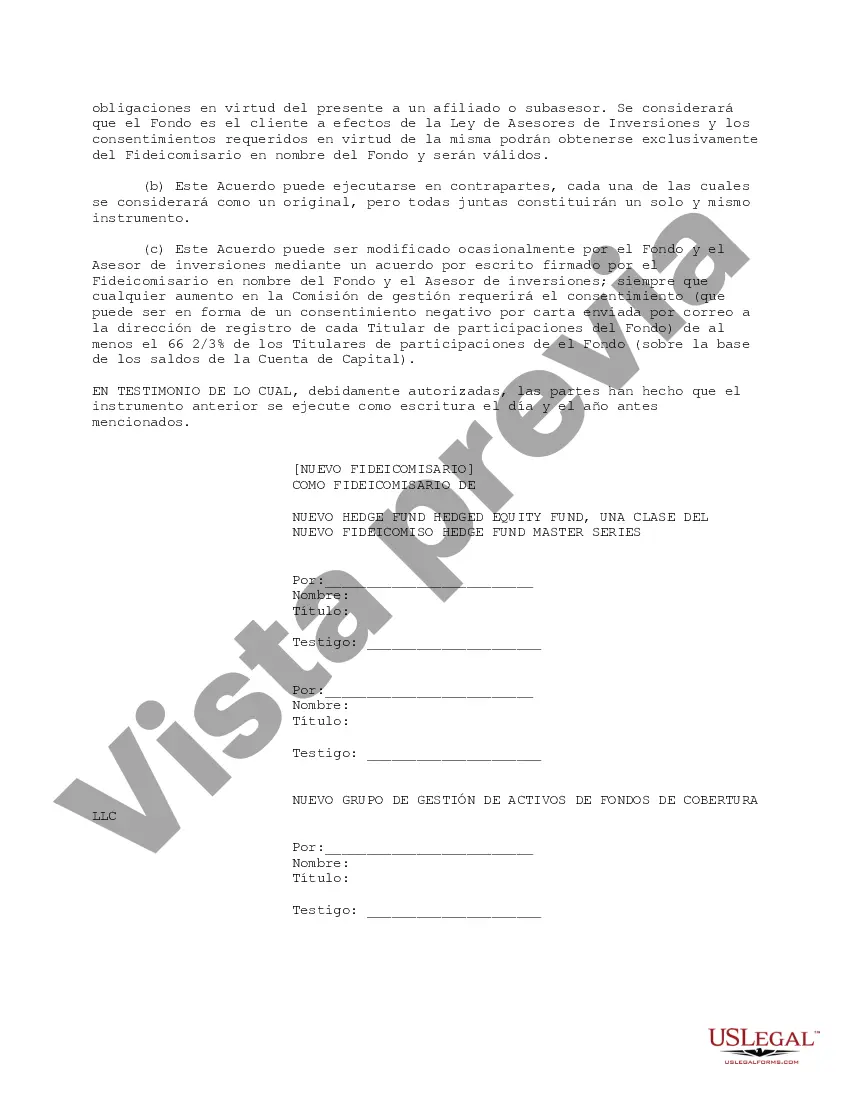

This document is an Investment Advisory Agreement that appoints the investment advisor as attorney-in-fact to the trustee. It details the duties and obligations of the investment advisor and provides indemnity to the advisor. It also spells out the duration and termination of the agreement and the governing law of the agreement.

The Riverside California Investment Advisory Agreement is a legally binding contract between an investor and an investment advisor based in Riverside, California. This agreement outlines the terms and conditions under which the investment advisor will provide advisory services to the investor. By entering into this agreement, both parties ensure that they are on the same page regarding the investment objectives, risks, and the roles and responsibilities of each party involved. The Investment Advisory Agreement serves as a blueprint for the professional relationship between the investor and the advisor. It includes details such as the scope of services, compensation structure, investment strategy, and any limitations or restrictions imposed on the advisor. The agreement aims to establish a clear understanding of the working relationship and to protect the interests of both parties. Common types of Riverside California Investment Advisory Agreements may include: 1. General Investment Advisory Agreement: This type of agreement covers a wide range of advisory services, including asset allocation, financial planning, portfolio management, and investment research. It caters to individual investors, families, or organizations seeking comprehensive investment guidance tailored to their specific needs. 2. Retirement Investment Advisory Agreement: This agreement specifically focuses on retirement planning and investment strategies. It considers factors like the investor's age, risk tolerance, and retirement goals to design a suitable investment plan that aims to maximize the investor's returns while minimizing risk. 3. Wealth Management Investment Advisory Agreement: This type of agreement caters to high net-worth individuals or families seeking comprehensive investment and financial management services. It typically covers investment management, tax planning, estate planning, charitable giving, and other related services. 4. Sustainable Investment Advisory Agreement: This agreement is designed for investors who prioritize environmental, social, and governance (ESG) factors in their investment decisions. It focuses on identifying and recommending investment opportunities that align with the investor's sustainability goals. The Riverside California Investment Advisory Agreement is crucial for clarifying the roles, responsibilities, and expectations of both the investor and the advisor. It is essential to carefully review and understand the terms of the agreement before signing, ensuring proper disclosure of risks, fees, and potential conflicts of interest. Seeking legal or financial advice is recommended to ensure compliance with relevant laws and regulations and to safeguard the investor's interests.The Riverside California Investment Advisory Agreement is a legally binding contract between an investor and an investment advisor based in Riverside, California. This agreement outlines the terms and conditions under which the investment advisor will provide advisory services to the investor. By entering into this agreement, both parties ensure that they are on the same page regarding the investment objectives, risks, and the roles and responsibilities of each party involved. The Investment Advisory Agreement serves as a blueprint for the professional relationship between the investor and the advisor. It includes details such as the scope of services, compensation structure, investment strategy, and any limitations or restrictions imposed on the advisor. The agreement aims to establish a clear understanding of the working relationship and to protect the interests of both parties. Common types of Riverside California Investment Advisory Agreements may include: 1. General Investment Advisory Agreement: This type of agreement covers a wide range of advisory services, including asset allocation, financial planning, portfolio management, and investment research. It caters to individual investors, families, or organizations seeking comprehensive investment guidance tailored to their specific needs. 2. Retirement Investment Advisory Agreement: This agreement specifically focuses on retirement planning and investment strategies. It considers factors like the investor's age, risk tolerance, and retirement goals to design a suitable investment plan that aims to maximize the investor's returns while minimizing risk. 3. Wealth Management Investment Advisory Agreement: This type of agreement caters to high net-worth individuals or families seeking comprehensive investment and financial management services. It typically covers investment management, tax planning, estate planning, charitable giving, and other related services. 4. Sustainable Investment Advisory Agreement: This agreement is designed for investors who prioritize environmental, social, and governance (ESG) factors in their investment decisions. It focuses on identifying and recommending investment opportunities that align with the investor's sustainability goals. The Riverside California Investment Advisory Agreement is crucial for clarifying the roles, responsibilities, and expectations of both the investor and the advisor. It is essential to carefully review and understand the terms of the agreement before signing, ensuring proper disclosure of risks, fees, and potential conflicts of interest. Seeking legal or financial advice is recommended to ensure compliance with relevant laws and regulations and to safeguard the investor's interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.