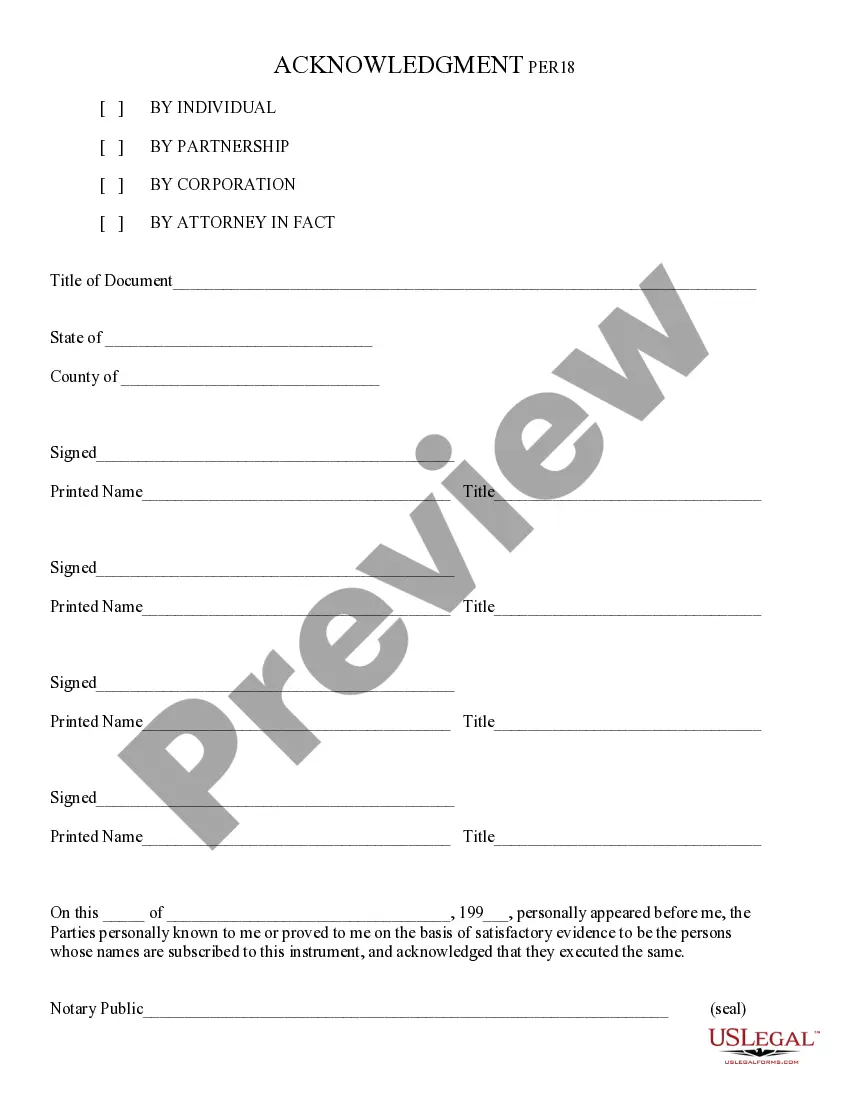

This document is an Investment Advisory Agreement that appoints the investment advisor as attorney-in-fact to the trustee. It details the duties and obligations of the investment advisor and provides indemnity to the advisor. It also spells out the duration and termination of the agreement and the governing law of the agreement.

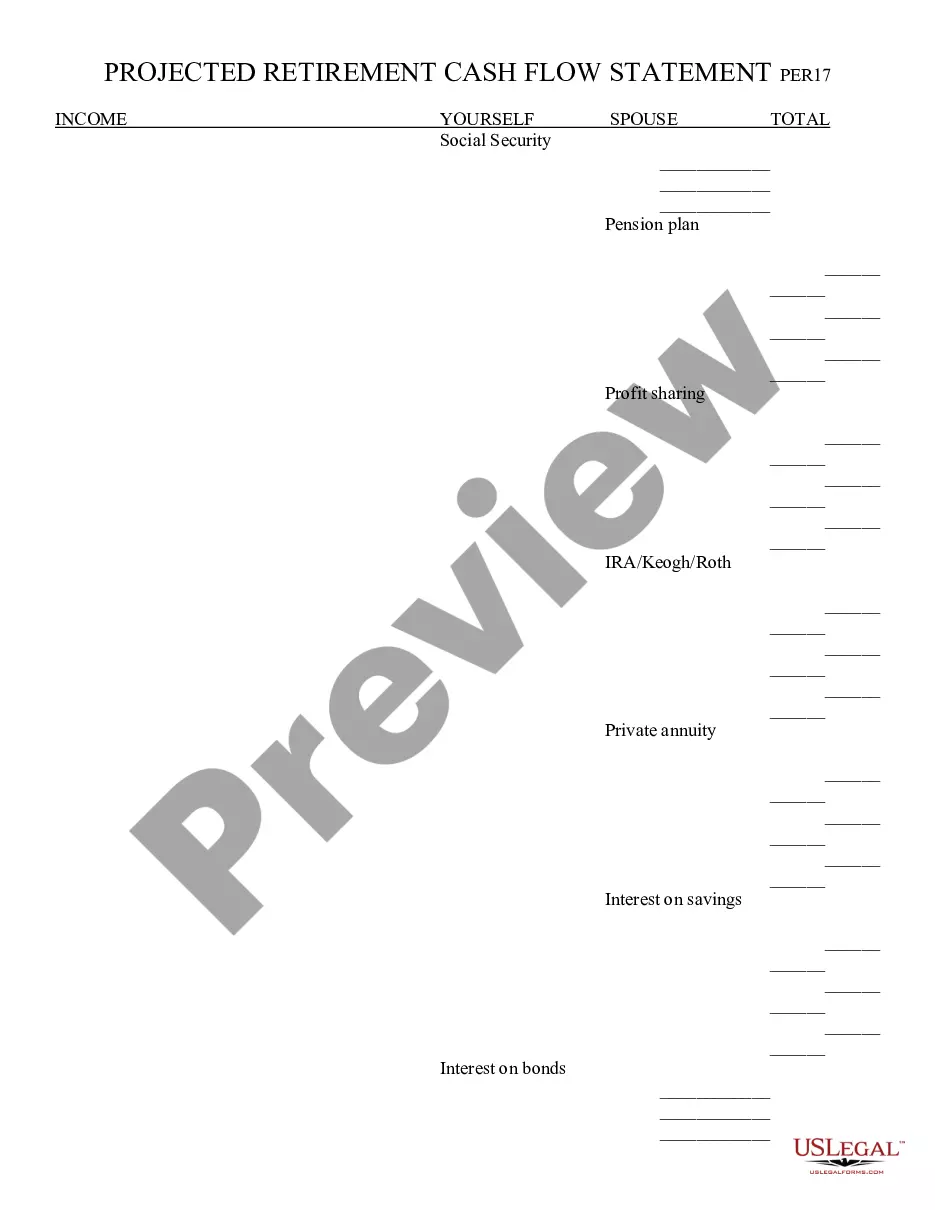

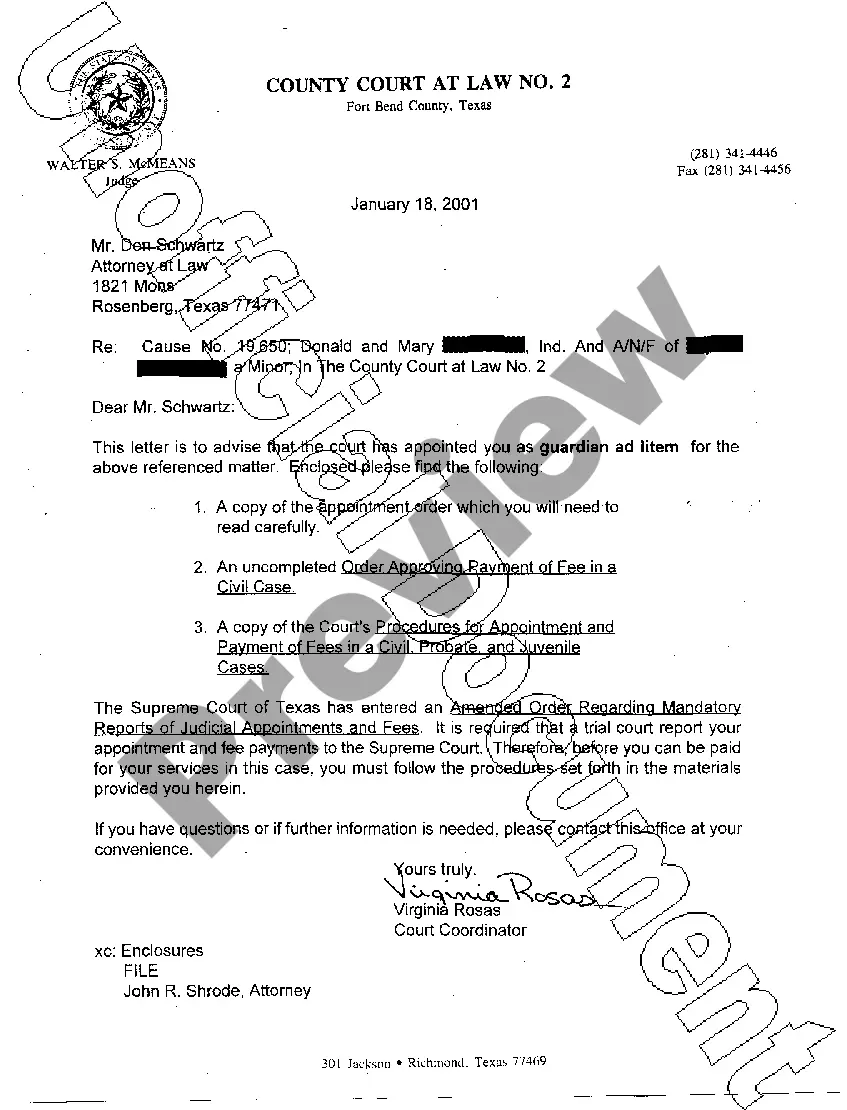

The Harris Texas Investment Advisory Agreement is a legally binding contract that outlines the terms and conditions between a client and Harris Texas, an investment advisory firm located in Texas. This agreement pertains to the provision of investment advisory services offered by Harris Texas and sets the framework for the relationship between the client and the firm. In the Harris Texas Investment Advisory Agreement, the client can expect to find a detailed description of the services provided by the firm. These services typically include investment management, financial planning, portfolio analysis, and ongoing monitoring of investment accounts. The agreement will also outline the fee structure associated with these services, including any management fees, performance-based fees, or other charges. The agreement will highlight the responsibilities and obligations of both the client and Harris Texas. It will specify the client's duty to provide accurate information about their financial situation, investment goals, and risk tolerance. On the other hand, Harris Texas will articulate its duty to act in the client's best interests, exercise due diligence, and provide suitable investment advice. The agreement may also cover important legal and compliance matters, including termination clauses, confidentiality obligations, and dispute resolution mechanisms. It may outline the duration of the agreement and the circumstances under which it may be terminated by either party. Types of Harris Texas Investment Advisory Agreements: 1. Individual Investment Advisory Agreement: This agreement is tailored for individual clients seeking personalized investment advisory services from Harris Texas. It caters to the unique needs and objectives of individual investors. 