This form addresses important considerations that may effect the legal rights and obligations of the parties in a buy-sell agreement. It is a tool to help assure the orderly transfer of interests in the partnership or corporation. This questionnaire enables those seeking legal help to effectively identify and prepare their issues and problems. Thorough advance preparation enhances the attorney’s case evaluation and can significantly reduce costs associated with case preparation.

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

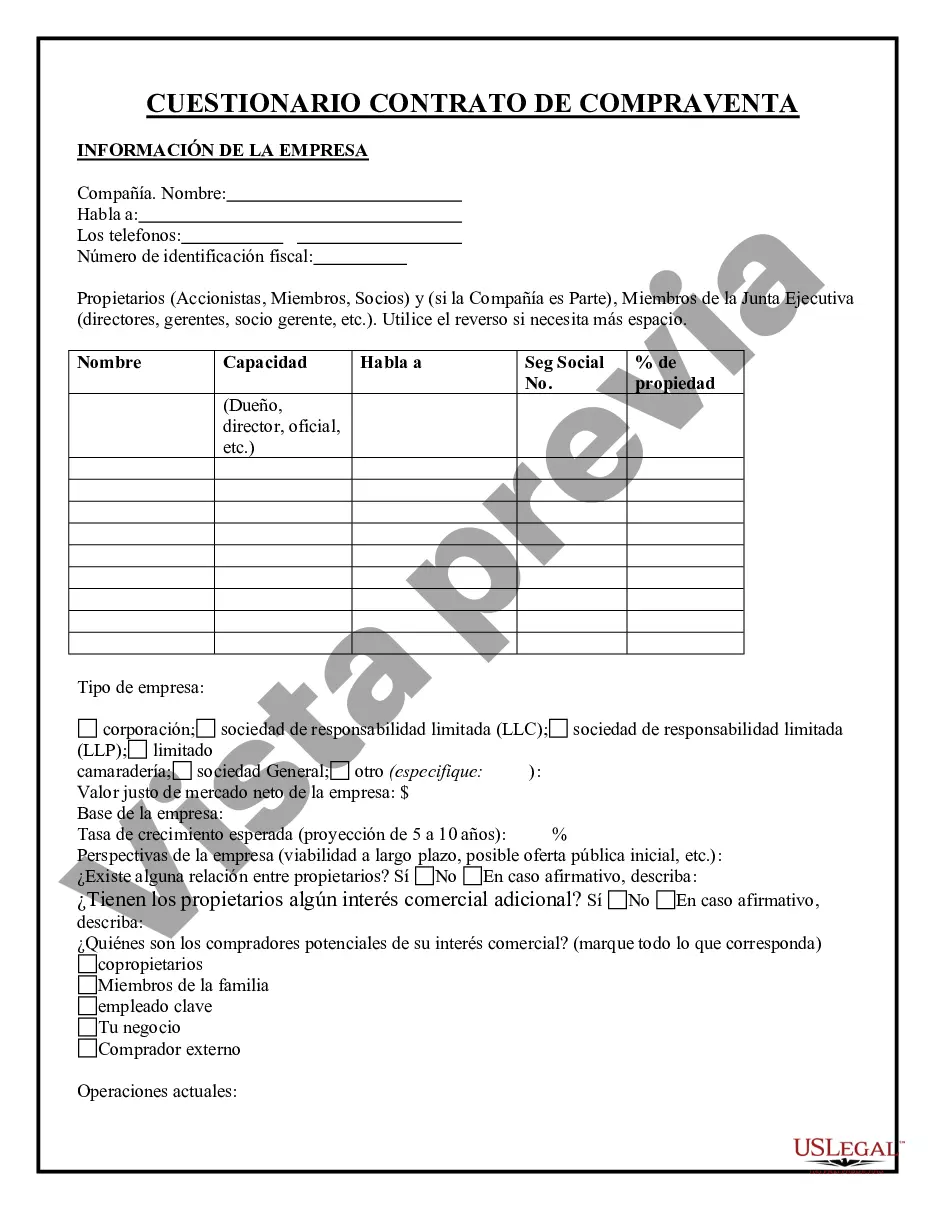

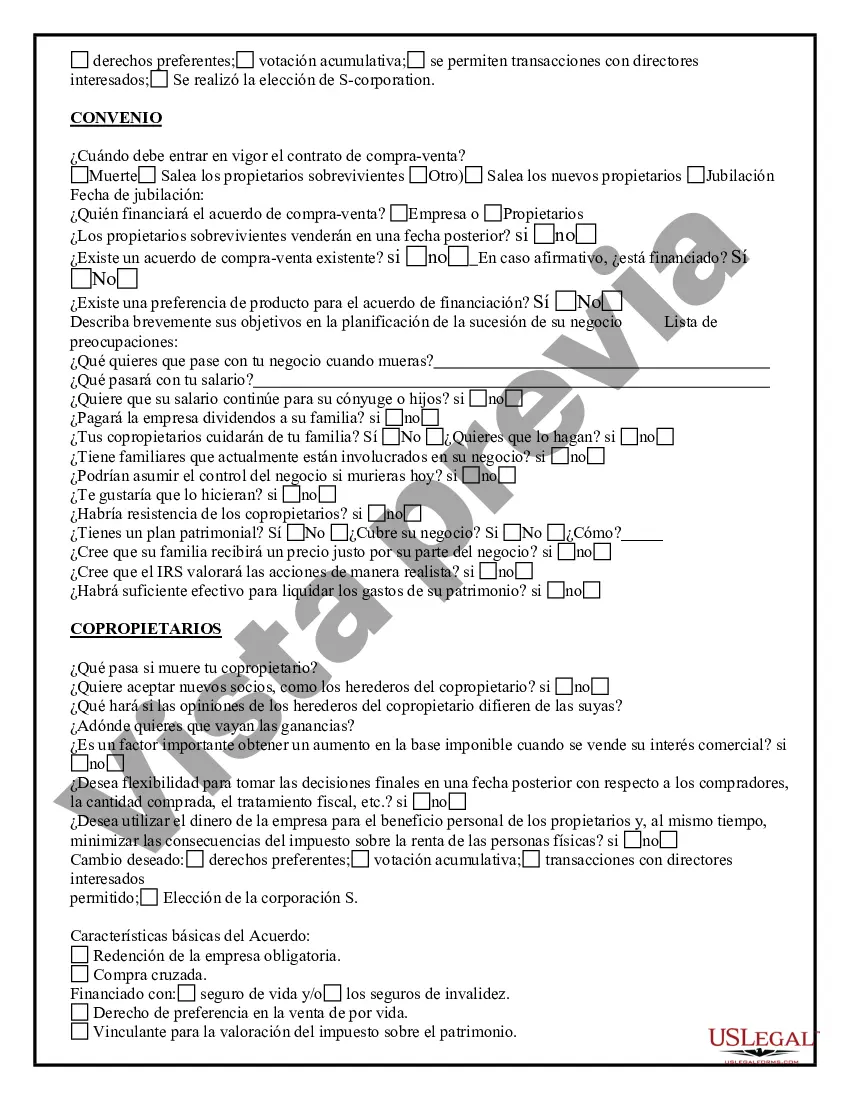

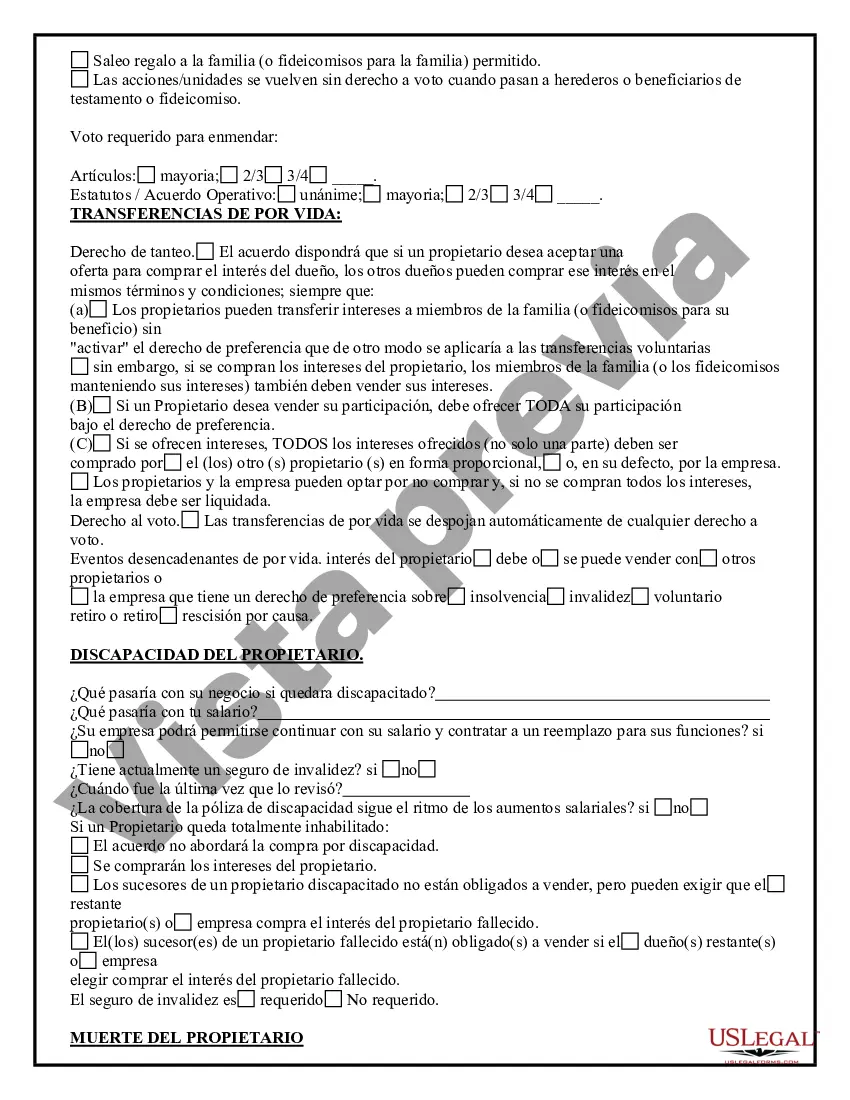

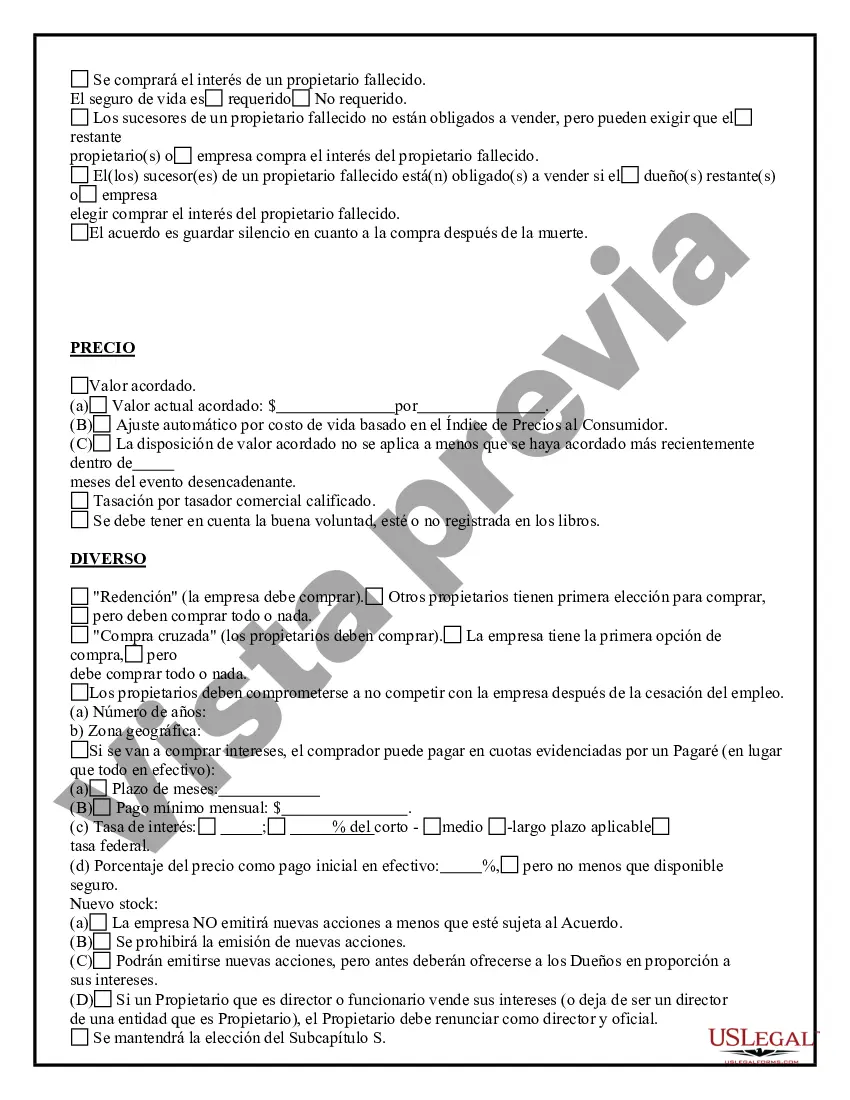

The Cook Illinois Buy Sell Agreement Questionnaire is a comprehensive document used in the state of Illinois for facilitating a smooth transfer of ownership in a business. This legal instrument is designed to outline the terms and conditions governing the buy-sell agreement, which is a contractual arrangement between the owners of a company to determine how shares will be bought or sold in the event of specific triggering events. The main purpose of the Cook Illinois Buy Sell Agreement Questionnaire is to address the orderly transfer of ownership interests in a business, minimize disputes, and ensure business continuity. It is typically utilized by business owners, shareholders, and stakeholders who want to establish clear guidelines for how ownership transitions will be handled in critical situations. This questionnaire covers various aspects essential to a buy-sell agreement, including the identification of shareholders, the definition of triggering events, valuation methods for determining the price of the shares being bought or sold, and the terms and conditions surrounding the purchase or sale. Key components of the Cook Illinois Buy Sell Agreement