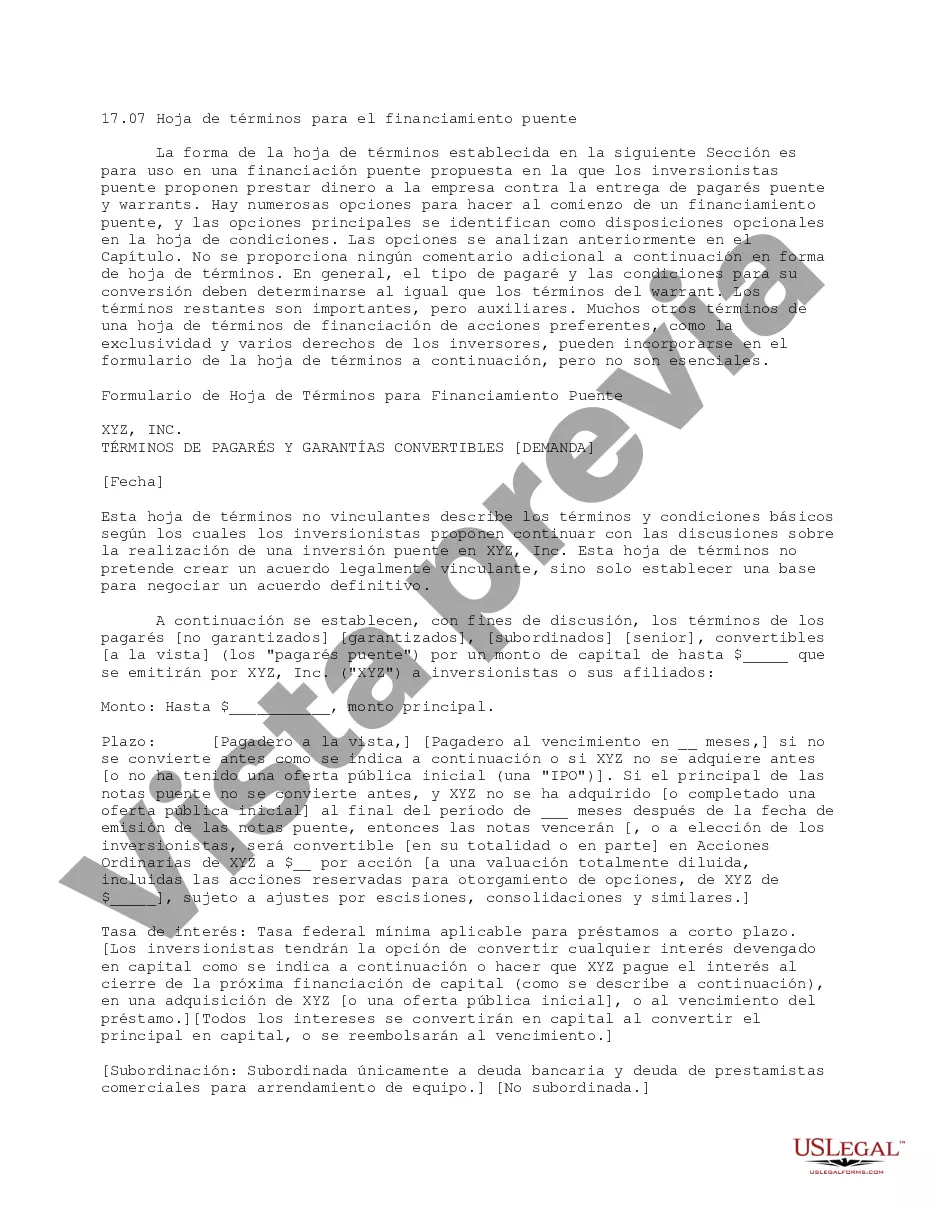

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

Allegheny Pennsylvania Term Sheet for Bridge Financing is a legal document that outlines the terms and conditions of a short-term loan provided to bridge the gap between the current financial need of a borrower and the finalization of a long-term financing solution. This term sheet serves as a blueprint for the agreement between the borrower and the lender, ensuring a clear understanding of the expectations, obligations, and repayment terms involved in the loan. Bridge financing options in Allegheny Pennsylvania generally include: 1. Residential Bridge Loans: These loans are designed to help homeowners who are looking to purchase a new home before selling their current one. It provides short-term funding, allowing homeowners to make a down payment on a new property while waiting for their old home to sell. 2. Commercial Bridge Loans: Commercial real estate developers or investors often utilize these loans to finance the acquisition or renovation of a property. Commercial bridge loans can help bridge funding gaps during the process of securing more permanent financing or when waiting for the completion of a sale or lease. 3. Construction Bridge Loans: Builders or developers seeking to initiate or continue construction projects can benefit from construction bridge financing. These loans assist in covering immediate costs like labor, materials, and other expenses before long-term funding is secured. Allegheny Pennsylvania Term Sheet for Bridge Financing typically covers the following key aspects: 1. Loan amount: Specifies the total amount of financing provided by the lender and outlines whether it covers the full purchase price or a percentage of it. 2. Interest rates and fees: Outlines the interest rate on the loan and any associated fees, such as origination fees or prepayment penalties. 3. Loan term: Defines the duration of the loan, which is typically short-term, usually ranging from a few months to a year. 4. Repayment terms: Describes how the loan will be repaid, including whether it will be paid in a lump sum at the end of the term or through monthly installments. 5. Loan security: Indicates the collateral or assets that secure the loan, such as the property being purchased or other valuable assets. 6. Conditions and covenants: Specifies any conditions or requirements that the borrower must fulfill, such as providing periodic progress reports on construction projects or maintaining insurance coverage. 7. Default provisions: Outlines the consequences if the borrower fails to repay the loan or violates any terms, including potential penalties or the lender's right to take legal action. As with any legal document, it is crucial for both parties involved in an Allegheny Pennsylvania Term Sheet for Bridge Financing to thoroughly review and understand the terms before agreeing and proceeding. Seeking legal advice is highly recommended ensuring compliance with