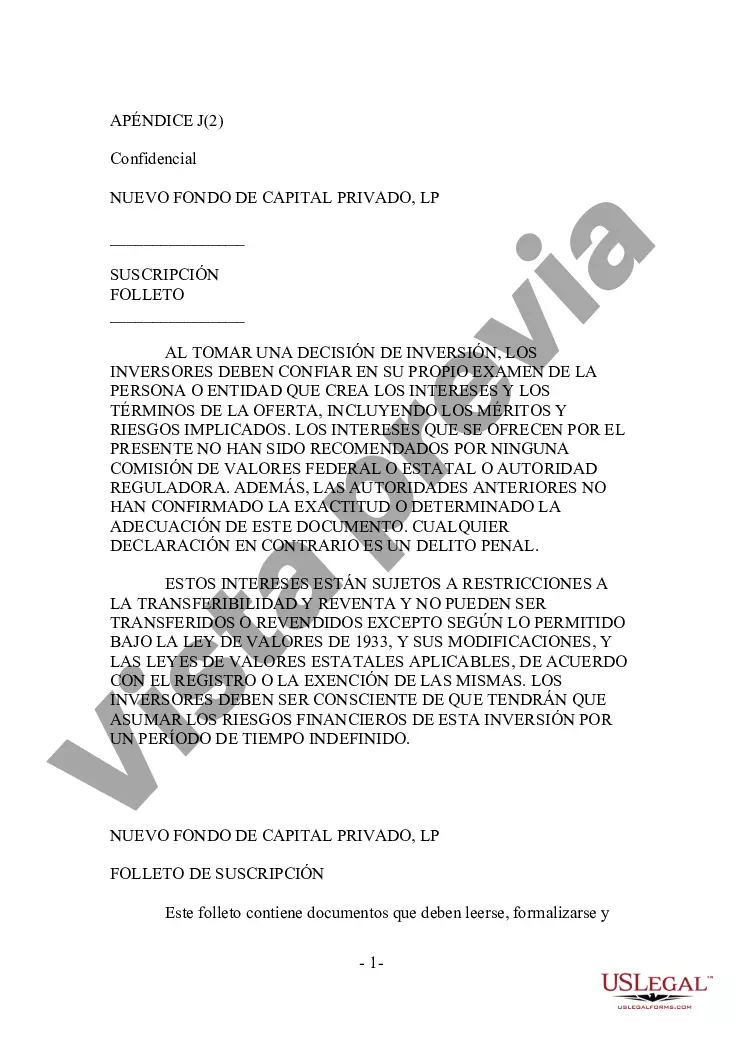

Riverside California Subscription Agreement for an Equity Fund is a legal document that establishes the terms and conditions for investors to subscribe and purchase equity units in an equity fund located in Riverside, California. This agreement outlines the rights, obligations, and responsibilities of both the equity fund and the subscribing investor. The agreement typically includes the following key provisions: 1. Parties: It identifies the equity fund and the subscribing investor, including their legal names and addresses. 2. Subscription Details: This section specifies the number of equity units the investor wishes to acquire and the total subscription amount, including any applicable fees or expenses. It may also outline any minimum or maximum subscription limits. 3. Representations and Warranties: The subscribing investor agrees to provide accurate and truthful information regarding their financial status, investment experience, and qualifications. They also warrant that they are eligible to invest in the equity fund under applicable securities laws. 4. Subscription Process: The agreement sets out the procedures for submitting the subscription request, including the timeline for acceptance or rejection by the equity fund. 5. Consideration and Payment: It specifies the accepted forms of payment for the subscription amount, such as wire transfer, check, or electronic funds transfer. The agreement will outline the payment deadlines and consequences of late or insufficient payment. 6. Investment Risk Disclosures: This section typically includes disclaimers regarding the risks involved in the investment, such as market fluctuations, potential losses, and liquidity of the equity units. 7. Transferability and Redemption: Depending on the specific terms of the equity fund, the agreement may address the process and limitations for transferring or redeeming equity units. 8. Termination: It outlines the circumstances under which either party can terminate the agreement, as well as any associated penalties or potential liabilities. Some types of Riverside California Subscription Agreement for an Equity Fund may include: 1. Institutional Investor Subscription Agreement: Specifically designed for institutional investors such as pension funds, insurance companies, or endowments that seek exposure to the Riverside equity fund. 2. Individual Investor Subscription Agreement: Tailored for individual investors who wish to invest in the Riverside equity fund, including requirements and provisions specific to retail investors. 3. Accredited Investor Subscription Agreement: Meant for investors who meet specific income or net worth criteria established by the Securities and Exchange Commission (SEC). This agreement typically includes additional disclosures and provisions to comply with applicable regulations. In conclusion, the Riverside California Subscription Agreement for an Equity Fund is a crucial document that governs the relationship between investors and an equity fund and ensures transparency and legal protection for both parties involved in the investment process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Contrato de Suscripción de un Fondo de Renta Variable - Subscription Agreement for an Equity Fund

Description

How to fill out Riverside California Contrato De Suscripción De Un Fondo De Renta Variable?

