This form addresses important considerations that may effect the legal rights and obligations of the parties in a buy-sell agreement. It is a tool to help assure the orderly transfer of interests in the partnership or corporation. This questionnaire enables those seeking legal help to effectively identify and prepare their issues and problems. Thorough advance preparation enhances the attorney’s case evaluation and can significantly reduce costs associated with case preparation.

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

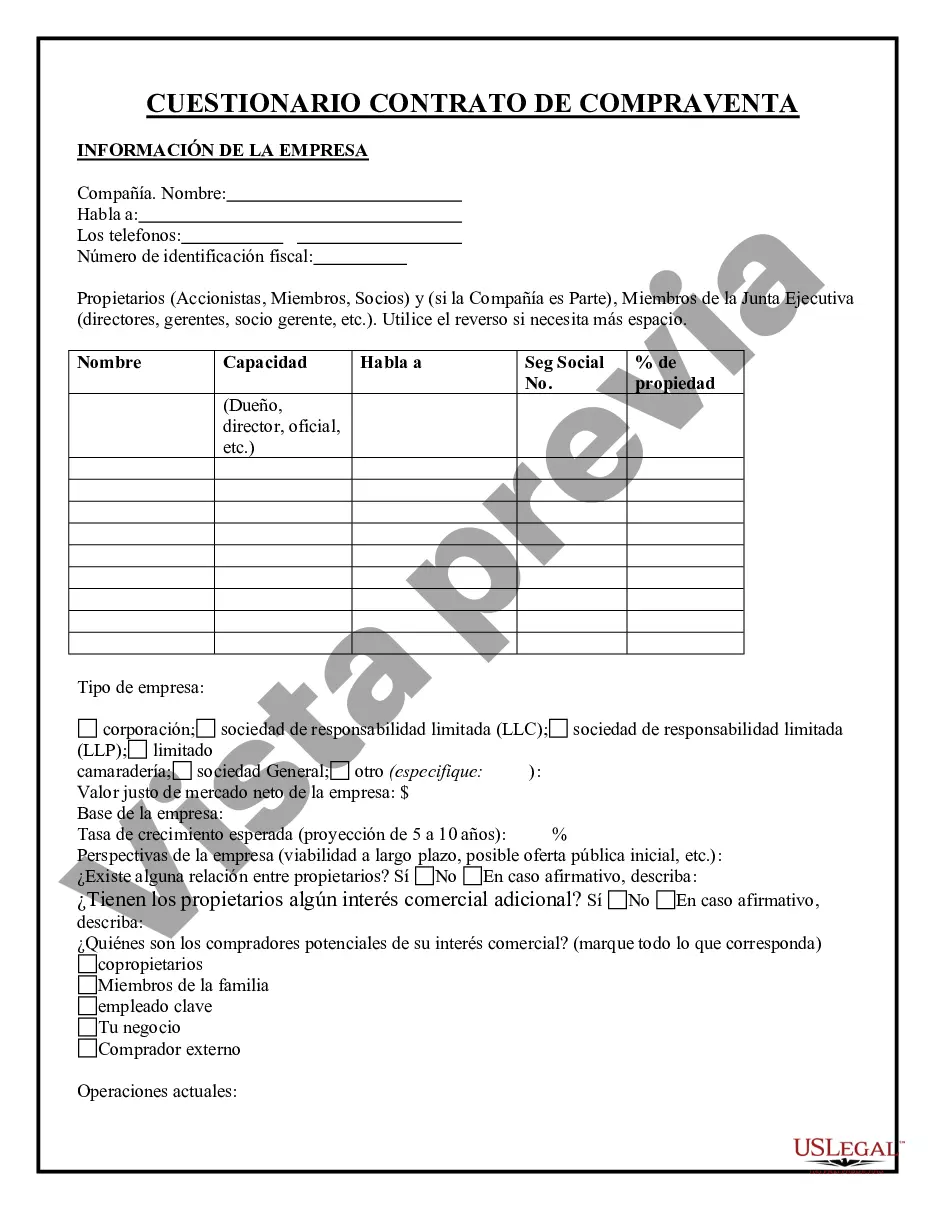

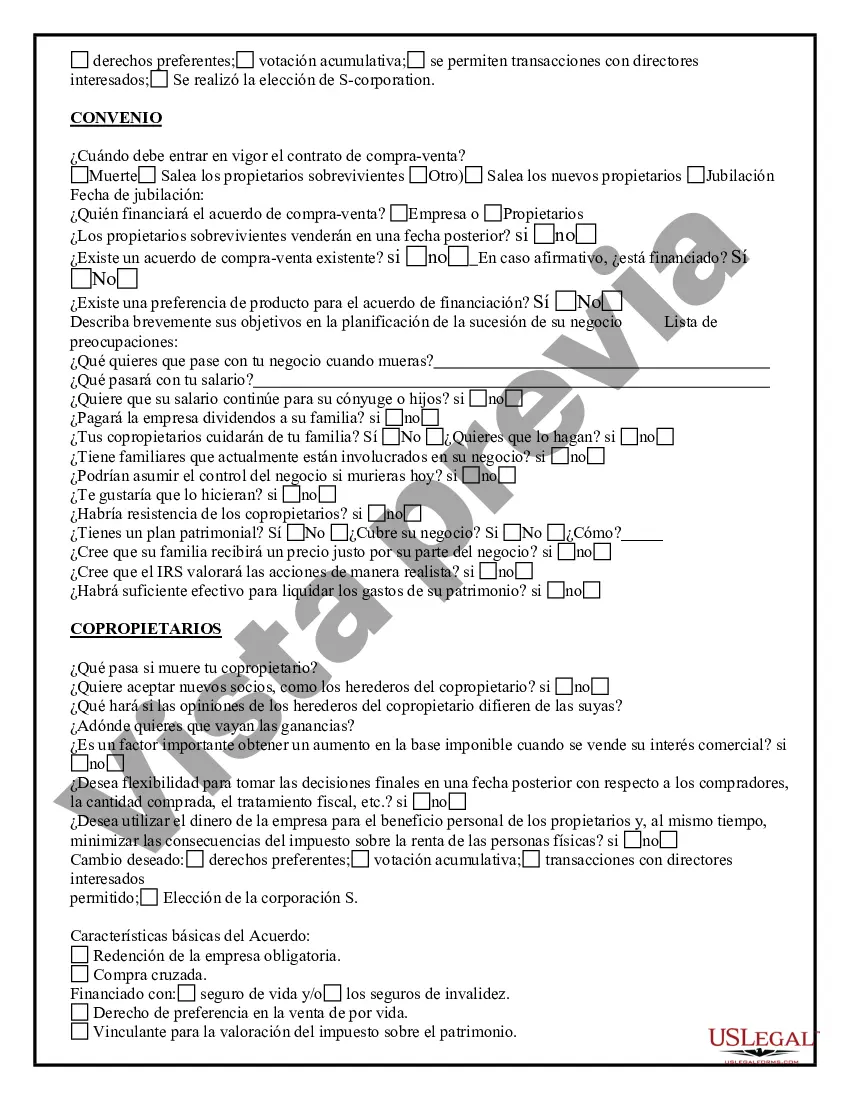

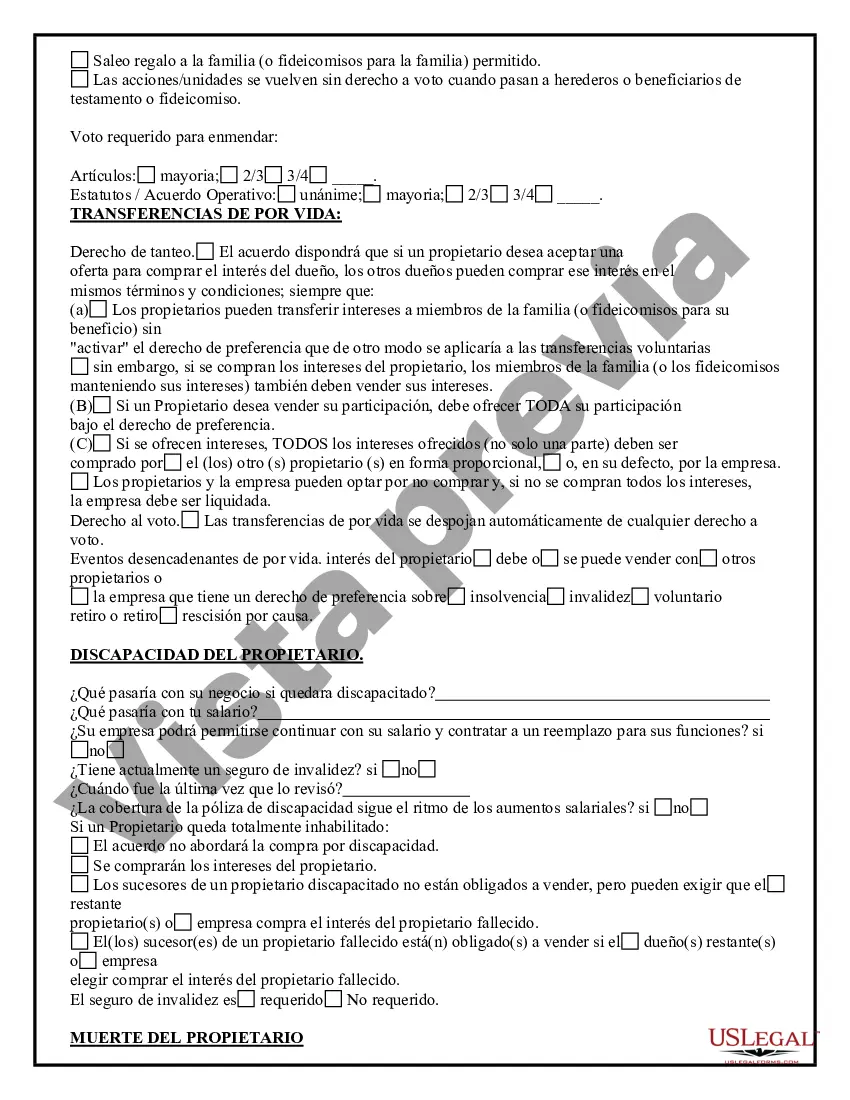

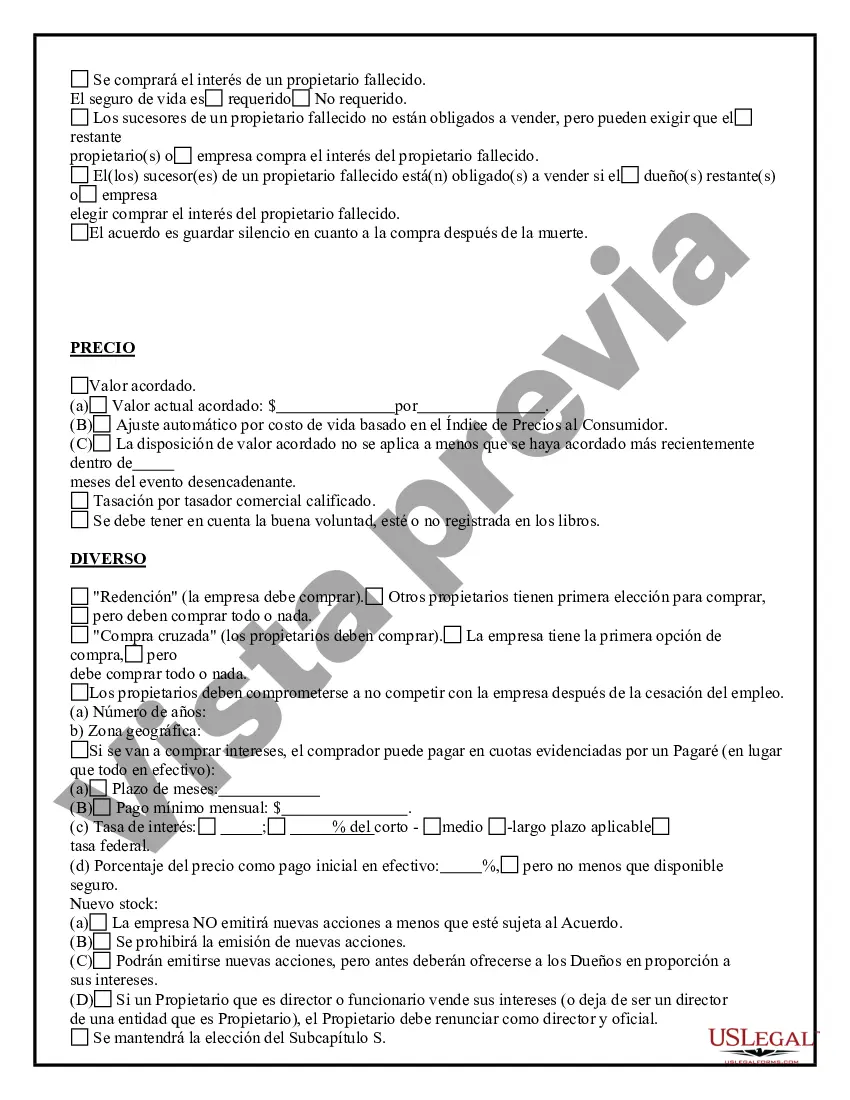

A Mecklenburg North Carolina Buy Sell Agreement Questionnaire is a comprehensive document used during the sale or transfer of a business in Mecklenburg County, North Carolina. This questionnaire serves as a tool to gather important information and assess various aspects of the business. It aids in identifying potential risks, clarifying ownership interests, and establishing a fair buying price. Key areas covered in a Mecklenburg North Carolina Buy Sell Agreement Questionnaire may include: 1. Business Identification: The questionnaire starts by collecting basic information about the business, such as its legal name, physical address, tax ID number, and the type of entity (e.g., corporation, partnership). 2. Business History: This section delves into the company's background, including its inception date, previous ownership changes, and any significant events or milestones. 3. Ownership Structure: Here, the questionnaire identifies the current owners, their ownership percentages, and the nature of their ownership interests (e.g., common stock, preferred stock). 4. Valuation Methodology: This part outlines the preferred approach for calculating the business's value. Common valuation methods may include market-based (comparable sales), income-based (discounted cash flow), or asset-based (book value) approaches. 