The Nassau New York Amended Equity Fund Partnership Agreement is a legally binding document that outlines the terms and conditions between partners who wish to establish an equity fund partnership in Nassau, New York. This agreement is crucial as it protects the rights and obligations of each partner while ensuring a smooth and transparent operation of the equity fund. This partnership agreement covers various aspects, such as the purpose of the partnership, the contributions made by each partner, the distribution of profits and losses, decision-making processes, management structure, and the dissolution process. It sets the foundation for a collaborative and mutually beneficial relationship between partners. The main objective of the Nassau New York Amended Equity Fund Partnership Agreement is to provide a framework that promotes transparency, fairness, and accountability among partners. It also serves as a mechanism to mitigate any potential disputes or conflicts that may arise during the course of the partnership. There can be different types of Nassau New York Amended Equity Fund Partnership Agreements, tailored to specific partnership objectives and structures. Some examples include: 1. General Partnership Agreement: This type of agreement is typically formed between two or more partners who jointly contribute their funds, expertise, and resources to establish an equity fund partnership. In a general partnership, partners share equal responsibility and liability for the partnership's actions. 2. Limited Partnership Agreement: A limited partnership agreement features both general partners and limited partners. General partners have unlimited liability and actively participate in the management of the equity fund, whereas limited partners contribute capital but have limited liability and a passive role. 3. Limited Liability Partnership Agreement: In a limited liability partnership agreement, partners enjoy limited liability, similar to a limited partnership. However, all partners have the ability to actively engage in the management of the equity fund, unlike limited partners in a limited partnership. 4. Master Limited Partnership Agreement: This type of partnership agreement is commonly used in the energy sector. It typically involves a publicly traded entity, called the master limited partnership (MLP), which provides tax benefits to its partners and allows them to trade units on a stock exchange. The MLP manages the equity fund's assets and operations. In conclusion, the Nassau New York Amended Equity Fund Partnership Agreement is an essential legal document for establishing and governing equity fund partnerships in Nassau, New York. It ensures clarity, fairness, and protection for all partners involved. Various types of partnership agreements exist, each tailored to meet specific partnership structures and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Acuerdo de asociación de fondo de capital modificado - Amended Equity Fund Partnership Agreement

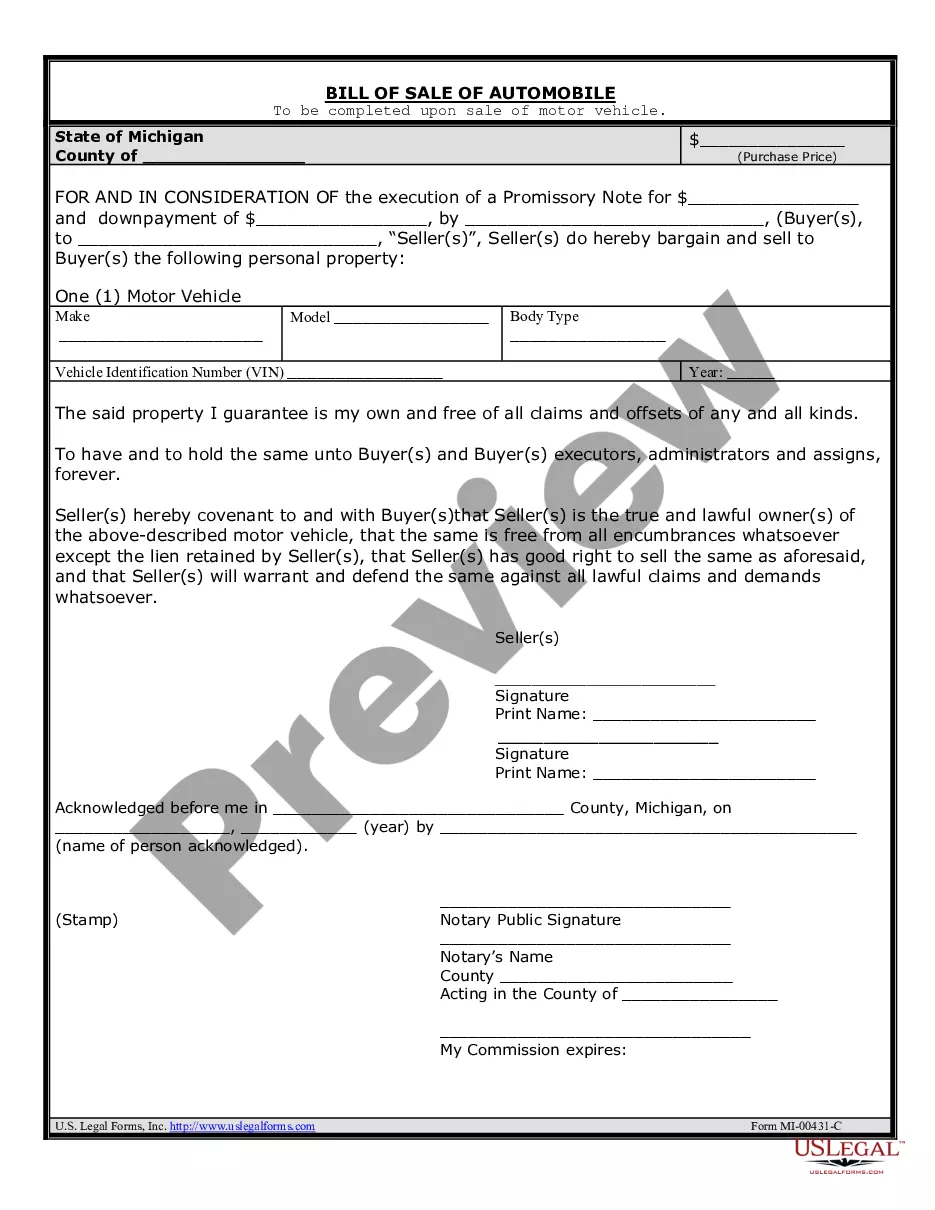

Description

How to fill out Nassau New York Acuerdo De Asociación De Fondo De Capital Modificado?

How much time does it normally take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, locating a Nassau Amended Equity Fund Partnership Agreement meeting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. In addition to the Nassau Amended Equity Fund Partnership Agreement, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Nassau Amended Equity Fund Partnership Agreement:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Nassau Amended Equity Fund Partnership Agreement.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!