A Hennepin Minnesota clawback guaranty refers to a legal provision or agreement that allows a creditor to recover certain funds or assets in the event of default or non-payment by the debtor. This guarantee is primarily related to financial transactions and often involves real estate or business loans in Hennepin County, Minnesota. Hennepin County, located in the state of Minnesota, is the most populous county in the state and encompasses several cities, including Minneapolis, the largest city in Minnesota. The term "clawback guaranty" typically applies to situations where a creditor wants to secure their investment and protect their interests in case the borrower fails to fulfill their financial obligations. The Hennepin Minnesota clawback guaranty serves as a safety net for the lender, enabling them to regain specific assets or funds if the debtor defaults on their loan or breaches the agreed-upon terms. In such instances, the creditor can exercise their right to claw back a portion or the entirety of their investment by initiating legal proceedings. This allows the lender to recover losses and mitigate the impact of non-payment. There are various types of Hennepin Minnesota clawback guaranties, each designed to address specific scenarios or requirements: 1. Full Recourse Guaranty: This type of guaranty provides the lender with the right to pursue the guarantor's personal assets beyond the collateral or property securing the loan. In case of default, the lender can initiate legal action against the guarantor to recover the outstanding amount, including legal fees and expenses. 2. Limited Recourse Guaranty: This type of guaranty limits the guarantor's liability to a specific portion of the loan or a pre-determined cap. It protects the guarantor from being held personally responsible for the entire outstanding debt, reducing their financial exposure. 3. Completion Guaranty: In real estate or construction projects, a completion guaranty ensures that the project will be finished by a specified date and guarantees that all financial obligations will be fulfilled by the borrower. If the borrower fails to complete the project or fulfill their financial commitments, the lender can enforce the guaranty to recover funds or assume control of the project. 4. Environmental Guaranty: This guaranty specifically applies to situations where the borrower might be liable for environmental contamination or damage caused by the property or business operations. The guarantor agrees to be held responsible for any potential environmental costs, ensuring the lender can recover such expenses through the guaranty. In summary, a Hennepin Minnesota clawback guaranty provides creditors with a legal tool to protect their investments in financial transactions, often related to real estate or business loans. It allows lenders to reclaim specific assets or funds in case of non-payment, default, or other breaches of the loan agreement. The different types of guaranties available cater to various scenarios, providing flexibility and ensuring the appropriate level of protection for both lenders and guarantors involved in Hennepin County, Minnesota.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Garantía de recuperación - Clawback Guaranty

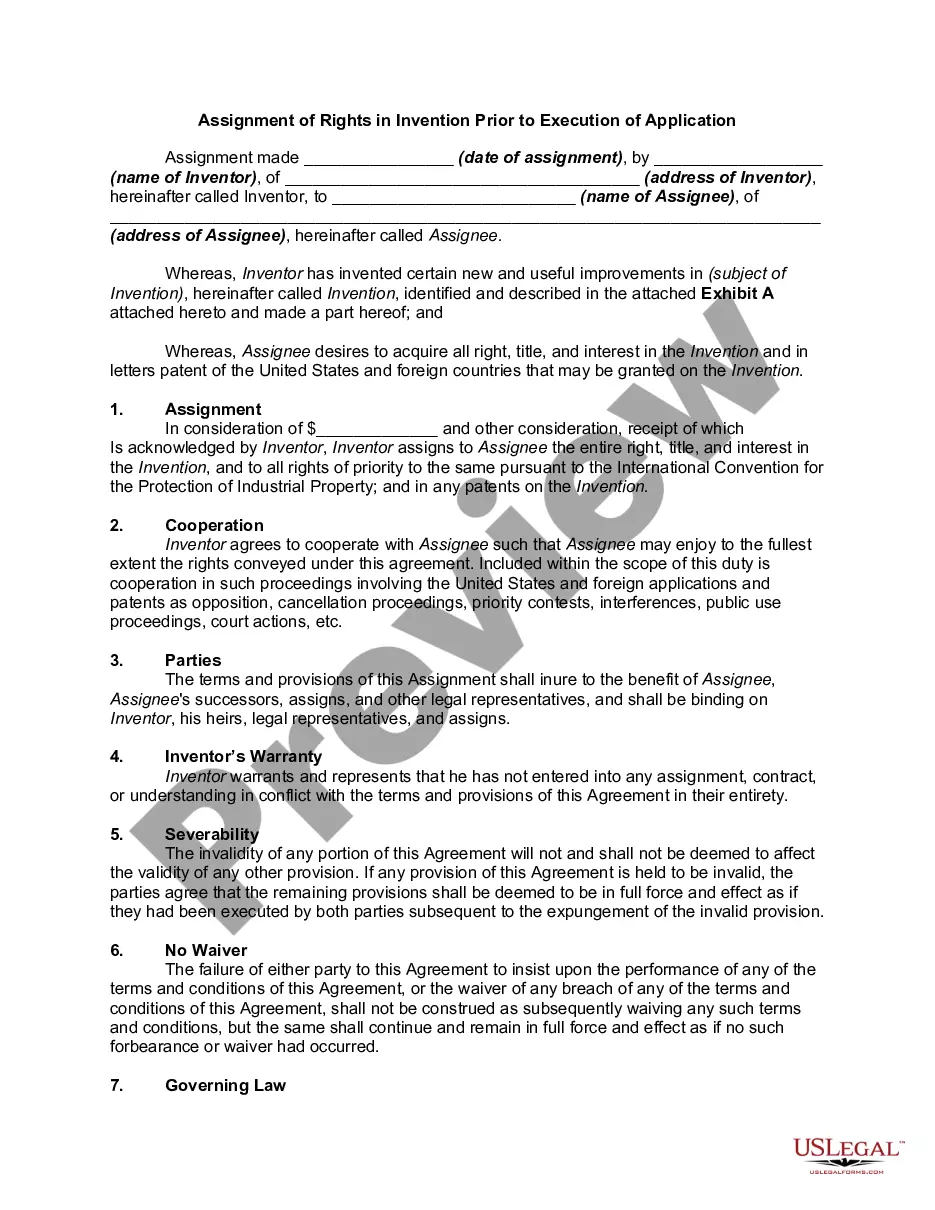

Description

How to fill out Hennepin Minnesota Garantía De Recuperación?

Preparing papers for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate Hennepin Clawback Guaranty without professional assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Hennepin Clawback Guaranty by yourself, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step guideline below to get the Hennepin Clawback Guaranty:

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!