2. Corporate Investment Advisory Agreement: This type of agreement is designed for corporate clients, such as businesses, organizations, or institutions, seeking investment advisory services from Harris Texas. It may involve managing corporate investment portfolios, advising on mergers and acquisitions, or other strategic financial planning. 3. Retirement Plan Investment Advisory Agreement: Harris Texas may offer specialized investment advisory services for retirement plans such as individual retirement accounts (IRAs), 401(k) plans, or pension funds. This agreement outlines the specific terms and conditions related to managing these retirement investment accounts. 4. Estate and Trust Investment Advisory Agreement: When clients require guidance on investing assets held within estates or trusts, Harris Texas may offer advisory services specifically tailored to these situations. This type of agreement would highlight the unique considerations and responsibilities associated with managing such assets. It is crucial for clients to carefully review and understand the Harris Texas Investment Advisory Agreement before entering into a professional relationship with the firm. This document serves to clarify expectations, protect the rights and interests of both parties, and ensure transparency in the provision of investment advisory services.The Harris Texas Investment Advisory Agreement is a legally binding contract that outlines the terms and conditions between a client and Harris Texas, an investment advisory firm located in Texas. This agreement pertains to the provision of investment advisory services offered by Harris Texas and sets the framework for the relationship between the client and the firm. In the Harris Texas Investment Advisory Agreement, the client can expect to find a detailed description of the services provided by the firm. These services typically include investment management, financial planning, portfolio analysis, and ongoing monitoring of investment accounts. The agreement will also outline the fee structure associated with these services, including any management fees, performance-based fees, or other charges. The agreement will highlight the responsibilities and obligations of both the client and Harris Texas. It will specify