all applicable laws and regulations.Allegheny Pennsylvania Term Sheet for Bridge Financing is a legal document that outlines the terms and conditions of a short-term loan provided to bridge the gap between the current financial need of a borrower and the finalization of a long-term financing solution. This term sheet serves as a blueprint for the agreement between the borrower and the lender, ensuring a clear understanding of the expectations, obligations, and repayment terms involved in the loan. Bridge financing options in Allegheny Pennsylvania generally include: 1. Residential Bridge Loans: These loans are designed to help homeowners who are looking to purchase a new home before selling their current one. It provides short-term funding, allowing homeowners to make a down payment on a new property while waiting for their old home to sell. 2. Commercial Bridge Loans: Commercial real estate developers or investors often utilize these loans to finance the acquisition or renovation of a property. Commercial bridge loans can help bridge funding gaps during the process of securing more permanent financing or when waiting for the completion of a sale or lease. 3. Construction Bridge Loans: Builders or developers seeking to initiate or continue construction projects can benefit from construction bridge financing. These loans assist in covering immediate costs like labor, materials, and other expenses before long-term funding is secured. Allegheny Pennsylvania Term Sheet for Bridge Financing typically covers the following key aspects: 1. Loan amount: Specifies the total amount of financing provided by the lender and outlines whether it covers the full purchase price or a percentage of it. 2. Interest rates and fees: Outlines the interest rate on the loan and any associated fees, such as origination fees or prepayment penalties. 3. Loan term: Defines the duration of the loan, which is typically short-term, usually ranging from a few months to a year. 4. Repayment terms: Describes how the loan will be repaid, including whether it will be paid in a lump sum at the end of the term or through monthly installments. 5. Loan security: Indicates the collateral or assets that secure the loan, such as the property being purchased or other valuable assets. 6. Conditions and covenants: Specifies any conditions or requirements that the borrower must fulfill, such as providing periodic progress reports on construction projects or maintaining insurance coverage. 7. Default provisions: Outlines the consequences if the borrower fails to repay the loan or violates any terms, including potential penalties or the lender's right to take legal action. As with any legal document, it is crucial for both parties involved in an Allegheny Pennsylvania Term Sheet for Bridge Financing to thoroughly review and understand the terms before agreeing and proceeding. Seeking legal advice is highly recommended ensuring compliance with all applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.