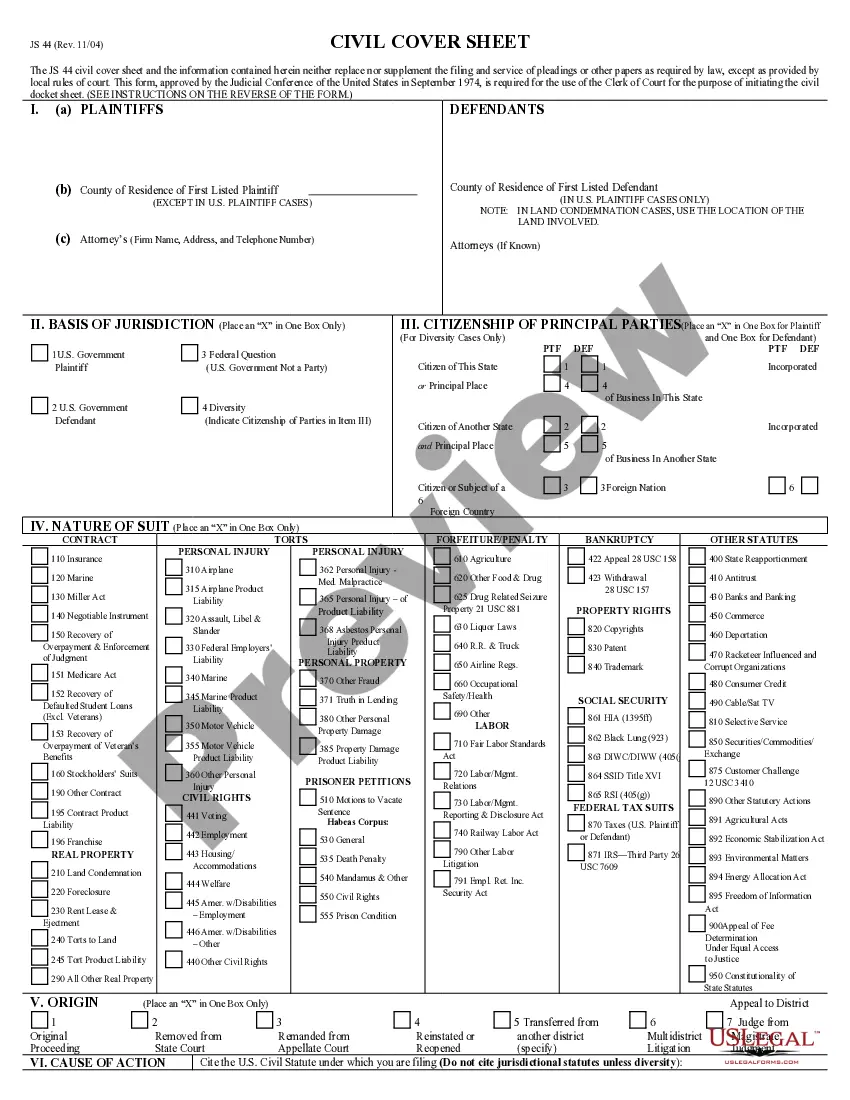

Maricopa, Arizona, is a vibrant city located in Pinal County, known for its diverse community and scenic desert landscapes. As an important aspect of maintaining a safe and transparent financial environment, Maricopa has implemented a comprehensive Anti-Money Laundering (AML) policy to combat illicit financial activities within its jurisdiction. The Maricopa Arizona Form of Anti-Money Laundering Policy aims to prevent money laundering, which involves the concealment of illegally obtained funds through various transactions to make them appear legitimate. This policy is designed to ensure that financial institutions, businesses, and individuals in Maricopa comply with the necessary regulations to detect and prevent money laundering activities. The Maricopa Arizona Form of Anti-Money Laundering Policy requires financial institutions, including banks, credit unions, and other regulated entities, to establish robust internal controls and procedures. These measures play a crucial role in identifying and reporting suspicious transactions, thereby enhancing the ability to detect potential money laundering activities effectively. Key elements of the Maricopa Arizona Form of Anti-Money Laundering Policy include: 1. Customer Due Diligence (CDD): Financial institutions are required to conduct thorough due diligence on their customers to understand their financial activities, risk profiles, and sources of wealth. This includes verifying customer identities, assessing transaction patterns, and monitoring accounts for unusual or suspicious activities. 2. Transaction Monitoring: The policy necessitates the implementation of sophisticated monitoring systems to track and analyze transactions for any potential red flags or unusual patterns. This helps to identify potentially suspicious activities and trigger further investigation for potential money laundering. 3. Suspicious Activity Reporting (SAR): Financial institutions must have established procedures for reporting any suspicious transactions or activities to the appropriate regulatory authorities. Timely submission of Suspicious Activity Reports enables law enforcement agencies to take necessary actions, such as investigations or freezing accounts for potential criminal activities. 4. Record Keeping: The policy emphasizes the importance of maintaining accurate and detailed records of all financial transactions, customer information, and due diligence procedures. Adequate record keeping helps ensure compliance with regulations and facilitates audits, investigations, or prosecutions when necessary. Different types of Maricopa Arizona Form of Anti-Money Laundering Policies may be applicable for specific sectors or industries. For instance, there could be specialized policies for banks, casinos, cryptocurrency exchanges, or real estate agencies. These sector-specific policies might have tailored requirements and guidelines, considering the distinct risks and characteristics associated with each industry. In conclusion, the Maricopa Arizona Form of Anti-Money Laundering Policy reflects the city's commitment to combat money laundering activities effectively. By implementing stringent measures, conducting due diligence, monitoring transactions, and promoting reporting, Maricopa aims to create a secure financial environment and uphold the integrity of its financial institutions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Formulario de Política Anti-Lavado de Dinero - Form of Anti-Money Laundering Policy

Description

How to fill out Maricopa Arizona Formulario De Política Anti-Lavado De Dinero?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Maricopa Form of Anti-Money Laundering Policy suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. Apart from the Maricopa Form of Anti-Money Laundering Policy, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Maricopa Form of Anti-Money Laundering Policy:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Maricopa Form of Anti-Money Laundering Policy.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!