Franklin Ohio Partnership Interest refers to the ownership or investment stake that individuals or entities hold in partnerships located in Franklin, Ohio. A partnership interest represents the ownership rights, responsibilities, and entitlements associated with being a partner in a business partnership based in Franklin, Ohio. Partnership interests are commonly found in various types of partnerships, such as general partnerships, limited partnerships (LP), and limited liability partnerships (LLP). Each type of partnership has its own specific characteristics and legal structure. In a general partnership, partners have equal rights and responsibilities in managing the business and sharing profits and losses. It is formed through an agreement between two or more individuals or entities who agree to contribute money, property, or skills to carry on a business together. On the other hand, a limited partnership consists of at least one general partner who has full liability for partnership debts and obligations, and one or more limited partners who have limited liability and are passive investors. Limited liability partnerships (Laps) offer limited liability protection to partners, shielding them from personal liability for the partnership's obligations and debts. This type of partnership is often favored by professionals such as lawyers, accountants, or doctors. Partnership interests can be bought, sold, or transferred, providing the opportunity for investors to enter or exit a partnership. These interests can also be subject to various restrictions and conditions imposed by the partnership agreement or state laws. Being a partner in a Franklin, Ohio partnership provides individuals or entities with the opportunity to participate in the local business community, contribute to economic growth, and share in the profits generated by the partnership. It also involves sharing in the risks and liabilities that come with the business operations. In conclusion, Franklin Ohio Partnership Interest refers to the ownership or investment stake in partnerships located in Franklin, Ohio. Different types of partnership interests include general partnerships, limited partnerships (LP), and limited liability partnerships (LLP), each offering distinct characteristics and legal frameworks. The ownership of partnership interests enables individuals or entities to participate in the local business community, share in profits, and contribute to the economic development of Franklin, Ohio.