Preparing paperwork for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Riverside Subscription Agreement for an Equity Fund without expert assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Riverside Subscription Agreement for an Equity Fund on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Riverside Subscription Agreement for an Equity Fund:

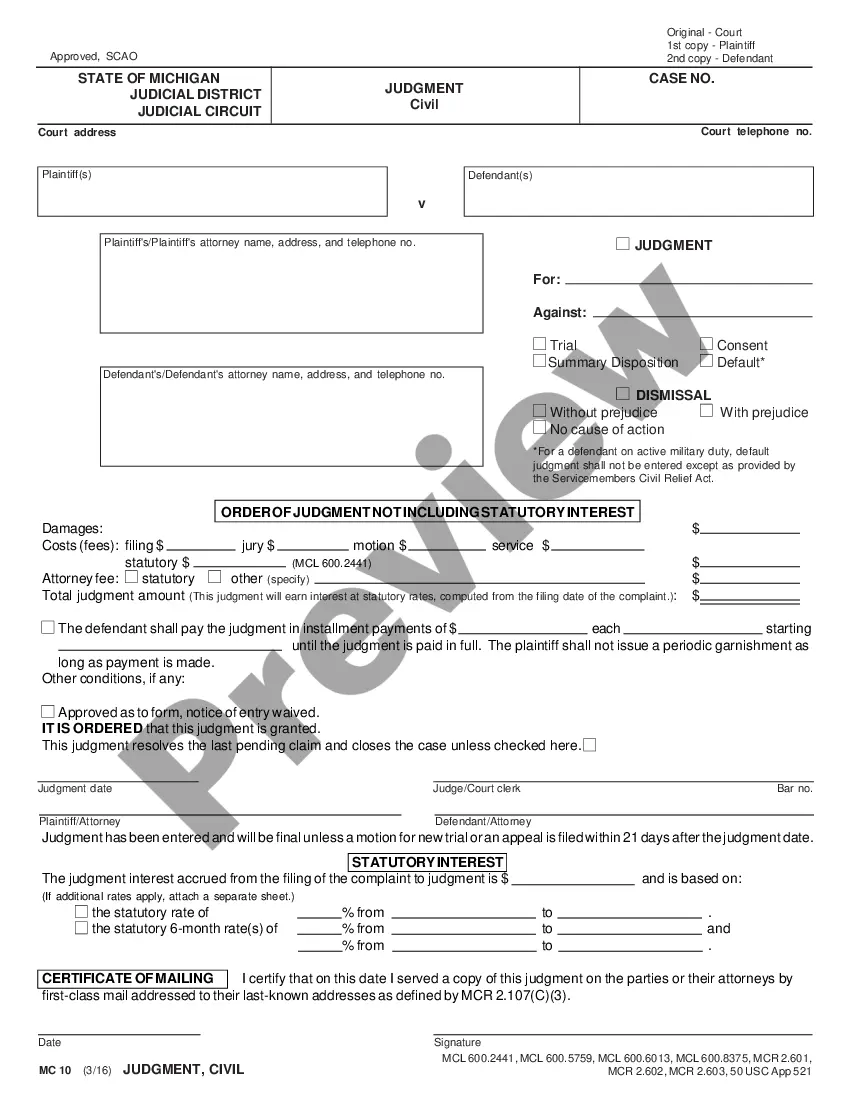

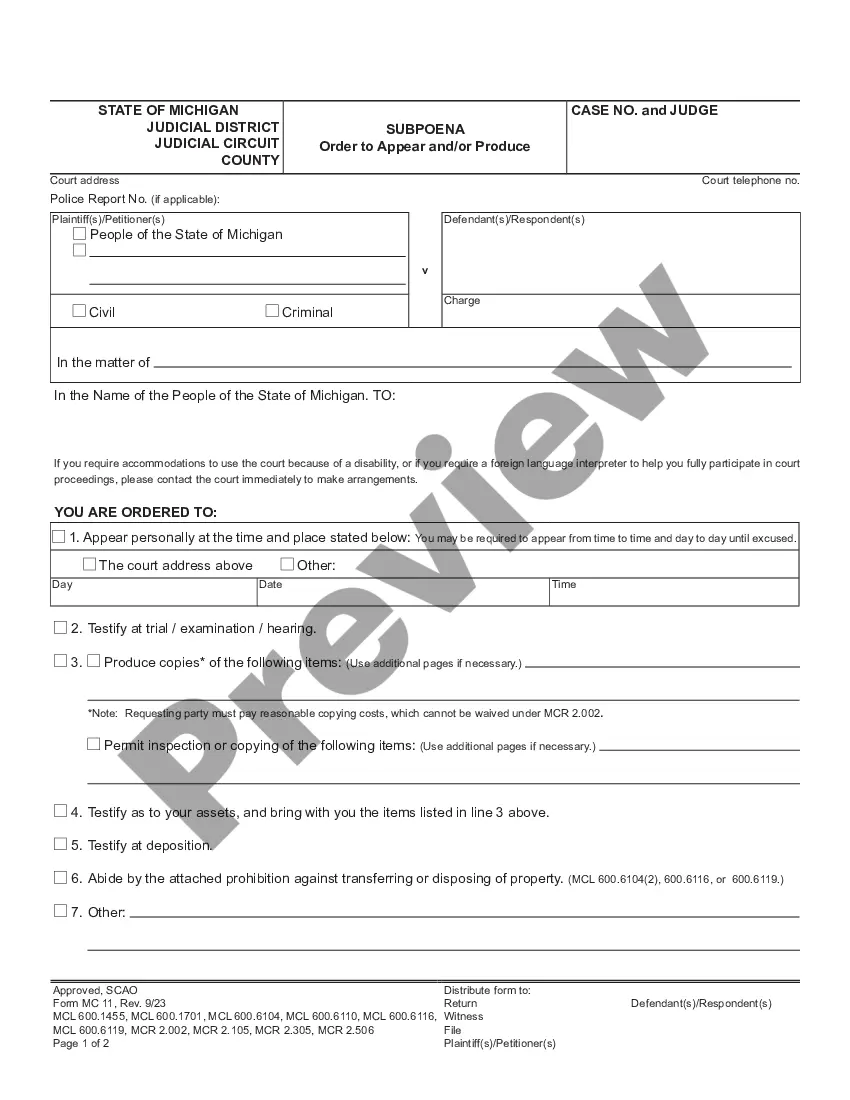

- Look through the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any situation with just a couple of clicks!

Form popularity

FAQ

Los fondos en la cocina se clasifican en dos: oscuros y blancos. Los caldos oscuros obtienen dicha tonalidad porque los ingredientes que se usan se frien un poco antes de hervirlos. A diferencia de estos, los caldos blancos dan un color y sabor mas suave.

Los fondos de renta variable se dividen en subcategorias en funcion del mercado en el que inviertan (Espana, Zona Euro, Estados Unidos, etc.), los sectores (energia, telecomunicaciones, tecnologico, etc.) o de otras caracteristicas que definan a los valores en que se invierte como, por ejemplo, la capitalizacion

Un fondo de inversion es un conjunto de productos financieros agrupados en un portafolio o cartera, al invertir adquieres la parte del portafolio que mas te convenga. Las ganancias obtenidas dependeran del comportamiento y condiciones del mercado.

