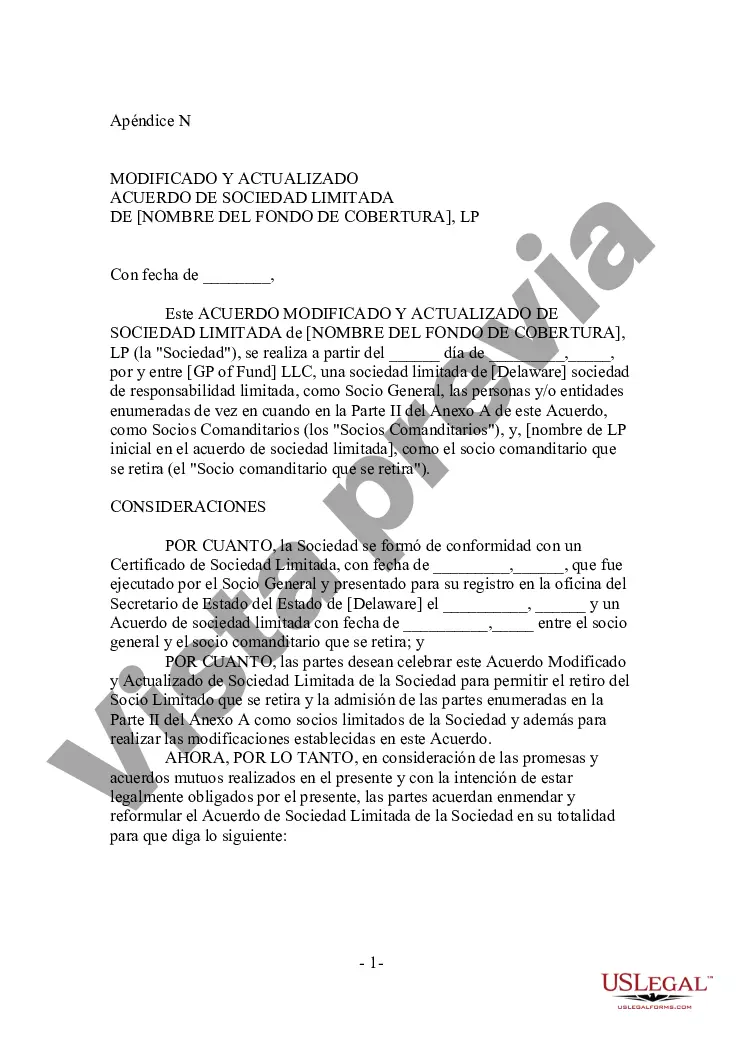

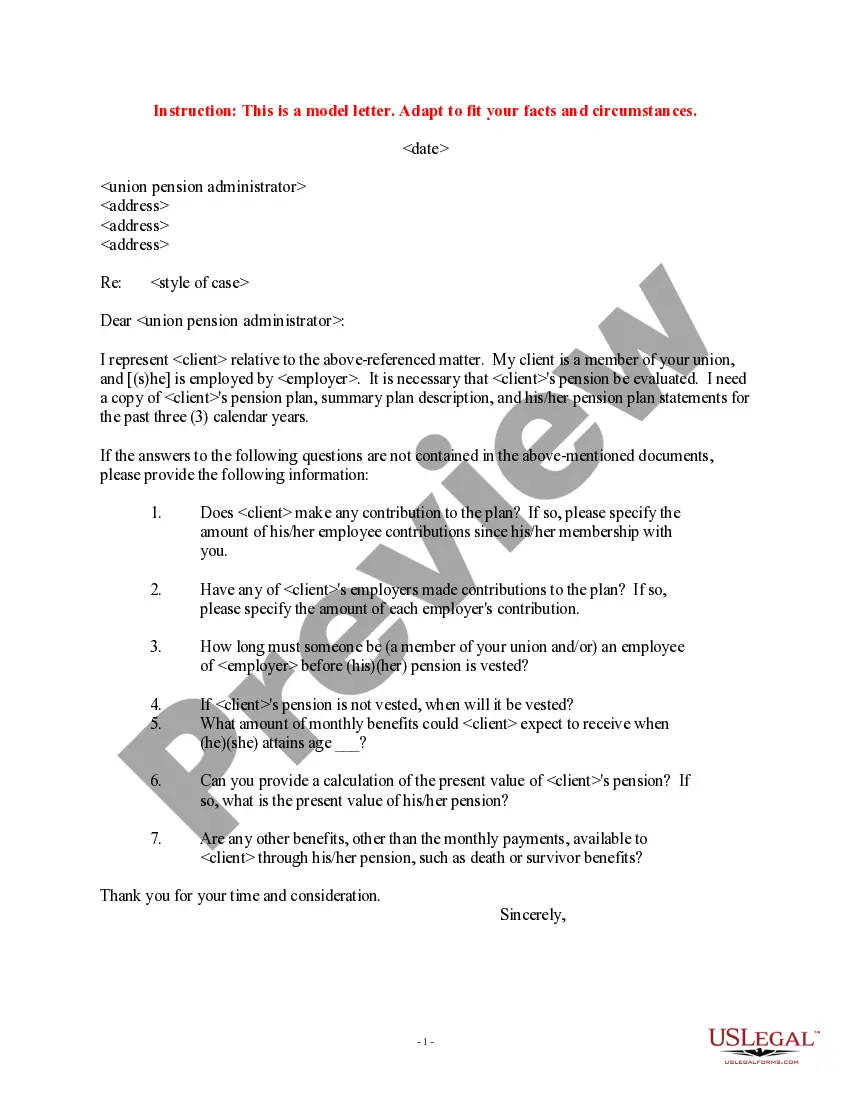

The Cuyahoga Ohio Limited Partnership Agreement for Hedge Fund is a legally binding contract that outlines the terms and conditions between the Limited Partners (LPs) and the General Partner (GP) of a hedge fund operating in Cuyahoga County, Ohio. This agreement plays a crucial role in defining the responsibilities, obligations, and rights of both parties involved in the establishment and operation of the hedge fund. The Cuyahoga Ohio Limited Partnership Agreement for Hedge Fund is tailored specifically to comply with the local laws and regulations of Cuyahoga County and the state of Ohio, ensuring adherence to the legal framework surrounding hedge funds and investment activities within the region. The agreement typically includes sections addressing key aspects such as capital contributions, profit and loss allocation, management structure, decision-making processes, distribution of funds, withdrawal provisions, dissolution procedures, and dispute resolution mechanisms. In addition to the standard provisions, there might be various types or variations of the Cuyahoga Ohio Limited Partnership Agreement for Hedge Funds, tailored to meet specific requirements of different types of hedge funds. Some of these types may include: 1. Long/Short Equity Partnership Agreement: This type of agreement pertains to hedge funds primarily engaged in long and short equity trading strategies. It outlines the specific investment objectives, risk management procedures, and performance fee structures related to these strategies. 2. Event-Driven Partnership Agreement: Designed for hedge funds utilizing event-driven investment strategies, this agreement focuses on capitalizing on specific corporate events, such as mergers, acquisitions, bankruptcies, or other significant business developments. It outlines the investment approach, risk management guidelines, and partnership dynamics specific to event-driven investing. 