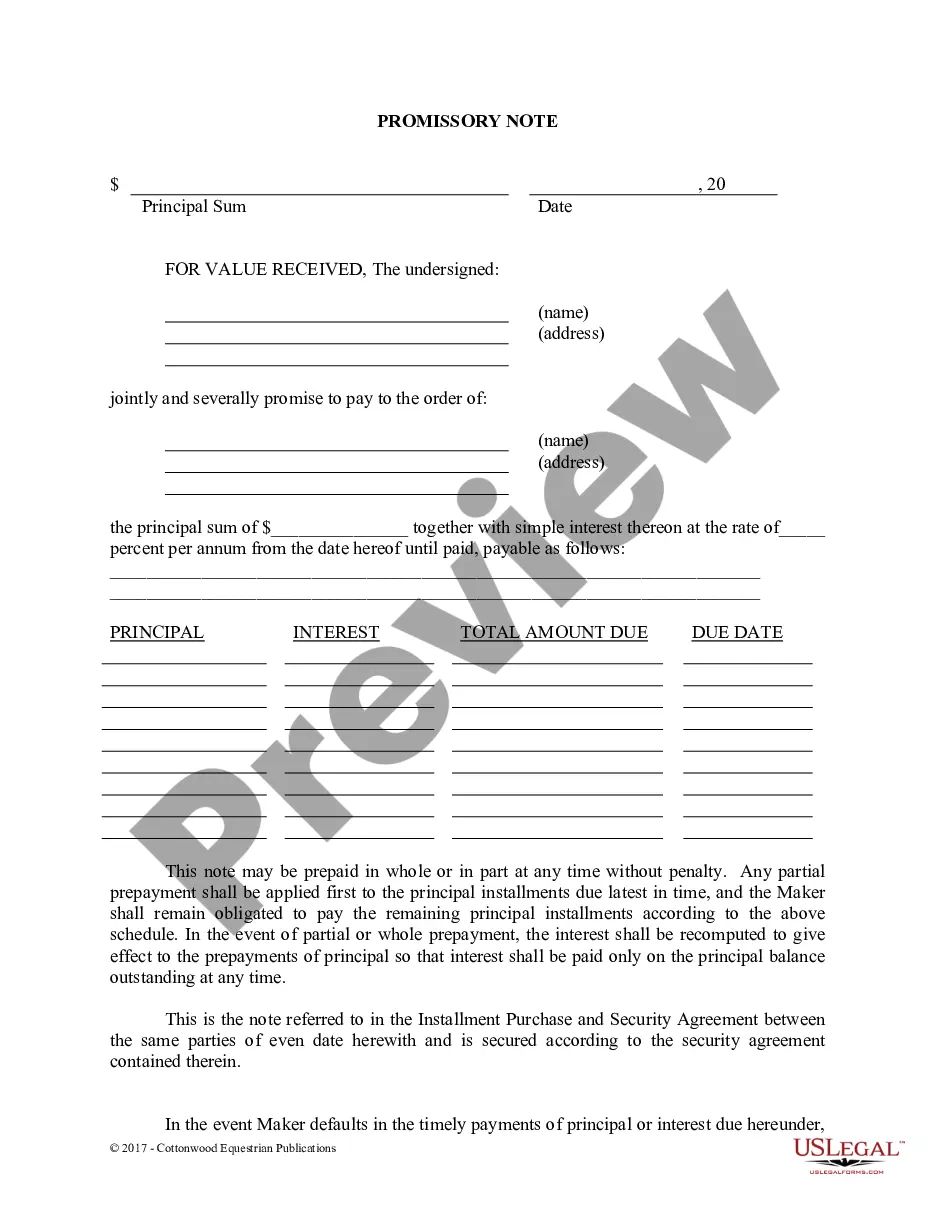

This Bridge Financing Demand Note is to be used in bridge financing when the bridge investors are loaning money to the company on a repayment on demand basis. The form of note can be changed to be secured or unsecured.