Questionnaire may include: 1. Shareholder Identification: This section requires detailed information about each shareholder, including their name, contact details, and the number of shares they hold. 2. Triggering Events: It is crucial to define triggering events that would activate the buy-sell agreement. Common triggering events include the death of a shareholder, retirement, disability, bankruptcy, divorce, or voluntary withdrawal from the business. 3. Valuation Methods: This part determines how the fair market value of the shares will be established. It may include options such as using a qualified appraiser, book value, or a predetermined formula agreed upon by the shareholders. 4. Purchase Terms: Here, the questionnaire outlines the terms of the buy-sell agreement, including the time frame for completing the transaction, payment methods (e.g., lump sum or installment payments), and any restrictions or obligations imposed on the buyer or seller. 5. Funding Mechanisms: This section addresses how the purchase price will be financed. It may involve life insurance policies, promissory notes, cash reserves, or external financing. 6. Dispute Resolution: In case of any disputes arising from the buy-sell agreement, this part outlines the preferred method of resolution, such as mediation or arbitration, to prevent unnecessary litigation. While the Cook Illinois Buy Sell Agreement Questionnaire is a standardized document, it may have variations or additional provisions tailored to specific business types or industries within Illinois. For instance, there could be separate versions for partnerships, limited liability companies (LCS), corporations, or family-owned businesses. These variations typically account for the specific requirements or characteristics of each business structure. In summary, the Cook Illinois Buy Sell Agreement Questionnaire