3. Multi-Strategy Partnership Agreement: This type of agreement caters to hedge funds that employ a combination of various investment strategies, including but not limited to long/short equity, event-driven, global macro, and quantitative approaches. The agreement outlines the allocation of capital between different strategies, risk management frameworks, and fee structures relevant to each strategy utilized. 4. Distressed Securities Partnership Agreement: Tailored specifically for hedge funds specializing in distressed securities, this agreement focuses on investing in securities of financially troubled companies to capitalize on potential turnarounds or asset valuations. It includes provisions related to valuation methodologies, risk management techniques, and investment restrictions specific to distressed securities. 5. Global Macro Partnership Agreement: Designed for hedge funds employing global macro investment strategies, this agreement outlines the fund's approach to investing in various financial instruments, including currencies, commodities, equities, and bonds, based on macroeconomic factors and global market trends. These are just a few examples of potential variations in the Cuyahoga Ohio Limited Partnership Agreement for Hedge Funds, highlighting the importance of tailoring the agreement to align with the unique investment strategies and objectives of each hedge fund operating in Cuyahoga County, Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Acuerdo de Sociedad Limitada para Fondo de Cobertura - Limited Partnership Agreement for Hedge Fund

Description

How to fill out Cuyahoga Ohio Acuerdo De Sociedad Limitada Para Fondo De Cobertura?