5. Offer and Sale Terms: This section sets out the terms and conditions related to the sale of the business, such as the proposed purchase price, payment terms, financing options, and any contingencies that need to be met. 6. Financial Information: The questionnaire requests financial statements, tax returns, and other relevant documents to assess the company's financial health, profitability, and potential risks. 7. Intellectual Property: If applicable, this area focuses on protecting intangible assets, such as trademarks, patents, copyrights, and trade secrets. It discusses the transfer or licensing of these assets as part of the sale. 8. Contracts and Liabilities: The questionnaire includes a detailed examination of the business's contracts, leases, loans, and any pending lawsuits or regulatory compliance issues. This helps identify potential legal and financial obligations. 9. Due Diligence: An important component, this section covers requests for additional information or documents necessary for the buyer's due diligence process and protects both parties during the transaction. Types of Mecklenburg North Carolina Buy Sell Agreement Questionnaires may vary based on the specific needs of the business being sold, the industry it operates in, and the preferences of the parties involved. Different types may include: 1. Business Asset Sale Agreement Questionnaire: Specifically designed for transactions involving the sale of business assets, rather than the transfer of ownership in a company. 2. Stock Purchase Agreement Questionnaire: Tailored for transactions mainly involving the purchase or transfer of shares or stock in a corporation. 