The Harris Texas Bridge Financing Demand Note is a financial instrument that serves as a short-term loan option for individuals or businesses in need of immediate funds for a variety of purposes. Harris Texas is a location-specific term indicating the availability of this financing option in the state of Texas, particularly in the Harris County region. Bridge financing refers to a temporary loan solution designed to "bridge" the gap between a borrower's current financial situation and their future long-term financing plans or sources of funds. It is often used in real estate transactions, business expansions, or to cover unexpected expenses or emergencies. The demand note, on the other hand, signifies that the loan amount will be repaid upon the lender's request. Harris Texas Bridge Financing Demand Note offers several types of loans to cater to the diverse needs of borrowers. These may include: 1. Residential Bridge Loan: This type of loan is primarily used by individuals who wish to buy a new home before selling their existing property. It allows borrowers to access the necessary funds for a down payment or to cover expenses related to buying a new residential property while waiting for the sale of their current home to close. 2. Commercial Bridge Loan: Businesses often require immediate capital to seize opportunities, expand operations, or recover from financial setbacks. A commercial bridge loan provides short-term funds to meet these needs, enabling businesses to grow or regain stability while waiting for long-term financing options. 3. Rehab and Renovation Bridge Loan: Investors or homeowners looking to renovate or rehabilitate a property can utilize this type of bridge loan. It allows them to access funds quickly to cover the costs associated with renovations, repairs, or upgrades. Once the improvements are completed, the property's value may increase, enabling the borrower to secure long-term financing or sell it for a profit. 4. Gap Financing: In situations where funds are needed to close a real estate transaction, but traditional lenders cannot provide the required amount or offer loans on a short notice, gap financing comes into play. This type of bridge loan can cover the financial gap, ensuring that the transaction can proceed smoothly. Harris Texas Bridge Financing Demand Note provides a flexible and efficient solution for those requiring immediate funds in Harris County, Texas. Whether individuals seek to purchase a new home, businesses need to capitalize on opportunities, or investors want to renovate properties, the various types of bridge loans offered cater to a wide range of situations. Accessing short-term capital through these loans allows borrowers to bridge financial gaps and accomplish their goals while waiting for long-term financing arrangements or funding sources to become available.The Harris Texas Bridge Financing Demand Note is a financial instrument that serves as a short-term loan option for individuals or businesses in need of immediate funds for a variety of purposes. Harris Texas is a location-specific term indicating the availability of this financing option in the state of Texas, particularly in the Harris County region. Bridge financing refers to a temporary loan solution designed to "bridge" the gap between a borrower's current financial situation and their future long-term financing plans or sources of funds. It is often used in real estate transactions, business expansions, or to cover unexpected expenses or emergencies. The demand note, on the other hand, signifies that the loan amount will be repaid upon the lender's request. Harris Texas Bridge Financing Demand Note offers several types of loans to cater to the diverse needs of borrowers. These may include: 1. Residential Bridge Loan: This type of loan is primarily used by individuals who wish to buy a new home before selling their existing property. It allows borrowers to access the necessary funds for a down payment or to cover expenses related to buying a new residential property while waiting for the sale of their current home to close. 2. Commercial Bridge Loan: Businesses often require immediate capital to seize opportunities, expand operations, or recover from financial setbacks. A commercial bridge loan provides short-term funds to meet these needs, enabling businesses to grow or regain stability while waiting for long-term financing options. 3. Rehab and Renovation Bridge Loan: Investors or homeowners looking to renovate or rehabilitate a property can utilize this type of bridge loan. It allows them to access funds quickly to cover the costs associated with renovations, repairs, or upgrades. Once the improvements are completed, the property's value may increase, enabling the borrower to secure long-term financing or sell it for a profit. 4. Gap Financing: In situations where funds are needed to close a real estate transaction, but traditional lenders cannot provide the required amount or offer loans on a short notice, gap financing comes into play. This type of bridge loan can cover the financial gap, ensuring that the transaction can proceed smoothly. Harris Texas Bridge Financing Demand Note provides a flexible and efficient solution for those requiring immediate funds in Harris County, Texas. Whether individuals seek to purchase a new home, businesses need to capitalize on opportunities, or investors want to renovate properties, the various types of bridge loans offered cater to a wide range of situations. Accessing short-term capital through these loans allows borrowers to bridge financial gaps and accomplish their goals while waiting for long-term financing arrangements or funding sources to become available.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.