Title: King Washington Complaint Regarding Insurer's Failure to Pay Claim: A Comprehensive Overview Keywords: King Washington, complaint, insurer, failure to pay-claim, detailed description, types Introduction: In King Washington, complaints regarding an insurer's failure to pay claims can occur across various fields and situations. This article aims to provide a detailed description of the reasons behind such complaints, highlighting the different types of King Washington Complaints regarding an Insurer's Failure to Pay Claim for a comprehensive understanding. Types of King Washington Complaints regarding Insurer's Failure to Pay Claim: 1. Health Insurance Claim Denials: Often, individuals file complaints when health insurance companies refuse to honor claims they believe are valid. Complaints may arise due to disputes over medical necessity, pre-existing conditions, in-network providers, or unclear policy terms. King Washington residents may face hardships when insurers fail to pay their legitimate medical bills, leading to increased stress and financial burden. 2. Auto Insurance Claim Denials: In case of an accident or damage caused to one's vehicle, individuals in King Washington rely on their auto insurance policies to cover the costs. However, complaints can arise when an insurer refuses to pay a valid claim, delaying repairs, or questioning the circumstances of the incident. Unresolved issues may result in additional expenses for policyholders, who might decide to escalate the situation via complaints. 3. Homeowners' Insurance Claim Denials: Homeowners' insurance is essential to protect against unexpected damages to properties. Yet, complaints may arise when insurers decline claims for reasons such as inadequate policy coverage, failure to properly investigate damages, or disputes over the value of losses. Such denials can lead to frustration and financial strain for King Washington residents affected by natural disasters, theft, or accidents. 4. Life Insurance Claim Denials: King Washington residents often rely on life insurance policies to provide financial security for their loved ones after their passing. However, complaints may occur if an insurer rejects a valid claim, alleging misrepresentation on the application, lack of insurable interest, or discrepancies in policy terms. Such denials can drastically impact beneficiaries, contesting their rightful claims. Resolution and Legal Actions: To address King Washington Complaints regarding an Insurer's Failure to Pay Claim, various steps can be taken. Policyholders are advised to initially reach out to their insurer's customer service, document all interactions, and try to resolve the issue amicably. If the dispute remains unresolved, filing an official complaint with the Washington State Office of the Insurance Commissioner can provide a formal channel for investigation and potential resolution. In extreme cases, seeking legal counsel may be necessary to review the policy, evaluate breach of contract, and pursue legal action against the insurer. Conclusion: King Washington Complaints regarding an Insurer's Failure to Pay Claim can stem from various insurance policy types, including health, auto, homeowners, and life insurance. These complaints cause distress and financial setbacks for policyholders. It is crucial for affected individuals to be aware of their rights and potential avenues for resolution, ensuring their valid claims are rightfully acknowledged and paid by insurers.

King Washington Complaint regarding Insurer's Failure to Pay Claim

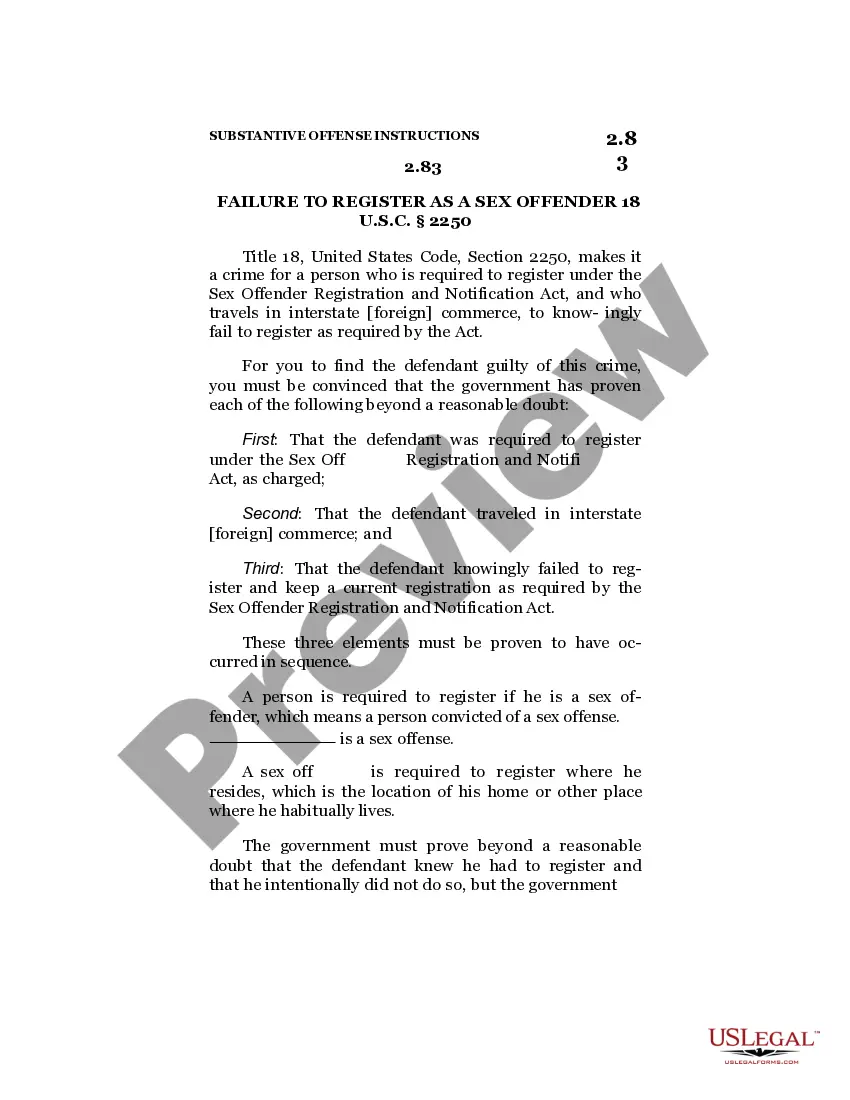

Description

How to fill out King Washington Complaint Regarding Insurer's Failure To Pay Claim?

Drafting documents for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create King Complaint regarding Insurer's Failure to Pay Claim without expert assistance.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid King Complaint regarding Insurer's Failure to Pay Claim by yourself, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the King Complaint regarding Insurer's Failure to Pay Claim:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that fits your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any scenario with just a few clicks!