This form addresses important considerations that may effect the legal rights and obligations of the parties during the process of incorporating a business. This questionnaire enables those seeking legal help to effectively identify and prepare their issues and problems. Thorough advance preparation enhances the attorney’s case evaluation and can significantly reduce costs associated with case preparation.

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

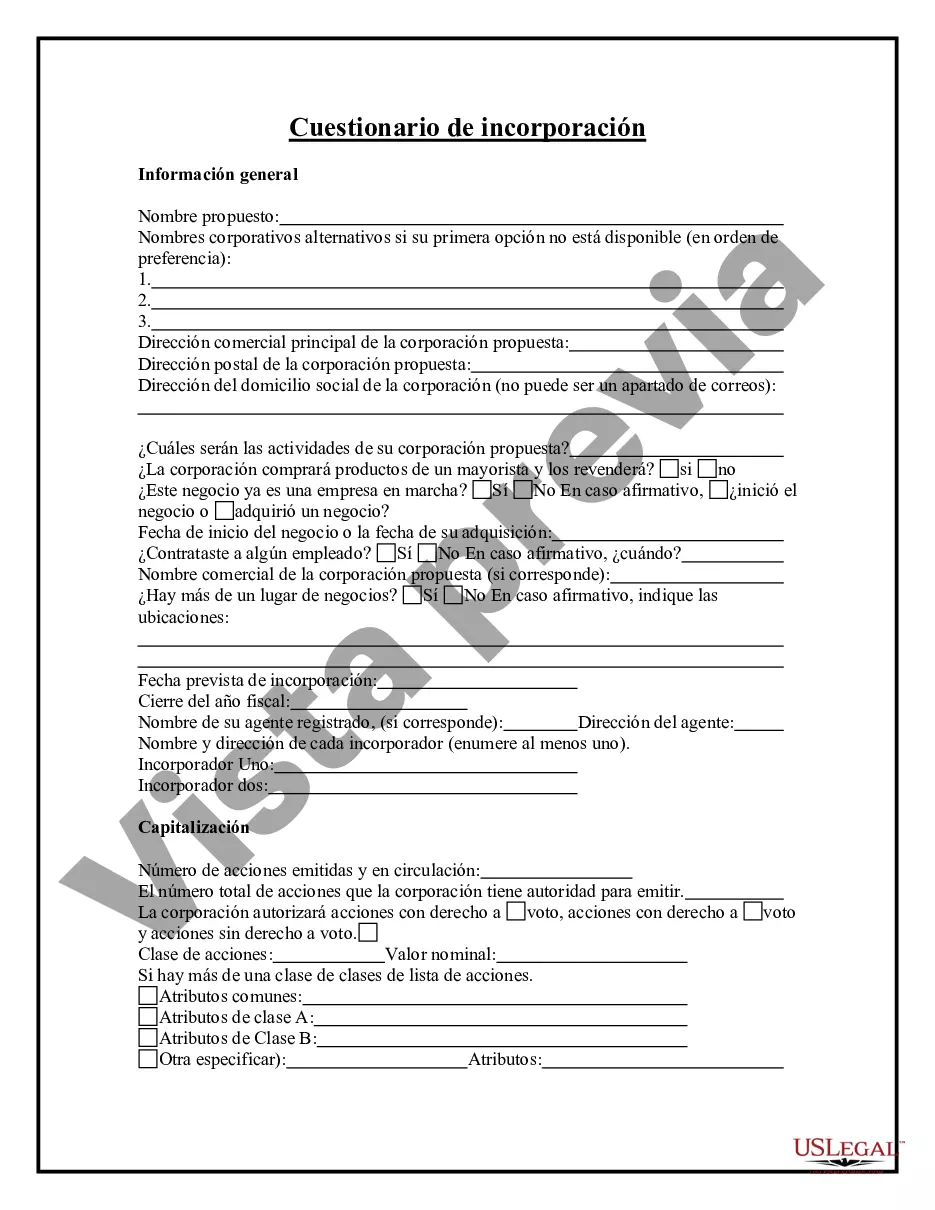

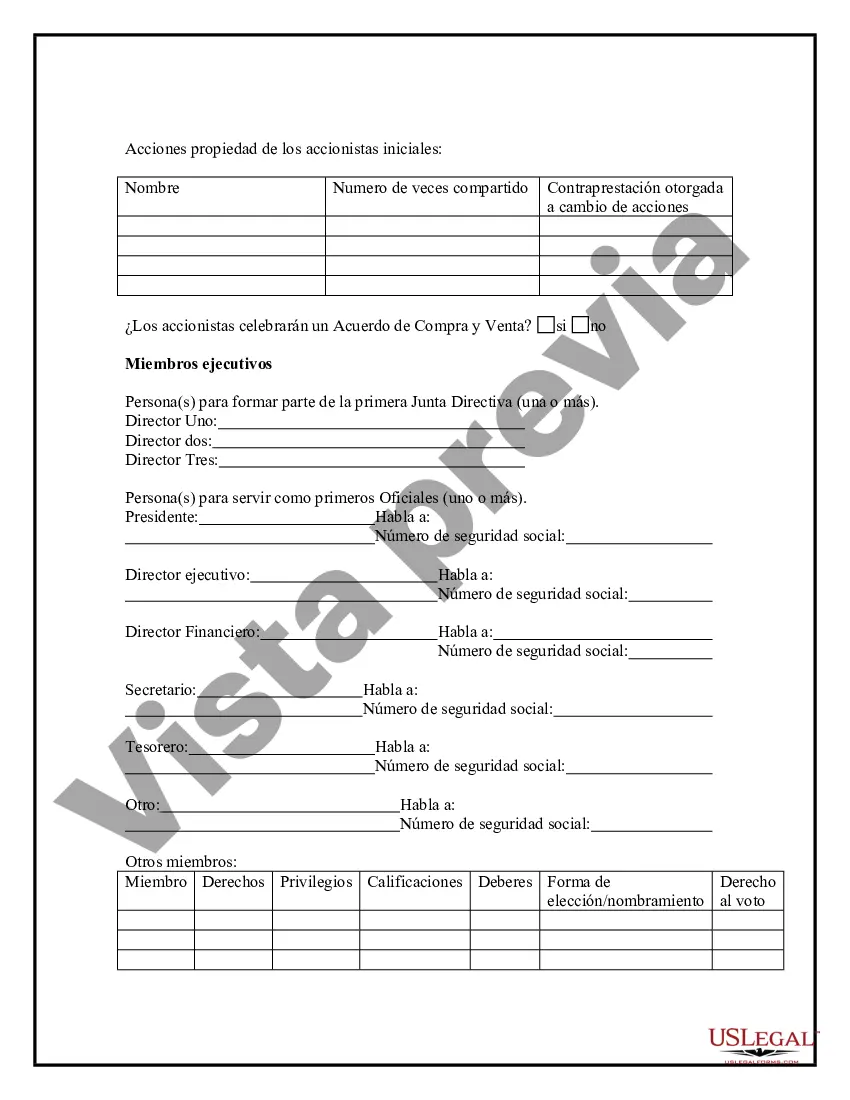

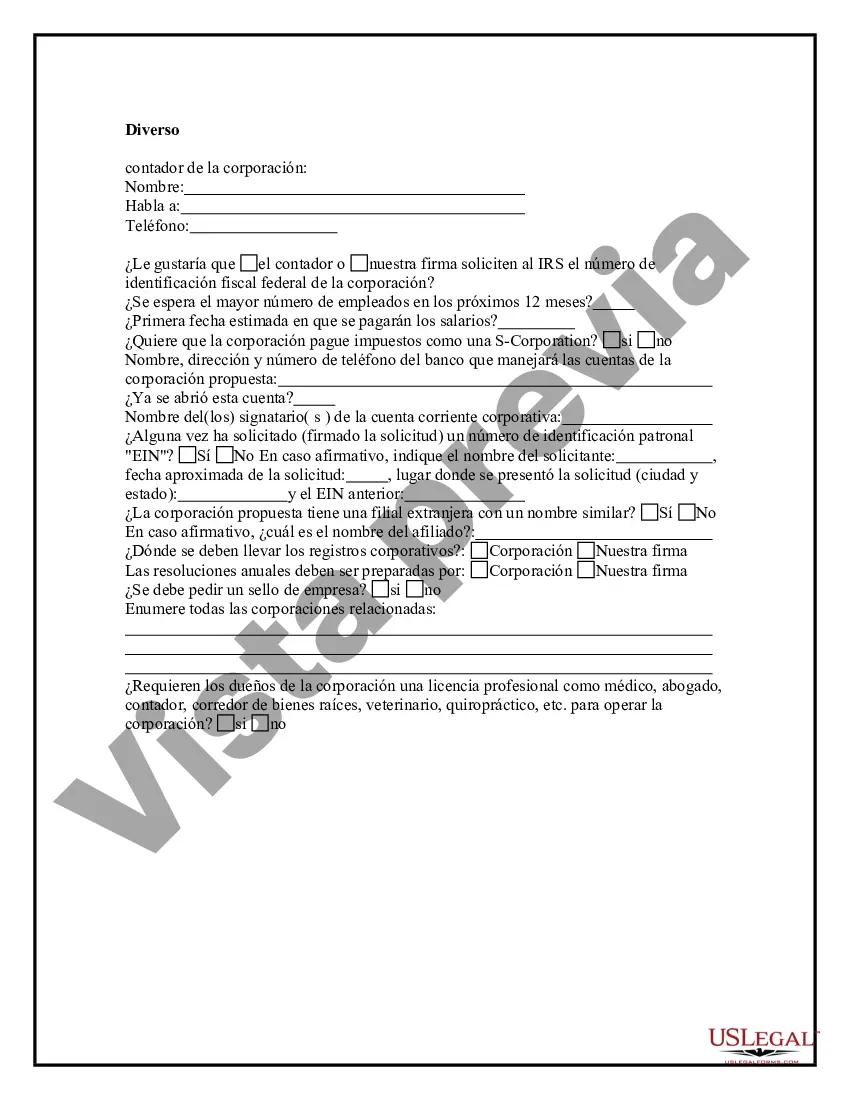

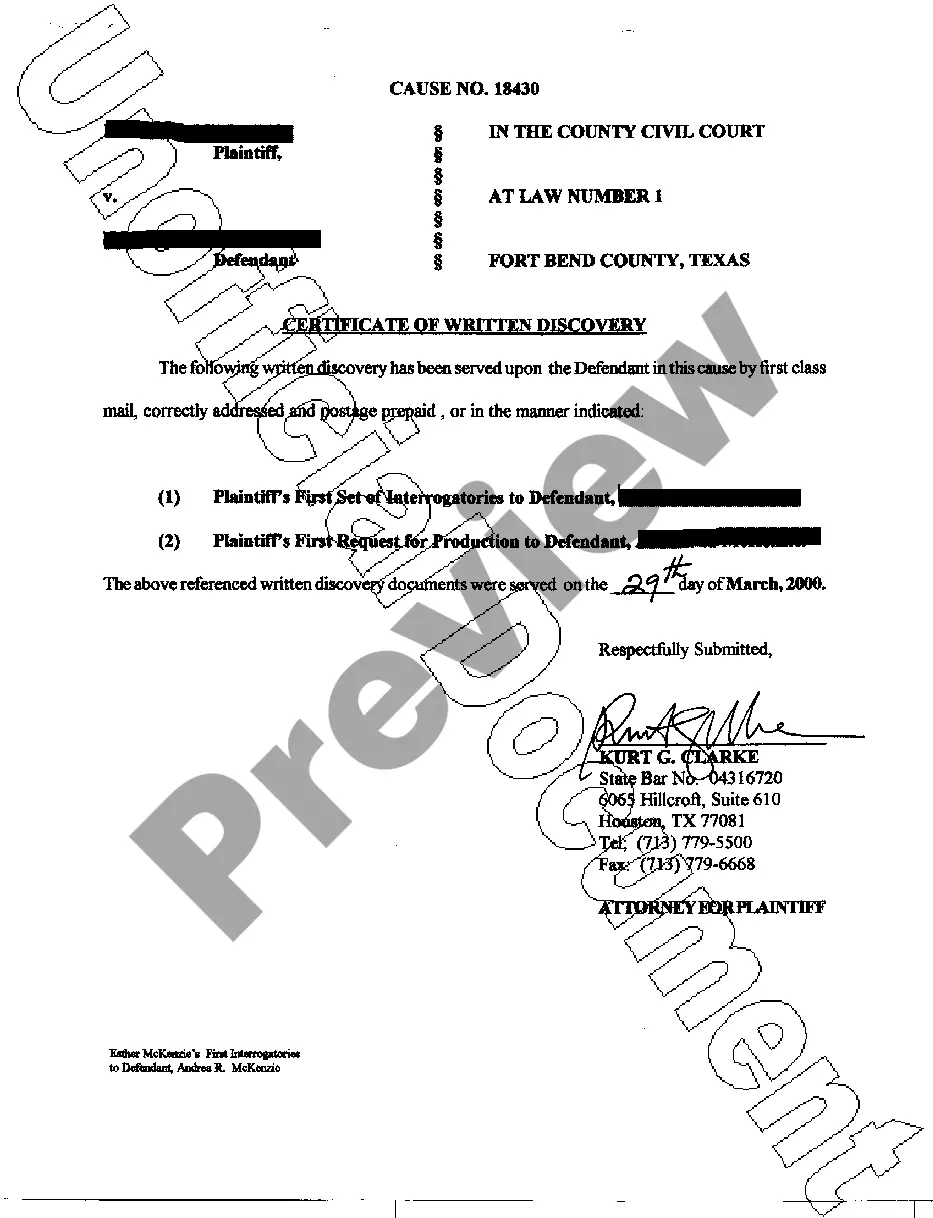

The Harris Texas Business Incorporation Questionnaire is a comprehensive document designed to gather essential information from individuals or business entities wishing to incorporate their company in Harris County, Texas. This questionnaire serves as an important tool for lawyers, accountants, or business consultants assisting clients in the incorporation process. By utilizing relevant keywords, here is a detailed description of the Harris Texas Business Incorporation Questionnaire and its potential types: 1. Purpose: The Harris Texas Business Incorporation Questionnaire enables professionals to gather detailed information regarding the business's structure, key operations, and legal considerations to ensure a smooth and compliant incorporation process. 2. Key Information: The questionnaire will request various details, including the proposed business name, intended activities, principal place of business, registered agent information, anticipated number of shareholders or members, purpose of the business, and desired entity type (such as corporation, limited liability company, partnership, etc.). 