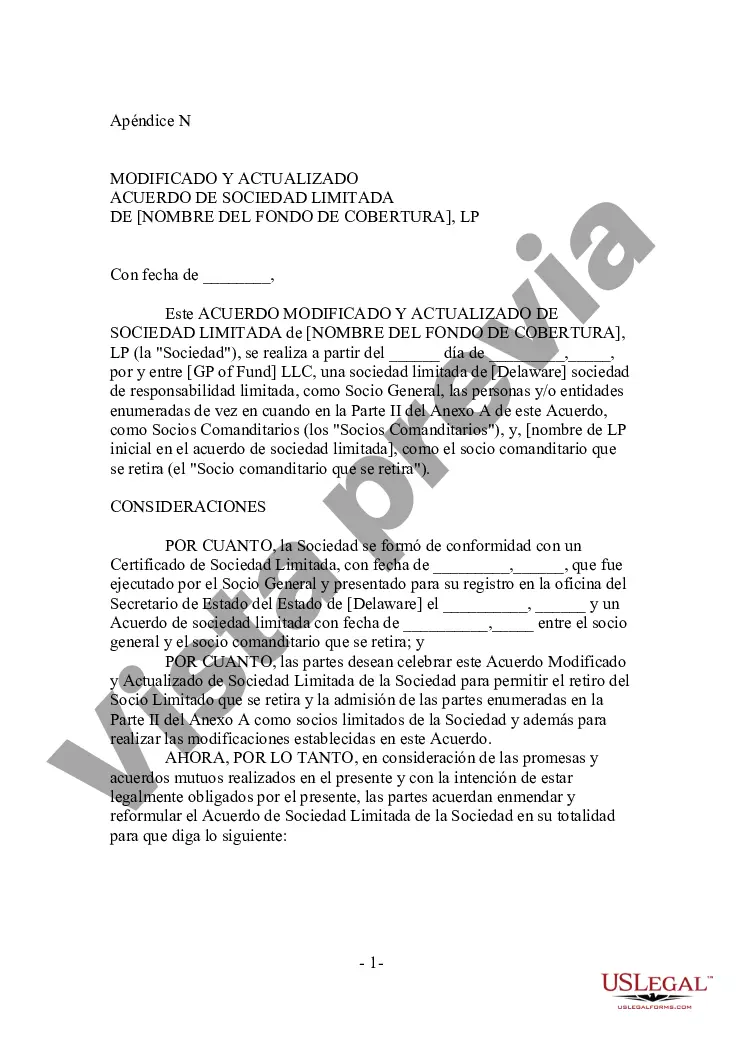

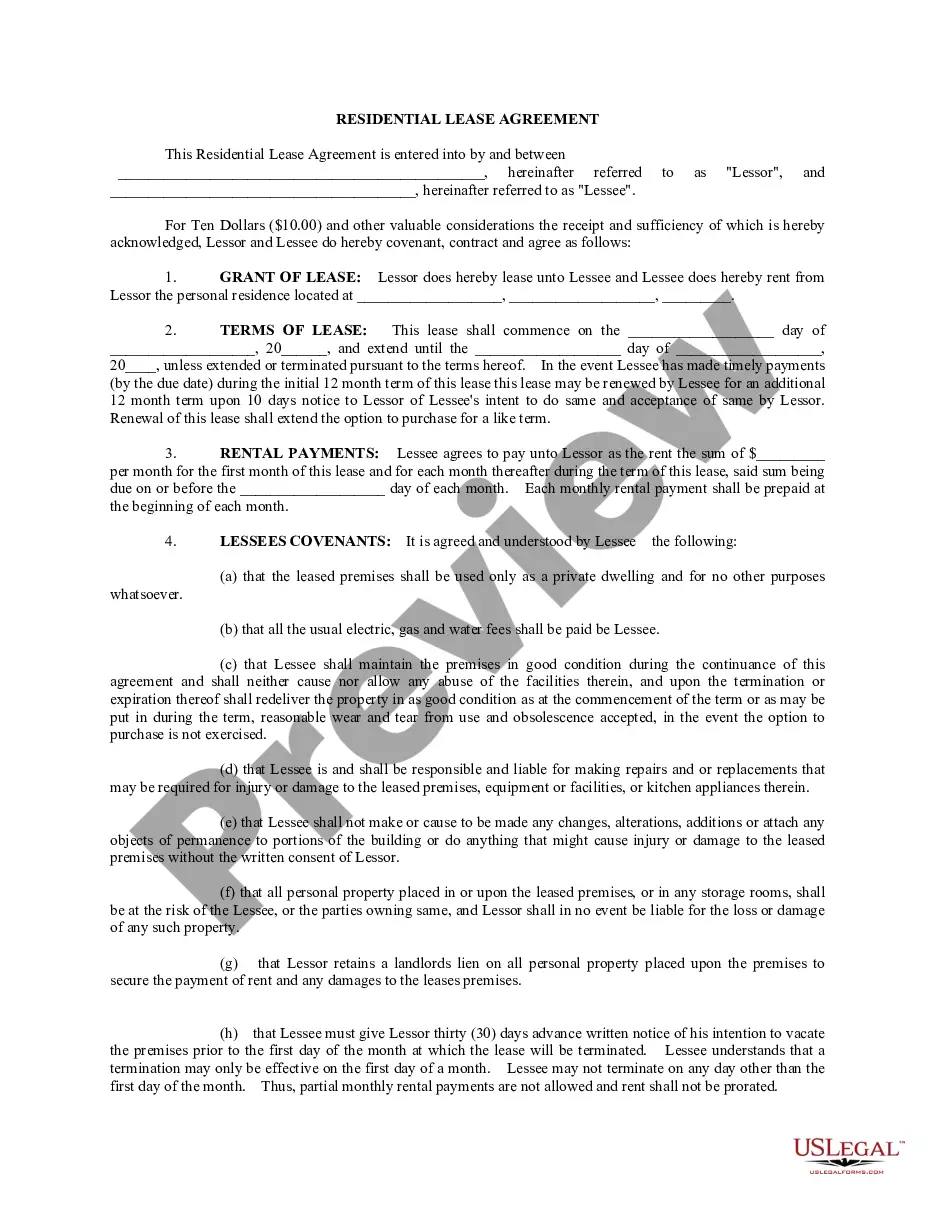

Nassau New York Limited Partnership Agreement for Hedge Fund is a legally binding contract that outlines the terms and conditions of a partnership between two or more entities in the hedge fund industry. This agreement sets forth the responsibilities, rights, and obligations of the general partner(s) and limited partner(s) involved in the fund. The Nassau New York Limited Partnership Agreement for Hedge Fund is designed to provide a framework for the successful operation of the hedge fund. It typically includes detailed provisions regarding the investment strategies, capital contributions, profit sharing, management fees, decision-making processes, and dissolution procedures. Different types of Nassau New York Limited Partnership Agreements for Hedge Funds may exist, catering to specific needs and preferences. Some variations may include: 1. Standard Nassau New York Limited Partnership Agreement for Hedge Fund: This type of agreement covers general terms and conditions common to most hedge funds, ensuring clarity and uniformity in partnership structures. 2. Customized Nassau New York Limited Partnership Agreement for Hedge Fund: These agreements are tailored to meet the unique requirements and preferences of specific hedge funds. They may include additional provisions or modifications to accommodate specific investment strategies or asset classes. 3. Family Office Nassau New York Limited Partnership Agreement for Hedge Fund: This type of partnership agreement is designed for hedge funds managed by family offices, which cater to the wealth preservation and growth objectives of high-net-worth families. 4. Multi-Manager Nassau New York Limited Partnership Agreement for Hedge Fund: In cases where a hedge fund involves multiple investment managers, this agreement outlines the relationship between the fund and each manager, ensuring coordination and alignment of interests. 5. Seed Investor Nassau New York Limited Partnership Agreement for Hedge Fund: When a hedge fund seeks initial capital from seed investors, this agreement governs the terms and conditions of the partnership between the fund and the seed investor(s). It is important to consult with legal professionals experienced in hedge fund partnership agreements to ensure compliance with Nassau New York legal requirements and industry best practices. The agreement should accurately reflect the intentions and objectives of the parties involved, while providing a robust framework for the efficient operation and management of the hedge fund.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Acuerdo de Sociedad Limitada para Fondo de Cobertura - Limited Partnership Agreement for Hedge Fund

Description

How to fill out Nassau New York Acuerdo De Sociedad Limitada Para Fondo De Cobertura?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Nassau Limited Partnership Agreement for Hedge Fund, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Nassau Limited Partnership Agreement for Hedge Fund from the My Forms tab.

For new users, it's necessary to make some more steps to get the Nassau Limited Partnership Agreement for Hedge Fund:

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!