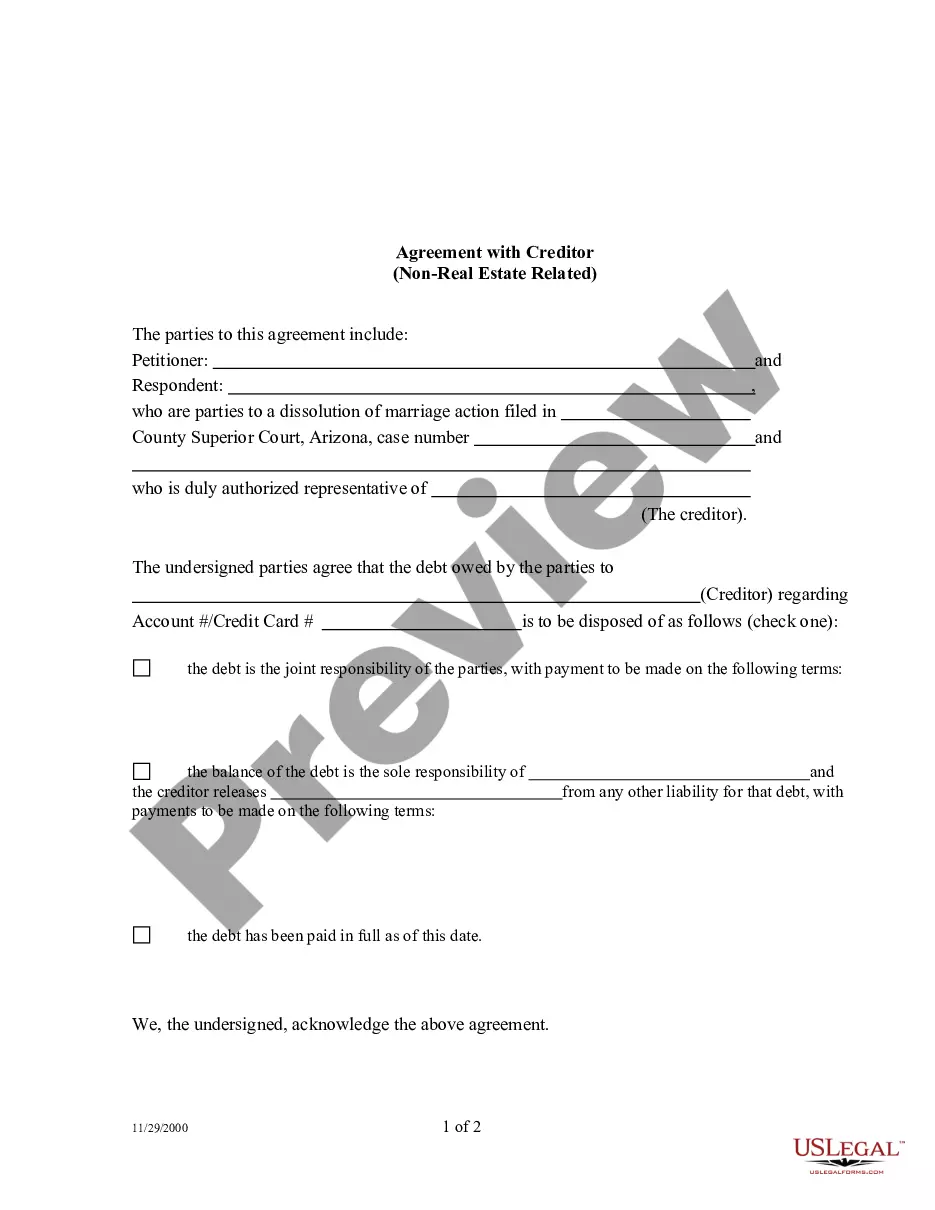

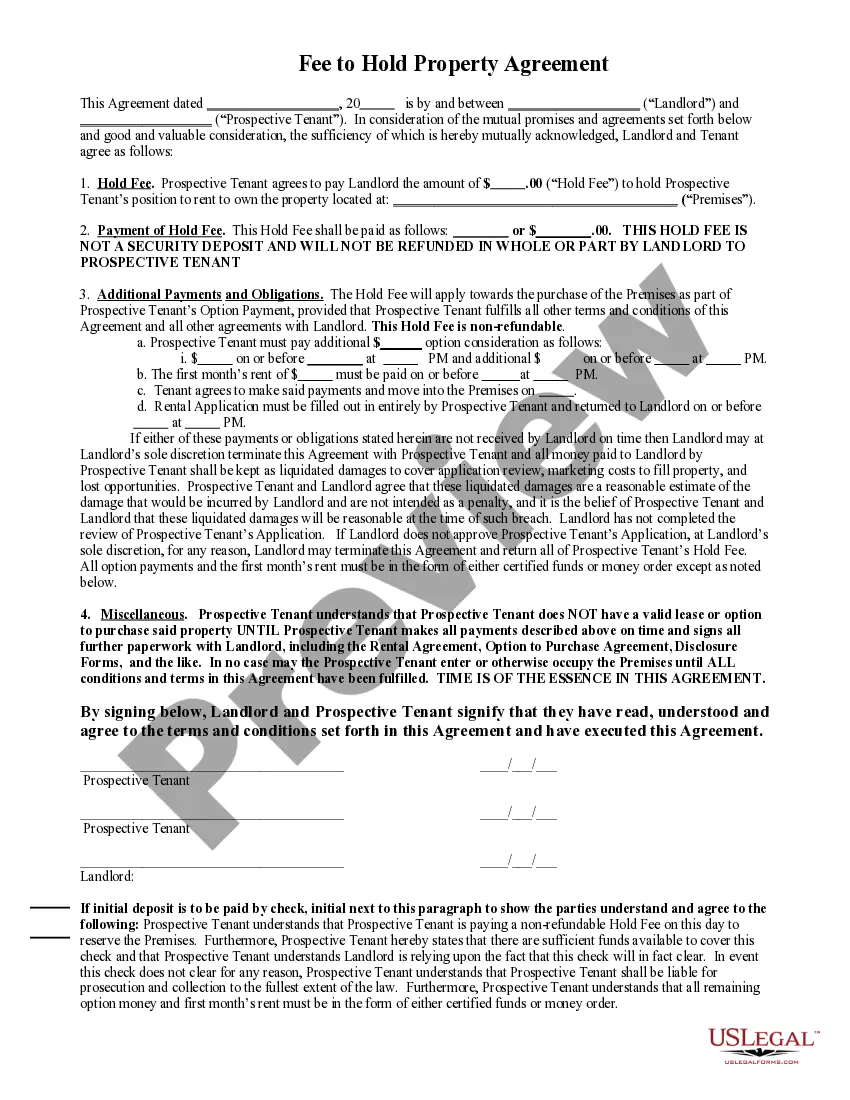

A Santa Clara California Limited Liability Company LLC Agreement for New General Partner is a legally binding document that outlines the terms and conditions for a new general partner joining an LLC based in Santa Clara, California. This agreement establishes the rights, obligations, and responsibilities of the new general partner, as well as any limitations or restrictions on their involvement in the LLC's operations. The agreement typically covers essential aspects such as capital contributions, profit and loss allocation, decision-making processes, management responsibilities, and dispute resolution mechanisms. It ensures that all parties involved are aware of their rights and obligations and helps prevent future conflicts or misunderstandings. Key terms and clauses that may be included in a Santa Clara California Limited Liability Company LLC Agreement for a New General Partner are: 1. Capital Contributions: This section specifies the amount and nature of the capital contribution that the new general partner is expected to make to the LLC. It outlines the payment schedule, whether it will be in cash or other assets, and any conditions or restrictions that may apply. 2. Profit and Loss Allocation: This clause determines how the profits and losses of the LLC will be distributed among its members, including the new general partner. It may outline a specific formula or percentage allocation based on each member's ownership percentage in the company. 3. Management and Decision-Making: This section defines the roles and responsibilities of the new general partner in managing the affairs of the LLC. It may specify whether the new general partner has the authority to make decisions independently or requires the approval of other members or a designated managing member. 