is a crucial tool for business owners in Illinois looking to establish a clear and legally binding framework for the transfer of ownership interests. By addressing various aspects of a buy-sell agreement, it helps protect the interests of the stakeholders and ensures a smooth transition in case of predefined triggering events.The Cook Illinois Buy Sell Agreement Questionnaire is a comprehensive document used in the state of Illinois for facilitating a smooth transfer of ownership in a business. This legal instrument is designed to outline the terms and conditions governing the buy-sell agreement, which is a contractual arrangement between the owners of a company to determine how shares will be bought or sold in the event of specific triggering events. The main purpose of the Cook Illinois Buy Sell Agreement Questionnaire is to address the orderly transfer of ownership interests in a business, minimize disputes, and ensure business continuity. It is typically utilized by business owners, shareholders, and stakeholders who want to establish clear guidelines for how ownership transitions will be handled in critical situations. This questionnaire covers various aspects essential to a buy-sell agreement, including the identification of shareholders, the definition of triggering events, valuation methods for determining the price of the shares being bought or sold, and the terms and conditions surrounding the purchase or sale. Key components of the Cook Illinois Buy Sell Agreement Questionnaire may include: 1. Shareholder Identification: This section requires detailed information about each shareholder, including their name, contact details, and the number of shares they hold. 2. Triggering Events: It is crucial to define triggering events that would activate the buy-sell agreement. Common triggering events include the death of a shareholder, retirement, disability, bankruptcy, divorce, or voluntary withdrawal from the business. 