3. Merger or Acquisition Agreement Questionnaire: Primarily used when two companies merge or one acquires another. This type of questionnaire may include additional sections related to the merger or acquisition process. In summary, a Mecklenburg North Carolina Buy Sell Agreement Questionnaire is a vital tool used to gather crucial information and facilitate a smooth sale or transfer of a business within Mecklenburg County. Various types exist based on the nature of the transaction, ensuring that the questionnaire is tailored to meet the specific needs of the parties involved.A Mecklenburg North Carolina Buy Sell Agreement Questionnaire is a comprehensive document used during the sale or transfer of a business in Mecklenburg County, North Carolina. This questionnaire serves as a tool to gather important information and assess various aspects of the business. It aids in identifying potential risks, clarifying ownership interests, and establishing a fair buying price. Key areas covered in a Mecklenburg North Carolina Buy Sell Agreement Questionnaire may include: 1. Business Identification: The questionnaire starts by collecting basic information about the business, such as its legal name, physical address, tax ID number, and the type of entity (e.g., corporation, partnership). 2. Business History: This section delves into the company's background, including its inception date, previous ownership changes, and any significant events or milestones. 3. Ownership Structure: Here, the questionnaire identifies the current owners, their ownership percentages, and the nature of their ownership interests (e.g., common stock, preferred stock). 4. Valuation Methodology: This part outlines the preferred approach for calculating the business's value. Common valuation methods may include market-based (comparable sales), income-based (discounted cash flow), or asset-based (book value) approaches. 5. Offer and Sale Terms: This section sets out the terms and conditions related to the sale of the business, such as the proposed purchase price, payment terms, financing options, and any contingencies that need to be met. 6. Financial Information: The questionnaire requests financial statements, tax returns, and other relevant documents to assess the company's financial health, profitability, and potential risks. 