Nassau New York Officers and Directors Questionnaire

Description

How to fill out Officers And Directors Questionnaire?

Managing legal documents is essential in the contemporary era. However, it's not always necessary to seek expert assistance to generate some of them from scratch, such as the Nassau Officers and Directors Questionnaire, using a platform like US Legal Forms.

US Legal Forms offers over 85,000 documents to choose from across various types, including living wills, real estate contracts, and divorce papers. All documents are categorized by their respective state, simplifying the search process.

You can also access comprehensive resources and guides on the website to facilitate any tasks related to document completion.

If you are already a subscriber of US Legal Forms, you can find the required Nassau Officers and Directors Questionnaire, Log In to your account, and download it. It’s important to note that our website cannot completely replace a lawyer. If you encounter a particularly complex situation, we advise utilizing an attorney’s services to examine your document before signing and filing it.

With over 25 years in the industry, US Legal Forms has become a preferred source for a range of legal forms for millions of users. Join them today and acquire your state-compliant documents with ease!

- Review the document's preview and description (if available) to acquire an overview of what you’ll receive after purchasing the document.

- Confirm that the document you select pertains to your state/county/region, as state laws can influence the legality of certain records.

- Examine related document templates or restart the search to locate the appropriate document.

- Click Buy now and create your account. If you already have one, opt to Log In.

- Choose the option and a preferred payment method, then purchase the Nassau Officers and Directors Questionnaire.

- Opt to save the form template in any supported file format.

- Navigate to the My documents section to re-download the document.