Valor liquidativo: las nuevas suscripciones de fondos suelen coger el valor liquidativo (fecha valor) del fondo del mismo dia o del dia despues (ver tabla abajo) Fecha operacion: lo normal es que las suscripciones tarden en liquidarse (fecha operacion) entre 2 a 5 dias habiles.

La renta variable son acciones y otros productos de inversion pero, por el contrario que la renta fija, no tiene garantizado ni el capital invertido ni el tipo de interes a percibir llegado el momento del vencimiento.

Suscripcion es cuando un inversor ingresa a un fondo aportando un monto de dinero, por el cual recibe una cantidad de cuotapartes. Rescate es cuando el inversor egresa del fondo, se dan de baja las cuotapartes y se devuelve el dinero resultante de la inversion.

Los fondos de inversion de renta variable son productos de inversion colectiva que invierten la mayor parte de su patrimonio en activos de renta variable. La exposicion a este tipo de activos debe ser igual o superior al 75% para que un fondo sea considerado de renta variable.

Generalmente cuando se habla de instrumentos de renta variable, se esta refiriendo, sobre todo, a acciones de empresas. Un accionista puede obtener rendimientos de dos formas: percibiendo dividendos y vendiendo sus acciones a otro inversor por un precio mayor de lo que pago por estas (plusvalia).

Es la que cobra la gestora individualmente a cada participe en el momento de invertir en el fondo, por lo que es una comision explicita. Se calcula como porcentaje del capital invertido. No puede superar el 5% del valor liquidativo de las participaciones suscritas.