdo De Compra De Acciones Para Inversión Estratégica Realizado En El Momento De La Oferta Pública Inicial?

Preparing paperwork for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft Bronx Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering without professional help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Bronx Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering on your own, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Bronx Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering:

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any situation with just a few clicks!