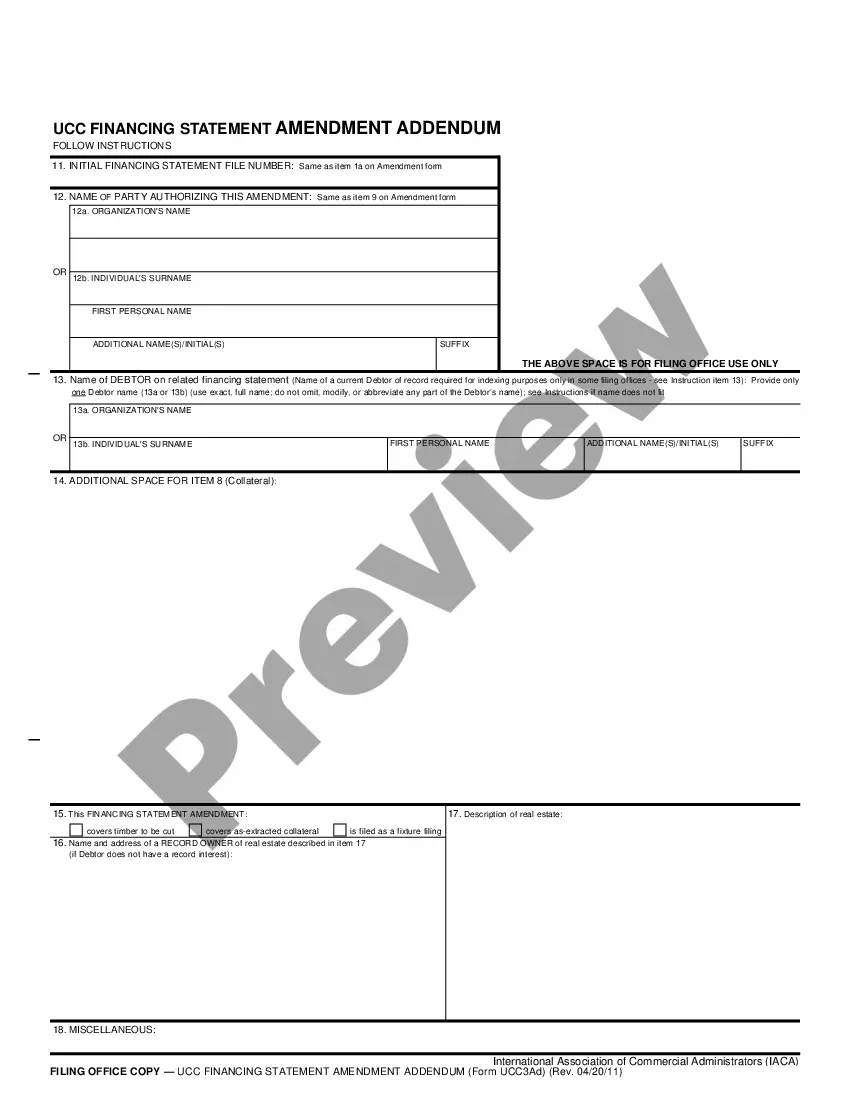

"Subordination Agreement Form and Variations" is a American Lawyer Media form. This is a subordination agreement with variations form.

San Diego California Subordination Agreement Form and Variations

Description

How to fill out Subordination Agreement Form And Variations?

A document process consistently accompanies any legal action you undertake.

Establishing a business, applying for or accepting a job offer, transferring assets, and numerous other life situations necessitate that you arrange formal paperwork that differs across the nation.

This is why having everything compiled in a single location is immensely beneficial.

US Legal Forms is the most comprehensive online repository of current federal and state-specific legal templates.

Utilize it as necessary: print it or complete it electronically, sign it, and file where needed. This is the simplest and most dependable method to obtain legal documents. All the templates available in our library are expertly drafted and verified for compliance with local laws and regulations. Prepare your documents and manage your legal matters effectively with the US Legal Forms!

- On this platform, you can conveniently find and acquire a document for any personal or business purpose relevant to your region, including the San Diego Subordination Agreement Form and Variations.

- Finding templates on the platform is incredibly easy.

- If you already have a subscription to our service, Log In to your account, use the search bar to find the sample, and click Download to save it to your device.

- Subsequently, the San Diego Subordination Agreement Form and Variations will be accessible for additional use in the My documents section of your profile.

- If you are using US Legal Forms for the first time, adhere to this simple process to obtain the San Diego Subordination Agreement Form and Variations.

- Ensure you have accessed the correct page with your localized form.

- Utilize the Preview option (if available) and review the template.

- Examine the description (if any) to confirm the template meets your requirements.

- Look for another document using the search tab if the sample does not suit you.

- Click Buy Now when you identify the required template.

- Choose the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment option (via credit card or PayPal) to continue.

- Choose the file format and download the San Diego Subordination Agreement Form and Variations to your device.

Form popularity

FAQ

An executory subordination agreement is an agreement under which the subordinating party, like the seller of land, agrees to execute a subsequent instrument subordinating his or her security interest to another security interest, like the lien of a construction loan.

A subordination agreement prioritizes collateralized debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

Subordination agreements are usually carried out when property owners take a second mortgage on their property. As a result, the second loan becomes the junior debt, and the primary loan becomes the senior debt.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

Key Takeaways. A subordination agreement prioritizes collateralized debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

Lenders almost always decline subordination requests because subordinating a mortgage means another loan or debt is repaid in full before the mortgage is repaid. Subordinating a mortgage exposes the lender to more risk in the event you default on the loan.

Example of a Subordination Agreement The business files for bankruptcy and its assets are liquidated at market value?$900,000. The senior debtholders will be paid in full, and the remaining $230,000 will be distributed among the subordinated debtholders, typically for 50 cents on the dollar.

A subordination clause serves to protect the lender in case you default. If a default happens, the lender would have the legal standing to repossess the home and cover their loan's outstanding balance first. If there are other subordinate mortgages involved, the secondary liens will take the backseat in this process.

Subordination agreement is a contract which guarantees senior debt will be paid before other ?subordinated? debt if the debtor becomes bankrupt.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.