This form addresses important considerations that may effect the legal rights and obligations of the parties in a lot or land sale matter. This questionnaire enables those seeking legal help to effectively identify and prepare their issues and problems. Thorough advance preparation enhances the attorney’s case evaluation and can significantly reduce costs associated with case preparation.

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

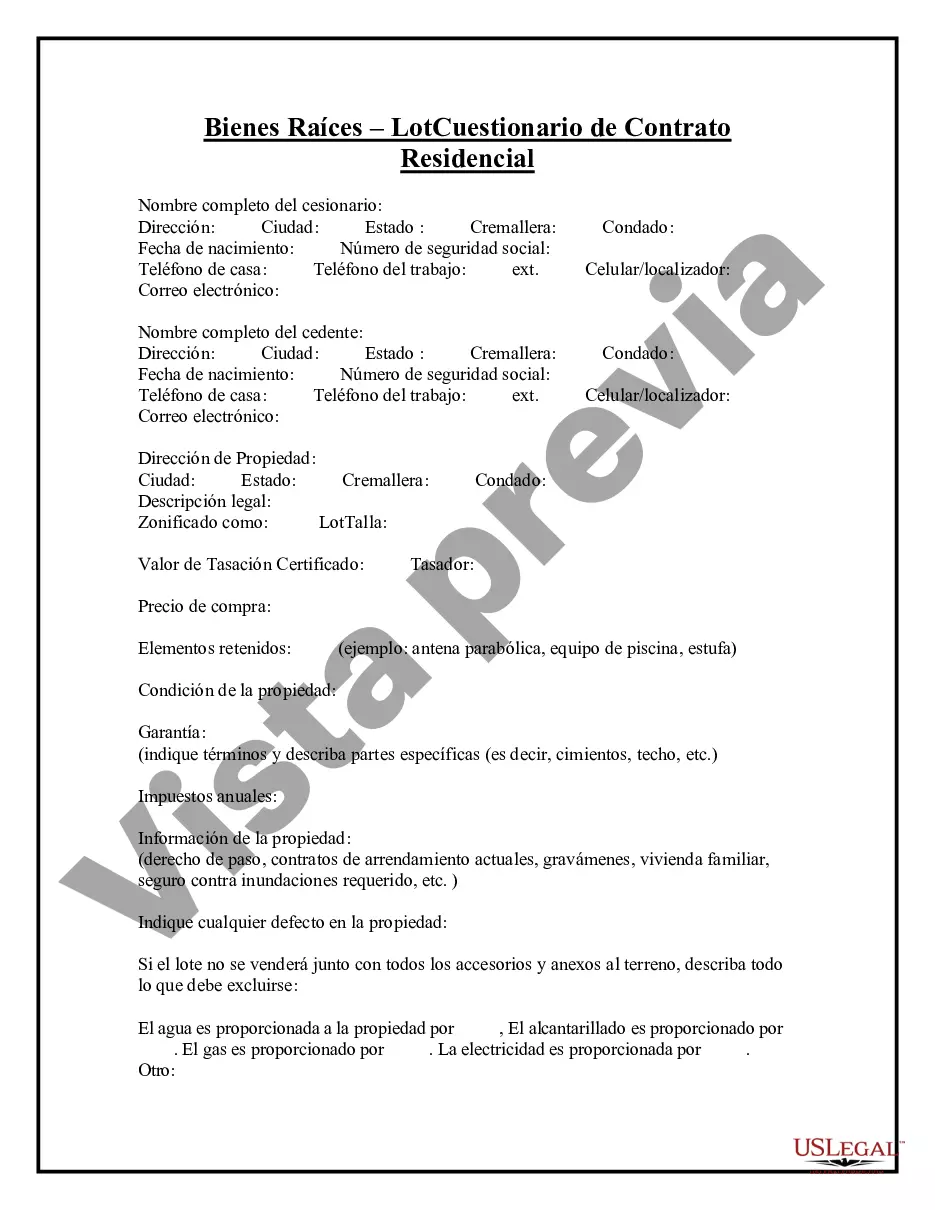

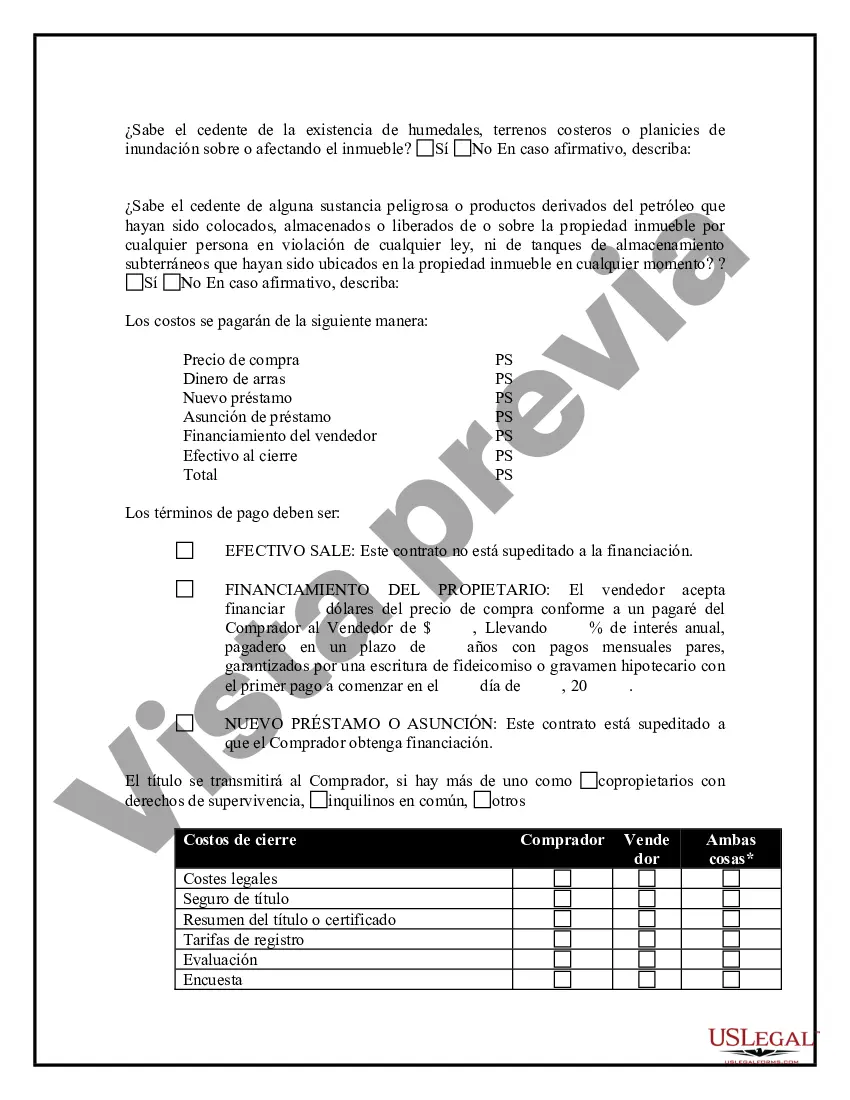

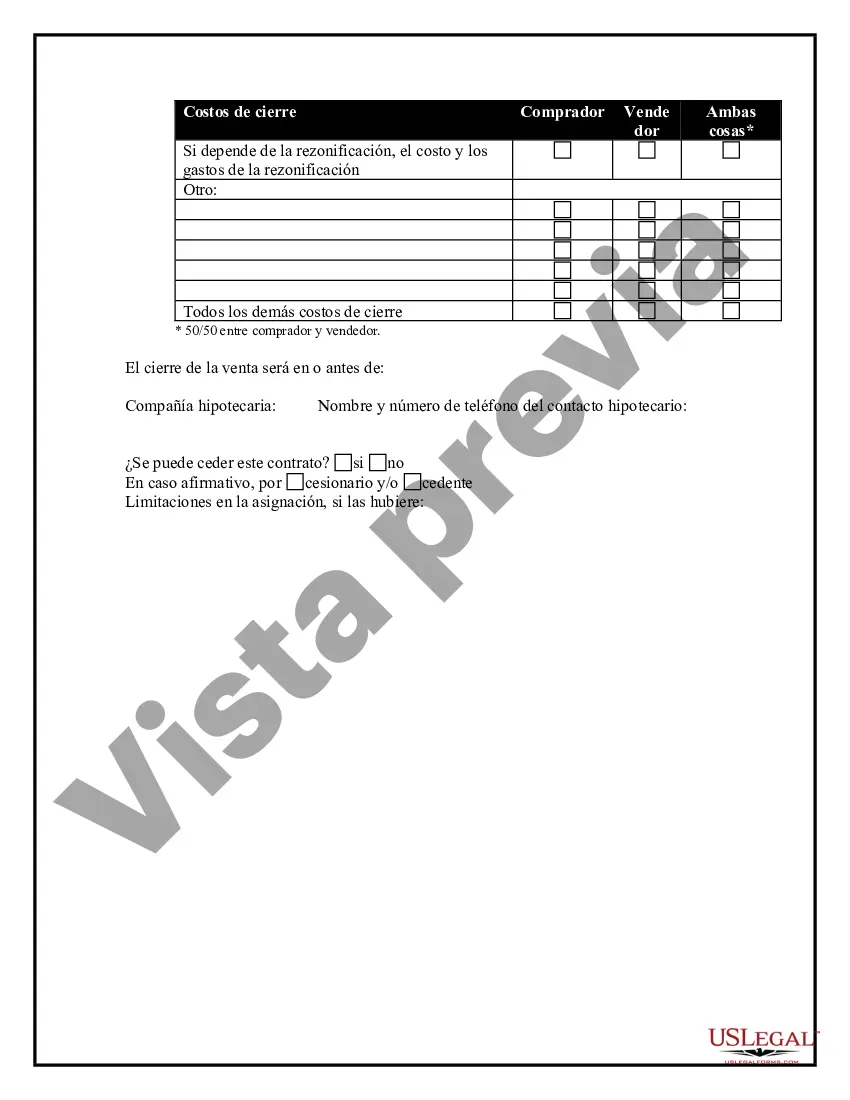

The Salt Lake Utah Purchase or Sale of Real Property — Land or Lo— - Questionnaire serves as a comprehensive tool to gather essential information related to buying or selling land or lots in Salt Lake, Utah. It aims to ensure all relevant details are provided, enabling smooth transactions and legal compliance. Here is a breakdown of the questionnaire and its key sections: 1. Property Details: — Location: Provide the exact address, legal description, and any landmarks or nearby amenities. — Lot Size: Specify the size of the land or lot in square feet or acres. — Zoning: Determine the property's current zoning classification and any specific regulations or restrictions to consider. — Environmental Factors: Identify if there are any environmental concerns or regulatory requirements related to the property. 2. Ownership and Titles: — Current Owner Details: Gather information about the current owner, including name, contact information, and any co-owners or beneficiaries. — Title Search: Indicate if a title search has been conducted and if there are any known encumbrances, liens, or disputes associated with the property. 3. Purchase/Sale Agreement: — Purchase Price: Enter the agreed-upon purchase price, currency, and the payment method or terms. — Financing: Specify whether the purchase involves financing and provide details if applicable. — Earnest Money: Determine the amount of earnest money, its deposit date, and its handling (e.g., held by the seller's agent or in escrow). — Closing Date: Establish the expected closing date for the transaction. — Contingencies: Identify any contingencies in the agreement, such as appraisal, inspection, or financing contingencies. 