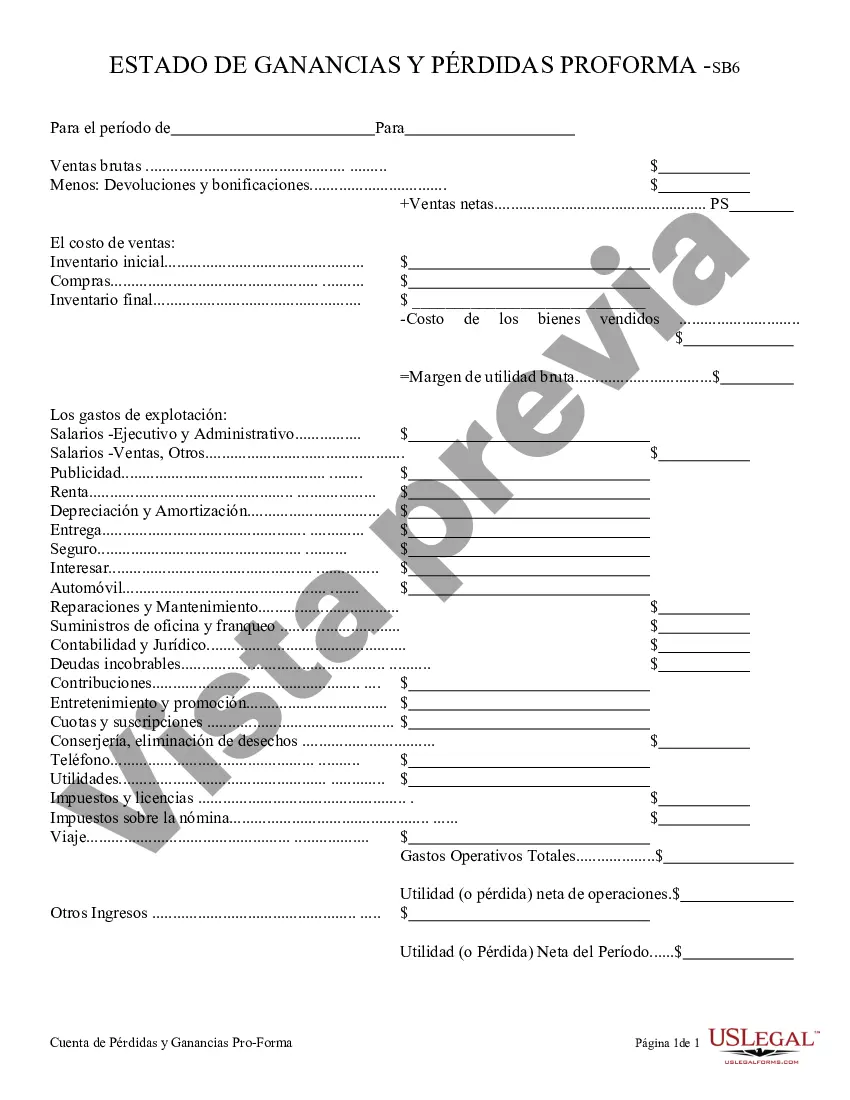

A Fulton Georgia Profit and Loss Statement, also known as an income statement, is a financial document that provides detailed information about a company's revenues, expenses, and overall profitability during a specific period of time. It is crucial for business owners, investors, and stakeholders to analyze this statement to get an insight into the financial health and performance of a company in Fulton, Georgia. The key components of a typical Fulton Georgia Profit and Loss Statement include revenues, cost of goods sold (COGS), gross profit, operating expenses, operating income, and net income. These components are essential in determining the profitability and financial trends of a business. Revenues: This section highlights the income generated by a company from its main operations, such as sales of products or services. Revenues are crucial for determining the overall financial performance of a company. Cost of Goods Sold (COGS): COGS refers to the direct costs incurred in producing or delivering the products or services sold by a company. This includes materials, labor, and any other costs directly associated with production. Gross Profit: Gross profit is calculated by deducting COGS from revenues. It represents the profit generated solely from the core operations of the business, excluding operating expenses. Operating Expenses: Operating expenses consist of all the costs incurred in running a business, apart from COGS. This includes salaries, rent, utilities, marketing expenses, insurance, and other administrative costs. Operating Income: Operating income, sometimes referred to as operating profit, is determined by deducting operating expenses from gross profit. It reflects the profitability of a company's normal business operations. Net Income: Net income, also known as net profit or net earnings, is the final profitability figure obtained after subtracting all expenses, including operating expenses, taxes, interests, and any other non-operating items from operating income. Different types of Fulton Georgia Profit and Loss Statements include single-step and multi-step statements. A single-step statement provides a straightforward breakdown of revenues and expenses, while a multi-step statement provides additional information by separating operating and non-operating revenues and expenses. The multi-step statement is often preferred for its ability to present a clearer picture of a company's financial performance. In conclusion, a Fulton Georgia Profit and Loss Statement is a crucial financial document that helps businesses and stakeholders assess the profitability and financial health of a company. It provides a detailed breakdown of revenues, expenses, and overall profitability during a specific period. By carefully analyzing this statement, businesses can make informed decisions and adapt strategies to enhance their financial performance and sustainability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Declaración de ganancias y pérdidas - Profit and Loss Statement