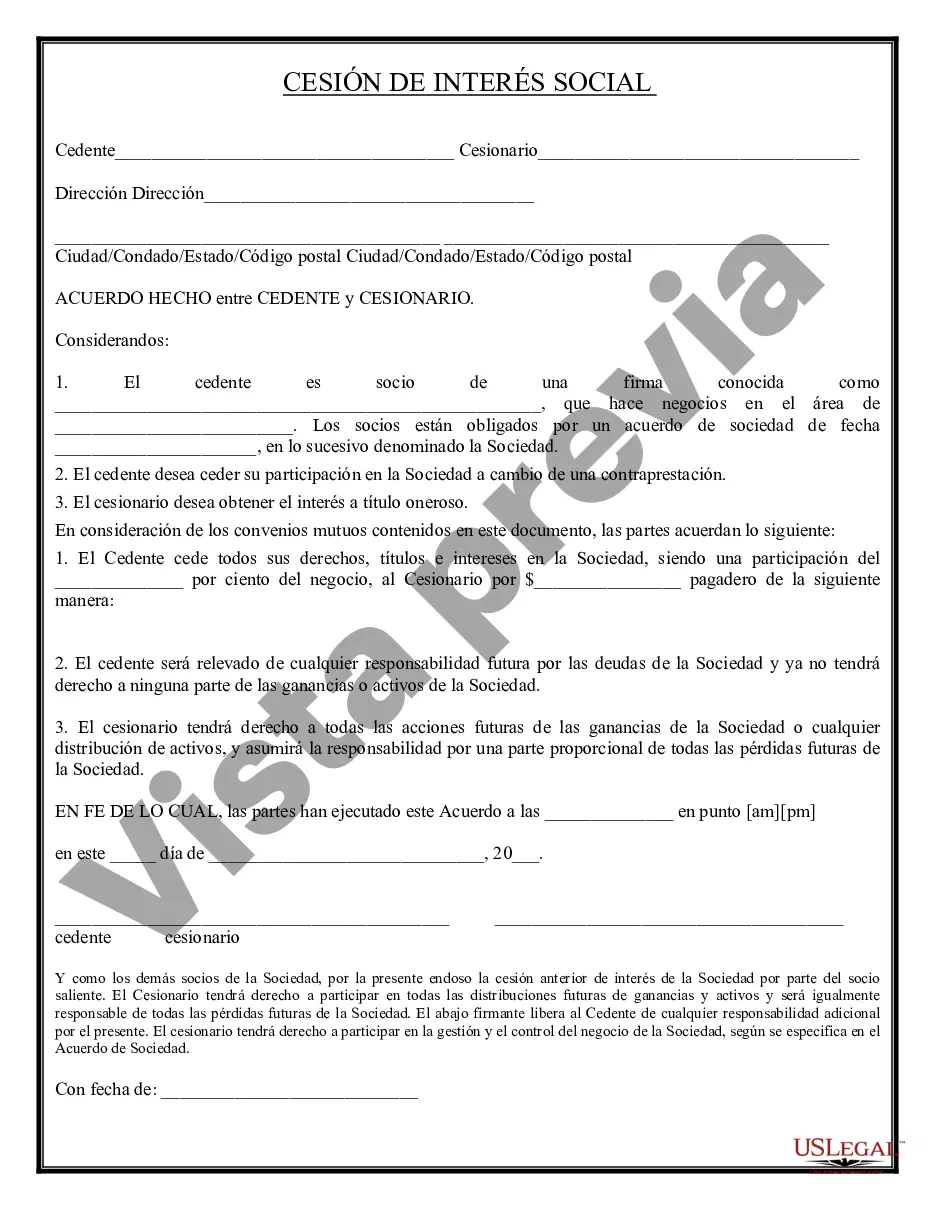

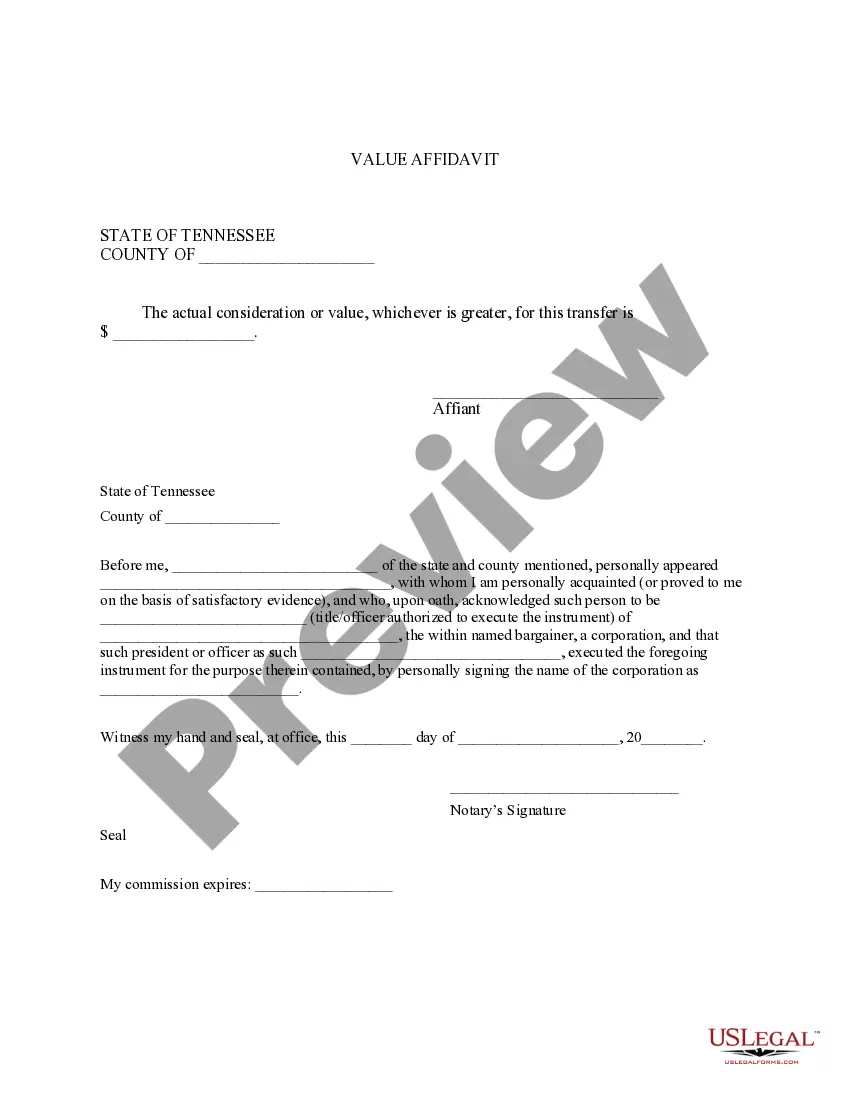

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Interés de sociedad - Partnership Interest

Description

How to fill out Franklin Ohio Interés De Sociedad?

If you need to find a trustworthy legal form supplier to get the Franklin Partnership Interest, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of supporting materials, and dedicated support make it simple to find and execute various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Franklin Partnership Interest, either by a keyword or by the state/county the form is intended for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Franklin Partnership Interest template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less costly and more affordable. Create your first business, arrange your advance care planning, draft a real estate agreement, or execute the Franklin Partnership Interest - all from the convenience of your sofa.

Sign up for US Legal Forms now!