4. Due Diligence: — Surveys and Inspections: Determine if any surveys, soil tests, or other inspections are required or recommended before closing the deal. — Utilities and Infrastructure: Gather information regarding the availability of utilities (water, electricity, gas, etc.) and existing infrastructure (roads, drainage, etc.). — Easements and Right-of-Ways: Identify any easements or right-of-ways that may impact the property. 5. Additional Provisions: — Special Clauses: Allow for any special clauses or conditions specific to the transaction to be communicated, such as seller financing or leaseback options. — Disclosures: Specify any legal disclosures required by local or state laws, such as lead-based paint, radon, or other hazardous material disclosures. — Tax and Assessment Information: Provide information on property taxes, assessments, and current tax status. — Homeowner's Association (HOA): If applicable, disclose relevant HOA information, including fees, rules, and restrictions. Variations of the Salt Lake Utah Purchase or Sale of Real Property — Land or Lo— - Questionnaire may include modified sections or additional questions based on the specific needs or requirements of individual real estate agents or agencies.The Salt Lake Utah Purchase or Sale of Real Property — Land or Lo— - Questionnaire serves as a comprehensive tool to gather essential information related to buying or selling land or lots in Salt Lake, Utah. It aims to ensure all relevant details are provided, enabling smooth transactions and legal compliance. Here is a breakdown of the questionnaire and its key sections: 1. Property Details: — Location: Provide the exact address, legal description, and any landmarks or nearby amenities. — Lot Size: Specify the size of the land or lot in square feet or acres. — Zoning: Determine the property's current zoning classification and any specific regulations or restrictions to consider. — Environmental Factors: Identify if there are any environmental concerns or regulatory requirements related to the property. 