3. Personal Information: The questionnaire may require personal details of the individuals initiating the incorporation process, such as their names, contact information, social security numbers, and addresses. 4. Ownership Structure: Depending on the type of entity chosen, the questionnaire may inquire about the ownership structure, distribution of ownership shares, and the designation of officers and directors. 5. Financial Considerations: The Harris Texas Business Incorporation Questionnaire might include queries regarding initial capitalization, funding sources, banking preferences, tax obligations, and financial reporting. 6. Compliance and Licenses: To ensure compliance with local, state, and federal regulations, the questionnaire can include inquiries about required licenses, permits, and industry-specific regulations. 7. Employment and Taxation: If the incorporated business is planning to hire employees, the questionnaire may request information about employment policies, employee benefits, federal employer identification numbers (EIN), and applicable payroll taxes. 8. Intellectual Property: For businesses involved in intellectual property-intensive ventures, a type of questionnaire may focus on patents, trademarks, copyrights, and other relevant intellectual property concerns. Types of Harris Texas Business Incorporation Questionnaires: While there may not be different named types, variations of the questionnaire may exist catering to specific entity types, such as Corporation Incorporation Questionnaire, Limited Liability Company Incorporation Questionnaire, Partnership Incorporation Questionnaire, or Professional Corporation Incorporation Questionnaire. These variations streamline the process by tailoring questions to meet the unique requirements and regulations associated with different entity types. In conclusion, the Harris Texas Business Incorporation Questionnaire is a comprehensive tool that facilitates the