4. Transfer of Interests: This clause outlines the conditions and procedures for transferring or selling the new general partner's interests in the LLC. It may specify whether the consent of other members is required, any restrictions on external transfer, and whether a buyout option exists. 5. Dissolution and Termination: This section details the circumstances under which the LLC may be dissolved or terminated, including the withdrawal or removal of the new general partner. It may outline the procedures for distributing assets and handling liabilities upon dissolution. It is important to note that there may not be different types of Santa Clara California Limited Liability Company LLC Agreements specifically for new general partners. However, each agreement is unique based on the specific terms negotiated between the members, particularly the existing general partner(s) and the new general partner. Therefore, it is crucial to tailor the agreement to the needs and circumstances of the LLC and its members.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Acuerdo de sociedad de responsabilidad limitada LLC para nuevo socio general - Limited Liability Company LLC Agreement for New General Partner

Description

How to fill out Santa Clara California Acuerdo De Sociedad De Responsabilidad Limitada LLC Para Nuevo Socio General?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life scenario, locating a Santa Clara Limited Liability Company LLC Agreement for New General Partner meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. In addition to the Santa Clara Limited Liability Company LLC Agreement for New General Partner, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Santa Clara Limited Liability Company LLC Agreement for New General Partner:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Santa Clara Limited Liability Company LLC Agreement for New General Partner.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!