A San Diego California Clawback Guaranty, also known as a clawback provision or clawback agreement, is a legal arrangement commonly found in business transactions, investments, and loan agreements. It is designed to protect lenders or investors in case of loan default, bankruptcy, or fraud by allowing them to "clawback" or recover assets or funds previously distributed. In San Diego, California, the clawback guaranty plays a significant role in various sectors, including real estate development, venture capital, private equity, and business acquisitions. This guarantee acts as a security measure for lenders or investors, ensuring that they can recoup their investments or minimize their losses if certain adverse events occur. There are different types of clawback guaranties in San Diego, California, tailored to specific scenarios and industries. Some notable types include: 1. Real Estate Clawback Guaranty: This type of guaranty is commonly used in real estate development and construction projects. It protects lenders or investors from potential losses if the project fails, and allows them to recover funds or assets distributed to developers or project sponsors. 2. Private Equity Clawback Guaranty: In the realm of private equity investments, this guaranty ensures that limited partners are protected if the performance of the investment falls short of expectations. It allows investors to reclaim previously distributed profits or carried interest from the fund's general partner. 3. Venture Capital Clawback Guaranty: Venture capitalists often require entrepreneurs and founders to sign clawback agreements to safeguard their investments. In case of business failure or adverse events, this guaranty allows the venture capitalists to reclaim their initial investment or a portion of it. 4. Acquisition Clawback Guaranty: In the context of business acquisitions or mergers, a clawback guaranty may be included to protect the acquirer from potential losses due to misrepresentation, breach of warranties, or undisclosed liabilities. It enables the acquirer to recover consideration paid to the seller if such circumstances arise. Overall, a San Diego California Clawback Guaranty serves as a vital legal instrument, offering lenders, investors, or acquirers an additional layer of protection against potential financial risks or fraudulent activities. The specific type of guaranty employed depends on the nature of the transaction, industry, and parties involved, allowing for tailored agreements that safeguard the interests of all parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Garantía de recuperación - Clawback Guaranty

Description

How to fill out San Diego California Garantía De Recuperación?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the San Diego Clawback Guaranty, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the San Diego Clawback Guaranty from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the San Diego Clawback Guaranty:

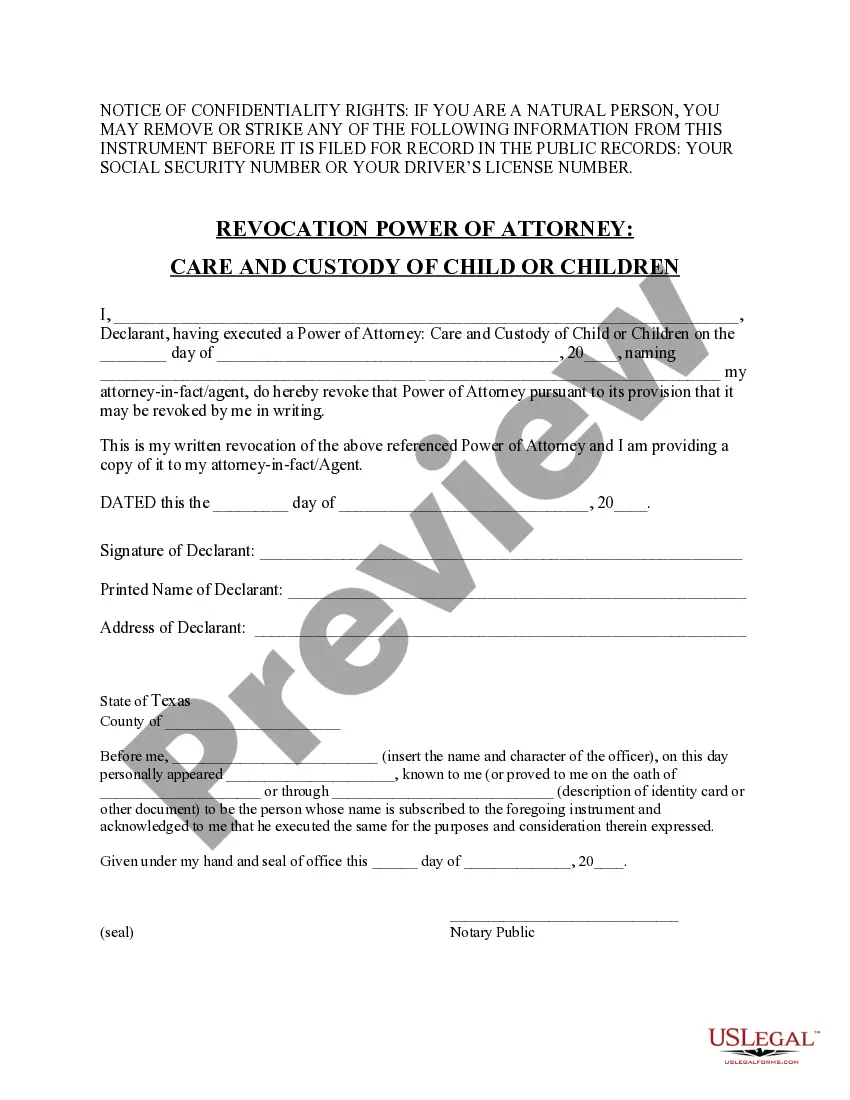

- Analyze the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!