Title: Comprehensive Guide to Suffolk New York Subscription Agreements — A Section 3C1 Fund Introduction: Suffolk New York Subscription Agreement — A Section 3C1 Fund is a legal document that serves as an agreement between an investor and a Section 3C1 fund located in Suffolk, New York. This agreement enables investors to participate in the fund by subscribing to its offerings. Conferring investors with various benefits, subscription agreements play a vital role in structuring investment arrangements. Types of Suffolk New York Subscription Agreements — A Section 3C1 Fund: 1. Individual Subscription Agreement: Individual subscription agreements are created for individual investors who wish to participate in the Section 3C1 fund. These agreements outline the terms, conditions, and obligations specific to the individual investor, ensuring transparent investment processing. 2. Corporate Subscription Agreement: Corporate subscription agreements cater to corporate entities seeking to invest in a Section 3C1 fund in Suffolk, New York. Designed to accommodate the unique needs and requirements of corporations, these agreements typically involve multiple shareholders and encompass relevant corporate governance provisions. 3. Institutional Subscription Agreement: Institutional subscription agreements are tailored for financial institutions, such as banks, insurance companies, and pension funds, interested in subscribing to a Section 3C1 fund. These agreements usually address specific regulatory considerations and requirements pertinent to institutional investors. 4. Accredited Investor Subscription Agreement: Accredited investor subscription agreements cater to individuals or entities who meet specific income or net worth thresholds, as determined by the Securities and Exchange Commission (SEC). These agreements showcase additional provisions and disclosures pertinent to accredited investors. Key Components of a Suffolk New York Subscription Agreement — A Section 3C1 Fund: 1. Parties involved: Clearly identify the parties participating in the agreement, including the fund manager and the investor(s). Include their full legal names, contact information, and roles within the agreement. 2. Subscription details: Outline the subscription terms, such as the number of shares/units to be allocated to the investor, total investment amount, and subscription price. Specify any additional payments, fees, or expenses involved. 3. Representation and warranties: Typically, subscription agreements require the investor to confirm their eligibility and compliance with applicable laws, regulations, and investor qualifications. These clauses protect both parties from potential legal issues. 4. Transfer and redemption terms: Define the process and conditions under which investors can transfer or redeem their shares/units within the Section 3C1 fund, addressing timing, fees, and potential limitations. 5. Confidentiality and non-disclosure: Include provisions holding both parties accountable for maintaining confidentiality and preventing the unauthorized disclosure of sensitive information shared during the subscription process. 6. Governing law and dispute resolution: Specify the jurisdiction under which the agreement will be governed and outline the procedure for dispute resolution, such as arbitration or mediation, to ensure a fair resolution. Conclusion: Suffolk New York Subscription Agreements — A Section 3C1 Fund are meticulously designed legal agreements enabling investors to participate in a Section 3C1 fund in Suffolk, New York. By understanding the nuances and various types of subscription agreements available, investors can make informed decisions and form mutually beneficial relationships with the fund managers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Acuerdo de Suscripción - Un Fondo de la Sección 3C1 - Subscription Agreement - A Section 3C1 Fund

Description

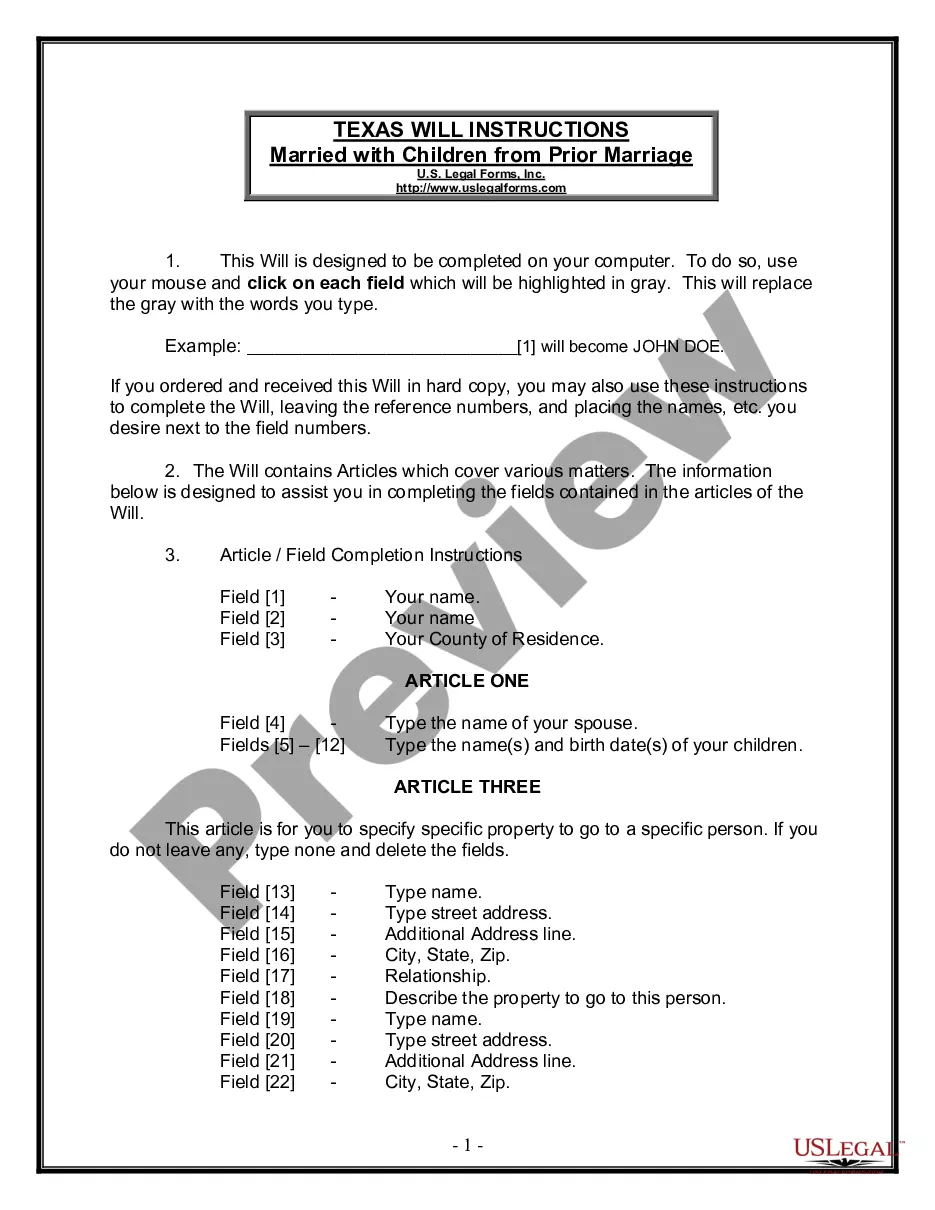

How to fill out Suffolk New York Acuerdo De Suscripción - Un Fondo De La Sección 3C1?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Suffolk Subscription Agreement - A Section 3C1 Fund, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Consequently, if you need the current version of the Suffolk Subscription Agreement - A Section 3C1 Fund, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Suffolk Subscription Agreement - A Section 3C1 Fund:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Suffolk Subscription Agreement - A Section 3C1 Fund and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!