Form popularity

FAQ

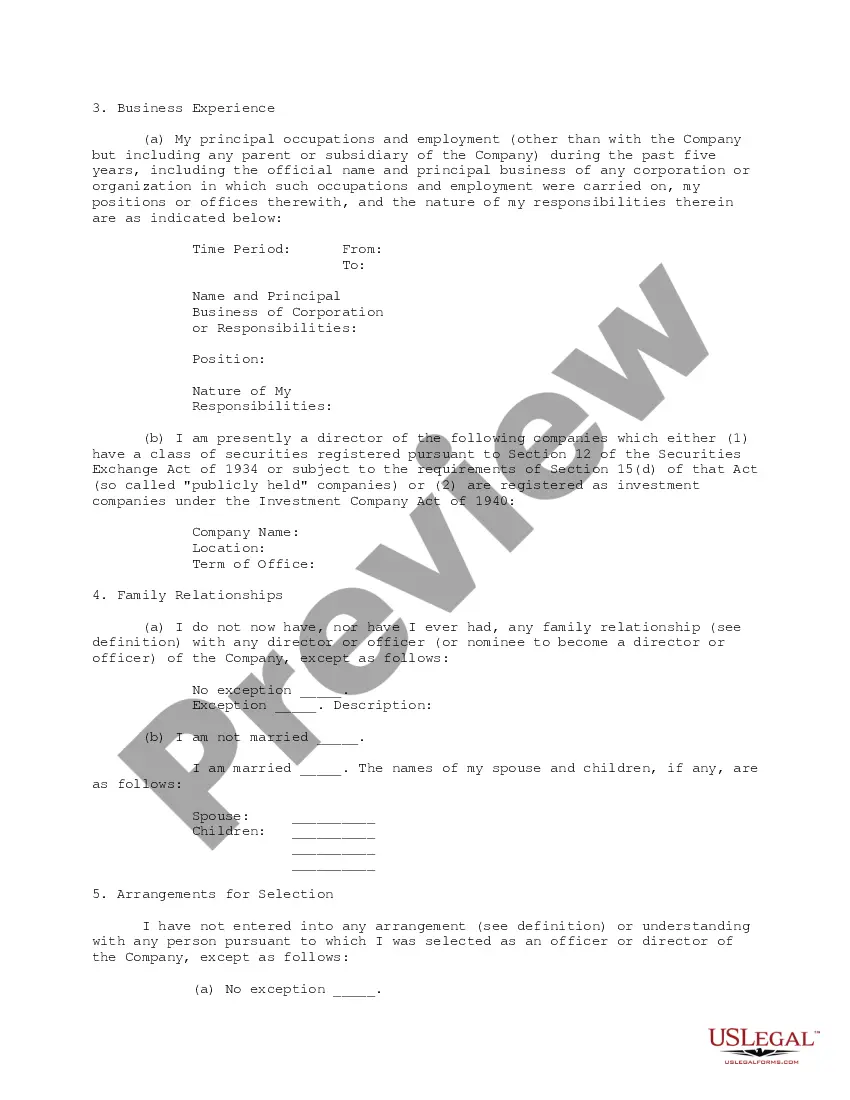

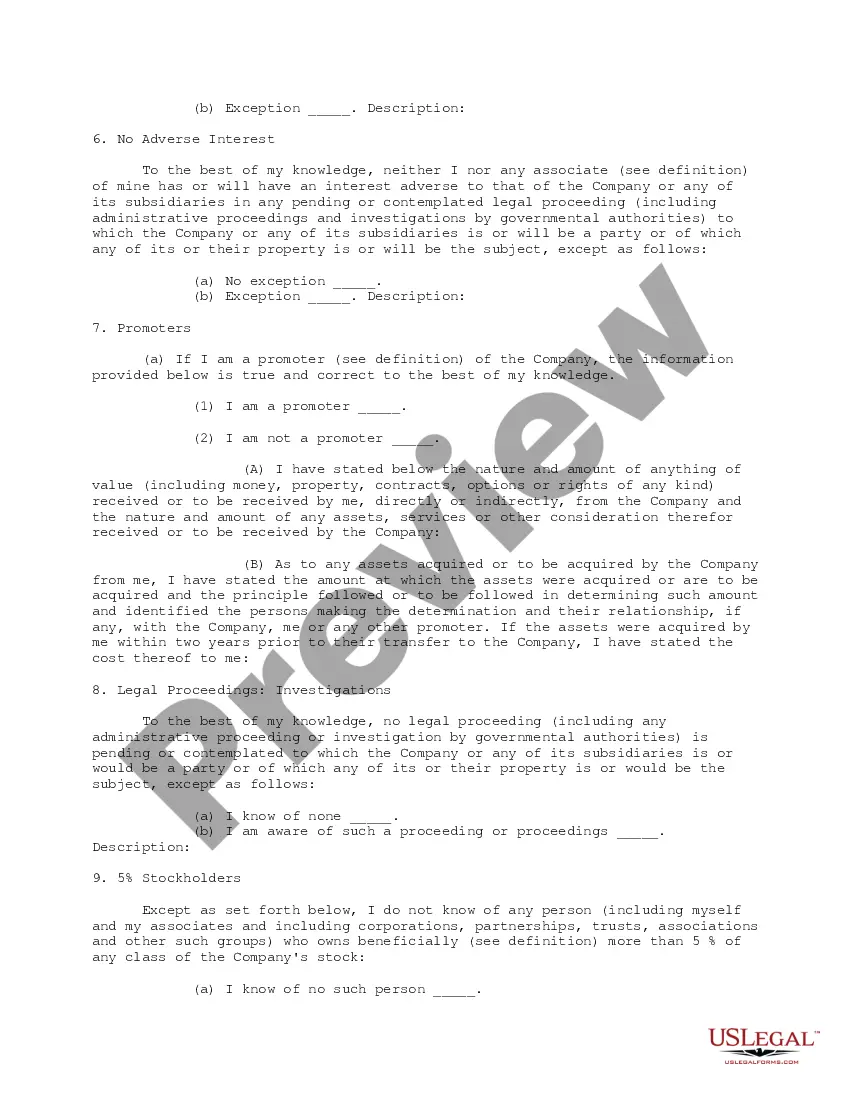

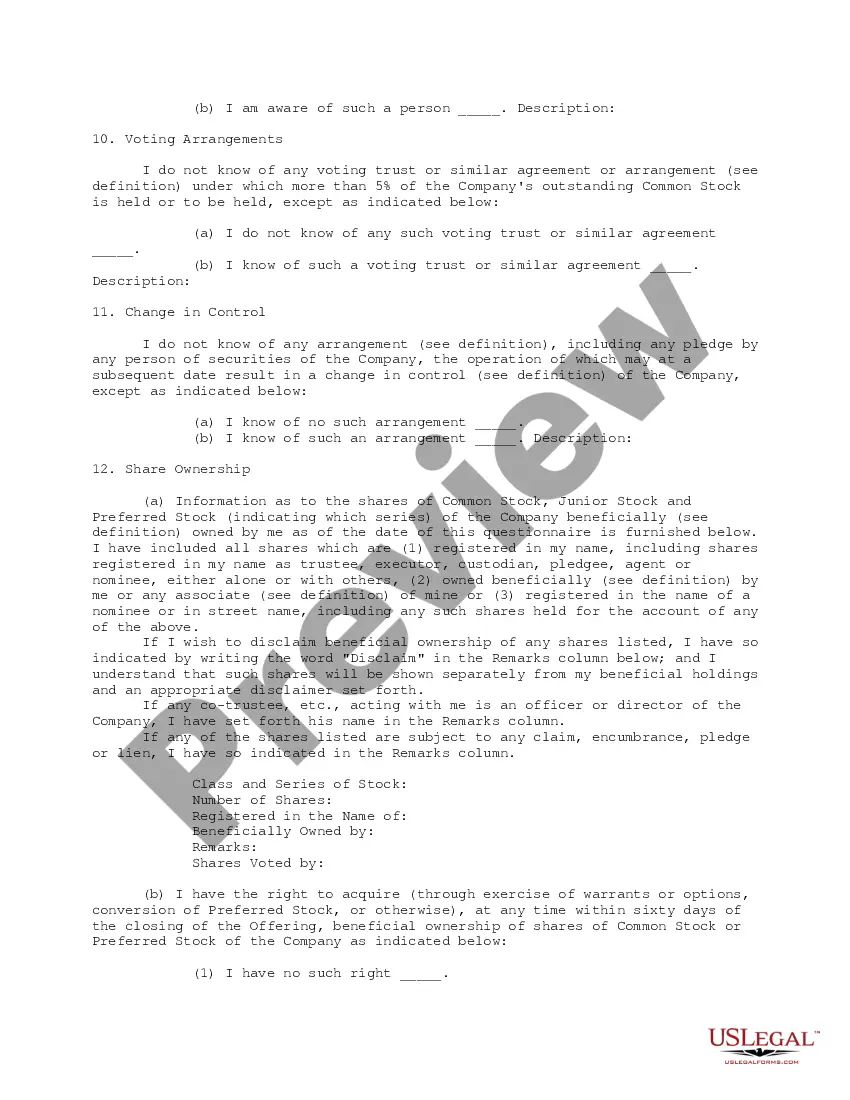

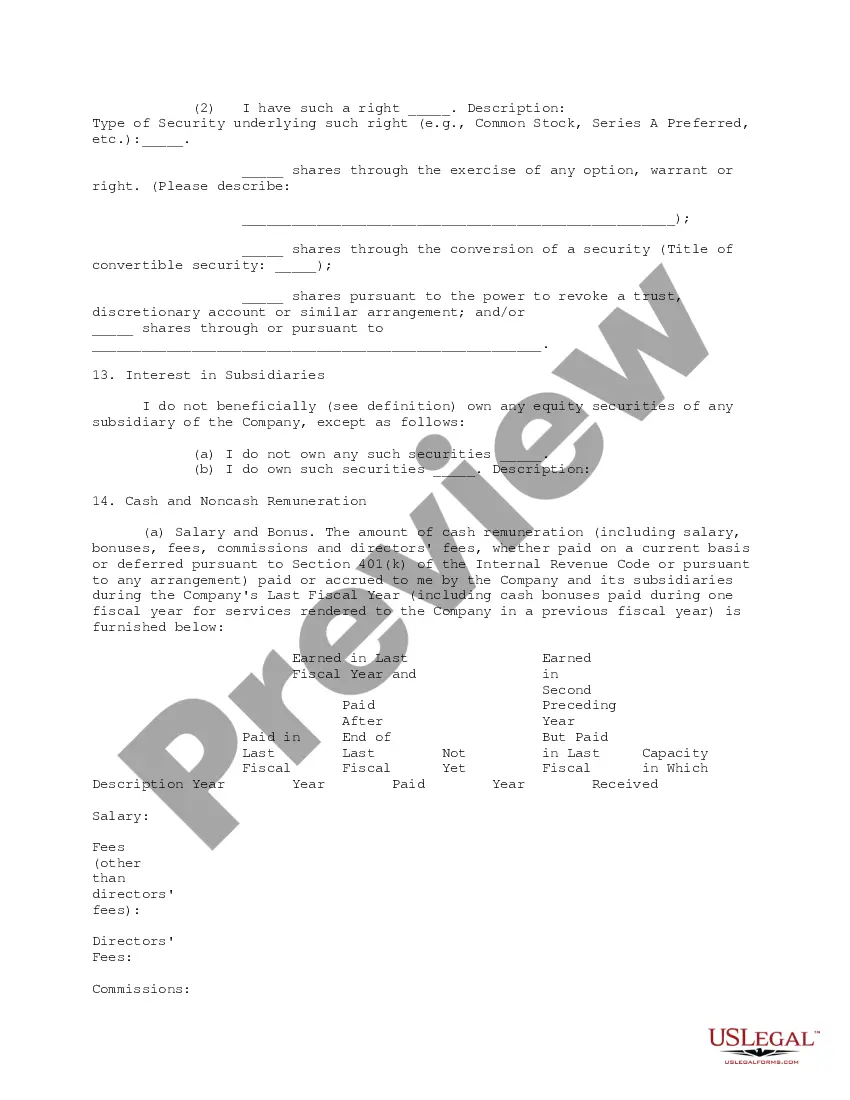

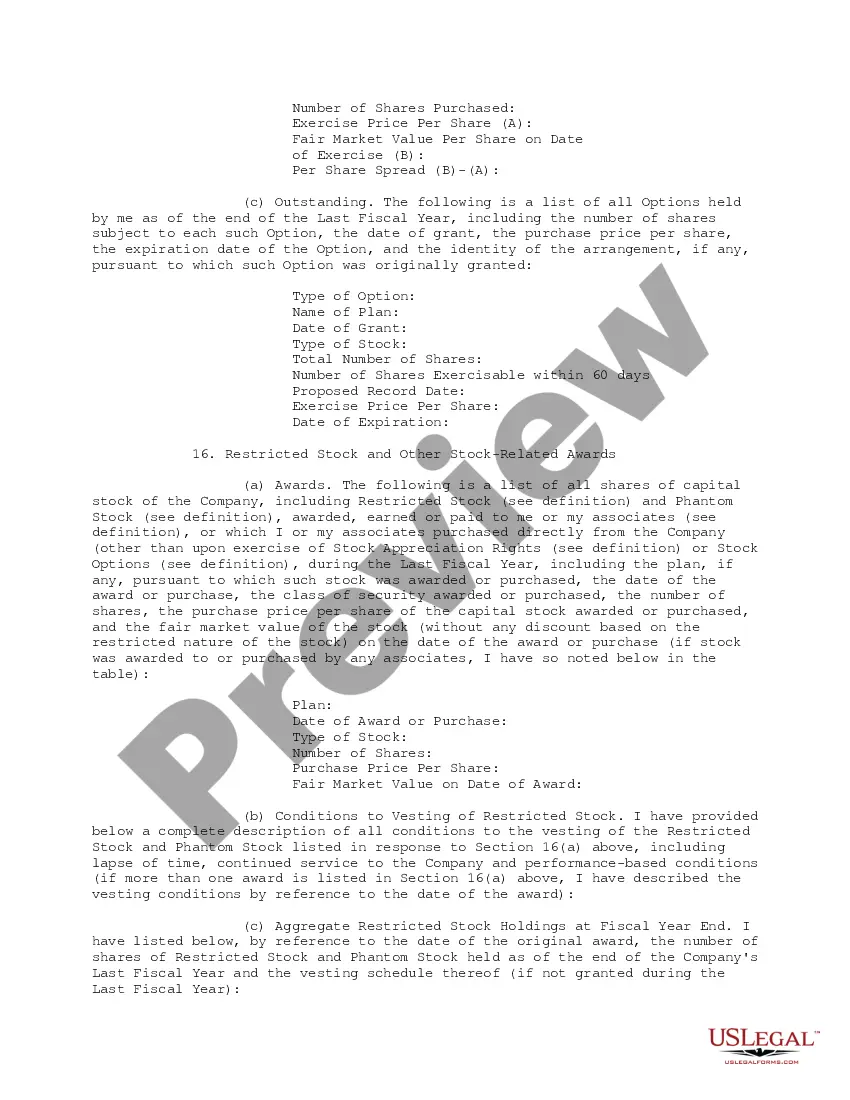

Also known as a D&O questionnaire. A questionnaire distributed by the company to its directors and officers during an initial public offering or during preparation of a registration statement on Form S-1 or the company's Form 10-K and proxy statement.

Also known as a D&O questionnaire. A questionnaire distributed by the company to its directors and officers during an initial public offering or during preparation of a registration statement on Form S-1 or the company's Form 10-K and proxy statement.

Customized Experience. D&O questionnaires can be customized for each director and officer. The platform hides irrelevant questions, so directors and officers only see questions relevant to their roles, priorities, and responsibilities.

Also known as a D&O questionnaire. A questionnaire distributed by the company to its directors and officers during an initial public offering or during preparation of a registration statement on Form S-1 or the company's Form 10-K and proxy statement.

Public companies, and companies that plan to register as public companies, are required to submit Form S-1, a registration statement required under the federal Securities Act of 1933.

Prepare your information Double check you've included all your transactions. Make sure they're all business expenses. Ensure your sales and expenses are for the same dates as your BAS reporting period. If you're using accounting software, make sure you've coded items correctly.

According to the ATO, you must lodge your activity statements and pay all your PAYG instalments before lodging your tax return to ensure that the instalments are taken into account in your tax assessment.

You need to lodge TFN declarations with us within 14 days after the form is either signed by the payee or completed by you (if not provided by the payee).

Persons to whom Division applies (1) For the purposes of this Division, a person is a prescribed person in relation to a year of income if: (a) the person is less than 18 years of age on the last day of the year of income; and. (b) the person is not an excepted person in relation to the year of income.