3. Valuation Methods: This part determines how the fair market value of the shares will be established. It may include options such as using a qualified appraiser, book value, or a predetermined formula agreed upon by the shareholders. 4. Purchase Terms: Here, the questionnaire outlines the terms of the buy-sell agreement, including the time frame for completing the transaction, payment methods (e.g., lump sum or installment payments), and any restrictions or obligations imposed on the buyer or seller. 5. Funding Mechanisms: This section addresses how the purchase price will be financed. It may involve life insurance policies, promissory notes, cash reserves, or external financing. 6. Dispute Resolution: In case of any disputes arising from the buy-sell agreement, this part outlines the preferred method of resolution, such as mediation or arbitration, to prevent unnecessary litigation. While the Cook Illinois Buy Sell Agreement Questionnaire is a standardized document, it may have variations or additional provisions tailored to specific business types or industries within Illinois. For instance, there could be separate versions for partnerships, limited liability companies (LCS), corporations, or family-owned businesses. These variations typically account for the specific requirements or characteristics of each business structure. In summary, the Cook Illinois Buy Sell Agreement Questionnaire is a crucial tool for business owners in Illinois looking to establish a clear and legally binding framework for the transfer of ownership interests. By addressing various aspects of a buy-sell agreement, it helps protect the interests of the stakeholders and ensures a smooth transition in case of predefined triggering events.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.