Maricopa, Arizona Investment Management Agreement is a legally binding contract between a client and an investment management firm that outlines the terms and conditions regarding the management of the client's investments. This agreement provides a comprehensive framework for effectively managing and growing financial assets while also considering the client's investment objectives, risk tolerance, and financial goals. The Maricopa, Arizona Investment Management Agreement is designed to ensure that all investment activities are carried out according to the highest industry standards and in compliance with relevant laws and regulations. It establishes the responsibilities and duties of both parties involved and sets clear expectations for the investment management firm's performance. Key aspects covered in the Maricopa, Arizona Investment Management Agreement may include: 1. Objective Setting: The agreement outlines the client's investment goals and objectives, such as capital appreciation, income generation, or a specific target return. 2. Asset Allocation: It defines the asset classes and allocation strategy suitable for achieving the client's investment objectives, taking into account their risk tolerance and time horizon. 3. Investment Guidelines: The agreement may specify certain investment restrictions or guidelines to ensure a tailored investment approach, which aligns with the client's preferences and risk profile. 4. Reporting and Communication: It includes provisions for regular reporting on investment performance, detailing holdings, gains, losses, and any other relevant updates. Communication protocols between the client and investment management firm are also established. 5. Fees and Compensation: The Maricopa, Arizona Investment Management Agreement discusses the fee structure associated with the investment management services provided, such as management fees, performance-based fees, or any other compensation arrangements. Types of Maricopa, Arizona Investment Management Agreements can vary based on different factors such as the client's investment amount, investment strategy, or specific requirements. Some potential variations include: 1. Individual Investment Management Agreement: This type of agreement caters to individuals seeking personalized investment management services for their financial portfolios. 2. Corporate Investment Management Agreement: Designed for corporations and businesses that require investment management services to oversee their company's capital or reserve funds. 