Description

How to fill out Fulton Georgia Declaración De Ganancias Y Pérdidas?

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, locating a Fulton Profit and Loss Statement meeting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the Fulton Profit and Loss Statement, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can retain the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Fulton Profit and Loss Statement:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Fulton Profit and Loss Statement.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Formulario 4797, en ingles.

Sus empleadores deben enviarle antes del 31 de enero su formulario W-2 por los ingresos que obtuvo por su trabajo durante el ano calendario previo. Este formulario muestra el salario que usted gano durante el ano y los impuestos que se le retuvieron por esos ingresos.

Formulario W-2 Este formulario muestra los salarios pagados e impuestos retenidos durante el ano para cada empleado. Ya que los beneficios de Seguro Social y de Medicare de los empleados se calculan segun la informacion en el Formulario W-2, es muy importante preparar el Formulario W-2 de manera correcta y puntual.

El Formulario W-2 contiene informacion importante sobre el ingreso que ganaste a traves de tu empleador, cantidad de impuestos retenidos de tu cheque salarial, beneficios provistos y otra informacion para el ano. Utilizaras este formulario para presentar tus impuestos federales y estatales.

Formulario W-2 Este formulario muestra los salarios pagados e impuestos retenidos durante el ano para cada empleado. Ya que los beneficios de Seguro Social y de Medicare de los empleados se calculan segun la informacion en el Formulario W-2, es muy importante preparar el Formulario W-2 de manera correcta y puntual.

Todo Empleado de Gobierno puede solicitar el Comprobante de Retencion (W-2PR) directamente a traves de la Colecturia Virtual. El mismo sera libre de costo. Para acceder a Colecturia Virtual, hacer clic aqui.

La diferencia mas importante es que el 1099 se utiliza para trabajadores independientes o subcontratistas, y el W-2, para empleados. De acuerdo con el IRS, los contratistas independientes controlan el metodo de trabajo que emplean, mientras que los empleados no.

Anexo 2: Para informar otros impuestos, como impuesto minimo alternativo, impuesto al trabajo por cuenta propia, sobre el empleo domestico, entre otros. Anexo 3: Para ofrecer detalles de una serie de creditos fiscales reembolsables y no reembolsables.

Acceda a SURI a traves del enlace: , o a traves del enlace disponible en el area de Hacienda Virtual de la pagina de internet del Departamento:pr.gov. Oprima el enlace Registrese en SURI. Seleccione el enlace Imprimir mi W-2 e informativas.

Si no recibes un formulario W-2 la primera semana de febrero, comunicate con tu empleador. Si tu empleador se rehusa a darte un W-2, comunicate con el IRS al 1-800-829-1040, deberas tener contigo el nombre de tu empleador, direccion, numero de telefono y su numero de identificacion, si lo sabes.