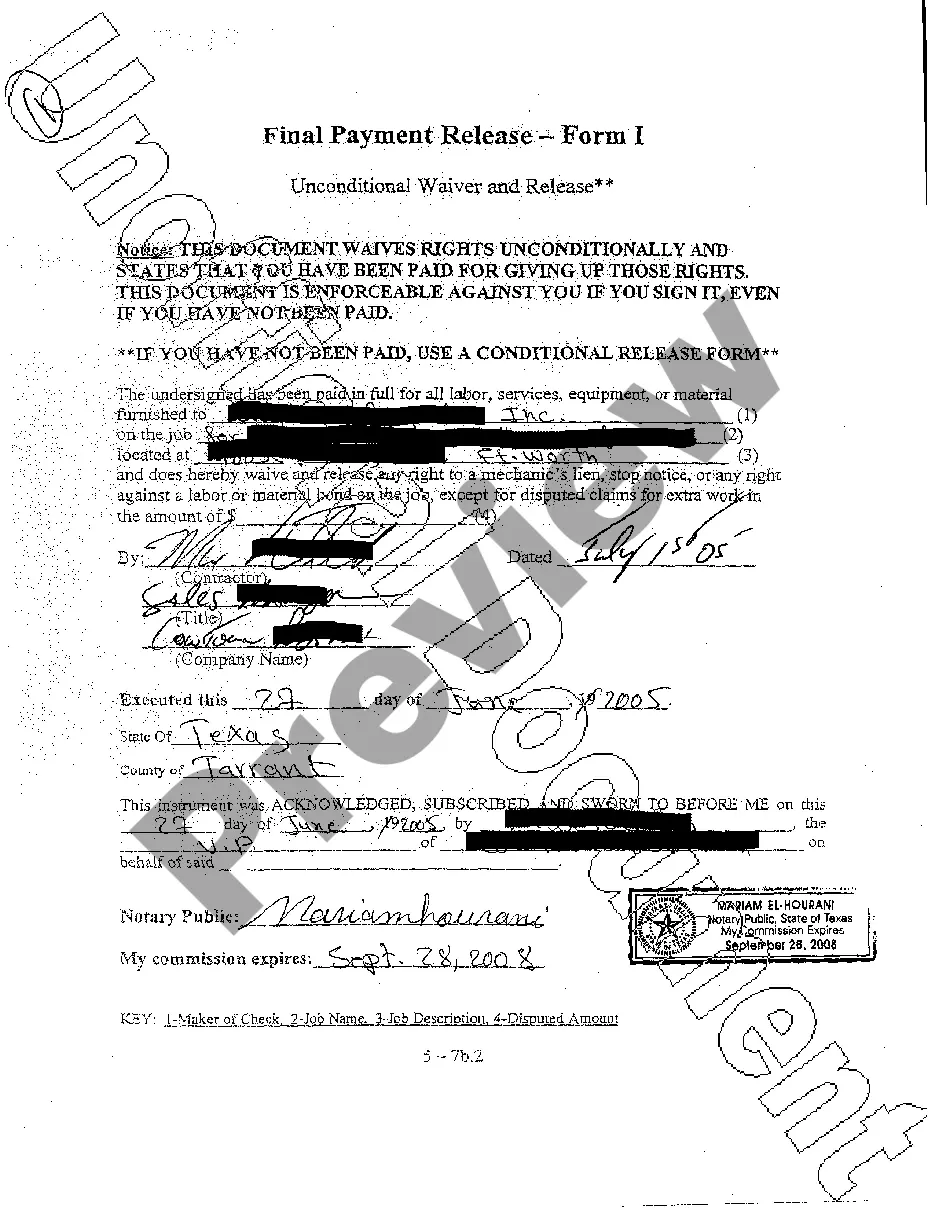

Draftwing documents, like Cuyahoga Limited Partnership Agreement for Hedge Fund, to take care of your legal affairs is a challenging and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. However, you can take your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for different scenarios and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Cuyahoga Limited Partnership Agreement for Hedge Fund form. Simply log in to your account, download the template, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before getting Cuyahoga Limited Partnership Agreement for Hedge Fund:

- Ensure that your template is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Cuyahoga Limited Partnership Agreement for Hedge Fund isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start utilizing our website and download the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment details.

- Your form is all set. You can try and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!