3. Non-Profit Investment Management Agreement: Non-profit organizations may enter into this type of agreement to ensure responsible management of their endowments or philanthropic funds. 4. Pension Fund Investment Management Agreement: This specific type of agreement is tailored to pension funds and retirement plans, focusing on long-term growth and the preservation of capital while meeting the obligations to pension plan beneficiaries. Maricopa, Arizona Investment Management Agreements are an essential tool for individuals, corporations, non-profit organizations, and pension funds seeking professional asset management services. By entering into an agreement, clients can establish a clear roadmap for their investments, ensuring efficient management while aligning with their financial goals and risk tolerance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo de gestión de inversiones - Investment Management Agreement

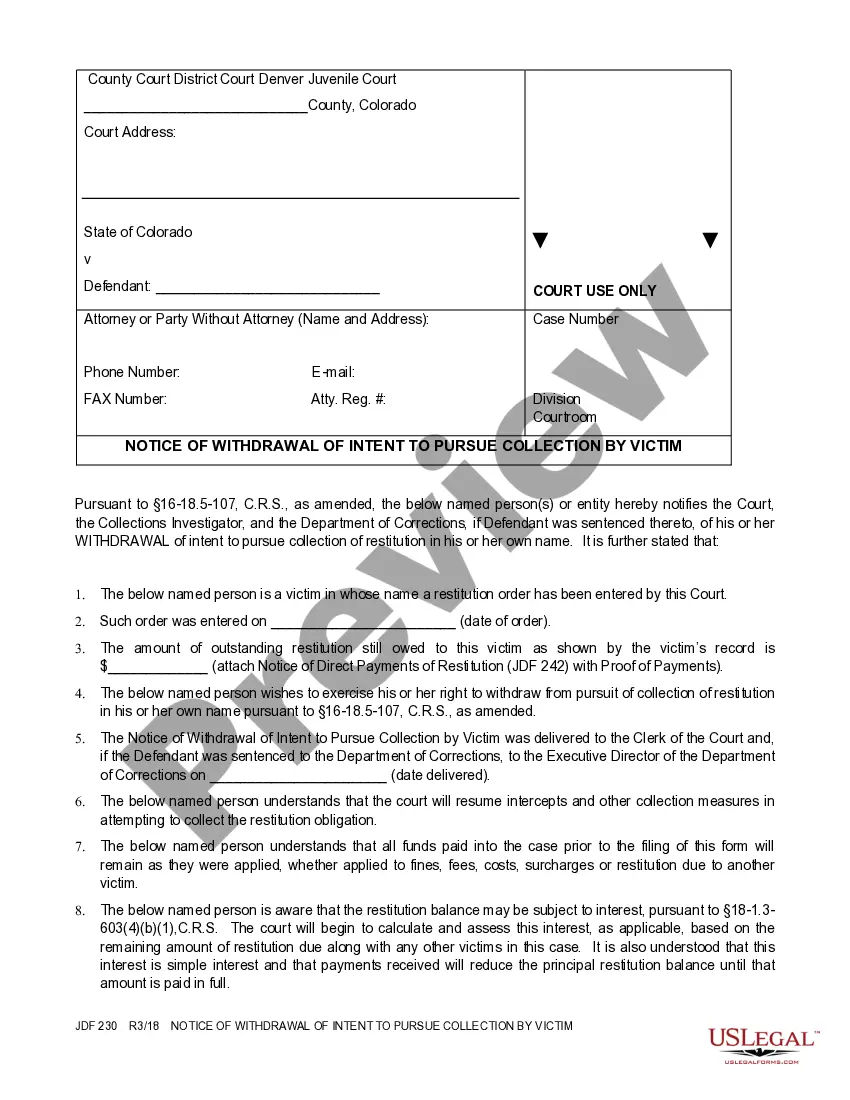

Description

How to fill out Maricopa Arizona Acuerdo De Gestión De Inversiones?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Maricopa Investment Management Agreement, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Maricopa Investment Management Agreement from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Maricopa Investment Management Agreement:

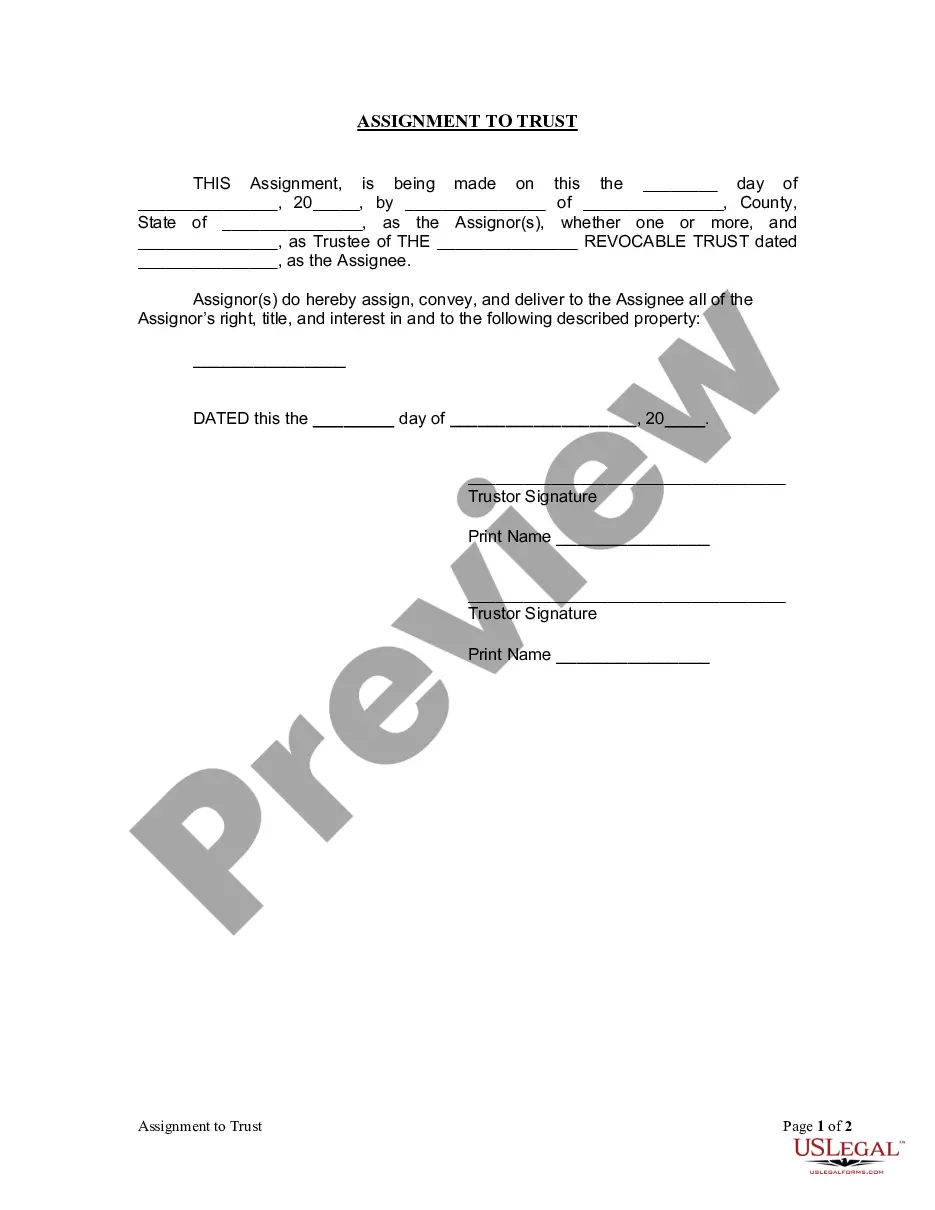

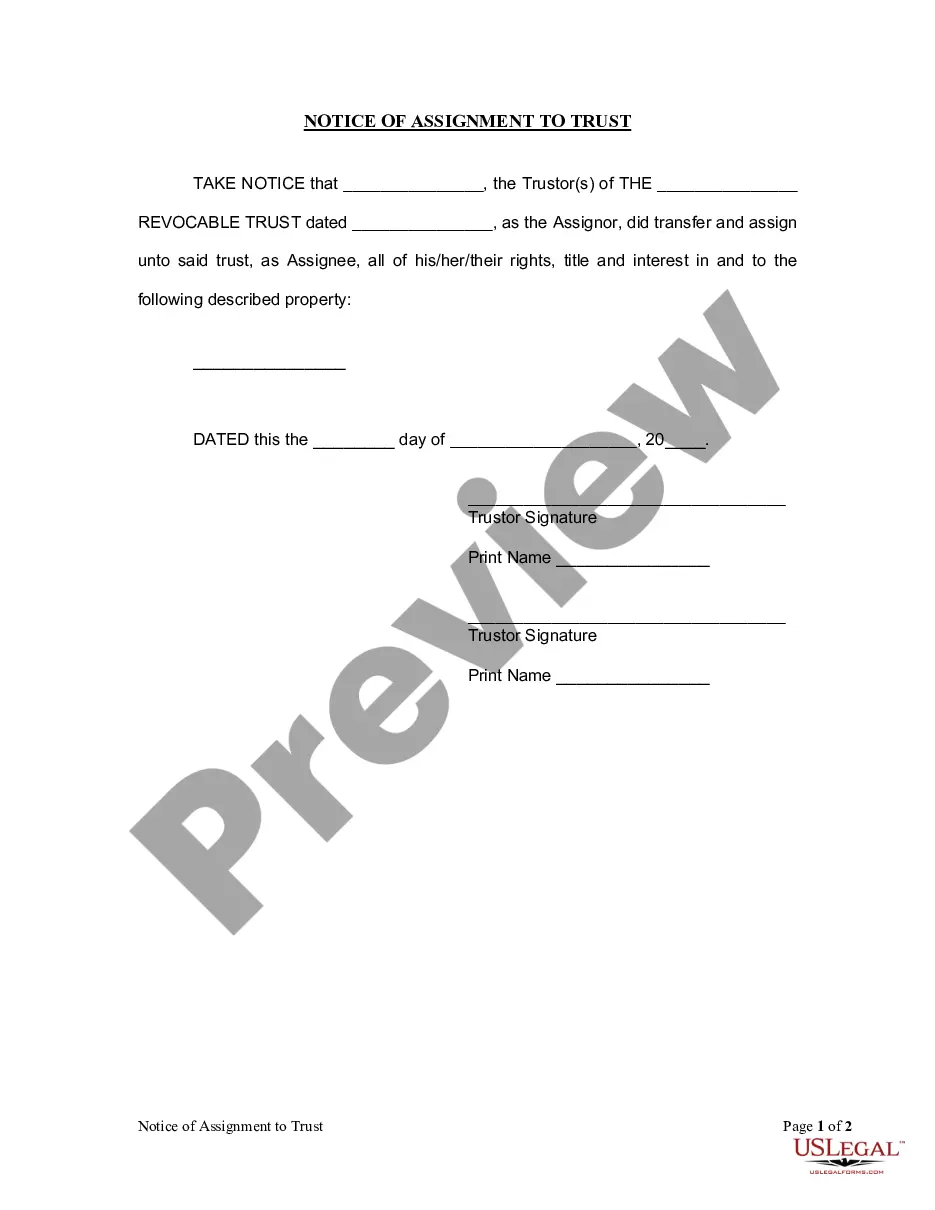

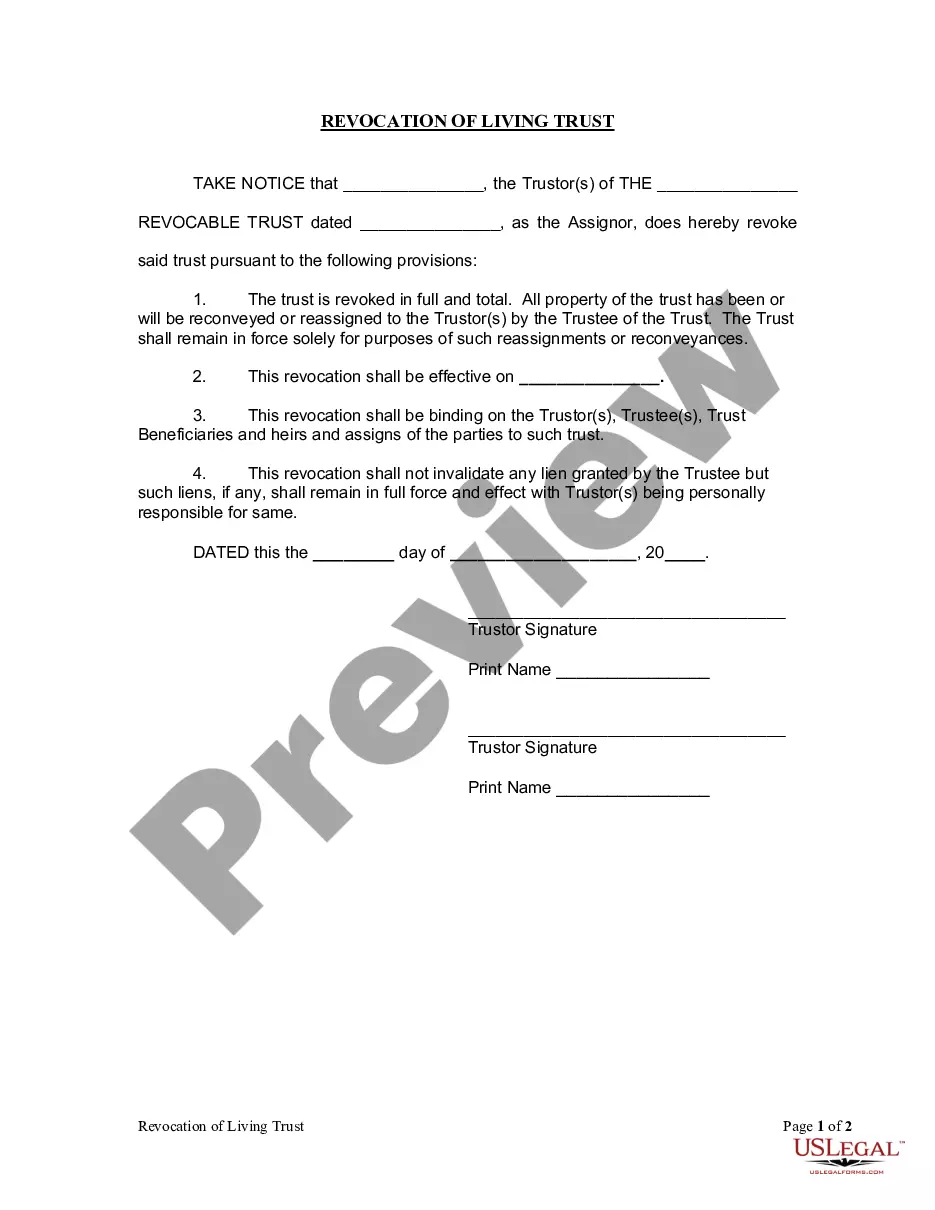

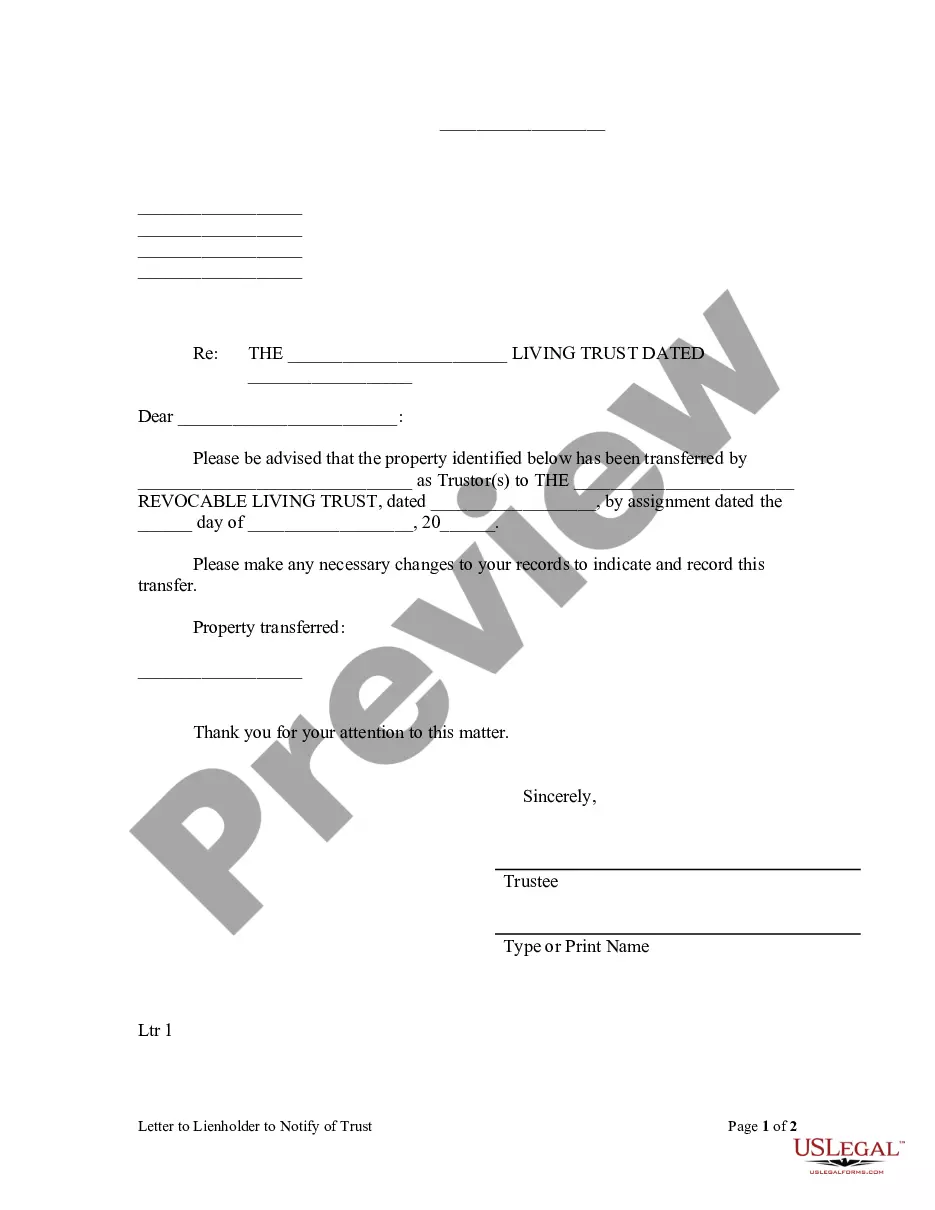

- Take a look at the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!