This document is to be used in bridge financing in which the bridge investors are loaning money to the company against delivery of bridge notes, and the company is issuing warrants. The agreement states that the bridge notes will be convertible into equity and specifies conditions when conversion will occur.

A Dallas Texas Note and Warrant Purchase Agreement is a legal document that outlines the terms and conditions surrounding the purchase of notes and warrants in the Dallas, Texas area. This agreement is crucial in facilitating transactions between buyers and sellers of financial instruments. The Note and Warrant Purchase Agreement in Dallas, Texas, is primarily used in the context of investment and financing activities. It allows individuals or entities to obtain funds by selling their promissory notes (representing debt obligations) and warrants (options to purchase additional securities at a specific price) to interested investors or financial institutions. There are several types of Note and Warrant Purchase Agreements available in Dallas, Texas, each tailored to specific situations and requirements: 1. Secured Note and Warrant Purchase Agreement: This agreement provides added security to the purchaser by including collateral assets that can be liquidated in case of default on the notes or warrants. 2. Unsecured Note and Warrant Purchase Agreement: This agreement lacks collateral assets, which increases the risk for the purchaser. It often requires a higher interest rate or additional terms to compensate for the absence of security. 3. Convertible Note and Warrant Purchase Agreement: This agreement incorporates a conversion feature where the notes can be converted into equity shares or other securities at a predetermined conversion rate. It provides flexibility to the purchaser and potential future benefits if the company's value increases. 4. Bridge Note and Warrant Purchase Agreement: These agreements are typically short-term financing solutions to bridge the gap between funding rounds or during a merger or acquisition. These notes and warrants are often converted into equity or paid back with interest upon a specified event or time frame. The Note and Warrant Purchase Agreement in Dallas, Texas, covers various essential elements, including the identification of the parties involved, the terms of the purchase, the purchase price, the payment schedule, provisions for events of default, representations and warranties, and dispute resolution mechanisms. It is vital for both buyers and sellers to seek legal counsel while drafting or reviewing a Dallas Texas Note and Warrant Purchase Agreement to ensure compliance with applicable laws and regulations. The agreement serves to protect both parties' interests and helps establish a clear understanding of the rights and obligations related to the notes and warrants being purchased or sold.A Dallas Texas Note and Warrant Purchase Agreement is a legal document that outlines the terms and conditions surrounding the purchase of notes and warrants in the Dallas, Texas area. This agreement is crucial in facilitating transactions between buyers and sellers of financial instruments. The Note and Warrant Purchase Agreement in Dallas, Texas, is primarily used in the context of investment and financing activities. It allows individuals or entities to obtain funds by selling their promissory notes (representing debt obligations) and warrants (options to purchase additional securities at a specific price) to interested investors or financial institutions. There are several types of Note and Warrant Purchase Agreements available in Dallas, Texas, each tailored to specific situations and requirements: 1. Secured Note and Warrant Purchase Agreement: This agreement provides added security to the purchaser by including collateral assets that can be liquidated in case of default on the notes or warrants. 2. Unsecured Note and Warrant Purchase Agreement: This agreement lacks collateral assets, which increases the risk for the purchaser. It often requires a higher interest rate or additional terms to compensate for the absence of security. 3. Convertible Note and Warrant Purchase Agreement: This agreement incorporates a conversion feature where the notes can be converted into equity shares or other securities at a predetermined conversion rate. It provides flexibility to the purchaser and potential future benefits if the company's value increases. 4. Bridge Note and Warrant Purchase Agreement: These agreements are typically short-term financing solutions to bridge the gap between funding rounds or during a merger or acquisition. These notes and warrants are often converted into equity or paid back with interest upon a specified event or time frame. The Note and Warrant Purchase Agreement in Dallas, Texas, covers various essential elements, including the identification of the parties involved, the terms of the purchase, the purchase price, the payment schedule, provisions for events of default, representations and warranties, and dispute resolution mechanisms. It is vital for both buyers and sellers to seek legal counsel while drafting or reviewing a Dallas Texas Note and Warrant Purchase Agreement to ensure compliance with applicable laws and regulations. The agreement serves to protect both parties' interests and helps establish a clear understanding of the rights and obligations related to the notes and warrants being purchased or sold.

