Oakland Michigan Partnership Interest refers to the legal rights and ownership stakes that individuals or entities hold in partnerships located in Oakland County, Michigan. These partnerships are formed when two or more entities come together to pursue a common business goal, sharing both the risks and rewards of the venture. The types of Oakland Michigan Partnership Interest can vary based on the specific terms agreed upon by the partners. Some common types include: 1. General Partnership: This type of partnership interest involves all partners having equal rights and responsibilities in the management and operation of the business. Each partner is personally liable for the partnership's obligations and debts. 2. Limited Partnership: In this partnership interest, there are both general partners and limited partners. General partners have management control and are personally liable for all obligations, while limited partners have limited liability and are typically passive investors. 3. Limited Liability Partnership (LLP): LLP partnership interest provides increased liability protection to partners, limiting their personal liability for the actions of other partners. This is a common choice for professionals such as lawyers, accountants, or architects. 4. Limited Liability Limited Partnership (LL LP): Similar to an LLP, the LL LP partnership interest combines features of both a limited partnership and an LLP. It offers limited liability protection for both general and limited partners, making it an attractive option for certain businesses. Regardless of the type of Oakland Michigan Partnership Interest, partners typically contribute capital, expertise, or assets to the partnership in exchange for a share of the profits and losses. The specific terms of each partnership are defined in a partnership agreement, which outlines elements such as profit-sharing ratios, decision-making processes, and dispute resolution methods. In Oakland County, Michigan, partnership interests are regulated by state laws, including the Michigan Uniform Partnership Act. This act provides a legal framework for the formation, operation, and dissolution of partnerships, ensuring fairness and consistency in business transactions. Oakland Michigan Partnership Interest plays a crucial role in fostering collaboration, pooling resources, and leveraging diverse skill sets to achieve common business objectives. It allows individuals and entities to share risks, responsibilities, and profits while operating within the legal boundaries set forth by the state.

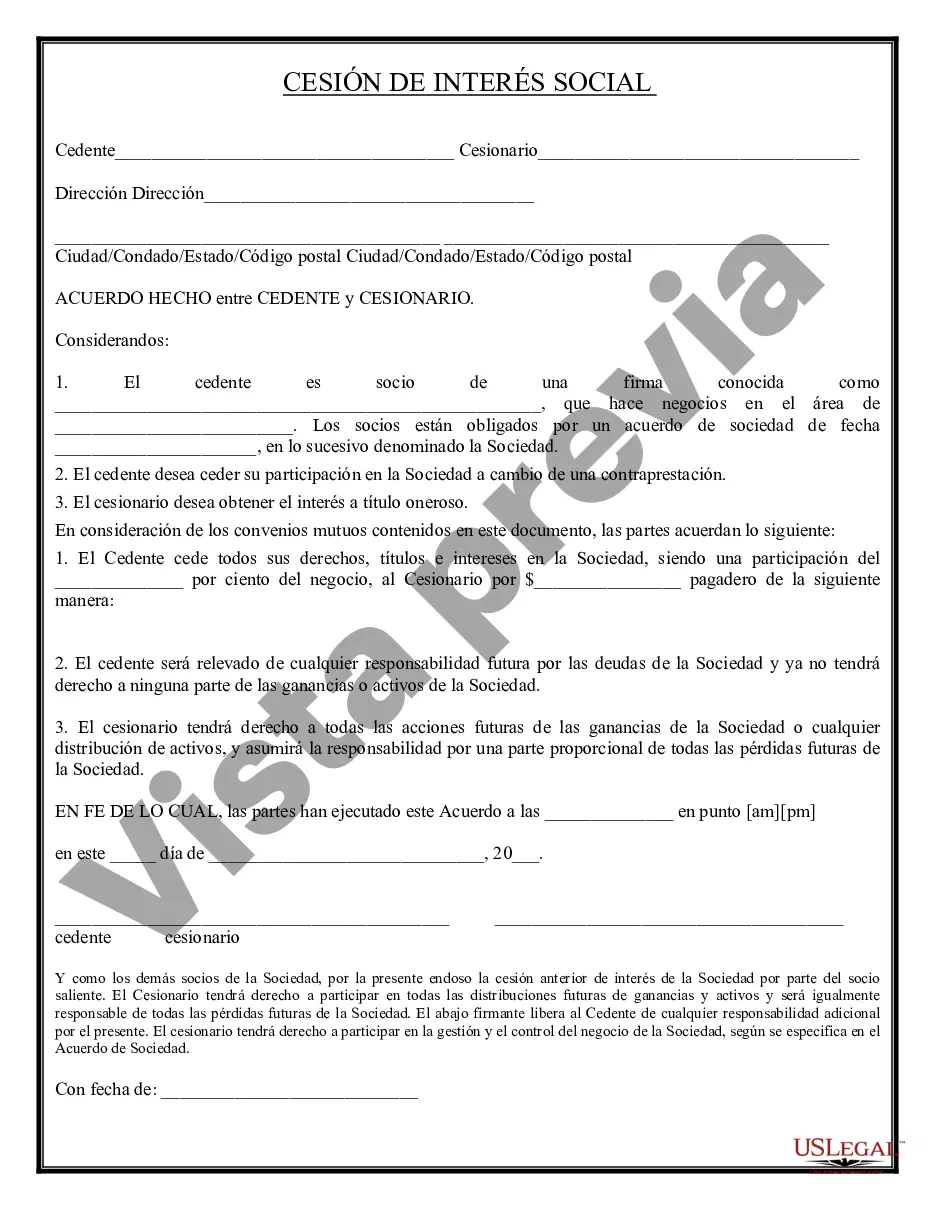

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Interés de sociedad - Partnership Interest

Description

How to fill out Oakland Michigan Interés De Sociedad?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Oakland Partnership Interest is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to obtain the Oakland Partnership Interest. Adhere to the guide below:

- Make sure the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Oakland Partnership Interest in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!