2. Ownership and Titles: — Current Owner Details: Gather information about the current owner, including name, contact information, and any co-owners or beneficiaries. — Title Search: Indicate if a title search has been conducted and if there are any known encumbrances, liens, or disputes associated with the property. 3. Purchase/Sale Agreement: — Purchase Price: Enter the agreed-upon purchase price, currency, and the payment method or terms. — Financing: Specify whether the purchase involves financing and provide details if applicable. — Earnest Money: Determine the amount of earnest money, its deposit date, and its handling (e.g., held by the seller's agent or in escrow). — Closing Date: Establish the expected closing date for the transaction. — Contingencies: Identify any contingencies in the agreement, such as appraisal, inspection, or financing contingencies. 4. Due Diligence: — Surveys and Inspections: Determine if any surveys, soil tests, or other inspections are required or recommended before closing the deal. — Utilities and Infrastructure: Gather information regarding the availability of utilities (water, electricity, gas, etc.) and existing infrastructure (roads, drainage, etc.). — Easements and Right-of-Ways: Identify any easements or right-of-ways that may impact the property. 5. Additional Provisions: — Special Clauses: Allow for any special clauses or conditions specific to the transaction to be communicated, such as seller financing or leaseback options. — Disclosures: Specify any legal disclosures required by local or state laws, such as lead-based paint, radon, or other hazardous material disclosures. — Tax and Assessment Information: Provide information on property taxes, assessments, and current tax status. — Homeowner's Association (HOA): If applicable, disclose relevant HOA information, including fees, rules, and restrictions. Variations of the Salt Lake Utah Purchase or Sale of Real Property — Land or Lo— - Questionnaire may include modified sections or additional questions based on the specific needs or requirements of individual real estate agents or agencies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.