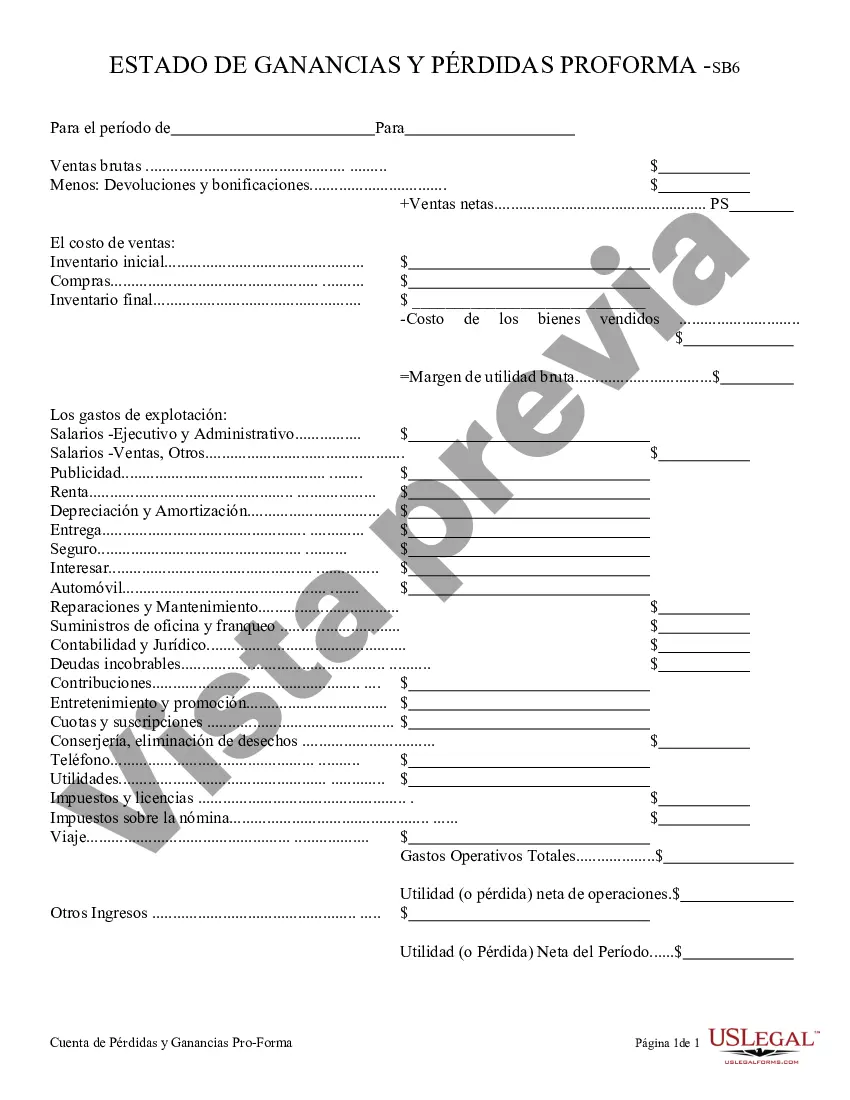

Contra Costa California Profit and Loss Statement is a financial document that provides a detailed overview of the revenue, expenses, and net income or loss of a business or organization operating in Contra Costa County, California. This statement helps stakeholders, such as business owners, investors, and lenders, to analyze the financial performance and profitability of the entity. Keywords: Contra Costa California, Profit and Loss Statement, financial document, revenue, expenses, net income, net loss, business, organization, stakeholders, financial performance, profitability. There are various types of Contra Costa California Profit and Loss Statements that cater to different industries and needs. Some notable types include: 1. Retail Profit and Loss Statement: This type of statement is commonly used by retail businesses, providing insights into sales revenue, cost of goods sold, operating expenses, and gross profit margin specific to the retail industry. It may also include metrics like average transaction value, sales per square foot, and inventory turnover. 2. Service Industry Profit and Loss Statement: Tailored for service-based businesses, this statement focuses on the revenue sources, such as service fees, subscriptions, or retainer fees, while highlighting direct costs and expenses associated with delivering those services. Profit margins, average billing rates, and utilization rates may be important metrics included. 3. Manufacturing Profit and Loss Statement: Manufacturing businesses typically have complex cost structures, making this statement vital for assessing cost-effectiveness and profitability. It captures revenue from sales, while breaking down direct costs of production, such as materials, labor, and overhead expenses. Additional metrics like cost of goods sold percentage and production efficiency may be included. 4. Nonprofit Profit and Loss Statement: Nonprofit organizations operate uniquely, with revenue often coming from donations, grants, and fundraising efforts. Their statements focus on revenue streams, program expenses, administrative costs, board contributions, and any surplus or deficit from operations. Key ratios like program expenses as a percentage of total expenses and fundraising efficiency may be highlighted. 5. Restaurant Profit and Loss Statement: The restaurant industry has specific revenue-generating and expense categories, requiring a statement that reflects food and beverage sales, cost of goods sold, labor costs, overhead expenses, and gross profit. To assess performance, metrics like food cost percentage, labor cost percentage, and table turnover ratio may be presented. Regardless of the type, a Contra Costa California Profit and Loss Statement should be prepared in accordance with generally accepted accounting principles (GAAP) and provide a clear breakdown of revenues, expenses, and the resulting financial outcome for a specified period, often annually or quarterly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Declaración de ganancias y pérdidas - Profit and Loss Statement

Description

How to fill out Contra Costa California Declaración De Ganancias Y Pérdidas?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any individual or business purpose utilized in your region, including the Contra Costa Profit and Loss Statement.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Contra Costa Profit and Loss Statement will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to obtain the Contra Costa Profit and Loss Statement:

- Ensure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Contra Costa Profit and Loss Statement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!