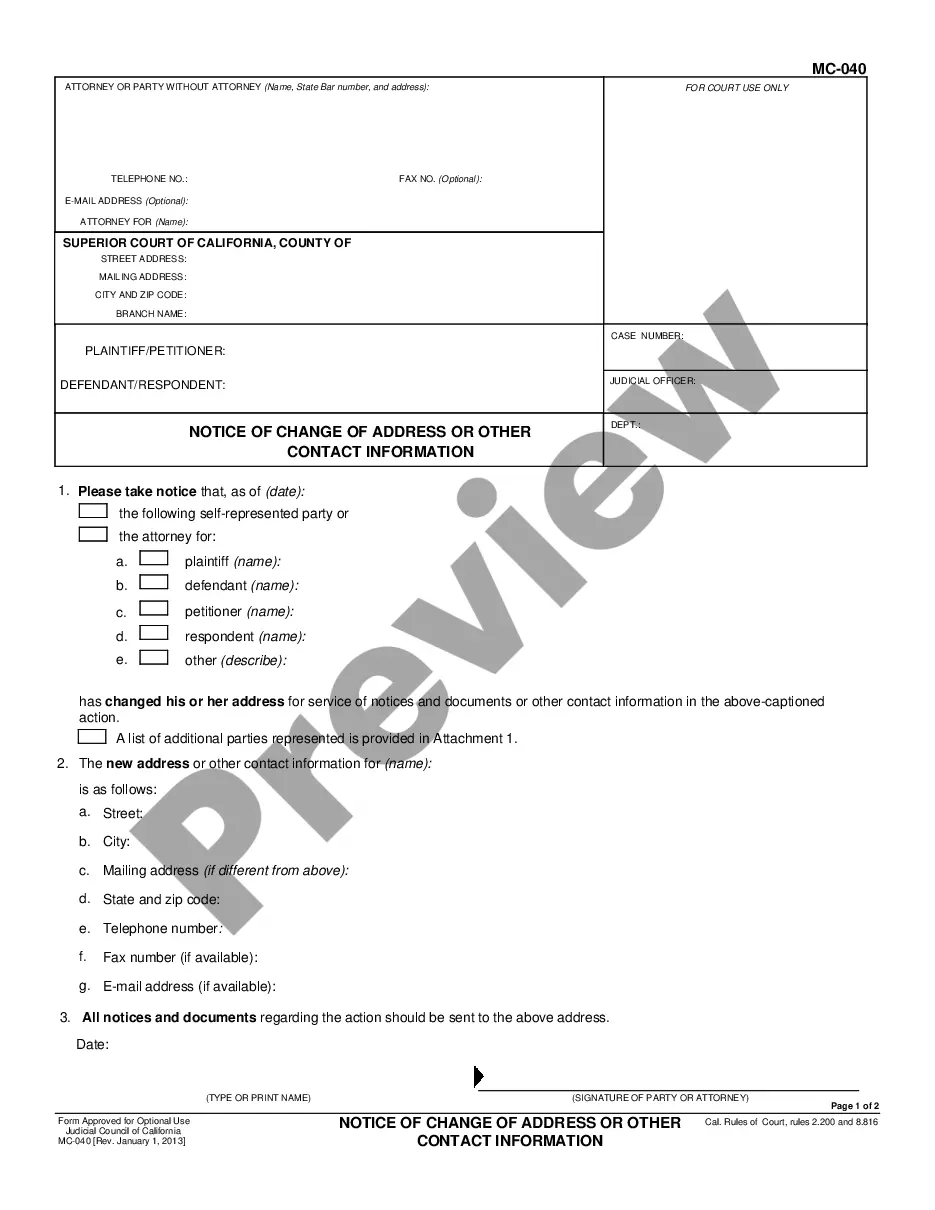

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.