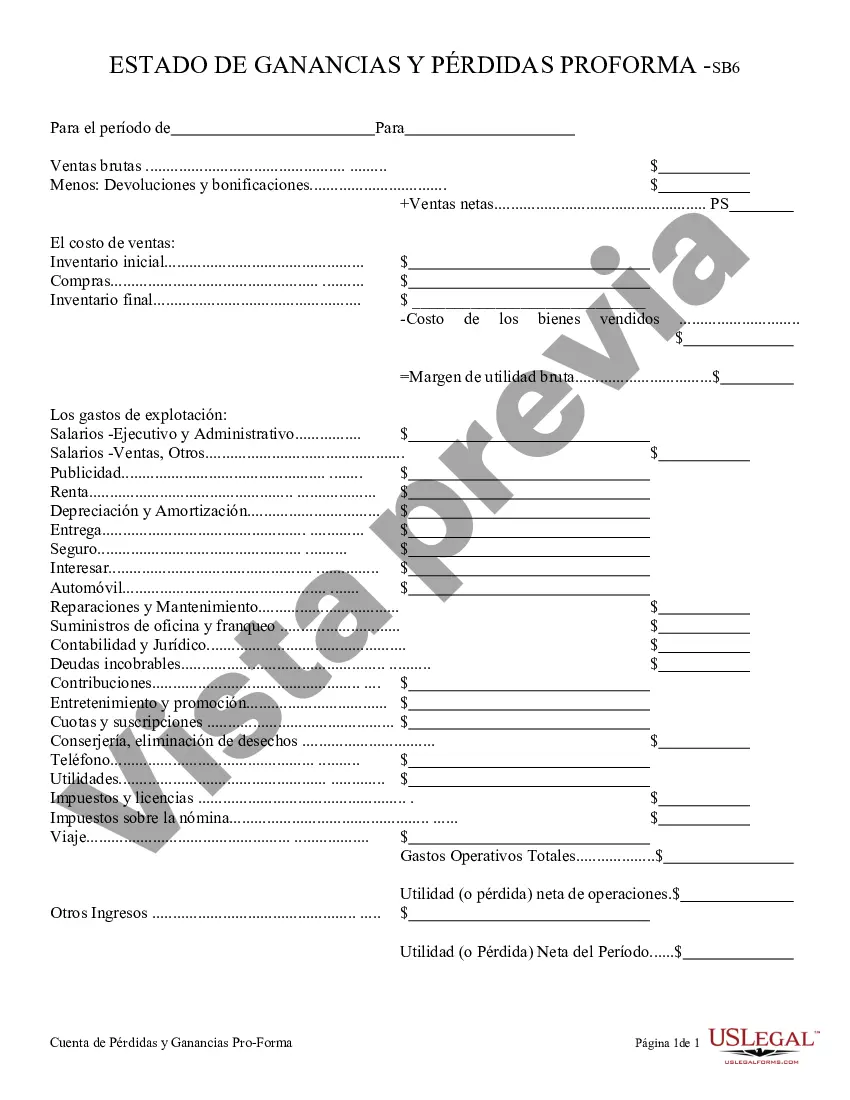

A profit and loss statement, also known as an income statement, is a financial document that summarizes the revenues, costs, and expenses incurred by a business during a specific period. In the context of Hennepin County, Minnesota, the Hennepin Minnesota Profit and Loss Statement is a financial statement that provides a detailed analysis of the financial performance of businesses operating within the county. The Hennepin Minnesota Profit and Loss Statement is essential for business owners, shareholders, and stakeholders to understand the profitability and financial health of their companies. It allows them to evaluate the revenue and expense patterns, identify areas of strength or weakness, and make informed decisions regarding the future course of action. The profit and loss statement typically consists of several key sections that capture various aspects of a business's financial activities. These sections often include: 1. Revenue: This section presents the total income generated by the business from its primary activities, such as sales of products or services. It may also include other sources of revenue, such as interest income or rental income. 2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing the goods or services sold by the business. It includes expenses like raw materials, direct labor, and manufacturing overheads. 3. Gross Profit: Gross profit is calculated by subtracting the COGS from the revenue. It indicates the profitability of the business's core operations before considering other expenses. 4. Operating Expenses: This section encompasses all the costs incurred in running the day-to-day operations of the business, such as rent, utilities, salaries, advertising, and insurance. 5. Operating Income: Operating income is derived by subtracting the operating expenses from the gross profit. It reflects the profitability of the business's core operations. 6. Other Income and Expenses: This section includes any additional income or expenses that are not directly related to the core operations of the business, such as gains or losses from investments, interest expenses, or extraordinary items. 7. Net Income: Net income is calculated by deducting the total operating expenses and other income/expenses from the operating income. It represents the overall profitability of the business after considering all costs and expenses. Different types of Hennepin Minnesota Profit and Loss Statements may vary based on the industry or specific requirements. For example, a retail business may have specific sections related to sales analysis, inventory costs, and discounts offered. Similarly, a service-based business may focus on billable hours, labor costs, and overheads specific to their industry. In summary, the Hennepin Minnesota Profit and Loss Statement is a vital financial document used to assess the performance, profitability, and financial health of businesses operating in Hennepin County. It provides a comprehensive overview of revenues, costs, and expenses, enabling business owners and stakeholders to make informed decisions and drive future growth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Declaración de ganancias y pérdidas - Profit and Loss Statement

Description

How to fill out Hennepin Minnesota Declaración De Ganancias Y Pérdidas?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a lawyer to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Hennepin Profit and Loss Statement, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Therefore, if you need the latest version of the Hennepin Profit and Loss Statement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Hennepin Profit and Loss Statement:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Hennepin Profit and Loss Statement and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!