the client's duty to provide accurate information about their financial situation, investment goals, and risk tolerance. On the other hand, Harris Texas will articulate its duty to act in the client's best interests, exercise due diligence, and provide suitable investment advice. The agreement may also cover important legal and compliance matters, including termination clauses, confidentiality obligations, and dispute resolution mechanisms. It may outline the duration of the agreement and the circumstances under which it may be terminated by either party. Types of Harris Texas Investment Advisory Agreements: 1. Individual Investment Advisory Agreement: This agreement is tailored for individual clients seeking personalized investment advisory services from Harris Texas. It caters to the unique needs and objectives of individual investors. 2. Corporate Investment Advisory Agreement: This type of agreement is designed for corporate clients, such as businesses, organizations, or institutions, seeking investment advisory services from Harris Texas. It may involve managing corporate investment portfolios, advising on mergers and acquisitions, or other strategic financial planning. 3. Retirement Plan Investment Advisory Agreement: Harris Texas may offer specialized investment advisory services for retirement plans such as individual retirement accounts (IRAs), 401(k) plans, or pension funds. This agreement outlines the specific terms and conditions related to managing these retirement investment accounts. 4. Estate and Trust Investment Advisory Agreement: When clients require guidance on investing assets held within estates or trusts, Harris Texas may offer advisory services specifically tailored to these situations. This type of agreement would highlight the unique considerations and responsibilities associated with managing such assets. It is crucial for clients to carefully review and understand the Harris Texas Investment Advisory Agreement before entering into a professional relationship with the firm. This document serves to clarify expectations, protect the rights and interests of both parties, and ensure transparency in the provision of investment advisory services.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.