seamless incorporation of businesses in Harris County, Texas. It collects pertinent information, ensuring compliance with legal and regulatory frameworks. By adapting to entity-specific needs, the questionnaire eases the process of business incorporation for a variety of organization types.The Harris Texas Business Incorporation Questionnaire is a comprehensive document designed to gather essential information from individuals or business entities wishing to incorporate their company in Harris County, Texas. This questionnaire serves as an important tool for lawyers, accountants, or business consultants assisting clients in the incorporation process. By utilizing relevant keywords, here is a detailed description of the Harris Texas Business Incorporation Questionnaire and its potential types: 1. Purpose: The Harris Texas Business Incorporation Questionnaire enables professionals to gather detailed information regarding the business's structure, key operations, and legal considerations to ensure a smooth and compliant incorporation process. 2. Key Information: The questionnaire will request various details, including the proposed business name, intended activities, principal place of business, registered agent information, anticipated number of shareholders or members, purpose of the business, and desired entity type (such as corporation, limited liability company, partnership, etc.). 3. Personal Information: The questionnaire may require personal details of the individuals initiating the incorporation process, such as their names, contact information, social security numbers, and addresses. 4. Ownership Structure: Depending on the type of entity chosen, the questionnaire may inquire about the ownership structure, distribution of ownership shares, and the designation of officers and directors. 