7. Intellectual Property: If applicable, this area focuses on protecting intangible assets, such as trademarks, patents, copyrights, and trade secrets. It discusses the transfer or licensing of these assets as part of the sale. 8. Contracts and Liabilities: The questionnaire includes a detailed examination of the business's contracts, leases, loans, and any pending lawsuits or regulatory compliance issues. This helps identify potential legal and financial obligations. 9. Due Diligence: An important component, this section covers requests for additional information or documents necessary for the buyer's due diligence process and protects both parties during the transaction. Types of Mecklenburg North Carolina Buy Sell Agreement Questionnaires may vary based on the specific needs of the business being sold, the industry it operates in, and the preferences of the parties involved. Different types may include: 1. Business Asset Sale Agreement Questionnaire: Specifically designed for transactions involving the sale of business assets, rather than the transfer of ownership in a company. 2. Stock Purchase Agreement Questionnaire: Tailored for transactions mainly involving the purchase or transfer of shares or stock in a corporation. 3. Merger or Acquisition Agreement Questionnaire: Primarily used when two companies merge or one acquires another. This type of questionnaire may include additional sections related to the merger or acquisition process. In summary, a Mecklenburg North Carolina Buy Sell Agreement Questionnaire is a vital tool used to gather crucial information and facilitate a smooth sale or transfer of a business within Mecklenburg County. Various types exist based on the nature of the transaction, ensuring that the questionnaire is tailored to meet the specific needs of the parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.