5. Financial Considerations: The Harris Texas Business Incorporation Questionnaire might include queries regarding initial capitalization, funding sources, banking preferences, tax obligations, and financial reporting. 6. Compliance and Licenses: To ensure compliance with local, state, and federal regulations, the questionnaire can include inquiries about required licenses, permits, and industry-specific regulations. 7. Employment and Taxation: If the incorporated business is planning to hire employees, the questionnaire may request information about employment policies, employee benefits, federal employer identification numbers (EIN), and applicable payroll taxes. 8. Intellectual Property: For businesses involved in intellectual property-intensive ventures, a type of questionnaire may focus on patents, trademarks, copyrights, and other relevant intellectual property concerns. Types of Harris Texas Business Incorporation Questionnaires: While there may not be different named types, variations of the questionnaire may exist catering to specific entity types, such as Corporation Incorporation Questionnaire, Limited Liability Company Incorporation Questionnaire, Partnership Incorporation Questionnaire, or Professional Corporation Incorporation Questionnaire. These variations streamline the process by tailoring questions to meet the unique requirements and regulations associated with different entity types. In conclusion, the Harris Texas Business Incorporation Questionnaire is a comprehensive tool that facilitates the seamless incorporation of businesses in Harris County, Texas. It collects pertinent information, ensuring compliance with legal and regulatory frameworks. By adapting to entity-specific needs, the questionnaire eases the process of business incorporation for a variety of organization types.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.